advanced verification

advertisement

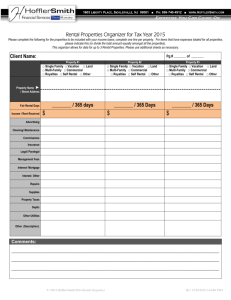

ADVANCED VERIFICATION PASFAA CONFERENCE 2010 LANCASTER, PA Marykay Klara Associate Director of Financial Assistance Villanova University POLICIES • “Because students sometimes make errors on their application, colleges have procedures for verifying the reported information.” (2010 AVG 81) POLICIES • “If your school has conflicting information concerning a student’s eligibility or you have any reason to believe a student’s application information is incorrect, you must resolve the discrepancies before disbursing FSA funds. If you discover discrepancies after disbursing FSA funds, you must still reconcile the conflicting information and take appropriate action under the specific program requirements.” (2010 AVG 106) POLICIES • “While Financial Aid Administrators do not need to be tax experts there are some issues that even a layperson with basic tax law information can evaluate. Because conflicting data often involve such information, FAA’s must have a fundamental understanding of relevant tax issues that can considerably affect the need analysis…” (2010 AVG 107) BASIC REQUIRED VERIFICATION ITEMS • • • • • Household size Number in college Adjusted gross income (AGI) U.S. taxes paid Certain types of untaxed income and benefits: ➔ Child support ➔ IRA/Keogh deductions ➔ Interest on tax-free bonds • All other untaxed income included on the U.S. income tax return, excluding information on the schedules (34 CFR 668.56) (AVG 81) ADVANCED VERIFICATION POSSIBILITIES • INCOME • SAVINGS AND DIVIDENDS • CAPITAL GAINS/LOSSES • RENTAL PROPERTY EARNED INCOME Line 7 of Tax Return • Check against W-2 Forms (box 1 vs. box 5) • Other income –tips • 1099 Form – consultant or part/time employee (compensation) Earnings INCOME Line 11 of Tax Return – Alimony Received – May indicate Child Support exists Possible child support BUSINESS INCOME Line 12 of Tax Return • Schedule C – Possible Income from working at home (line 1) May be income from working at home High debt for equipment in the home Earned income BUSINESS INCOME Line 17 of Tax Return • Schedule E – Book Royalties – Property Management and Rental Income – Potential assets of the family » rental property Potential Assets Do you add this to income? BUSINESS INCOME Line 18 of Tax Return • Schedule F – Farm Income Do they live on the farm or is it an investment property? INCOME Line 19 of Tax Return • Unemployment Compensation – Taxed and Untaxed Taxed and untaxed OTHER INCOME Line 21 of Tax Return • Other income • What is it? Source of Income ASSETS Line 8 - Interest Income • Schedule B • Does savings support the amount reported? • How do you compute a value? Assets – do not include life insurance ASSETS Line 9 - Dividend Income • Schedule B • Does investments support the amount reported? • Usually better to impute a higher rate as these assets are riskier and have better rates of return Riskier Assets ASSETS Line 13 – Capital Gains/losses • Schedule D Line 14 – Other Gains/losses • What created the amount listed – stocks sold? • Review amounts listed on Line 3 and Line 10 – should have at least a combined amount listed in savings/investments Cash received Cash received ASSETS Schedule C – Line 16 (mortgage interest) – Line 20 (rent or lease) – is the building tied to the business and is it listed on Schedule E as parents’ personal asset? If working from home what is this? If working from home what is this? ASSETS Schedule E – Is it business related or personal? – Royalties – what did they do with all of the income earned – Rental Property • calculate net worth % • www.zillow.com Watch for more than one property listed Do you add this back to income? Value computed or on a form? This is only for the year in question – not overall ASSETS Form 8825 – Rental Real Estate Income and Expenses of a Partnership or S Corporation – Line 2 Gross Rents • Is income tied to a business or personally owned rental property made to look like a business? What type of property is this – is it really a business? If personal property – can be source of value