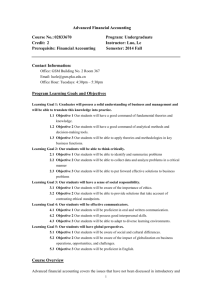

Intra-entity - McGraw Hill Higher Education - McGraw

Chapter Five

Consolidated

Financial

Statements—

Intra-Entity

Asset

Transactions

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Intra-entity Transactions

Learning Objective 5-1:

Understand why intra-entity asset transfers create accounting effects within the financial records of affiliated companies that must be eliminated or adjusted in preparing consolidated financial statements.

Companies in a business combination often retain their legal identities as separate operating centers and maintain their own recordkeeping.

Inventory sales between the companies must be recorded. The seller records revenue, and the buyer enters the purchase into its accounts.

5-2

Intra-entity Transactions

Recording an inventory transfer as a sale/purchase provides vital data to measure operational efficiency of each enterprise.

From a consolidated perspective, neither a sale nor a purchase has occurred. It is an internal movement of inventory that creates no net change in the financial position of the business combination as a whole. In the consolidated financial statements, the transfers are eliminated.

The consolidated statements reflect only transactions with outside parties. Worksheet entries report the perspective of the consolidated enterprise.

5-3

Sales and Purchases- Intra-entity

Learning Objective 5-2:

Demonstrate the consolidation procedures to eliminate intra-entity sales and purchases balances.

ENTRY TI (Transferred Inventory)

Both parties record the transfer in their internal records as a normal sale/purchase. A consolidation worksheet entry removes the balances from the externally reported figures.

5-4

Unrealized Gross Profit –

Intra-entity

Learning Objective 5-3:

Explain why consolidated entities defer intra-entity gross profit in ending inventory and the consolidation procedures required to recognize profits when actually earned.

If all of the transferred inventory is retained by the business combination at the end of the year, entry G eliminates the effects of the seller’s gross profit that remains unrealized within the buyer’s ending inventory in year 1.

5-5

Unrealized Gross Profit –

Intra-entity

Learning Objective 5-4:

Understand that the consolidation process for inventory transfers is designed to defer the unrealized portion of an intra-entity gross profit from the year of transfer into the year of disposal or consumption.

Worksheet entries to eliminate sales/purchases balances

(Entry TI) and to remove unrealized gross profit from ending Inventory in Year 1 (Entry G) are standard, regardless of the circumstances of the consolidation.

5-6

Unrealized Gross Profit –

Intra-entity

In year 2, Entry *G (the asterisk indicates a previous year transfer created the intra-entity gross profits) removes the unrealized gross profit from beginning figures to be recognized in consolidated income in the period in which it is earned.

If only 25% of inventory remains, the required reduction (Entry

G ) is not the entire $30,000 shown previously but only the

$7,500 unrealized gross profit that remains in ending inventory.

5-7

Unrealized Gross Profit –

Intra-entity

This entry recognizes the remaining unrealized profit left at the end of the previous year.

5-8

Unrealized Inventory Gain -

Downstream Transfers

For intra-entity beginning inventory profits resulting from downstream transfers when the parent applies the equity method: a. Parent’s retained earnings are appropriately stated due to intra-entity profit deferrals and recognition.

b. The subsidiary retained earnings reflect none of the intra-entity profit and require no adjustment.

c.

The parent’s investment account at beginning of Year 2 contains a credit from the deferral of Year 1 downstream profits.

d. Worksheet Entry *G transfers the Year 1 Investment account credit to a Year 2 earnings credit via COGS to recognize the profit in the year of sale to outsiders.

5-9

Intra-entity Transactions –

Upstream vs. Downstream transfers

Compare the Entry *G for the downstream and upstream transfers to see the difference in the transactions.

The effect of downstream and upstream transfers when the parent uses the equity method are compared in more detail.

5-10

Intra-entity Transactions –

Upstream vs. Downstream transfers

5-11

Unrealized Gross Profits –

Effect on Noncontrolling Interest

Learning Objective 5-5

Explain the difference between upstream and downstream intra-entity transfers and how each affects the computation of noncontrolling interest balances.

According to FASB ASC paragraph 810-10-45-6:

The amount of intra-entity profit or loss to be eliminated is not affected by the existence of a noncontrolling interest.

5-12

Unrealized Gross Profits –

Effect on Noncontrolling Interest

The complete elimination of intra-entity profit or loss is consistent with underlying assumption that consolidated financial statements represent the financial position and operating results of a single economic entity.

The elimination of the intra-entity profit or loss may be allocated proportionately between the parent and noncontrolling interest.

5-13

Intra-entity Transactions –

Land Transfer Entry TL

Learning Objective 5-6:

Prepare the consolidation entry to remove any unrealized gain created by the intra-entity transfer of land from the accounting records of the year of transfer and subsequent years.

If land is transferred between parent and sub at a gain, the gain is considered unrealized and must be eliminated. Credit land for the same amount to return the land to its carrying value on the date of transfer.

5-14

Intra-entity Transactions --

Land Transfer Entry *GL

As long as the land remains on the books of the buyer, the unrealized gain must be eliminated at the end of each fiscal period. The original gain was closed to R/E at the end of that period. To eliminate the gain in subsequent years, it must come from R/E.

When the land is sold to a third party, the unrealized gain must be eliminated one more time, and finally recognized as a

REALIZED gain in the current consolidated financial statements.

5-15

The Effect of Land Transfers on

Noncontrolling Interests

DOWNSTREAM transfers have no effect on noncontrolling interest.

UPSTREAM transfers have a gain on the

SUBSIDIARY books!

All noncontrolling interest balances are based on the sub’s net income EXCLUDING the intra-entity gain.

5-16

Intra-entity Transactions --

Depreciable Asset Transfers

Learning Objective 5-7:

Prepare the consolidation entries to remove the effects of upstream and downstream intra-entity fixed asset transfers across affiliated entities.

Example

Able Co and Baker Co are related parties.

Able purchased equipment for $100,000 several years ago, and has recorded $40,000 of depreciation since that time.

Baker buys the equipment from Able for $90,000 on 1/1/14.

Equipment has a remaining useful life of 10 years.

5-17

Intra-entity Depreciable Asset Transfers

Entry TA and Entry ED

In the year of transfer, the unrealized gain must be eliminated and the assets restated to original cost.

The buyer’s depreciation is based on the inflated transfer price.

Excess depreciation expense must be eliminated.

5-18

Intra-entity Transactions --

Depreciable Asset Transfers

In Years Following the Year of Transfer

Equipment is carried on the individual books at a different amount than on the consolidated books.

The amounts change each year as depreciation is computed.

For every subsequent period, the separately reported figures must be adjusted on the worksheet to present the consolidated totals from a single entity’s perspective.

5-19

Intra-entity Depreciable Asset

Transfers(Subsequent Years)

If the transfer is downstream and the parent uses the equity method, then their Retained Earnings balance has already been reduced for the gain, and we adjust the Investment account instead.

5-20