Economic Outlook Presentation

advertisement

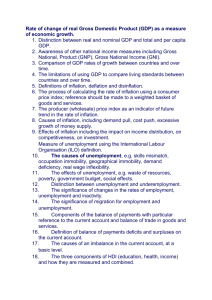

Outlook for the U.S. Economy Joe Kennedy Is there a Trade-off Between Inflation and Unemployment? Years 16.0 Annual Inflation Rate 14.0 12.0 10.0 8.0 6.0 4.0 2.0 .0 -2.0 0.0 2.0 4.0 6.0 8.0 Annual Unemployment Rate 10.0 12.0 GDP Growth 10 Growth is Moderate •Growth in the 1st Quarter of 2012 slipped to 2.2 percent. •This ended a streak of three straight quarters of accelerating growth and indicated that strong growth may not be just around the corner. 8 6 4 2 0 -2 -4 -6 -8 -10 2000 2005 2010 The Economy has Finally Started Adding Jobs •The economy added only 115,000 jobs in April 2011. •After three strong months at the turn of the year, job creation may be slowing. •Economists believe that the economy needs add approximately 125,000 each month just to accommodate new entrants into the workforce. Change in Total Nonfarm Employment (Thousands) Monthly Job Loss/Gain 600 400 200 0 2000 - Jan 2010 - Jan -200 -400 -600 -800 -1000 Year 20 The degree of long-term unemployment remains high 18 U-6 16 14 12 10 8 6 4 Unemployment Rate 2 0 1994 1995 1996 1997 1999 2000 2001 2002 2004 2005 2006 2007 2009 2010 2011 •The unemployment rate fell to 8.1 percent in April although much of the recent improvement has been due to people leaving the workforce rather than finding jobs. •A broader measure of unemployment that includes marginally attached workers, discouraged workers and part-time workers who seek full-time work is much higher. •The average duration of unemployment is 39.1 weeks. •41.3 percent of the unemployed have been jobless for 27 weeks or longer. •An interesting question is whether the expiration of extended unemployment benefits helped create a sudden fall in unemployment that is now petering out. •Labor market participation has declined over 2 percentage points from its high going into the recession. 18 16 Less than high school Education matters 14 12 10 8 6 College or more 4 2 0 1994 1995 1996 1997 1999 2000 2001 2002 2004 2005 2006 2007 2009 2010 2011 The unemployment rate for those without a high-school degree is much higher than for those with a college degree or more. •Age and race also matter. •The unemployment rate for teenagers is 24.9 percent, for those age 25-54 it is 6.9 percent. •The unemployment rate of blacks is usually double that for whites, currently 13.0 percent to 7.4 percent. The Economy is Still Driven by Consumer Spending •Consumption has risen to over 70 percent of GDP, while private investment has fallen to just over 13 percent. •A persistent criticism is that America does not invest enough in infrastructure, education, and research and development. Personal Consumption and Private Percent of GDP Investment as a Percent of GDP 80% 70% 60% 50% 40% 30% 20% 10% 0% 1950 1960 1970 1980 Year 1990 2000 2010 And Consumers are Still Over-Leveraged •Much of the reduction in household debt has been due to write-offs as consumers and homeowners defaulted on outstanding loans. Only a portion has been due to a shift away from consumption and into savings. Percent of Disposable Income Household Debt Service Ratio 1600% 1400% 1200% 1000% 800% 600% 400% 200% 0% 1980Q1 1985Q1 1990Q1 1995Q1 Year 2000Q1 2005Q1 2010Q1 Price $4.50 $4.00 $3.50 $3.00 $2.50 $2.00 $1.50 $1.00 $0.50 Axis Title 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 $0.00 1991 •Crude oil accounts for 65 percent of the cost of gasoline. Taxes add another 13 percent. Weekly Price of Regular Gasoline 1990 Rising Gas Prices Could Depress Consumer Spending Business Fixed Investment Continues to Rebound $Billion 2500 Gross Private Domestic Investment 2000 1500 1000 500 0 1980 - Q1 1985 - Q1 1990 - Q1 1995 - Q1 Year 2000 - Q1 2005 - Q1 2010 - Q1 But the Financial Sector Still Accounts for a High Percent of Total Profits •This is a dangerous sign. The financial sector is a service industry that should follow business activity in the rest of the economy, not lead it. •High profits may mean that financial institutions are building leverage and expanding risk again. Axis Title 0.5 Financial as a percent of total corporate profits 0.4 0.3 0.2 0.1 0 1980-I 1985-I 1990-I 1995-I -0.1 -0.2 Axis Title 2000-I 2005-I 2010-I Index The Dollar Has Fallen •Most recently the dollar has been trending up after a long decline •The weak American economy has caused the dollar to depreciate against major currencies. •But this has been offset by the dollar’s position as the world’s reserve currency and the tendency of investors to flock to Treasuries in times of high risk. •The European and Japanese markets also have economic difficulties. Major Currencies Index 120 100 80 60 40 20 0 2000-01 2005-01 2010-01 Date $ Billion Exports have Increased but so have Imports •Changes in the currency rate usually take about two years to fully affect trade patterns Real Value of Exports and Imports 2500 Imports 2000 1500 1000 Exports 500 0 1980 - Q1 1985 - Q1 1990 - Q1 1995 - Q1 Year 2000 - Q1 2005 - Q1 2010 - Q1 1982 - Jan 1983 - Dec 1985 - Nov 1987 - Oct 1989 - Sep 1991 - Aug 1993 - Jul 1995 - Jun 1997 - May 1999 - Apr 2001 - Mar 2003 - Feb 2005 - Jan 2006 - Dec 2008 - Nov 2010 - Oct Inflation Expectations Remain Low Cleveland 5-year Expected Inflation Rate 7 6 5 4 3 2 1 0 Inflation Remains Low Despite Rising Food and Gas Prices •Motor fuel accounts for 5.1 percent of all consumer purchases •Household energy accounts for another 4 percent of purchases •Food accounts for only 14.8 percent of all purchases Monthly Percent Change Major Indices of Inflation 7.0 6.0 CPI 5.0 4.0 3.0 2.0 CPI Less Food and Energy 1.0 0.0 2000 2004 2008 -1.0 -2.0 -3.0 -4.0 Year Federal Defict as a Percent of GDP The Federal Deficit Has Expanded Rapidly •The automatic rise in spending and fall in taxes accounted for much of the deterioration between 2008 and 2011. •Policy changes, in particular the ARRA accounted for a smaller portion. •Future deficits are driven largely by entitlement programs driven by the growing number of retirees and, especially, the expected rise in medical costs. Percent of GDP 10 5 0 -5 -10 -15 1935 1945 1955 1965 1975 -20 -25 -30 -35 Year 1984 1994 2004 The Current Deficit is due to Both Rising Spending and Falling Revenues •But even without additional taxes, revenues are expected to surpass the recent average of around 18 percent of GDP once the economy recovers. Revenues and Spending as a Percent of GDP Percent of GDP 30.0 Outlays 25.0 20.0 15.0 Revenues 10.0 5.0 0.0 1971 1981 1991 Year 2001 2011 Total Federal Debt is on Pace to Exceed World War II Highs Percent of GDP Federal Debt Held by Public 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 1971 1981 1991 Year 2001 Case-Shiller 10-City Index of Home Prices Index Value Housing Remains Weak •Housing prices appear to have stabilized •A large number of foreclosures remain in the system. •Uncertainty over how these foreclosures will be handled and how quickly will continue to depress prices. •Approximately 25 percent of homes remain underwater. •It is unclear whether financial institutions have adequately marked down these assets. 250.00 200.00 150.00 100.00 50.00 0.00 Year Major Stock Market Indices Equity Markets have Rebounded Adjusted Daily Closing Price 16000 14000 12000 10000 DJIA 8000 6000 4000 NASDAQ 2000 0 Date Index value Volatility is Down 90 Although far down from its extraordinary highs during the financial crisis, the VIX index, is still subject to sudden swings. 80 VIX Index Weekly Prices 70 60 50 40 30 20 10 0 Date P/E Ratio But Markets Still Appear to be Overvalued When prices are divided by a ten-year average of real earnings, they appear to be much higher than their long-run average. Shiller P/E Ratio 50.00 45.00 40.00 35.00 30.00 25.00 20.00 15.00 10.00 5.00 0.00 1960.011965.011970.011975.011980.011985.011990.011995.012000.012005.012010.01 Year Main Risks Going Forward International • European Sovereign Debt • Unrest in the Middle East (including Pakistan and Afghanistan) • Overheating and Political Instability in China Domestic • Fears of Inflation • Inevitable Fed Unwinding • Government Deficits • Continued Foreclosures • Policy Uncertainty