Amount payable is a percentage of the benefit based

advertisement

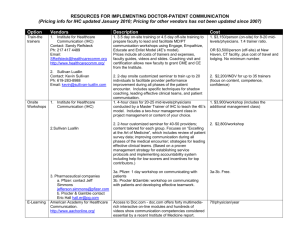

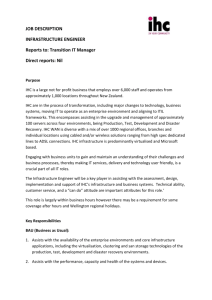

© IHC Group 2016 Balance Critical Illness & Accident Plans Brought to you by: Anthem and The IHC Group For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 The Partnership Anthem and The IHC Group have partnered together to offer critical illness and accident plans for your clients, designed to help consumers cover everyday expenses, such as mortgage payments and daycare. This is accomplished by building four membership levels: Balance 1 Balance 2 Balance 3 Balance 4 Partners: Producers, Anthem, Designated Agent Company and The IHC Group Designated Agent Company is a General Agency owned by Anthem For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 The IHC Group Corporate Overview Madison National Life Insurance Company, Inc. (MNL) is the underwriting carrier for Balance, rated A- by A.M. Best Ebix Health Administration Exchange, a member of The IHC Group, administers Balance New York Stock Exchange traded company (NYSE:IHC) For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Communicating For America Association membership in Communicating For America (CA) is required CA is a national 501(c) non-profit corporation Members across all 50 states Separate board of directors not affiliated with The IHC Group, or SSL. National headquarters in Fergus Falls, Minn. Since 1972, more than 100,000 consumers have trusted CA to help them find gap plans to stretch their healthcare dollar. Continues to advocate on behalf of its members with insurance companies, regulators and lawmakers. Cost of the association is included in the monthly retail rate For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Balance Guarantee issue product that complements your clients medical plan Provides a package of insurance coverage, services and discounts, including: Critical Illness Medical Expenses due to Accidents Hospital Confinement due to Accidents Disability Income due to Accidents Doctor on Demand Association based non-insurance services such as emergency road-side reimbursement and legislative hotline Insurance benefit payments go directly to your client unless assignment to a medical provider is requested For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Consumer Perspective No coordination of benefits with the members health plan Critical illness and accident plans assist in funding out-of-pocket costs or daily living expenses Payments may be assigned to providers or paid directly to insured Critical illness and Accident Medical Expense benefits can provide income in excess of plan out-of-pocket to help defray the impact of significant illnesses on family budgets For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 The Broker Perspective Single product source No need to deal with multiple underwriters or administrators for ancillary plans Outstanding customer service for all bundled Balance products at one location Lower cost Bundling ancillary products lessens the impact of selection Lower administrative cost due to multiple products on single bill Product ease Co-branding arrangement with Anthem limits client confusion Online policy fulfillment For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 State Availability Map For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Accident Benefit Levels Balance 1 Balance 2 Balance 3 Balance 4 Critical illness $2,500 $5,000 $7,500 $10,000 Accident medical $2,500 $5,000 $7,500 $10,000 Accident hospital confinement $150 $150 $150 $150 per day per day per day per day Accident disability income $1,000 $1,000 $1,000 $1,000 per month per month per month per month Individual monthly cost $34.95 $44.95 $54.95 $64.95 Family monthly cost $51.95 $69.95 $89.95 $109.95 Exclusions and limitations apply For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Accident Medical Expense Balance 1 Accident medical insurance Balance 4 $5,000 $7,500 $10,000 $100 $250 $500 $500 Coverage eligibility Balance 3 $2,500 Deductible per accident Balance 2 A family membership covers the primary member, spouse and all dependents up to age 26 Coverage duration After the deductible, benefits are payable for medical expenses incurred as a result of each covered accident Pays medical expenses resulting from a covered accident The benefit payment is up to the amount of the medical expense For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Accident Medical Expense Example - Balance 2 Deductible $250 Customer submits bill for full claim amount after network discounts (if in-network) Insured receives an EOB from their medical insurance company $5,000 AME IHC reimburses up to cost of discounted medical expenses or plan maximum whichever is less Total claim expense/cost $6,000 Insured sends a completed accident medical claim form and any additional requirements to IHC IHC reviews, and if approved, sends a check for $4,750 to the client unless payment is assigned to the provider For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Accident Hospital Confinement Balance 1 Accident hospital confinement Balance 3 Balance 4 $150 Per day Coverage eligibility Balance 2 A family membership covers the primary member, spouse and all dependents up to age 26 Coverage duration Benefits are available for up to 30 days when hospital confined due to a covered injury For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Accident Disability Income Balance 1 Accident Disability Income Insurance Balance 3 Balance 4 $1,000 per month Coverage eligibility Balance 2 This benefit is available only to the primary insured Coverage duration Pays a monthly benefit up to 12 months for disability due to a covered accident After a 90 day elimination period For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Critical Illness Benefit Levels Balance 1 Critical Illness Coverage $2,500 Balance 2 $5,000 Balance 3 $7,500 Balance 4 $10,000 Pays a lump sum benefit upon diagnosis of: Heart attack Kidney failure Paralysis Loss of sight, speech or hearing Stroke Major organ transplant Coma Life-threatening cancer Coronary bypass Severe burn* *Amount payable is a percentage of the benefit based on the area burned The amount payable will be reduced by 50 percent if the covered person is age 65 or older on the date the benefit becomes payable. Covered illnesses may vary by state For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Critical Illness Continued Coverage eligibility A family membership covers the primary insured and spouse only Dependent children are not covered for Critical Illness Coverage Subject to a 12 month pre-existing condition limitation (based on date of first diagnosis) Benefit varies by type of illness and other terms; benefit reduces by 50% when the insured attains age 65 Coverage terminates at age 70 Coverage duration 30 Day Waiting Period / 90 Days for Life Threatening Cancer diagnosis Critical illnesses diagnosed in the first 30 days of coverage will have the lesser of a $500 benefit or 10 percent of the amount that it would have paid for the condition if first diagnosed more than 30 days after the insured person’s effective date. For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Critical Illness Example 1. Member suffers from a stroke 2. Member completes a claim form and sends all requirements to Ebix Health Administration Exchange 3. Ebix Health Administration Exchange Reviews 4. Ebix Health Administration Exchange(on behalf of MNL) sends check for a lump sum to the insured member Request and complete claim form for Balance Ebix Health Administration Exchange Reviews Check sent to customer if claim is approved For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Getting Started You must be contracted with The IHC Group and Anthem in order to sell Balance Contracting is available from your Anthem representative or at the Anthem Coverage Resource Center www.healthedeals.com/ccc-ic Click “Get set up to sell” You must have an active Health license in each state that you do business and be appointed by the carrier For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Your Personalized Link Once contracted, you will receive a welcome email which will provide you with a unique link to quote and enroll your clients. Bookmark your link for easy continued access This personalized link will ensure that you receive credit for your sales; do not share with other agents to sell from. Publish and access your link with the “Link Creation Tool” at any time Post your link on your website Place a banner in your email signature Email to a client so they can self-enroll For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Quoting and Enrollment www.myihcgroup.com Enroll and assist customers online Email proposals with application links for clients to self enroll Only allows you to quote plans that are available in your state View brochures View product information Access your activity reports Case status View policy information Download policy information For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Compensation Standard writing agent compensation is 26%* *Enrollment and monthly admin fee not included For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Important Information THIS PLAN IS NOT CONSIDERED TO BE MINIMAL ESSENTIAL COVERAGE AS DEFINED BY THE PATIENT PROTECTION AND AFFORDABLE CARE ACT (ACA). ENROLLING IN AND MAINTAINING THIS PLAN WILL NOT EXEMPT YOU FROM THE SHARED RESPONSIBILITY PAYMENT (TAX) THAT MAY APPLY IF YOU DO NOT HAVE PLAN WITH ACACOMPLIANT COVERAGE. Communicating for America, Inc. (CA) is a national non-profit advocacy organization that supports affordable healthcare for all Americans. Since 1972, more than 100,000 consumers have trusted CA to help them find affordable health insurance and GAP plans to stretch their healthcare dollar while advocating on their behalf with insurance companies, regulators and lawmakers. About Madison National Life Insurance Company, Inc. Madison National Life Insurance Company, Inc. (Madison National Life), domiciled in Wisconsin is licensed to sell insurance products in 49 states, the District of Columbia, Guam, American Samoa and the U.S. Virgin Islands. Its core products and services are health insurance, group life and disability income, employer stoploss, specialized individual life and annuity products to military and government personnel. It is rated A- (Excellent) for financial strength by A.M. Best Company, a widely recognized rating agency that rates insurance companies on their relative financial strength and ability to meet policyholder obligations (an A++ rating from A.M. Best is its highest rating). Ebix Health Administration Exchange Ebix Health Administration Exchange is a full service administrative services company that operates in 50 jurisdictions in the individual and employer markets, and provides state of the art and highly efficient open health insurance exchanges through its affiliation with Ebix Incorporated, and, through an affiliate, is the provider of pet insurance solutions that provide pet parents, specialty pet hospitals and universities and general veterinary practices with the only open exchange in the country for all interested constituencies. About The IHC Group The IHC Group is an organization of insurance carriers and marketing and administrative affiliates that has been providing life, health, disability, medical stop-loss and specialty insurance solutions to groups and individuals for over 30 years. Members of The IHC Group include Independence Holding Company (NYSE:IHC), American Independence Corp. (NASDAQ: AMIC), Standard Security Life Insurance Company of New York, Madison National Life Insurance Company, Inc. and Independence American Insurance Company. Each insurance carrier in The IHC Group has a financial strength rating of A- (Excellent) from A.M. Best Company, Inc., a widely recognized rating agency that rates insurance companies on their relative financial strength and ability to meet policyholder obligations. (An A++ rating from A.M. Best is its highest rating.) Collectively, the companies in The IHC Group provide insurance coverage to more than one million individuals and groups. For more information about The IHC Group, visit www.ihcgroup.com. For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216 © IHC Group 2016 Thank you Questions? Please reach out to your Anthem representative, call 855-632-9003 or email start@ihcgroup.com For training purposes only. Not for public distribution or solicitation. PPT Anthem Balance 0216