Ch. 3 : Simple Keynesian Model

advertisement

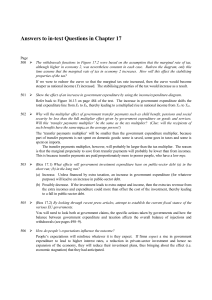

Ch. 3 : National Income Determination (II) (Simple Keynesian Model) C C=Ca + cYd Y I I=Ia Y G G=Ga Y X X=Xa Y T T=Ta Y M M=Ma + mY Y AE AE=C+I+G+(X-M) Y Y* $ S+T+M I+G+X Y Y* Fiscal Policy • • • • • Discretionary Fiscal Policy expansionary fiscal policy (1) increased government spending, (2) lower taxes, or (3) a combination of the two. • • • • contrationary fiscal policy (1) decreased government spending, (2) higher taxes, or (3) a combination of the two. • Problems of Fiscal Policy 1. Recognition Lag 2. Executive Lag 3. Response Lag Changing Government Expenditure or Taxes? • • • • 1. Location of Effects 2. Time Lag 3. The Reversibility of the Policy 4. The Public’s Reaction to Short-term Changes Built-in stabilisers • Built-in stabilisers are those institutional arrangements that automatically increase government deficit (or decrease surplus) during slumps/recessions, and increase surplus (or decrease deficit) during booms, without the government having to make any policy decision. Examples of built-in stabilizers • • • • Progressive Tax System Welfare Scheme Government Purchases Corporate and Family Savings Some built-in stabilizers that may create disincentives: • progressive taxation • unemployment and welfare benefits Some built-in stabilizers that do not create disincentives: • corporate savings • family savings Limitations of built-in stabilizers: • Built-in stabilisers can reduce fluctuations but cannot maintain full stability. • built-in stabilisers may reduce the speed of recovery Balanced-Budget Multiplier • C=Ca+cYd • G=Ga • I=Ia • T=Ta • The government expenditure multiplier: Kg=1/(1-c) • The tax multiplier : Kt=-c/(1-c) • The balanced-budget multiplier: Kb=1/(1-c) + -c/(1-c) =1 • Ga by $1 will increase income by: 1+MPC+MPC2+MPC3 ......---(1) • Ta by $1 will decrease income by: MPC+MPC2+MPC3 ......---(2) Ga - Ta = 1 Recessionary (Deflationary) Gap and Fiscal Policy AE AE’ AE Y Ye Yf Inflationary Gap and Fiscal Policy AE AE AE’ Y Yf Ye Paradox of Thrift • Thriftiness, while a virtue for the individual, is disastrous for an economy. • If consumers seek to save a larger amount out of any given level of income, that attempt to save more may lead to a fall in income leaving the amount of savings unchanged or even decreased. Case 1: Investment expenditure is autonomous Given: S = -Ca+(1-c)Y I =Ia The Paradox of Thrift I,S S2 S1 I=Ia Y Y2 Y1 Example • S1=-20+(1-0.75)Y • I=20 • At equilibrium, • • • • I=S 20=-20+(1-0.75)Y 40=0.25Y Y=160 the realized saving is: S1=-20+(1-0.75)Y =-20+0.25(160) =-20+40 =20 Suppose the saving function shifts upward, S2=-10+(1-0.75)Y I=20 At equilibrium, I=S 20=-10+(1-0.75)Y 30=0.25Y Y=120 Now the realized saving is: S2=-10+(1-0.75)Y =-10+0.25(120) =-10+30 =20 Case 2: Investment expenditure is an increasing function of national income • Given: • • S = -Ca+(1-c)Y I = Ia+eY The Paradox of Thrift I,S S2 S1 I=Ia+eY Y Y2 Y1 How the paradox can be resolved? • If planned investment increases as a result of the increase in planned saving, then there may not be a decrease in national output. The Paradox of Thrift I,S S1 I=Ia Y Y1 The Paradox of Thrift I,S S2 S1 I=Ia Y Y2 Y1 The Paradox of Thrift I,S S2 I=Ia’ S1 I=Ia Y Y2 Y1 The Paradox of Thrift I,S S1 I=Ia Y Y1 The Paradox of Thrift I,S S2 S1 I=Ia+eY Y Y2 Y1 The Paradox of Thrift I,S S2 S1 I=Ia’+eY I=Ia+eY Y Y2 Y1 Revision Exercise • What is the 'paradox of thrift'? Explain, with the aid of diagrams, how this paradox can be resolved. • Compare the magnitudes of the income multipliers of the simple Keynesian model under the following tax systems: lump sum income tax, proportional income tax and progressive tax. • • What are “automatic stabilizers”? Give two examples to illustrate your answer. • Compare the effectiveness of the proportional income tax and the progressive income tax in reducing economic instability. 'Consumption depends on the level of income.' 'The level of income depends on consumption.' With the aid of diagrams, reconcile these two statements with reference to the Keynesian model. Answer: • In the consumption curve, consumption is a function of the level of income. As income increases, consumption will also increase. In the Keynesian model, the consumption is assumed to be: C = a + c Y where a is the intercept and c is the marginal propensity to consume. • If the consumption curve shifts upward, the level of income will be increased because of the increase of aggregate demand in the economy. Therefore the level of income depends on consumption. • There is no circular reasoning: it is a case of mutual determination of income and consumption. Mutual dependence is not an inconsistency. • Consider the following information about Country A: C = 0.8Yd I = 260 G = 400 T = 0.5Y X = 300 M = 0.2Y Find: i. the equilibrium level of national income ii. the income multiplier iii. the tax multiplier Answer • a. Find the equilibrium income. • In equilibrium, Y = AE • Y=C+I+G • = 400 + 0.8(Y-T) + 50 + 32 • = 482 + 0.8(Y - 40 - 0.375Y) • = 450 + 0.5Y • 0.5Y = 450 • Y = 900 • In equilibrium, Y = 900 b.b. Find the income multiplier. Income multiplier = 1/(1-c-ct) = 1/[10.8+(0.8)(0.375)] =2 The income multiplier is equal to 2. c. Given that the existing income level is 900, and that the income multiplier is 2, the government has to increase its expenditure by 50 for full employment to be attained. Consider the following information: Labour force (L) = 600 Production function = 3L Find: i. the full-employment income level ii. the no. of labour that is unemployed Suppose the government is planning to increase her expenditure in order to stimulate the economy. How much expenditure should the government increase to achieve full-employment? In a closed economy, private consumption (C), investment (I), government expenditure (G), transfer payments (TR) and tax revenue (T) are as follows: C = 50 + 0.8Yd I = 50 G = 100 TR = 50 T = 0.25Y a. (i) What is the equilibrium value of Y? (ii) What is the value of the multiplier for government expenditure? (iii) What is the balance of the government budget? b. Assume that government expenditure is now increased by 20, from 100 to 120. If the government wants to pursue a balanced budget, what should be the amount of transfer payments? AL Questions AL 2000/5 AD, X, M (C+I+G+X-M)’ C+I+G+X-M D M B A trade deficit X C 450 Y Y* Y**