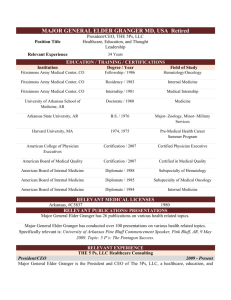

Financial Stability

advertisement

Structural modelling: Causality,

exogeneity and unit roots

Andrew P. Blake

CCBS/HKMA May 2004

What do we need to do

with our data?

• Estimate structural equations (i.e.

understand what’s happening now)

• Forecast (i.e. say something about what’s

likely to happen in the future)

• Conduct scenario analysis (i.e. perform

simulations) to inform policy

What do we need to know?

• Inter-relationships between variables

– Causality in the Granger sense

– Exogeneity

• Concepts

– Unit roots

• Spurious regression

• Role of pre-testing

• Appropriate single equation methods

0.08

0.04

0.00

-0.04

-0.08

94 95 96 97 98 99 00 01

X

Y

Inter-relationships between

variables

Period t

Period t+1

xt

xt+1

yt

yt+1

How best to estimate an

equation?

• Single equation structural model (estimated

by OLS)

• Single equation reduced form (IV/OLS)

• Structural system (estimated by TSLS,

3SLS or by a system method - SUR, FIML)

• Unrestricted VAR (OLS)

• VECM (FIML)

xt is autoregressive

Period t

Period t+1

xt

xt+1

yt

yt+1

xt has an autoregressive

representation

Period t

Period t+1

xt

xt+1

yt

yt+1

xt has an ARMA representation

xt yt t

}

yt yt 1 t

yt 1

1

x

t 1

Structural system

t 1

yt xt 1 t 1 t

so, xt xt 1 t t t 1 Reduced form

Granger Causality

Period t

Period t+1

xt

xt+1

yt

yt+1

Vector autoregressions (VARs)

Period t

Period t+1

xt

xt+1

yt

yt+1

Needs to be modelled to have

a structural interpretation

Granger causality

• If past values of y help to explain x, then y

Granger causes x

• Statistical concept

• A lack of Granger causality does not imply

no causal relationship

GC tested by an unrestricted VAR

xt a11 xt 1 a12 yt 1 b11 xt 2 b12 yt 2 ... t

yt a21 xt 1 a22 yt 1 b21 xt 2 b22 yt 2 ... t

• Definition of Granger Causality:

– y does not Granger cause x if a12=b12=...=0

– x does not Granger cause y if a21=b21=...=0

• NB. x and y could still affect each other in the

same period or via unmeasured common shocks to

the error terms.

Eviews Granger causality test result

Null Hypothesis

x does not Granger Cause y

y does not Granger Cause x

F-Statistic Probability

F1

F2

P1

P2

• The closer P1 is to zero, the less the likelihood of

accepting the null that x does not Granger cause y.

• (P1<0.10 : at least 90% confident that s1 Granger

causes s2).

• P1 should be less than 0.10 for us to be reasonably

confident that x Granger causes y.

Leading indicators

y is a leading indicator of x if

• y Granger causes x;

• x does not Granger cause y;

• and y is weakly exogenous.

73

.2

74

.2

75

.2

76

.2

77

.2

78

.2

79

.2

80

.2

81

.2

82

.2

83

.2

84

.2

85

.2

86

.2

87

.2

88

.2

89

.2

90

.2

91

.2

92

.2

93

.2

94

.2

95

.2

96

.2

97

.2

% on year earlier, smoothed, prices lagged 6

quarters

Long term trends of money and prices

in UK

30.0

25.0

20.0

15.0

10.0

5.0

0.0

Broad Money

Prices

Criticisms of Granger causality

• Granger causality can be assessed using an

unrestricted VAR - not tied to any particular

theory

• How would you explain to your governor

when it goes wrong?

• It depends on the choice of lags, data

frequency and variables in VAR

Exogeneity

• Engle et al. (1983)

– Separate parameters into two groups

– Those that matter, those that don’t

• These are endogenous and weakly

exogenous variables

• In practice a bit more complicated than that

Exogeneity (cont.)

• Correct assumptions of exogeneity simplify

modeling, reduce computational expense

and aid interpretation

• But incorrect assumptions may lead to

inefficient or inconsistent estimates and

misleading forecasts

Exogeneity (cont.)

• A variable is exogenous if it can be taken as

given without losing information for the

purpose at hand

• This varies with the situation

• We do not want the independent variables to

be correlated with the regressors

• If they are, the estimates will be biased

Relationships between variables

Period t

Period t+1

xt

xt+1

yt

yt+1

• We do not want the black arrows

• We need to understand the red arrows

Both demand and supply shocks

14

12

P

10

8

6

4

2

0

0

1

2

3

4

5

6

Q

OLS is unable to identify either the demand or supply curve

Only supply shocks

14

12

P

10

8

6

4

2

0

0

1

2

3

4

5

Q

We can identify the demand schedule using OLS

6

Weak exogeneity

• Is y weakly exogenous with respect to x?

• Do values of current x affect current y?

• Are x and y both affected by a common

unmeasured third variable?

• Does the range of possible values for the

parameters in the process that determines x

affect the possible values of those that

determine y

Weak exogeneity: example 1

• Money demand function:

mt yt rt

• Would you estimate this as a single equation

using OLS?

• Very unlikely that money does not affect

real output or the nominal interest rate

Weak exogeneity: example 2

• Uncovered interest parity:

E t et 1 rt rt

*

• Tests of UIP have performed very poorly,

but ...

• No risk premia and monetary policy might

react to exchange rate changes

Interest rate

differentials

Exchange

rate change

Question: how would you test for exogeneity in UIP?

Weak exogeneity: example 3

• In UK consumption had been forecast using

single-equation ECM

• But relationship broke down in late 1980s

• Problem was that possibility that wealth

reactions to disequilibrium had been

ignored

Single Equation ECM

yt yt 1 xt xt 1 ...

Dynamic terms

... yt 1 xt 1

Long run

Vector ECMS

xt 1yt 11xt 1 12 yt 1 ... 1 ECM

yt 2 xt 21xt 1 22 yt 1 ... 2 ECM

Halfway between structural VARs and

unrestricted VARs

Strong exogeneity

• Necessary for forecasting

• Is y strongly exogenous to x?

– Is y weakly exogenous to x

– Does x Granger cause y?

• Need the answers to be yes and no

respectively

Strong exogeneity: example

First order VAR, ‘core’ and non-‘core’ inflation:

zt Azt-1 t , zt xt , yt '

Given a forecast of {yt} can we forecast {xt}?

• If y is not strongly exogenous to x, feedback

problems

Super exogeneity

Necessary for policy/scenario analysis. Is y super

exogenous to x?

• Is y weakly exogenous to x?

• Is the relationship between x and y invariant?

Need the answers to be yes to both

Invariance

• The process driving a variable does not

change in the face of shocks

• Linked to ‘deep parameters’

• Example: the Lucas critique

Testing for weak exogeneity:

orthogonality test

• Estimate a reduced form (marginal model)

for x, regress x on any exogenous variables

of the system

• Take residuals from this reduced form and

put them into the structural equation for y

• If they are significant then x is not weakly

exogenous with respect to the estimation of

c10

Testing for weak exogeneity with

respect to c(lr)

• Estimate a reduced form (marginal model) for x:

regress x on exogenous variables of system,

including lagged ECM term involving x and y

• Test if coefficient of ECM term is significant

• If it is, then x is not weakly exogenous with

respect to the estimation of long-run coeff, c(lr)

• Consequence is that estimate is inefficient

Stationarity

• Why should we test whether series are stationary?

• A non-stationary time series implies that shocks

never die out

• The mean, variance and higher moments depend

on time

• Standard statistics do not have standard

distributions

• Problem of spurious regression

Non-stationarity

• Start with the following expression

yt = + yt-1 + ut u, 2

• Substitute recursively:

yt = n + n yt-n + n-1jut-j

• The variable will be non-stationary if =

E(y)=t

Var(y) = Var(n-1ut-j - t) = t 2

• Displays time dependency

Non-stationarity (cont.)

• t is a stochastic trend

• The series drifts upwards or downwards

depending on sign of ; increases if positive

• Stationary series tend to return to its mean value

and fluctuate around it within a more-or-less

constant range

• Non-stationary series has a different mean at

different points in time and its variance increases

with the sample size

Non-stationarity (cont.)

•

•

•

•

•

•

Mean and variance increase with time

yt = n + n yt-n +n-1jut-j

If = then shocks never die out

If | |<1 as n, then y is like a finite MA

What do non-stationary series look like?

Could show made-up series (with and

without drift)

Difference vs trend stationarity

• Compare previous equation with

yt = a + b t + ut

E(y) = a + b t

var(y) = 2

• b t - deterministic trend

• But stationary around a trend

E(y - b t) = a

Difference vs trend stationarity (2)

• Compare two generated series

• Stationary around trend

• Difference stationary are non-constant

around a trend

• But can be difficult to tell apart

• Also difficult to tell series with AR

coefficients 1 and 0.95

Difference vs trend stationary

80

500

60

400

40

300

20

200

0

100

-20

0

00

10

20

30

40

50

X

60

70

Z

80

90

00

Difference vs trend stationarity

• Can you tell the difference?

xt = 1 + xt-1 + 0.6 ut

zt = 1 + 0.15 t + 0.8 et

• Can you tell the difference with a near-unit

root?

Unit root vs near-unit root

50

500

40

400

300

30

200

20

100

10

0

00

0

00

01

02

03

04

05

06

07

08

09

10

20

30

40

50

X

X

W

60

10

W

70

80

90

00

Testing for unit roots

• Dickey-Fuller test

• Write

yt = yt-1 + et

as

yt - yt-1 = (-1)yt-1 + et

Null: Coefficient on lagged value 0, vs < 0

Dickey-Fuller tests

•

•

•

•

Test akin to t-test but distributions not standard

Depends if series contains constant and/or trends

Must incorporate this into DF test

Augmented DF test - use lags of dependent

variable to remove serial correlation

• All of these must be checked against relevant DF

statistic

• But introducing extra variables reduces power

Unit versus near-unit roots

• Thus difficult to tell the difference between

two series over small samples

• Low power of ADF tests (sample of 400)

x: ADF statistic -0.77048 p-value 0.8258

w: ADF statistic -6.90130 p-value 0.0000

• Small sample (40 observations)

x: ADF statistic 0.39323 p-value 0.9804

w: ADF statistic -0.49216 p-value 0.8828

Stationarity in non-stationary

time series

• A variable is integrated of order d - I(d) - if

it musto be differenced d times for

stationarity

• The required number of differences depends

on the number of unit roots a series has

• For example, an I(1) variable needs to be

differenced once to achieve stationarity: it

has only one unit root

Spurious regressions

• Trends in data can lead to spurious

correlation between variables: there appears

to be meaningful relationships

• What is present are uncorrelated trends

• Time trend in a trend-stationary variable can

be removed by regressing variable on time

• Regression model then operates with

stationary series with constant means and

variances (standard t and F test inferences)

Spurious regressions

• Regressing a non-stationary variable on a

time trend generally does not yield a

stationary variable (it must be differenced)

i.e. taking trend away does not lead to

stationarity

• Using standard regression techniques with

non-stationary data can lead to the problem

of spurious regression involving invalid

inference based on usual t and F tests

Spurious regressions

• Consider the following DGP:

yt = yt-1 + ut u , 1

xt = xt-1 + et e , 1

• y and x are uncorrelated, but estimating

y t = a + b xt + v t

we find that we can reject b = 0.

• Why? Non-stationary data => v nonstationary gives problems with t and F stats

• Also find high R2 and low DW (G&N 1974)

Spurious Regressions

Dependent Variable: Y

Method: Least Squares

Date: 03/31/03 Time: 18:28

Sample: 1900:1 2003:4

Included observations: 416

Variable

X

R-squared

Adjusted R-squared

S.E. of regression

Sum squared resid

Log likelihood

Coefficient

Std. Error

t-Statistic

Prob.

0.964478

0.001112

867.6800

0.0000

0.997879

0.997879

5.543177

12751.63

-1302.206

Mean dependent var

S.D. dependent var

Akaike info criterion

Schwarz criterion

Durbin-Watson stat

202.9399

120.3730

6.265414

6.275103

0.023766

Spurious regression

• Why do we find significant coefficients?

• What will happen if we estimate a spurious

regression with the variables in first

differences?

• What ‘economic problem’ do we encounter

if we only use differenced variables in

economics?

• We lose information about the long-run

Spurious Regression

Dependent Variable: DY

Method: Least Squares

Date: 03/31/03 Time: 18:36

Sample(adjusted): 1900:2 2003:4

Included observations: 415 after adjusting endpoints

Variable

C

DX

R-squared

Adjusted R-squared

S.E. of regression

Sum squared resid

Log likelihood

Durbin-Watson stat

Coefficient

Std. Error

t-Statistic

Prob.

0.989704

-0.005194

0.016085

0.012185

61.52980

-0.426235

0.0000

0.6702

0.000440

-0.001981

0.211922

18.54827

56.03014

1.752192

Mean dependent var

S.D. dependent var

Akaike info criterion

Schwarz criterion

F-statistic

Prob(F-statistic)

0.984475

0.211713

-0.260386

-0.240973

0.181676

0.670159

Cointegration (definition)

• In general, regressing two I(d) variables, d>0,

leads to the problem of spurious regression

• Assume two I(d) variables and estimate:

yt xt t

• If is a vector such that t is I(d-b) then we say

that y and x are co-integrated of order CI(d,b)

What is cointegration?

• If two (or more) series have an equilibrium

relationship in the long run even though the

series contain stochastic trends they move

together such that a (linear) combination of

them is stationary

• Cointegration resembles a long-run

equilibrium and differences from the

relationship are akin to disequilibrium

• Trivially, a stationary model must be

Modelling the short-run

• Are we ever in the long run?

• How do we model the short run?

• Problem of using only differenced data and

the loss of long-run information

• Assume yt xt t

• In steady state yt xt 0 has little

meaning for the long run

Modelling short run

• Assume

yt = xt + yt-1 + xt-1 + t, , 2

• If a LR relationship exists

yt = + xt

• We can write

yt = xt - (1- )(yt-1 - - xt-1 ) + t

• (1- ) is speed of adjustment

• Implications for the sign of ECM

Modelling the short-run

• There are some issues about the estimation

of

• Stock (1987) shows that OLS is fine, is

super-consistent; the estimator converges to

its true value at a faster rate when a series is

I(1) than when it is I(0)

• However, there is significant of bias in

small samples

Testing strategies

• Perron’s suggestion:

– start with regression with constant and trend

– proceed trying to reduce unnecessary paramaters

– if we fail to reject parameters continue testing until

we are able to reject the hypothesis of a unit root

• In the end we should use common sense and

economics

– If there should not be a unit root - probably a

break

Cointegration and single

equations

• When looking at single equations it is easy

to test for cointegration

– Engle and Granger two-step procedure

– Engle-Granger-Yoo three-step approach

• What if there is more than a single

cointerating relationship?

– Need a system approach

– VECMs

Modelling strategies

• Understand the data

– Do whatever tests necessary to be sure of using

appropriate models

• Understand the limitations of individual

methods

– By not taking limitations into account a rejection does

not necessarily imply that the hypothesis is false

• Use appropriate methods for different

problems

EXOGENEITY

•

Banerjee, A, D.F. Hendry and G.E. Mizon (1996) “The econometric analysis of economic policy”, Oxford Bulletin of

Economics and Statistics 58(4), 573-600

•

Ericsson, N.R. and J.S. Irons (eds) (1994) Testing Exogeneity. Advanced Texts in Econometrics. Oxford University

Press.

•

Lindé, J. (2001) “Testing for the Lucas Critique: A quantitative investigation”, American Economic Review 91(4),

986-1005.

•

Monfort, A and R. Rabemananjara (1990) “From a VAR model to a structural model, with an application to the wageprice spiral”, Journal of Applied Econometrics 5, 203-227

•

Urbain, J.P. (1995) “Partial versus full system modelling of cointegrated systems: An empirical illustration”,

Journal of Econometrics 69(1), 177-210.

•

Boswijk, P. and J.P. Urbain (1997) “Lagrange Multiplier tests for weak exogeneity: A synthesis”,

Econometric Reviews 16(1), 21-38.

•

Charezma, W.W and D.F. Deadman, (1997) New Directions in Econometric Practice, Edward Elgar, Second Edition.

•

Urbain, J.P. (1992) “On weak exogeneity in error correction models”, Oxford Bulletin of Economics and Statistics

54(2), 187-207.

MODELLING AND FORECASTING SHORT-TERM DATA

•

Jondeau, É., H. Le Bihan and F. Sédillot (1999) Modelling and Forecasting the French Consumer Price Index

Components, Banque de France Working paper 68.

•

Clements, M. P. and D.F. Hendry (1999) Forecasting non-stationary economic time series. MIT Press.

•

Bardsen, G and P.G. Fisher (1996) On the roles of economic theory and equilibria in estimating dynamic econometric

models-with an application to wages and prices in the United Kingdom, Essays in Honour of Ragnar Frisch.

VARS

•

Levtchenkova, S., A.R. Pagan and J.C. Robertson (1998) “Shocking stories”, Journal of Economic Surveys 12(5),

507-532.