HCA 341 Financial Management of Health Care Institutions

advertisement

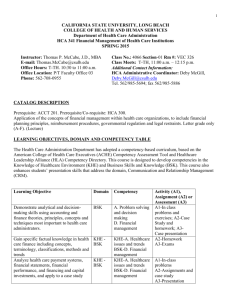

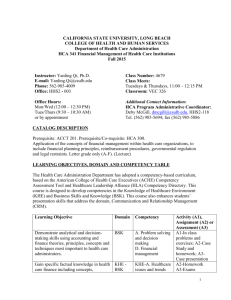

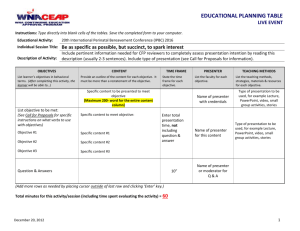

1 CALIFORNIA STATE UNIVERSITY, LONG BEACH COLLEGE OF HEALTH AND HUMAN SERVICES Department of Health Care Administration HCA 341 Financial Management of Health Care Institutions Spring 2012 Instructor: Thomas P. McCabe, J.D., MBA E-mail: tmccabe@csulb.edu Office Hours: Weds. 12:00 to 1:00 p.m. Office Location: ET 101 Phone: 562-708-0955 Class Number:8863-02 Room Number: ET 107 Class Meets: Wednesdays, 1:00 – 3:45pm Additional Contact Information: HCA Administrative Coordinator: Deby McGill, dmcgill@csulb.edu Tel. 562/985-5694; fax 562/985-5886 Catalog Description Prerequisite: ACCT 201. Prerequisite/Co-requisite: HCA 402. Application of the concepts of financial management within health care organizations, to include financial planning principles, reimbursement procedures, governmental regulation and legal restraints. Letter grade only (A-F). (Lecture) Learning Objectives, Domain and Competency Table The Health Care Administration Department has adopted a competency-based curriculum, based on the American College of Health Care Executives (ACHE) Competency Assessment Tool and Healthcare Leadership Alliance (HLA) Competency Directory. This course is designed to develop competencies in the Knowledge of Healthcare Environment (KHE) and Business Skills and Knowledge (BSK). This course also enhances students’ presentation skills that address the domain, Communication and Relationship Management (CRM). Learning Objective Domain Competency Demonstrate analytical and decisionmaking skills using accounting and finance theories, principles, concepts and techniques most important to health care administrators. BSK A. Problem solving and decision making D. Financial management Gain specific factual knowledge in health care finance including concepts, terminology, classifications, methods and trends Analyze health care payment systems, financial statements, financial performance, and financing and capital investments, and apply to a case study KHE BSK KHE-A. Healthcare issues and trends BSK-D. Financial management KHE-A. Healthcare issues and trends BSK-D. Financial management KHE BSK Activity (A1), Assignment (A2) or Assessment (A3) A1-In class problems and exercises; A2-Case Study and homework; A3Case presentation A2-Homework A3-Exams A1-In-class problems A2-Assignments and case study A3-Presentation 2 Learning Objective Domain Competency Learn how to operate a financial calculator BSK D. Financial management Demonstrate oral communication skills CRM B. Communication skills Activity (A1), Assignment (A2) or Assessment (A3) A1-Exercise with financial calculator in class A2-Homework A3-Exams A2-Case study A3 Presentation Text(s) and other course materials Gapenski, L. C. (2008). Healthcare Finance: An Introduction to Accounting and Financial Management, 4th Ed. Chicago, IL; Health Administration Press. Business calculator-BA Models such as Texas Instruments BA-IIPLUS or SHARP EL-733A. Course Format This course will consist of lectures, class discussions, assignments, group projects, and presentations. The instructor will explain topics in class as scheduled and supplementary materials will be handed when needed. Case Presentation and Analysis: Each group, which consists of 3-4 students, will present a selected case. Group assignments will be made in the first class. Each group should plan for a formal presentation with overheads, computer slides and handouts (PowerPoint required). These case presentations should take no longer than 20-25 minutes including time for questions. Presentations will be scheduled for the last few classes of the semester. Assignments: To get the most out of this class, students should read the material assigned prior to coming to class and complete assignments. There will be five assignments distributed in class, and be collected the following week or in the following class (see Course Outline for more information). A financial calculator is needed for many of these assignments. Exams: There will be a midterm and a final exam in this class. Both exams will be given IN-CLASS as they are scheduled. No makeup exam is given unless there is convincing reason such as doctor’s note, etc. The midterm exam is scheduled for October 20 and the final exam is on December 15. Participation and Absences: Attendance and participation are expected for all classes. If a student is ill, please inform the professor prior to the class and turn in the work as soon as possible. Students will receive no credit for unexcused late work. You participation grade is heavily depends on your attendance. Each missed class will lower your participation grade by 3 points. Attendance policy conforms to: http://www.csulb.edu/divisions/aa/grad_undergrad/senate/documents/policy/2001/01/. Disabled students requiring special accommodations, please advise instructor early in the course. 3 Course Evaluation Success in achieving the course objectives will be evaluated with the following instruments. Students can accumulate up to 350 points from all course requirements. Points 100 points 100 points 50 points 50 points 25 points 25 points 350 points Midterm Final Assignments Case Presentation Participation Student Grading TOTAL Weights 28.6% 28.6% 14.3% [10 points x 5] 14.3% 7.1% 7.1% ~100% Cutoff Points A = 350 - 315 points B = 314 - 280 points C = 279 - 245 points D = 244 – 210 points F = less than 210 points Cheating And Plagiarism Please be aware of and ensure that your behavior conforms to University Policy. See: http://www.csulb.edu/divisions/aa/grad_undergrad/senate/documents/policy/2008/02/. . Withdrawal policy Per University policy; see: http://www.csulb.edu/divisions/aa/grad_undergrad/senate/documents/policy/2002/02/. Withdrawal after 2nd week and before final 3 weeks “permissible for serious and compelling reasons;” instructor will evaluate student withdrawal requests on a case by case basis. TOPIC OUTLINE WEEK/DATE CONTENT/ACTIVITY WEEK #1 January 25 Introductions, Course Syllabus/Outline and Part I The Healthcare Environment Introduction to healthcare finance Definition of health care finance Goals of the course The role of healthcare finance The health services industry Regulatory and legal issues Course organization READINGS Chapter 1 4 WEEK #2 February 1 The financial environment Group Assignments Forms of business organization Alternative forms of ownership Taxes and financial decisions Third party payer system Managed care plans Alternative reimbursement methods ASSIGNMENT I DISTRIBUTED Chapter 2 WEEK #3 February 8 Part II Financial Accounting Financial accounting basics and the income statement Introduction to financial accounting The standard setting process The income statement Net income versus cash flow WEEK #4 February 15 The balance sheet and statement of cash flows Chapter 4 Balance sheet Accounting identity Assets Liabilities and equity Relationship between income statement and balance sheet Statement of cash flows ASSIGNMENT I COLLECTED ASSIGNMENT II DISTRIBUTED WEEK #5 February 22 Analyzing financial performance Purpose of performance analysis Types of analysis Financial statement analysis Operating analysis MVA and EVA Analysis Problems with performance analysis ASSIGNMENT II COLLECTED ASSIGNMENT III DISTRIBUTED WEEK #6 February 29 Managerial Accounting Managerial accounting basics, cost/profit analysis Introduction to managerial accounting Cost classifications by relationship to volume Fixed costs Variable costs Profit analysis Profit and loss statements Graphical analysis ASSIGNMENT III COLLECTED WEEK #7 March 7 Cost allocation Direct versus indirect costs Cost allocation basics Cost allocation methods Traditional versus activity based costing Chapter 3 Chapter 17 Chapter 5 Chapter 6 5 WEEK #8 March 14 ` Week #9 March 21 Pricing and service decisions Price setter versus price takers Pricing approaches Full cost Marginal cost Direct cost Target costing Analysis methods Setting prices Determining service ASSIGNMENT IV DISTRIBUTED WEEK #10 March 28 SPRING BREAK- NO CLASSES WEEK #11 April 4 Planning and budgeting Planning process Budget types Flexible budgeting and variance analysis Cash Budget ASSIGNMENT IV COLLECTED ASSIGNMENT V DISTRIBUTED WEEK #12 April 11 Basic Financial Analysis Concepts BRING YOUR FINANCIAL CALCULATOR **** Time value analysis Chapter 9 Future and present values Lump sums Annuities Solving for I and N Investment returns Amortization ASSIGNMENT V COLLECTED WEEK #13 April 18 The basics of capital budgeting Chapter 14 Project classifications Role of financial analysis Cash flow estimation Breakeven and profitability analysis Net present value and internal rate of return MIDTERM EXAM Chapter 7 Chapter 8 6 WEEK #14 April 25 Financial risk and required return Financial risk basics Stand-alone risk Portfolio risk Corporate risk Market risk Risk and required return WEEK #15 May 2 CASE PRESENTATIONS WEEK #16 May 9 CASE PRESENTATIONS WEEK #17 May 16 FINAL Chapter 10 PRESENTATION EVALUATION FORM Possible Points: Presentation Style Personal appearance (posture, expression); speaking (articulation, projection); energy, interest, audience contact Organization Opening and concluding remarks, flow of ideas and reasoning within sections. Content Ideas (novelty, clarity), value of content, use of examples Use of Media Linking media with speaking; Knowledge in handling of media; general appearance Weight 1 2 3 Presenter appears uninterested, has little or no energy, does not have eye contact with audience, and is difficult to hear or understand. Presenter seems slightly uncomfortable at times, audience occasionally has trouble hearing speaker, much of the information is read and pacing is sometimes too fast or slow. Presentation is planned and paced for audience understanding, speaker is NOT reading off paper and speaker is comfortable in front of the group and can be heard by all. Presenter appears professional and lively, articulates and projects well, engages in frequent eye contact and holds both attention and interest of audience. 2 Logic of arguments is unclear. Presentation has little to no organization or structure. Listeners are unsure of the purpose of presentation and are left confused. Listener can follow presentation with effort. Some arguments are not clear. Organization seems haphazard. Opening is absent or difficult to grasp. Reasoning is faulty or unclear and closing fails to wrap up topic or make conclusions. Presentation is generally clear, logical and well organized. Listener can follow line of reasoning; however, a few minor points may be confusing. Presentation is wellorganized, clear and effectively structured. Intro effectively grasps the audience’s attention and explains the purpose. Sections flow together well and connections between topics are easy to follow. Closing wraps up topic and states conclusions clearly. 3 Ideas are not new or interesting and show a lack of understanding of subject. Content has little or no value to the discipline, and examples or references are absent. Explanations of concepts and/or theories are inaccurate or incomplete. Enough errors are made to distract a knowledgeable listener. Listeners gain little from the presentation. Explanations of concepts and theories are accurate and complete. Few significant errors are made. Speaker provides a clear and complete explanation of key concepts and theories. Ideas are interesting and show a new take on the subject, content contains potentially useful. Information (names, facts, etc.) included in presentation is consistently accurate. Listeners gain valuable insight on topic. 1 No communication aids are used, or they are so poorly prepared that they detract from the presentation. Media used are poorly prepared or used inappropriately (i.e. timing is off, slides are out of order, font is too small, too much Media used contributes to the quality of presentation. Presenter has adequate knowledge Media used are well integrated with speech and with each other. Presenter shows expertise in preparing and using media. Materials are legible, 1 X X X X 4 COMMENTS 7 of media materials (legibility, layout) Mechanics Grammar, gestures, pace Groups Coordination of presenters. Flow and organization of transitions between speakers and sections information is included). Presenter shows lack of knowledge in the handling of media used. 1 Listeners are so distracted by the presenter’s apparent difficulty with grammar, pronunciation and inappropriate vocabulary that they cannot focus on the ideas presented. 2 Members’ information presented is duplicative, contradictory or both. and/or Non-equal participation of members X X of handling media being used. Font size is appropriate for reading. attractive and well laid-out and support overall effectiveness of presentation. Presentation includes some grammatical errors, sentences are incomplete and vocabulary is somewhat limited. Mannerisms and gestures are distracting and presenter speaks too quickly or too slowly. Most sentences are complete and grammatical, most words express precise meaning.. Presenter speaks at appropriate pace. Sentences are complete and grammatical, and they flow together easily. Presenter shows good grasp of language (grammar, sentence structure), uses gestures effectively to support ideas, pace is neither too fast nor too slow; presenter shows good preparation. Awkward transitions from one presenter to another; information flow is not smooth Although presenters have varying levels of presentation skills, all are comfortable with the material they present. Introduction of group members and brief explanation of their contributions. Smooth transition between presenters. Material flows logically. Presentation Evaluation Form is above. This presentation should be high quality, appropriate for an undergraduate study, and suitable for the board of a local health care organization. It may be done alone, or with classmates in which case both students will receive the same grade. Work-in-progress may be reviewed by the instructor for preliminary feedback. The presentation should be 20-25 minutes long, although additional time may be scheduled in advance. The Presentation should educate the audience and at least: a. b. c. d. e. f. clearly state and explain the underlying case issue (s) and problem (s) to be resolved describe and explain relevant health, economic, finance, and historical background of the case, issue, or problem argue for and against potential solutions describe the solution (s) and its actual or likely implementation explain the actual (or expected ) results of the solution and relate them to the original problems and issues explain how this solution (s) is viewed by relevant interest groups in the company. TEAM MEMBERS RATING FORM Your name: Team project: Date: The ratings you provide on this form will be used to determine individual grades for your fellow team members. If you feel that someone has contributed less than, or more than, a fair share, then you can reflect those feelings on this evaluation form. As you consider each team member’s contribution, you should think about such things as: 1. attending team meetings 2. defining and clarifying tasks 3. researching and gathering need information 4. analysis and problem solving 5. working well with others 6. ensuring that final products are done well 7. giving time, effort, and energy, 8. offering useful ideas 9. helping to lead the team 10. other contributions to the team and project Rate each team member, excluding yourself, in terms of above criteria. List the names of the team members other than yourself, in the spaces below. Then, assign a number of points to each person to reflect your rating for each person’s contribution to the team project. These ratings must total 100. Someone who contributed more to the team would receive a higher number of points than someone who contributed less. Remember, the points must total 100. The instructor will use this information to assign an individual grade to each team member. Group Member Names Points Assigned Total points=100 Comments (Use other side if necessary) Are there problems in the group such that the instructor should intervene? If so, for what purpose? (Use the other side if necessary). 9 OPTIONAL STUDENT INFORMATION SHEET HCA 341 – FALL 2011 (TURN IN TO INSTRUCTOR) Name___________________________________________________________ Name you prefer to use____________________________________________ Address_________________________________________________________ ________________________________________________________________ Phone(s):________________________________________________________ Best time/place to reach you:_______________________________________ Fax(es):_________________________________________________________ E-mail address:__________________________________________________ Please describe briefly: a. Your educational background and work experience: b. Future educational and career plans: c. Your reasons for taking this course, what you hope to learn from it: d. Languages you speak, read and write