introduction to the stock market

advertisement

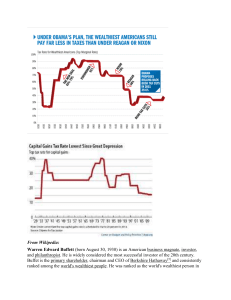

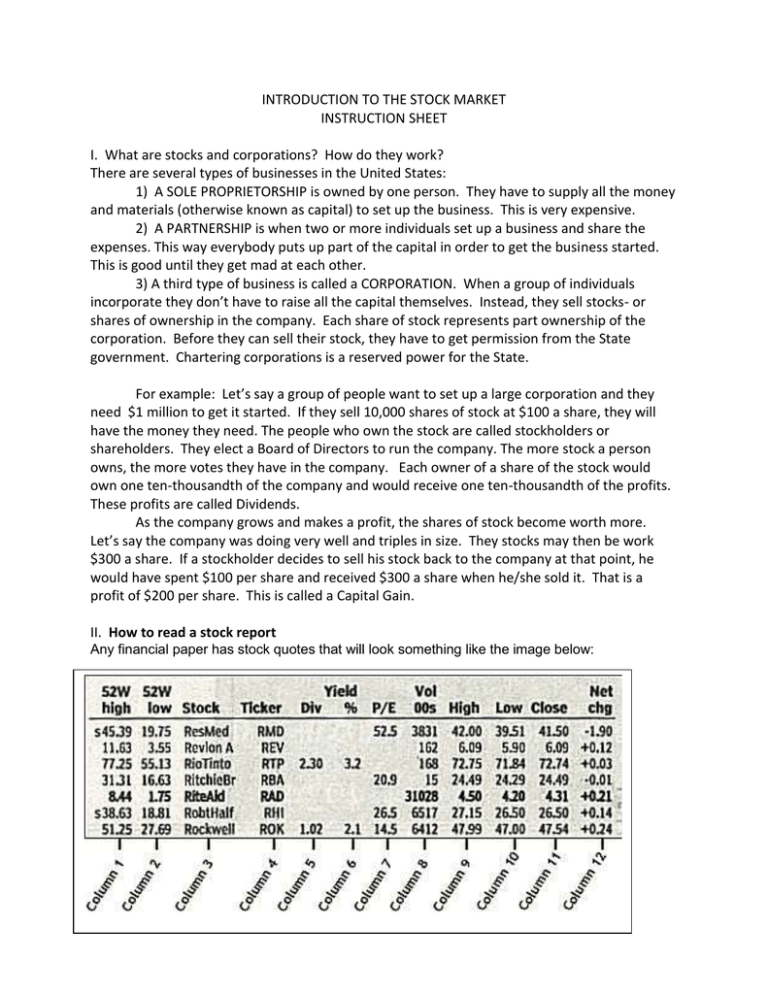

INTRODUCTION TO THE STOCK MARKET INSTRUCTION SHEET I. What are stocks and corporations? How do they work? There are several types of businesses in the United States: 1) A SOLE PROPRIETORSHIP is owned by one person. They have to supply all the money and materials (otherwise known as capital) to set up the business. This is very expensive. 2) A PARTNERSHIP is when two or more individuals set up a business and share the expenses. This way everybody puts up part of the capital in order to get the business started. This is good until they get mad at each other. 3) A third type of business is called a CORPORATION. When a group of individuals incorporate they don’t have to raise all the capital themselves. Instead, they sell stocks- or shares of ownership in the company. Each share of stock represents part ownership of the corporation. Before they can sell their stock, they have to get permission from the State government. Chartering corporations is a reserved power for the State. For example: Let’s say a group of people want to set up a large corporation and they need $1 million to get it started. If they sell 10,000 shares of stock at $100 a share, they will have the money they need. The people who own the stock are called stockholders or shareholders. They elect a Board of Directors to run the company. The more stock a person owns, the more votes they have in the company. Each owner of a share of the stock would own one ten-thousandth of the company and would receive one ten-thousandth of the profits. These profits are called Dividends. As the company grows and makes a profit, the shares of stock become worth more. Let’s say the company was doing very well and triples in size. They stocks may then be work $300 a share. If a stockholder decides to sell his stock back to the company at that point, he would have spent $100 per share and received $300 a share when he/she sold it. That is a profit of $200 per share. This is called a Capital Gain. II. How to read a stock report Any financial paper has stock quotes that will look something like the image below: Columns 1 & 2: 52-Week Hi and Low These are the highest and lowest prices at which a stock has traded over the previous 52 weeks (one year). This typically does not include the previous day's trading. Column 3: Company Name & Type of Stock This column lists the name of the company. If there are no special symbols or letters following the name, it is common stock. Different symbols imply different classes of shares. For example, "pf" means the shares are preferred stock. Column 4: Ticker Symbol This is the unique alphabetic name which identifies the stock. If you watch financial TV, you have seen the ticker tape move across the screen, quoting the latest prices alongside this symbol. If you are looking for stock quotes online, you always search for a company by the ticker symbol. If you don't know what a particular company's ticker is you can search for it at: http://finance.yahoo.com/l. Column 5: Dividend Per Share This indicates the annual dividend payment per share. If this space is blank, the company does not currently pay out dividends. Column 6: Dividend Yield This states the percentage return on the dividend, calculated as annual dividends per share divided by price per share. Column 7: Price/Earnings Ratio This is calculated by dividing the current stock price by earnings per share from the last four quarters. For more detail on how to interpret this, see our P/E Ratio tutorial. Column 8: Trading Volume This figure shows the total number of shares traded for the day, listed in hundreds. To get the actual number traded, add "00" to the end of the number listed. Column 9 & 10: Day High & Low This indicates the price range at which the stock has traded at throughout the day. In other words, these are the maximum and the minimum prices that people have paid for the stock. Column 11: Close The close is the last trading price recorded when the market closed on the day. If the closing price is up or down more than 5% than the previous day's close, the entire listing for that stock is bold-faced. Keep in mind, you are not guaranteed to get this price if you buy the stock the next day because the price is constantly changing (even after the exchange is closed for the day). The close is merely an indicator of past performance and except in extreme circumstances serves as a ballpark of what you should expect to pay. Column 12: Net Change This is the dollar value change in the stock price from the previous day's closing price. When you hear about a stock being "up for the day," it means the net change was positive. Quotes on the Internet Nowadays, it's far more convenient for most to get stock quotes off the Internet. This method is superior because most sites update throughout the day and give you more information, news, charting, research, etc. To get quotes, simply enter the ticker symbol into the quote box of any major financial site like Yahoo Finance, CBS Marketwatch, or MSN Moneycentral. The example below shows a quote for Microsoft (MSFT) from Yahoo Finance. Interpreting the data is exactly the same as with the newspaper. How to Play the game: 1. Choose four stocks from the list of stocks attached in this packet. You must choose stocks from four different sectors. You may research our companies on the internet before you decide which one you would like to choose. Example: Aetna, Inc. – Health care eBay Inc. – Information Technology Starbucks Corp. – Consumer Discretionary Verizon Communications – Telecommunications. 2. Fill in the names of your companies on your Stock Holding Record Sheet along with their Ticker Symbol so you can use the ticker symbol to look it up in the following weeks. Look up the price of your stocks- you will be using the column labeled “close” for the closing price of the day. Record the price in the “Price per share” column on your record sheet. Decide how many shares of each of your stocks you will purchase. Multiply the price of your stock times the number of share you are purchasing and write the total in the total value column. You will be “given” $10,000 to spend on your investments You may not exceed your $10,000 when making your initial purchases. 3. Each month record the price of each of your stocks and write the total value in the correct column. 4. At the conclusion of the project, you will turn in the following: 1) Record of Stock Holding sheet. Make sure you have fill in in the final value of all your stocks added together at the bottom of the page. 2) Using the data you collected, compete a graph showing the activity of our stocks. You may make a separate graph for each stock or one graph showing all four stocks. 3) Write a summary comparing and contrasting the progress of your stocks: A. Did any particular stock do better than the others? Why do you think this happened? Were there any events in the country or the world that may have affected the stock prices? B. What would you do differently next time AND why? 4) Read the timeline of Warren Buffett, one of the most successful investors to ever trade in the stock market. Choose one of his quotes and write a brief explanation of the quote. What did you find most interesting about Warren Buffett’s life AND why? Rubric 1. initial set up of stocks – 10 pts. 2. Recording of stocks regularly (March 9, April 9, May 8, June 9) 10 pts.each (40 Pts.) 3. Warren Buffett Quote interpretation (#4) 10 pts. 4. Final analysis of personal stock portfolio including graph (#2,#3) 20 pts. Total Have fun! 80 pts. Warren Buffett and his friend Bill Gates (The following information was taken from www.beginnersinvest.about.com) Over the past thirty-five years, Warren Buffett has emerged as arguably the greatest investor in American history. If you had invested $10,000 in Berkshire Hathaway when he took control in 1965, your holdings would be worth more than $50 million today. The thirdrichest man in the world, Buffett still lives in the same house he bought three decades ago for $31,500, drives an older Lincoln Towncar, and downs countless cans of Coca-Cola every day. WARREN BUFFETT TIMELINE August 30, 1930: Warren Edward Buffett is born to his parents, Howard and Leila Buffett, in Nebraska. 1941: At eleven years old, Warren buys his first stock. He purchases 6 shares of Cities Service preferred stock [3 shares for himself, 3 for his sister, Doris], at a cost of $38 per share. The company falls to $27 but shortly climbs back to $40. Warren & Doris sell their stock. Almost immediately, it shoots up to over $200 per share. 1943: Warren declares to a friend of the family that he will be a millionaire by the time he turns thirty, or "[I'll] jump off the tallest building in Omaha." 1945: Warren is making $175 monthly delivering Washington Post newspapers. At fourteen years old, he invests $1,200 of his savings into 40 acres of farmland. 1947: In his senior year of high school, Warren and a friend purchase a used pinball machine at a cost of $25. Buffett begins to think about the potential profit, and places it in a nearby Barber Shop. Within months, he owns three machines in three different locations. The business is sold later in the year for $1,200 to a War Veteran. 1947: Warren has earned over $5,000 delivering newspapers. His father presses him to attend college, a suggestion Warren does not take well. Nevertheless, that year, he enrolls as a freshman at the Wharton School of Finance and Commerce in Pennsylvania. Buffett hates it, complaining he knows more than the teachers. 1949: Classmates return to find that Warren is no longer enrolled at Wharton. He has transferred to the University of Nebraska. 1949: Warren is enrolled in classes, but has already begun his life. He is offered a job at J.C. Penny's after college, but turns it down. He graduates from college in only three years by taking his last three credits over the summer. His savings have reached $9,800. 1950: Buffett applies for admission to Harvard Business School and is turned down. He eventually enrolls at Columbia after learning that Ben Graham and David Dodd, two well-known security analysts, are professors. 1951: Warren discovers Graham is on the Board of GEICO insurance. He takes a train to Washington, D.C., and knocks on the door of its headquarters until a janitor lets him in. After asking if anyone is working, he find a man on the sixth floor, who ends up being high up in the company. They talk for hours while Warren questions him on the business and insurance in general. [Buffett now owns GEICO entirely]. 1951: Buffett graduates and wants to go to work on Wall Street. Both his father [Howard] and mentor [Graham] urge him not to. Warren offers to work for Ben Graham for free but Graham refuses. 1951: Warren returns home and begins dating Susan Thompson. 1951: Buffett purchases a Texaco station as a side investment. It doesn't work out as well as he hopes. Meanwhile, he is working as a stockbroker 1951: Buffett takes a Dale Carnegie public speaking course. Using what he learnt, he began to teach a night class at the University of Nebraska, "Investment Principles". The students were twice his age [he was only 21 at the time]. April, 1952: Warren and Susie get married. They rent an apartment for $65 a month, and have their first child, also Susie. 1954: Ben Graham calls Warren and offers him a job at his partnership. Buffett's starting salary is $12,000 a year. 1956: Graham retires and folds up his partnership. Since leaving college six years earlier, Warren's personal savings have grown from $9,800 to over $140,000. 1956: The Buffett family returns home to Omaha. On May 1, Warren created Buffett Associates, Ltd. Seven family members and friends put in a total of $105,000. Buffett himself invested only $100. He was now running his own partnership, and would never again work for anyone else. Over the course of the year, he opened two additional partnership, eventually bringing the number under his management to three. Years later, they would all be consolidated into one. 1957: Buffett adds two more partnerships to his collection. He is now managing five investment partnerships from his home. 1957: With Susan about to have her third child, Warren purchases a five-bedroom, stucco house on Farnam street. It cost $31,500. 1958: The third year of the partnership completed, Buffett doubles the partner's money. 1959: Warren is introduced to Charlie Munger, who will eventually become the Vice Chairman of Berkshire Hathaway, and an integral part of the company's success. The two get along immediately. 1960: Warren asks one of his partners, a doctor, to find ten other doctors who will be willing to invest $10,000 each into his partnership. Eventually, eleven doctors agreed to invest. 1961: With the partnerships now worth millions, Buffett made his first $1 million dollar investment in a windmill manufacturing company. 1962: Buffett returns to New York with Susie for a few weeks to raise capital from his old acquaintances. During the trip, he picks up a few partners and several hundred thousand dollars. 1962: The Buffett Partnership, which had begun with $105,000, was now worth $7.2 million. Warren and Susie personally own over $1 million of the assets. Buffett merges all of the partnerships into one entity known simply as Buffett Partnerships, Ltd. The operations are moved to Kiewit plaza, a functional but less-than-grand office, where they remain to this day. The minimum investment is raised from $25,000 to $100,000. 1962: Buffett consults Munger on Dempster, the windmill manufacturing company. Munger recommends Harry Bottle to Warren; a move that would turn out to be very profitable. Bottle cut costs, laid off workers, and caused the company to generate cash. 1962: Warren discovers a textile manufacturing firm, Berkshire Hathaway, that is selling for under $8 per share. He begins to buy the stock. 1963: Buffett sells Dempster for 3x the amount he invested [The almost worthless company had built a portfolio of stocks worth over $2 million alone during the time of Buffett's investment]. 1963: The Buffett partnerships becomes the largest shareholder of Berkshire Hathaway. 1964: Due to a fraud scandal, American Express shares fall to $35. While the world is selling the stock, Buffett begins to buy shares en masse. 1965: Warren's father, Howard, dies. 1965: Buffett begins to purchase shares in Walt Disney Co. after meeting with Walt personally. Warren invested $4 million [which was equal to around 5% of the company]. 1965: The American Express shares which were purchased shortly before are selling for more than double the price Warren paid for the them. 1965: Buffett arranges a business coup - taking control of Berkshire Hathaway at the board meeting and naming a new President, Ken Chace, to run the company. 1966: Warren's personal investment in the partnership reaches $6,849,936. 1967: Berkshire pays out its first and only dividend of 10 cents. 1967: In October, Warren writes to his partners and tells them he finds no bargains in the roaring stock market of the '60s. His partnership is now worth $65 million. 1967: Buffett is worth, personally, more than $10 million. He briefly considers leaving investing and pursuing other interests. 1967: American Express hits over $180 per share, making the partnership $20 million in profit on a $13 million investment. 1967: Berkshire Hathaway acquires National Indemnity insurance at Buffett's direction. It pays $8.6 million. 1968: The Buffett Partnership earns more than $40 million, bringing the total value to $104 million. 1969: Following his most successful year, Buffett closes the partnership and liquidates its assets to his partners. Among the assets paid out are shares of Berkshire Hathaway. Warren's personal stake now stands at $25 million. He is only 39 years old. 1970: The Buffett Partnership is now completely dissolved and divested of its assets. Warren now owns 29% of the stock outstanding in Berkshire Hathaway. He names himself chairman and begins writing the annual letter to shareholders. 1970: Berkshire makes $45,000 from textile operations, and $4.7 million in insurance, banking, and investments. Warren's side investments are making more than the actual company itself. 1971: Warren [at his wife's request], purchases a $150,000 summer home at Laguna Beach. 1973: Stock prices begin to drop; Warren is euphoric. At his direction, Berkshire issues notes at 8%. 1973: Berkshire begins to acquire stock in the Washington Post Company. 1974: Due to falling stock prices, the value of Berkshire's stock portfolio began to fall. Warren's personal wealth was cut by over 50%. 1974: The SEC opens a formal investigation into Warren Buffett and one of Berkshire's mergers. Nothing ever comes of it. 1977: Berkshire indirectly purchases the Buffalo Evening News for $32.5 million. He would later be brought up on antitrust charges by a competing paper. 1977: Susie leaves Warren, although not officially divorcing him. Warren is crushed. 1978: Susie introduces Warren to Astrid, who eventually moves in with him. 1979: Berkshire trades at $290 per share. Warren's personal fortune is approximately $140 million, but he was living solely on a salary of $50,000 per year. 1979: Berkshire begins to acquire stock in ABC. 1981: Munger and Buffett create the Berkshire Charitable Contribution plan, allowing each shareholder to donate some of the company's profits to his or her personal charities. 1983: Berkshire ends the year with $1.3 billion in its corporate stock portfolio. 1983: Berkshire begins the year at $775 per share, and ends at $1,310. Warren's personal net worth is $620 million. He makes the Forbes list for the first time. 1983: Buffett purchases Nebraska Furniture Mart for $60 million. It turns out to be one of his best investments yet. 1985: Buffett finally shuts down the Berkshire textile mills after years of sustaining it. He refuses to allow it to drain capital from shareholders. 1985: Warren helps orchestrate the merger between ABC and Cap Cities. He is forced to leave the Board of the Washington Post [Federal legislation prohibited him sitting on the Boards of both Capital Cities and Kay Graham's Washington Post. 1985: Buffett purchases Scott & Fetzer for Berkshire's collection of businesses. It costs around $315 million, and boasts such products as Kirby vacuums and the World Book Encyclopedia. 1986: Berkshire breaks $3,000 per share. 1987: In the immediate crash and aftermath of October, Berkshire loses 25% of its value, dropping from $4,230 per share to around $3,170. The day of the crash, Buffett loses $342 million personally. 1988: Buffett begins buying stock in Coca-Cola, eventually purchasing up to 7 percent of the company for $1.02 billion. It will turn out to be one of Berkshire's most lucrative investments. 1989: Berkshire rises from $4,800 per share to over $8,000. Warren now has a personal fortune of $3.8 billion. 2015 current net worth: $73 Billion QUOTES FROM WARREN BUFFETT: 1. We do not view the company itself as the ultimate owner of our business assets but instead view the company as a conduit through which our shareholders own assets. 2. Never invest in a business you cannot understand. 3. Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell. 4. An investor should act as though he had a lifetime decision card with just twenty punches on it. 5. Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market. 6. Lethargy, bordering on sloth should remain the cornerstone of an investment style.