Tax Authorities

advertisement

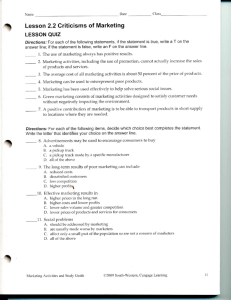

Chapter 16 Tax Research Kevin Murphy Mark Higgins ©2007 South-Western Introduction Tax research is the process by which the tax consequences of a completed or proposed transaction are determined. © 2007 South-Western Transparency 16-2 Tax Authorities There are two classes of tax authorities Primary Authoritative law and writings of the three branches of the federal government: legislative, executive, and judicial Secondary Supporting materials which provide interpretation of the primary authorities © 2007 South-Western Transparency 16-3 Primary Authorities: Legislative U.S. Constitution Article 1, Section 7 Sixteenth Amendment Internal Revenue Code of 1986 (the Code) Statutory language Legislative intent Tax treaties © 2007 South-Western Transparency 16-4 How a Bill Becomes Law House of Representatives Senate Finance Committee Senate House Ways & Means Committee Joint Conference Committee President © 2007 South-Western Transparency 16-5 Primary Authorities: Executive/Administrative Treasury Regulations Interpretive versus Legislative Proposed, temporary, and final Revenue Rulings and Procedures Acquiescence and Non-acquiescence Letter Rulings Before or after the action Other IRS Pronouncements Memorandums Notices, announcements, publications, instructions © 2007 South-Western Transparency 16-6 Trial level Appellate level Primary Authorities: Judicial U.S. Supreme Court U.S. Courts of Appeals U.S. Tax Court Small claims division of U.S. Tax Court U.S. District Court U.S. Court of Appeals for the Federal Circuit U.S. Court of Federal Claims Citations to Primary Authorities References made to a primary authority should include a full citation Examples are Internal Revenue Code Treasury Regulation Revenue Ruling U.S. Tax Court Case © 2007 South-Western Sec. 108 Reg. Sec. 1.61-12 Rev. Rul. 54-56, 1954-2 C.B. 108 Julian S. Danenberg, 73 T.C. 370 (1979) Transparency 16-8 Secondary Authorities: Tax Services Tax services fall into two categories Services with limited editorial discussion but many short interpretive comments CCH’s Standard Federal Tax Reporter RIA’s United States Tax Reporter Services with extensive editorial discussion and interpretation of the law RIA’s Federal Tax Coordinator 2d BNA’s Tax Management Portfolios Merten’s Law of Federal Income Taxation © 2007 South-Western Transparency 16-9 Secondary Authorities: Others Computer assistance tools are used to speed research LEXIS & WESTLAW Internet access CD-ROM Citators are used to determine the history of a judicial decision Tax Periodicals are used to keep up with current developments © 2007 South-Western Transparency 16-10 Types of Research Tax Compliance Research Facts are known Goal is to determine the consequence of a completed transaction Tax Planning Research Facts are open-ended Goal is to structure a future transaction for taxpayer’s advantage Non-tax factors must be considered © 2007 South-Western Transparency 16-11 Tax Research Process Determine the facts and establish relevance Determine the issue(s) Locate and evaluate the relevant authorities Assess the importance of each Understand the hierarchy of weight Reach a conclusion and communicate the results © 2007 South-Western Transparency 16-12 End of Chapter 16 © 2007 South-Western Transparency 16-13