Chapter 11

CFIN4

Chapter 11 Solutions

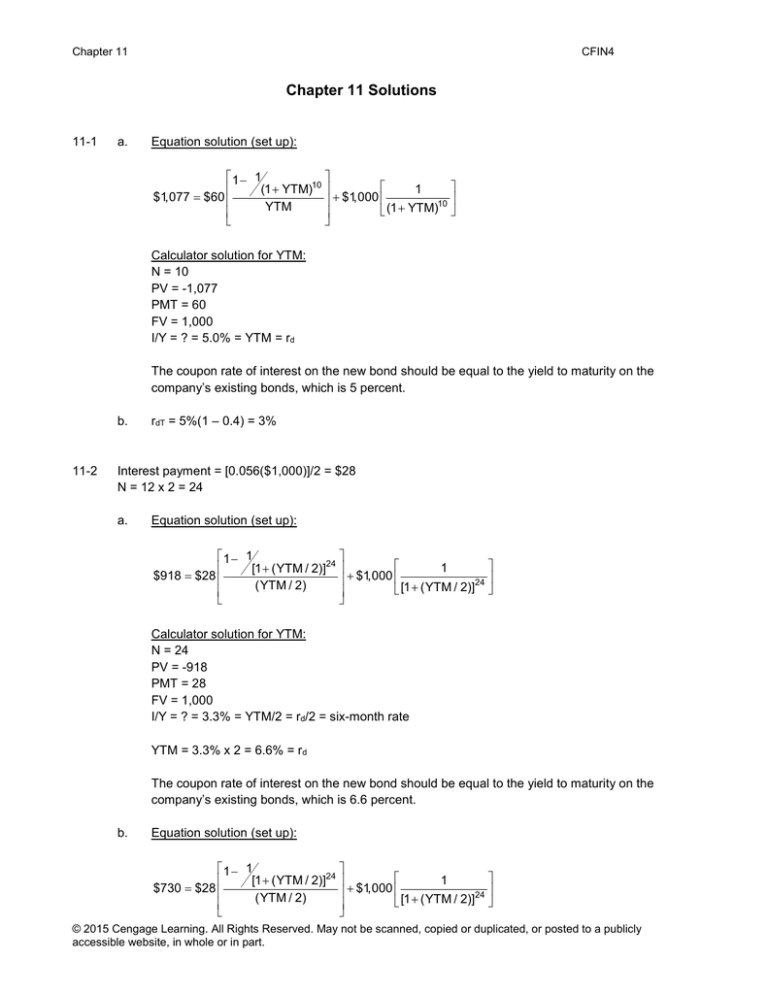

11-1

a.

Equation solution (set up):

1 1

1

(1 YTM)10

$1,077 $60

$1,000

10

YTM

(1 YTM)

Calculator solution for YTM:

N = 10

PV = -1,077

PMT = 60

FV = 1,000

I/Y = ? = 5.0% = YTM = rd

The coupon rate of interest on the new bond should be equal to the yield to maturity on the

company’s existing bonds, which is 5 percent.

b.

11-2

rdT = 5%(1 – 0.4) = 3%

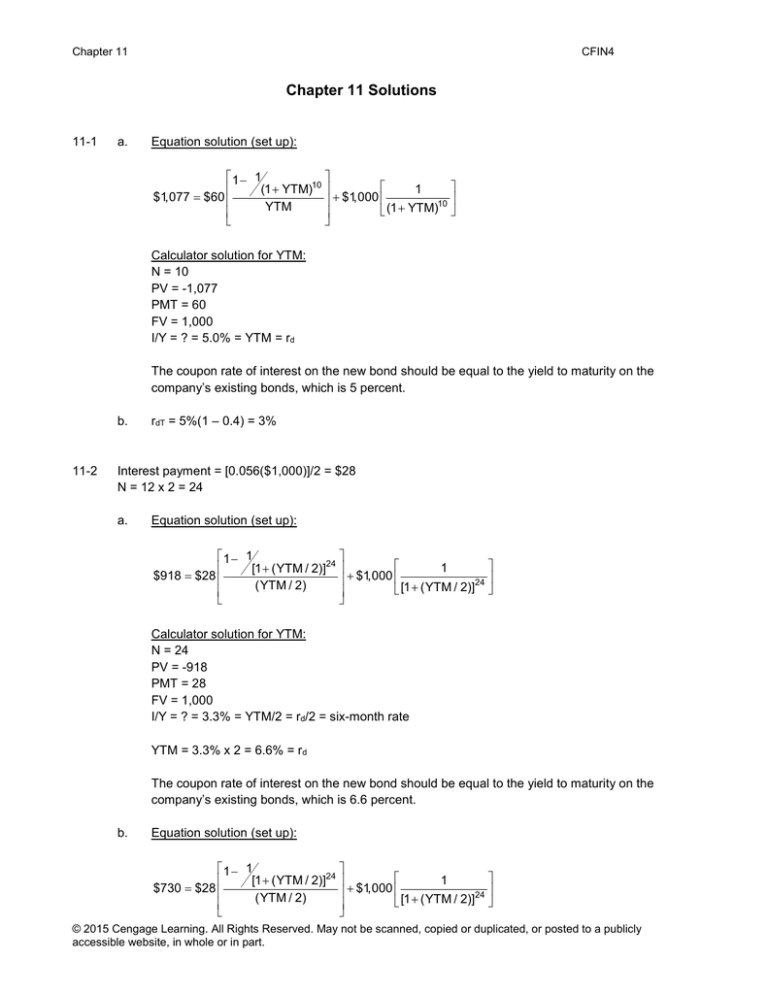

Interest payment = [0.056($1,000)]/2 = $28

N = 12 x 2 = 24

a.

Equation solution (set up):

1 1

1

[1 (YTM / 2)]24

$918 $28

$1,000

24

(YTM / 2)

[1 (YTM / 2)]

Calculator solution for YTM:

N = 24

PV = -918

PMT = 28

FV = 1,000

I/Y = ? = 3.3% = YTM/2 = rd/2 = six-month rate

YTM = 3.3% x 2 = 6.6% = rd

The coupon rate of interest on the new bond should be equal to the yield to maturity on the

company’s existing bonds, which is 6.6 percent.

b.

Equation solution (set up):

1 1

1

[1 (YTM / 2)]24

$730 $28

$1,000

24

(YTM / 2)

[1 (YTM / 2)]

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 11

CFIN4

Calculator solution for YTM:

N = 24

PV = -730

PMT = 28

FV = 1,000

I/Y = ? = 4.7% = YTM/2 = rd/2 = six-month rate

YTM = 4.7% x 2 = 9.4% = rd

11-3

Dividend = 0.05($120) = $6

rps =

11-4

D

$6

0.08 8.0%

NP0 $75

a.

Net proceeds to the firm = $50(10,000)(1 – 0.05) = $500,000(0.95) = $475,000

b.

rps =

D

$4.75

$4.75

0.10 10.0%

NP0 $50(1 0.05) $47.50

11-5

rs = rRF + (rM - rRF)βs = 3.5% + (9.0% - 3.5%)1.4 = 11.2%

11-6

rs = rRF + (rM - rRF)βs = = rRF + (RPM)βs = 5% + (7%)2.0 = 19.0%

11-7

Equation solution (set up) for rd:

1 1

1

[1 (YTM / 2)]12

$900 $20

$1,000

12

(YTM / 2)

[1 (YTM / 2)]

Calculator solution for YTM:

N = 12

PV = -900

PMT = 20

FV = 1,000

I/Y = ? = 3.0% = YTM/2 = rd/2

rd = 3% x 2 = 6%

rs = 6% + Risk premium = 6% + 4% = 10% (using the mid-point risk premium)

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 11

11-8

CFIN4

g = 4%

P0 = $34

D0 = $4.25

F = 8.25%

a.

Cost of retained earnings, rs

rs

b.

$4.25(1.04)

$4.42

0.04

0.04 0.17 17.0%

$34

$34

Cost of new equity, re

re

11-9

D̂1

g

P0

D̂1

g

NP0

$4.25(1.04)

$4.42

0.04

0.04 0.182 18.2%

$34(1 0.085)

$31.11

g = 0%

P0 = $50

D0 = $6

F = 7%

a.

Cost of retained earnings, rs

rs

b.

D̂1

g

P0

$6(1.0)

$6

0.0

0.12 12.0%

$50

$50

Cost of new equity, re

re

D̂1

g

NP0

$6(1.0)

$6

0.0

0.129 12.9%

$50(1 0.07)

$46.50

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 11

11-10

CFIN4

g = 5%

P0 = $28

D0 = $2.40

re = 15%

F=?

re

ˆ

ˆ

D

D

1

1

g

g

NP0

P0 (1 F)

$2.40(1.05)

0.05 0.15

$28(1 F)

$2.52

0.05 0.15

$28(1 F)

1

0.09

0.10

1 F

0.09 0.10(1 F) 0.10 0.10F

F

0.10 0.09

0.10

0.10

Check: If flotation costs equal 10 percent, the cost of new equity, r e, is:

re

11-11

D̂1

g

P0 (1 F)

$2.40(1.05)

$2.52

0.05

0.05 0.15 15.0%

$28(1 0.1)

$25.20

g=?

P0 = $32

D̂1 = $3.36

re = 15.5%

F = 6.5%

Solve for the firm’s growth rate:

rs

D̂1

$3.36

g

g 0.155

P0

$32

g 0.155 0.105 0.05

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 11

CFIN4

Cost of new equity, re:

re

11-12

11-13

ˆ

ˆ

D

D

1

1

g

g

NP0

P0 (1 F)

$3.36

$3.36

0.05

0.05 0.162 16.2%

$32(1 0.065)

$29.92

Break points associated with the debt:

BP1

$450,000

$750,000

0.6

BP2

$750,000

$1,250,000

0.6

There are two break points associated with the new funds—(1) when more than $240,000 in debt is

issued and (2) when new common equity must be issued.

BPDebt

BPRE

$240,000

$800,000

0.3

$560,000

$800,000

0.7

According to this information, Western’s WACC will increase when it raises more than $800,000 in total

funds because both the cost of debt and the cost of equity will increase beyond this point. In other

words, the break point for debt and the break point for equity occur at the same level of funds.

11-14

11-15

a.

WACC1 = wd(rdT) + ws(rs) = 0.4[5%(1 – 0.35)] + 0.6(8%) = 6.1%

b.

WACC2 = wd(rdT) + ws(re) = 0.4[5%(1 – 0.35)] + 0.6(11%) = 7.9%

wd = 20%

rdT = 3.5%

wps = 30%

rps = 6.0%

ws = 50%

rs = 10.2%

Retained earnings = $100,000

Funding needs = $220,000

re

= 12.4%

The retained earnings break point must be computed to determine whether a new common stock issue

is required to raise the $220,000 in total funds that Killer Burgers needs.

BPRE

$100,000

$200,000

0.5

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 11

CFIN4

Killer Burgers needs to raise $220,000, but it can only raise a total of $200,000 before new common

stock must be issued. As a result, the firm must issue new stock.

Alternative solution: If Killer Burgers raises $220,000, following is the breakdown of how the funds will

be raised:

Debt = $220,000(0.2) = $44,000

Preferred stock = $220,000(0.3) = $66,000

Common equity = $220,000(0.5) = $110,000

Total amount = $220,000

Because the amount of funds that will be raised using common equity is greater than the $100,000

expected increase in retained earnings, new common stock must be issued.

When new common stock must be issued, Killer’s WACC is:

WACC = 3.5%(0.2) + 6.0%(0.3) + 12.4%(0.5) = 8.7%

11-16

wd = 60%

rd = 5.0%

wps = 10%

rps = 7.0%

ws = 30%

rs = 11.0%

Retained earnings = $26,000

Funding needs = $85,000

Marginal tax rate = T = 30%

re

= 13.0%

The retained earnings break point must be computed to determine whether a new common stock issue

is required to raise the $85,000 in total funds that FC needs.

BPRE

$26,000

$86,667

0.3

FC needs to raise $85,000, and it can raise up to a total of $86,667 before new common stock must be

issued. As a result, the firm does not need to issue new stock.

Alternative solution: If FC raises $85,000, following is the breakdown of how the funds will be raised:

Debt = $85,000(0.6) = $51,000

Preferred stock = $85,000(0.1) =

$8,500

Common equity = $85,000(0.3) = $25,500

Total amount = $85,000

Because the amount of funds that will be raised using common equity is less than the $26,000 expected

increase in retained earnings, new common stock does not need to be issued.

When new common stock must be issued, FC’s WACC is:

WACC = [5%(1 – 0.3)](0.6) + 7.0%(0.1) + 11%(0.3) = 6.1%

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 11

11-17

CFIN4

The retained earnings break point must be computed to determine at what point new common stock

must be issued:.

BPRE

$24,000

$40,000

(1 0.4)

Based on this information, we know that WACC = 14 percent as long as the total capital budget is less

than $40,000. If the capital budget is greater than $40,000, WACC = 17 percent. The following table

applies this information to the three projects Lazy Loungers is evaluating:

Project

A

B

C

Cost

$10,000

15,000

25,000

Costs

$10,000

$25,000

$50,000

IRR

21.0%

20.0

16.0

WACC

14.0%

14.0

17.0

Acceptable?*

Yes, IRR > WACC

Yes, IRR > WACC

No, IRR < WACC

* Indicates whether the project in the row and the project(s) in the row(s) above are acceptable.

Projects A and B should be purchased.

11-18

The retained earnings break point must be computed to determine at what point new common stock

must be issued:.

BPRE

$230,000

$287,500

0.8

As a result, following are the WACCs when no new stock must be issued and when new common stock

must be issued:

Capital budget < $287,500; no new stock is needed:

WACC = 0.2(4.0%) + 0.8(10.0%) = 8.8%

Capital budget > $287,500; new stock must be issued:

WACC = 0.2(4.0%) + 0.8(12.5%) = 10.8%

. The following table applies this information to the projects OTC is evaluating:

Project

S

L

Cost

$150,000

140,000

Costs

$150,000

$290,000

IRR

12.0%

10.0

WACC

8.8%

10.8

Acceptable?*

Yes, IRR > WACC

No, IRR < WACC

* Indicates whether the project in the row and the project(s) in the row(s) above are acceptable.

Only Project S should be purchased.

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 11

11-19

CFIN4

The WACCs are:

Total Amount Raised

$1 – $520,000

520,001 –

745,000

Over 745,000

WACC

11.0%

12.5

15.2

Using these WACCs, the following table summarizes the capital budgeting decision:

Project

1

3

2

4

Cost

$214,000

$214,000

$214,000

$214,000

Costs

$214,000

$428,000

$642,000

$856,000

IRR

19.0%

18.0

15.0

14.0

WACC

11.0%

11.0

12.5

15.2

Acceptable?*

Yes, IRR > WACC

Yes, IRR > WACC

Yes, IRR > WACC

No, IRR < WACC

* Indicates whether the project in the row and the project(s) in the row(s) above are acceptable.

Projects 1, 2, and 3 should be purchased.

11-20

(1)

Compute the break points:

BPRE

$1,300,000

$2,000,000

0.65

BPDebt

(2)

$420,000

$1,200,000

0.35

Compute the WACC for each interval of funds:

Total Funds: $1 to $1,200,000 (first break point); at the maximum amount of this interval,

Debt

= 0.35($1,200,000) = $420,000

Equity = 0.65($1,200,000) = $780,000

WACC1 = [5%(1 – 0.4)](0.35) + 12%(0.65) = 8.85%

Total Funds: $1,200,001 to $2,000,000 (second break point); at the maximum amount of this

interval,

Debt

= 0.35($2,000,000) = $700,000

Equity = 0.65($2,000,000) = $1,300,000

WACC1 = [7%(1 – 0.4)](0.35) + 12%(0.65) = 9.27%

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 11

CFIN4

Total Funds: Greater than 2,000,000; if the entire project is funded at $2.6 million,

Debt

= 0.35($2,600,000) = $910,000

Equity = 0.65($2,600,000) = $1,690,000

WACC1 = [7%(1 - 0.4)](0.35) + 14%(0.65) = 10.57%

(3)

Determine how much of the project should be purchased.

Because the project’s IRR = 9.2%, Tri-Q should purchase the project until the WACC = 9.2%,

which means that $2,000,000 of the project should be purchased. The entire project cannot be

purchased because the total cost is $2,600,000, and raising this amount of funds has a WACC =

10.57%, which means IRR < WACC at this point.

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.