Chapter 8

Depreciation, Cost

Recovery, Amortization,

and Depletion

Individual Income Taxes

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

1

The Big Picture (slide 1 of 2)

• Dr. Cliff Payne purchases and places in service in his dental

practice the following fixed assets during the current year:

Office furniture and fixtures

Computers and peripheral equipment

Dental equipment

$ 70,000

67,085

475,000

• Using his financial reporting system, he concludes that the

depreciation expense on Schedule C of Form 1040 is $91,298.

Office furniture and fixtures ($70,000 X 14.29%)

$10,003

Computers and peripheral equipment ($67,085 X 20%) 13,417

Dental equipment ($475,000 X 14.29%)

67,878

$91,298

2

The Big Picture (slide 2 of 2)

• In addition, during the current year, Dr. Payne

purchased another personal residence for $300,000

– He converts his original residence to rental property.

• He also purchased a condo for $170,000 near his

office that he is going to rent.

• Has Dr. Payne correctly calculated the depreciation

expense for his dental practice?

– Will he be able to deduct any depreciation expense for his

rental properties?

• Read the chapter and formulate your response.

3

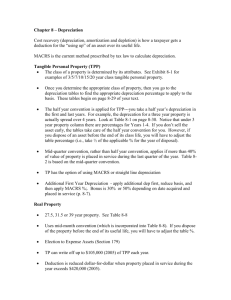

Cost Recovery

• Recovery of the cost of business or incomeproducing assets is through:

– Cost recovery or depreciation: tangible assets

– Amortization: intangible assets

– Depletion: natural resources

4

Nature of Property

• Property includes both realty (real property) and

personalty (personal property)

– Realty generally includes land and buildings permanently

affixed to the land

– Personalty is defined as any asset that is not realty

• Personalty includes furniture, machinery, equipment, and many

other types of assets

• Personalty (or personal property) should not be

confused with personal use property

– Personal use property is any property (realty or personalty)

that is held for personal use rather than for use in a trade or

business or an income-producing activity

• Cost recovery deductions are not allowed for personal use assets

5

General Considerations

(slide 1 of 3)

• Basis in an asset is reduced by the amount of cost

recovery that is allowed and by not less than the

allowable amount

– Allowed cost recovery is cost recovery actually taken

– Allowable cost recovery is amount that could have been

taken under the applicable cost recovery method

• If no cost recovery is claimed on property

– The basis of the property must still be reduced by the

amount that should have been deducted

• i.e., The allowable cost recovery

6

General Considerations

(slide 2 of 3)

• If personal use assets are converted to business

or income-producing use

– Basis for cost recovery and for loss is lower of

• Adjusted basis or

• Fair market value at time property was converted

– Losses that occurred prior to conversion can not be

recognized for tax purposes through cost recovery

7

General Considerations

(slide 3 of 3)

• MACRS applies to:

– Assets used in a trade or business or for the

production of income

– Assets subject to wear and tear, obsolescence, etc.

– Assets that have a determinable useful life or

decline in value on a predictable basis

– Assets that are tangible personalty or realty

8

The Big Picture - Example 2

Cost Recovery Basis for Personal Use Assets

Converted to Business Use

• Return to the facts of The Big Picture p. 8-1.

• Five years ago Dr. Payne purchased his personal residence for

$250,000.

– This year Dr. Payne found a larger home that he acquired for his

personal residence.

– Unfortunately he cannot sell his original residence and recover his

purchase price of $250,000.

• The residence was appraised at $180,000.

• Instead of continuing to try to sell the original residence, Dr.

Payne converted it to rental property.

– The basis for cost recovery of the rental property is $180,000 because

the fair market value is less than the adjusted basis.

– The $70,000 decline in value is deemed to be personal (since it

occurred while the property was held for personal use by Dr. Payne)

and therefore nondeductible.

9

MACRS-Personalty

• MACRS characteristics:

MACRS Personalty

Statutory lives:

Method:

Convention:

3, 5, 7, 10 yrs

200% DB

Half Yr

or

.

15, 20 yrs

150% DB

Mid-Quarter

DB = declining balance with switch to straight-line

Straight-line depreciation may be elected

10

Half-Year Convention

• General rule for personalty

• Assets treated as if placed in service (or

disposed of) in the middle of taxable year

regardless of when actually placed in service

(or disposed of)

11

Example: Half-Year Convention

• Purchased and placed an asset in service on

March 15 (Tax year end is December 31)

– Treated as placed in service June 30

– Six months cost recovery in year 1 (and year

disposed of, if within recovery period)

12

Mid-Quarter Convention

• Applies when more than 40% of personalty is

placed in service during last quarter of year

• Assets treated as if placed into service (or

disposed of) in the middle of the quarter in

which they were actually placed in service (or

disposed of)

13

Example: Mid-Quarter Convention

• Business with 12/31 year end purchased and placed in

service the following used 5-year class assets:

• Asset 1: on 3/28 for $50,000, and

• Asset 2: on 12/28 for $100,000

• More than 40% placed in service in last quarter;

therefore, mid-quarter convention used:

• Asset 1: $50,000 × 35% (Exhibit 8.5) = $17,500

• Asset 2: $100,000 × .05 (Exhibit 8.5) = $5,000

14

The Big Picture - Example 7

Mid-Quarter Convention

15

MACRS-Realty

(slide 1 of 2)

• MACRS characteristics:

MACRS Realty

Residential Rental Nonresid. Realty

Statutory lives:

27.5 yrs

31.5 yrs or 39 yrs

Method:

Straight-line

Convention:

Mid-month

• Residential rental real estate

– Includes property where 80% or more of gross rental

revenues are from nontransient dwelling units

• e.g., Apartment building

– Hotels, motels, and similar establishments are not

residential rental property

16

MACRS-Realty

(slide 2 of 2)

• Mid-month Convention

– Property placed in service at any time during a

month is treated as if it was placed in service in the

middle of the month

– Example: Business building placed in service April

25 is treated as placed in service April 15

17

Optional Straight-line Election

• May elect straight-line rather than accelerated

depreciation on personalty placed in service

during year

– Use the class life of the asset for the recovery

period

– Use half-year or mid-quarter convention as

applicable

– Election is made annually by class of property

18

The Big Picture - Example 11

Straight-Line Election

19

The Big Picture - Example 12

Straight-Line Election

20

Additional First-Year Depreciation

(slide 1 of 2)

• Additional first-year depreciation has been

allowed for several years

• Although the provision was written to expire at

the end of 2013, Congress may extend this

provision during 2015

21

Additional First-Year Depreciation

(slide 2 of 2)

• Additional first-year depreciation allows an

additional 50% of cost recovery in year asset is

placed in service

• Qualified property includes most types of new

property other than buildings

– Property that is used but new to the taxpayer does

not qualify

22

Example: Additional

First-Year Depreciation

Maple Company acquires a 5-year class asset on

April 25, 2015, for $20,000. Maple’s cost recovery

deduction for 2015 is computed as follows:

50% additional first-year

depreciation ($20,000 X .50)

MACRS cost recovery

[($20,000 - $10,000) X .20 (Exhibit 8.4)]

Total cost recovery

$10,000

2,000

$12,000

23

The Big Picture - Example 15

MACRS With Additional First-Year

Depreciation

24

Election to Expense Assets

-Section 179 (slide 1 of 5)

• General rules

– Can elect to immediately expense up to $500,000

of business tangible personalty placed in service in

2015

– Cannot use § 179 for most realty or production of

income property

25

Election to Expense Assets

-Section 179 (slide 2 of 5)

• Section 179 general rules

– Amount expensed reduces depreciable basis

– Any elected § 179 expense is taken before

additional first-year depreciation is computed

• The base for calculating the standard MACRS

deduction is net of the § 179 expense and the additional

first-year depreciation (50% in 2015)

26

Election to Expense Assets

-Section 179 (slide 3 of 5)

• Annual limitations:

– Expense limitation ($500,000 for 2015) is reduced

by amount of § 179 property placed in service

during year that exceeds $2,000,000 in 2015

• Example: In 2015, taxpayer placed in service

$2,015,000 of § 179 property.

– The § 179 expense limit is reduced to $485,000

• [$500,000 – ($2,015,000 – $2,000,000)]

27

Election to Expense Assets

-Section 179 (slide 4 of 5)

• Annual limitations:

– Election to expense cannot exceed taxable income (before

§ 179) of taxpayer’s trades or businesses

• Any amount expensed under § 179 over taxable income limitation

may be carried over to subsequent year(s)

• Amount carried over still reduces basis currently

– The § 179 amount eligible for expensing in a carryforward

year is limited to the lesser of

• The statutory dollar amount ($500,000 in 2015) reduced by the cost

of § 179 property placed in service in excess of $2,000,000 (in

2015) in the carryforward year, or

• The business income limitation in the carryforward year.

28

Election to Expense Assets

-Section 179 (slide 5 of 5)

Example 17:

29

Listed Property (slide 1 of 4)

• There can be substantial limits on cost

recovery of assets considered listed property

• Listed property includes the following:

– Passenger automobile

– Other property used as a means of transportation

– Property used for entertainment, recreation, or

amusement

– Computer or peripheral equipment

– Cellular telephone

30

Listed Property (slide 2 of 4)

• To be considered as predominantly used for

business, business use must exceed 50%

• Use of asset for production of income is not considered

in this 50% test

• However, both business and production of income use

percentages are used to compute cost recovery

31

Listed Property (slide 3 of 4)

• To be considered as predominantly used for

business (cont’d)

• If 50% test is met, then allowed to use statutory

percentage method of cost recovery with some

limitations

32

Listed Property (slide 4 of 4)

• If asset is not used predominantly for business

i.e., business use does not exceed 50%

– Must use straight-line method

– If business use falls to 50% or lower after year

property is placed in service, must recapture excess

cost recovery

33

Passenger Auto Cost

Recovery Limits (slide 1 of 7)

For autos placed in service in 2014, cost recovery limits are:

Year

Recovery Limitation

1

$3,160

2

5,100

3

3,050

Succeeding years until

the cost is recovered

1,875

• If a passenger auto used predominantly for

business qualifies for additional first-year

depreciation

– First-year recovery limitation is increased by $8,000

• Limit increases from $3,160 to $11,160 ($3,160 + $8,000).

34

Passenger Auto Cost

Recovery Limits (slide 2 of 7)

• Limits are for 100% business use

– Must reduce limits by percentage of personal use

• Limit in the first year includes any amount the

taxpayer elects to expense under § 179

35

Passenger Auto Cost

Recovery Limits (slide 3 of 7)

Example: Taxpayer acquired an auto in 2014

for $30,000, used it 80% for business, and

elects not to take additional first-year

depreciation.

2014 cost recovery allowance:

($30,000 × 20%) × 80%

$4,800

But deduction is limited to

× Business use %

Cost recovery allowance

$3,160

× 80%

$2,528

36

Passenger Auto Cost

Recovery Limits (slide 4 of 7)

• Limit on § 179 deduction

– For certain vehicles not subject to the statutory

dollar limits imposed on passenger automobiles the

§ 179 deduction is limited to $25,000

• The limit applies to sport utility vehicles with an

unloaded GVW rating of more than 6,000 pounds and

not more than 14,000 pounds

37

Passenger Auto Cost

Recovery Limits (slide 5 of 7)

• Listed property that fails the >50% business usage

test in year property is placed in service must be

recovered using the straight-line method

– Such property does not qualify for additional first-year

depreciation

• If the >50% business usage test is failed in a year

after the property is placed in service, straight-line

method must be used for remainder of property’s life

– Cost recovery of passenger auto under straight-line listed

property rule still subject to annual limits

38

Passenger Auto Cost

Recovery Limits (slide 6 of 7)

• Change from predominantly business use

– If the business use percentage falls to 50% or

lower after the year the property is placed in

service, the property is subject to cost recovery

recapture

– The amount recaptured as ordinary income is the

excess cost recovery

• Excess cost recovery is the excess of the cost recovery

deductions taken in prior years using the statutory

percentage method over the amount that would have

been allowed if the straight-line method had been used

39

Passenger Auto Cost

Recovery Limits (slide 7 of 7)

• Leased autos subject to inclusion amount rule

– Using IRS tables, taxpayer has gross income equal

to each lease year’s inclusion amount

– Purpose is to prevent avoidance of cost recovery

dollar limits applicable to purchased autos by

leasing autos

40

Farm Property

(slide 1 of 2)

• Generally, for farm assets use:

– MACRS 150% declining-balance method for

personalty

• MACRS straight-line method is required for any tree or

vine bearing fruits or nuts

– Straight line method over the normal periods (27.5

years and 39 years) for real property

– If the election is made to not have the uniform

capitalization rules apply, alternative depreciation

system (ADS) straight-line method must be used

41

Farm Property

(slide 2 of 2)

42

Alternative Depreciation

System (ADS) (slide 1 of 2)

• ADS is an alternative depreciation system that

is used in calculating depreciation for:

– Alternative minimum tax (AMT)

– Assets used predominantly outside the U.S.

– Property owned by the taxpayer and leased to tax

exempt entities

– Earnings and profits

43

Alternative Depreciation

System (ADS) (slide 2 of 2)

• Generally, use straight-line recovery without

regard to salvage value

– For AMT, 150% declining balance is allowed for

personalty

– Half-year, mid-quarter, and mid-month

conventions still apply

44

Amortization (slide 1 of 2)

• Can claim amortization deduction on § 197

intangibles

– Use straight-line recovery over 15 years (180

months) beginning in month intangible is acquired

• Section 197 intangibles include acquired

goodwill, going-concern value, trademarks,

trade names, etc.

45

Amortization (slide 2 of 2)

• Startup expenditures are also partially amortizable

under § 195

– Treatment is available only by election

• Allows the taxpayer to deduct the lesser of:

– The amount of startup expenditures, or

– $5,000, reduced by the amount startup expenditures exceed

$50,000

– Any amounts not deducted may be amortized ratably over

180-months beginning in month trade or business begins

46

Depletion

(slide 1 of 4)

• Two methods of natural resource depletion

– Cost: determined by using the adjusted basis of the

resource and allocating over the recoverable units

– Percentage: determined using percentage provided

in Code and multiplying by gross income from

resource sales

47

Depletion

(slide 2 of 4)

• Cost depletion

– Depletion is computed on a per unit basis

– Per unit amount is determined by dividing the

basis of the resource by the estimated recoverable

units of resource

• Number of units sold in year × per unit depletion =

depletion for year

– Total depletion can not exceed total cost of the

property

48

Depletion

(slide 3 of 4)

• Percentage depletion

– Depletion is computed by using the statutory

percentage rate for the type of resource

– Rate is applied to the gross income from the

property

49

Depletion

(slide 4 of 4)

• Percentage depletion

– Percentage depletion cannot exceed 50% of the

taxable income (before depletion) from the

property

– Percentage depletion reduces basis in property

– However, total percentage depletion may exceed

the total cost of the property

• Example: Property with zero basis but still generating

income

50

Intangible Drilling Costs

(IDC)

• Intangible drilling costs include

– Costs for making the property ready for drilling

– Costs of drilling the hole

• Treatment of IDC

– Expense in the year incurred, or

– Capitalize and write off through depletion

• It is generally advantageous to write off IDC

immediately

51

The Big Picture - Example 41

Tax Planning

•

Return to the facts of The Big Picture p. 8-1.

• In January 2014, Dr. Payne purchased residential rental property for

$170,000 ($20,000 allocated to the land, $150,000 to the building).

– He made a down payment of $25,000 and assumed the seller’s mortgage for the

balance.

– Monthly payments of $1,000 are required and are applied toward interest,

taxes, insurance, and principal.

• Since the property was already occupied, Dr. Payne continued to receive

rent of $1,200 per month from the tenant.

• Assume any losses generated by the property are currently deductible and

he is in the 28% tax bracket.

• During 2015, Dr. Payne’s expenses were as follows:

Interest

$10,000

Taxes

800

Insurance

1,000

Repairs and maintenance

2,200

Depreciation ($150,000 X .03636)

5,454

Total

$19,454

52

The Big Picture - Example 41

Tax Planning

• The deductible loss from the rental property is computed as follows:

Rent income ($1,200 X 12 months)

Less expenses (see above)

Net loss

$ 14,400

(19,454)

($ 5,054)

• But what is Dr. Payne’s overall position for the year when the tax benefit of

the loss is taken into account?

• Considering just the cash intake and outlay, it is summarized below:

Intake—

Rent income

Tax savings [28% (income tax bracket) X $5,054

(loss from the property)]

Net Intake

Outlay—

Mortgage payments ($1,000 X 12 months)

Repairs and maintenance

Net Outlay

Net cash benefit

$14,400

1,415

$ 15,815

12,000

2,200

(14,200)

$ 1,615

53

Refocus On The Big Picture

• Evidently, Dr. Payne’s accounting system uses MACRS

because $91,298 of depreciation is the correct amount.

– The computers and peripheral equipment are 5-year property.

– The furniture and fixtures and the dental equip. are 7-year property.

• Based on the IRS tables, the following percentages are used to

calculate first year depreciation expense:

5-year property

7-year property

20.00%

14.29%

• Dr. Payne will also be able to deduct depreciation on the house

he converted from personal use to rental use and on the rental

house that he purchased.

54

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA

trippedr@oneonta.edu

SUNY Oneonta

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

55