BAF 3M Learning Goals

advertisement

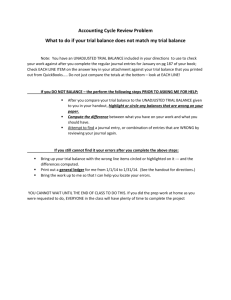

Learning Goals and Success Criteria Analyzing Changes in Financial Position Chapter 1 Learning Goals I have a broad understanding of the objectives of accounting I know the four main kinds of businesses and the 3 forms of ownership I understand the benefits to be gained by having a background in accounting I know what is meant by Professional Accountant and Public Accountant Chapter 1 Learning Goals I know the different ways that I can become an Accountant I understand the types of work done by an accounting department I understand what is meant by ‘Accounting Cycle’ Understand the value of computer skills to an accountant Chapter 1 Success Criteria I have made a list of 5 main activities in accounting I have defined the four main kinds of business and the 3 forms of ownership I have researched job opportunities in the accounting professions I have discussed the benefits to having accounting background I have discussed the difference between a Public and a Professional Accountant Chapter 1 Success Criteria I have met a Professional Accountant in class as a guest speaker I have researched the different ways that I can become an Accountant I have of list of duties that the Accounting Department is responsible for I have defined the Accounting Cycle I have discussed the value of computers to accountants Chapter 2 Learning Goals I understand what is meant by Financial Position for a person and a business I know the meanings of Accounts Receivable and Accounts Payable I understand the fundamental accounting equation I understand the meaning of Claims Against the Assets Chapter 2 Learning Goals I am able to use basic record keeping practices I understand the concept of liquidity I understand the purpose of GAAP I understand the purpose of spreadsheets in accounting Chapter 2 Success Criteria I have prepared a simple Balance Sheet for a person and a business I have discussed the meanings of Accounts Receivable and Accounts Payable I have completed word problems associated with the fundamental accounting equation I have listed reasons why Creditors have Claims on Assets Chapter 2 Success Criteria I have created a Balance Sheet that is neat, on columnar paper (spreadsheet), dated, titled and formatted correctly in units ($). I have listed assets in order of liquidity I have discussed and presented the purpose of GAAP to my classmates I have used Excel to prepare my statements of financial position Chapter 3 Learning Goals I understand factors that affect change in financial position I understand what a business transaction is I can work out the changes created in Assets, Liabilities and Capital due to transactions I am able to record a series of transactions on an equation analysis sheet Chapter 3 – Learning Goals I understand the steps in analyzing a business transaction I know the purpose of Source Documents I understand the Objectivity Principle Chapter 3 Success Criteria I have given examples of, and recognized business transactions I have distinguished between a business transaction and a non-business transaction from a long list of economic events that have been presented to me I have analyzed business transactions and recorded entries into the proper accounts using an equation analysis sheet Chapter 3 Success Criteria I have discussed and seen examples of source documents i.e. (receipts of my own, cell-phone bills, etc…) I have dealt with the Objectivity Principle in an actual Case Study Chapter 4 – Learning Goals I know what an account is and what a ledger is I know the rules of debit and credit as they apply to assets, liabilities and capital I know how to record transactions in T-accounts and calculate account balances I know what the balance in a T-account means I understand the concept of Double-Entry Accounting Chapter 4 – Learning Goals I am able to take off a Trial Balance I understand the importance of the Trial Balance I can locate errors that I have made in T-Accounts I am able to use the term ‘on-account’ in the four customary ways I can identify the benefits of using software for accounting procedures Chapter 4 Success Criteria I have created an account, a group of accounts and ledger on Excel I have demonstrated how debits and credits affect each type of account on the balance sheet I have analyzed transactions and recorded debit and credit entries into the proper accounts I have recorded debits and credits equally into respective T-Accounts, thus understanding the concept of Double Entry Accounting I have entered beginning balances into accounts, thus understanding natural balances Chapter 4 Success Criteria I have totaled T-Accounts and created new balances I have entered new balances onto a Trial Balances and checked if my debits equal my credits I have located errors made in T-Accounts using the process of ‘Trial Balance Out of Balance’ I have used the term ‘On-Account’ when recording transactions I have completed a Transaction Analysis Assignment using Excel Completing the Accounting Cycle Chapter 5 Learning Goals I will understand the need for expanding the equity section into capital, expenses, revenue and drawings. I will understand the function of the income statement and its role in the accounting system. I will understand the relationship between equity accounts and the balance sheet. Chapter 5 Success Criteria I can define revenue, expenses, capital and drawings. I will understand the time period concept, the revenue recognition convention and the matching principle. I will understand the importance of the income statement to owners, managers and other interested parties. I will understand net income and net loss and be able to calculate both. Chapter 5 Success Criteria I will complete a simple income statement. I will understand that the data for the income statement are accumulated in special accounts in the equity section of the ledger. I will be able to prepare an expanded equity section on a balance sheet. Chapter 6 Learning Goals I understand why a journal and a ledger are both used in the accounting process. I understand the purpose and function of source documents in the accounting system. I will be able to explain the purpose of the HST and know how it affects accounting. Chapter 6 Success Criteria I will record transactions in the two-column general journal. I will be able to record an opening entry in the journal using information from the balance sheet. I will be able to recognize a number of basic source documents. I will know the journal entries for a number of source documents. Chapter 6 Success Criteria I will be able to give a definition of HST. I will know how to calculate sales tax and include it in a transaction. I will know the journal entries for transactions including the HST I will know the journal entries for remitting the HST to the government. Chapter 7 Learning Goals I will be able to post (transfer) transactions from the general journal to the general ledger. I will know four different ways to find an error in a trial balance. I will know the purpose of a trial balance. I will calculate the “trial balance difference”. I will apply four quick tests to an example where the “trial balance difference” is not zero. Chapter 7 Success Criteria I will be able to give a definition of general ledger and general journal. I will know how to record transactions in the general journal. I will be able to explain why transactions are also recorded in a general ledger. I will show and that I understand the steps involved in posting (transferring amounts from the general journal to the general ledger) by actually completing the process. Chapter 8 Learning Goals I will complete a six-column worksheet. I will know how accountants use income statements. I will know how accountants use balance sheets. I will know the importance of accountability in the management and performance of a business. Chapter 8 Success Criteria I can give a definition of a worksheet. I know the first five steps of the accounting cycle. I know the purpose of control accounts for payables and receivables. I know which accounts to place on the income statement and the balance sheet. I know how to calculate net income. I know how to calculate increase/decrease in equity. I know that the data for the income statement comes from the worksheet. Chapter 8 Success Criteria I know how to calculate net income. I know how to calculate trends in revenues and expenses. I know how to prepare a comparative income statement. I know how to prepare a common-size income statement. I know that data for the balance sheet comes directly from the worksheet. I know how to calculate increase/decrease in equity. Chapter 8 Success Criteria I know how to prepare a “classified” balance sheet. I know the two types of balance sheets; “report form” and “account form” I know the definition of “accountability”. I know the five main users of financial statements. I know the definition of “audit”. I understand how three GAAPs – the Consistency Principle, the Materiality Principle and the Full Disclosure Principle – help produce top-notch financial statements. Chapter 9 Learning Goals I will be able to make the adjusting entries for supplies, prepaid insurance, and late-arriving invoices. I will be able to journalize and post the closing entries for the end of a fiscal year. I will be able to calculate depreciation and make the necessary adjusting entries for depreciation. Chapter 9 Success Criteria I know why adjusting entries are necessary. I can give a definition for supplies, prepaid insurance, and late-arriving invoices. I can calculate the value of supplies and prepaid insurance left at the end of the fiscal year. I can record the transactions that result from adjusting entries in the journal and to the ledger. I know how to use the adjustment columns on an 8-column worksheet. Chapter 9 Success Criteria I understand the Time Period concept GAAP. I know why closing entries are necessary. I know the definition of “real” and “nominal” accounts. I understand why “nominal” accounts must be cleared. I understand the purpose of the “income summary” account. Chapter 9 Success Criteria I will know the meaning of “depreciation”. I will know the meaning of “accumulated depreciation”. I will calculate depreciation using the straightline and declining balance methods. I will know the CRA rates of capital cost allowance. Internal Control, Financial Analysis and Decision-Making Chapter 10 Learning Goals I will understand the various forms of payment systems used in business I will understand accounting procedures for cash receipts (incoming cash) I will understand accounting procedures for cash payments. I will understand how and why cash controls are necessary in business I will use computers to prepare a bank reconciliation. Chapter 10 Success Criteria I can identify the advantages and disadvantages of the various methods of payment in Canada I can compare trends in cheque, debit and credit card usage in Canada I can prepare a cash proof and prepare a bank deposit I can account for cash shortages or overages I know the features of a current bank account I know the purpose of a petty cash fund I can establish, operate and replenish a petty cash fund Chapter 10 Success Criteria I understand the need for accounting controls over expenditures I understand the meaning of internal control I know the specific control features associated with cash I can prepare a bank reconciliation I understand how accounting software simplifies the bank reconciliation process.