Recovering a debt

advertisement

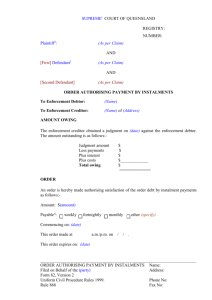

Arbins gate 7 0253 Oslo Switchboard Fax Internet +47 22 84 29 00 +47 22 84 29 01 http://www.jussbuss.no Legal information from law students RECOVERING A DEBT This document mainly gives information on how to recover a debt. It also contains a brief discussion of the rules on time-barring and promissory notes. This will be relevant to you if someone owes you money. When you have a claim to money, you are called the creditor for the claim in question. The person who owes the money is called the debtor. Having a debt means that one has an obligation to pay a sum of money to another person. Such a claim may arise in many ways, but the typical situation in most cases is that the creditor has made a loan of money to the debtor. Demands The first step in recovering a debt is to send the debtor a demand. A demand is a request from the creditor to the debtor to repay the debt. The demand should specify what amount you, the creditor, believe the debtor owes. An example of a demand is attached (annex 1). The general rule is that the debt is due on receipt of the demand; see Section 5 of the Promissory Notes Act (Gjeldsbrevsloven). When the debt is due, this means that the debtor is required to repay the debt. The usual practice is to defer the due date by 14 days when you send a demand. That way, you give the debtor 14 days to pay the debt. If the debtor has not paid by the due date, he has not complied with his agreement with the creditor. If you agreed a payment date with the debtor at the time when you loaned the money, this date will determine when the debt is due. Forced recovery of a debt If the debtor does not pay when the debt is due, the creditor can have the claim enforced. The rules for forced recovery can be found in the Debt Enforcement Act (Tvangsfullbyrdelsesloven). Enforcement is the legal recovery of a claim with the support of the authorities. In the case of enforcement, the State, in the person of the enforcement officer (‘namsfogden’ or ‘namsmannen’) helps to recover the claim; see Debt Enforcement Act, § 2-1. This may happen by deducting from the debtor’s salary or by the creditor taking possession of the debtor’s assets. By taking possession of the assets, you obtain security for the claim. Then you can recover the debt by arranging a forced sale of the assets in your possession. The enforcement office has a statutory duty to provide guidance laid down in the Debt Enforcement Act, Section 5-3(2). People working there are therefore required to give information and guidance on the areas in which the enforcement officer operates, including forced recovery. As a creditor, you cannot simply go to the enforcement officer with a claim. In order to recover a claim through the enforcement officer, the creditor must have a “basis for enforcement”. This is a document entitling you to have the claim recovered with the aid of the enforcement officer. A letter sent by the creditor to the debtor setting out the basis for the claim and the amount is such a basis for enforcement; see Debt Enforcement Act, Section 72(f). A demand as described above will be a basis for enforcement provided that, in addition to specifying the amount, it also states what the claim relates to. There are many bases for enforcement, including a judgment of the Conciliation Board (Forliksrådet) or an “enforceable promissory note” (more on this under “Securing a claim with a promissory note”). If the creditor has sent a demand and the debtor does not pay by the due date, the creditor may send a written request for payment with a warning that the claim will be subject to enforcement if payment is not made within a specified time limit. If payment is still not forthcoming, the demand is considered to be a basis for enforcement. As creditor, you can take a copy of the warning notice with you to the enforcement office for forced recovery. You can request forced recovery by the enforcement officer both orally and in writing. You can obtain further guidance from the enforcement office. You can also find more information on their website www.namsfogden.no. The enforcement officer will decide how a claim is to be recovered. In practice, this is done either by seizing assets or by deductions from salary. The Debt Enforcement Act, Section 7-1, provides that any asset belonging to the respondent can be seized. That means that you can take possession of the assets. If enforcement is effected against the debtor’s salary, their employer is obliged to deduct a certain amount from their salary each month before it is paid. The actual amount depends on the total extent of the debtor’s income. Under the Satisfaction of Claims Act (Dekningsloven), Section 2-7, the debtor should always be left with an amount to cover day-to-day expenses and living costs. In the case of day-to-day expenses, the amount is calculated on a general basis by the enforcement officer. Different maintenance rates are specified according to whether a person is single or has a partner/spouse or children. How much the debtor is entitled to retain thus depends on their rent/living costs and the maintenance rate determined by the enforcement officer. A fee is charged for forced recovery. This is a fee that the debtor is required to pay, but it is the creditor who has to make the payment and claim the amount back from the debtor; see Debt Enforcement Act, § 3-1. Objections by the debtor to the basis for enforcement The debtor is given the opportunity to protest to the enforcement officer against the basis for enforcement; see Debt Enforcement Act, Sections 4-2 and 7-6(2). In such cases, the enforcement officer will decide whether the basis for enforcement should be upheld or not. If the basis for enforcement lapses, you can acquire a fresh basis for enforcement by obtaining a decision from the Conciliation Board or the court. If the debtor raises objections with the enforcement officer, and the officer then withdraws the basis for enforcement, the creditor can summon them before the Conciliation Board for mediation. As the creditor, you can mention in your request to the enforcement officer that you want to summon the debtor before the Conciliation Board for mediation if they raise objections to the demand with the enforcement officer; see Debt Enforcement Act, Section 7-7(2) Then the debtor will automatically be summoned before the Conciliation Board for mediation if they protest against the demand. There is a Conciliation Board in every municipality. The Board decides on most types of debt matters before a case can be appealed before the courts. The Conciliation Board acts both as a mediation body and as a court. If you do not agree on the demand before the Conciliation Board, a ruling may be pronounced there. If this is in your favour, it will constitute a basis for enforcement for recovery via the enforcement officer. To have a case heard by the Conciliation Board, you have to pay a fee of NOK 860. For further information on the process before the Conciliation Board, you can contact your local board, or visit their website at www.forliksraadet.no. Securing a claim with a promissory note If you do not want to recover the debt all at once, you can secure the claim by having the debtor sign a promissory note. A promissory note is a written promise to pay or an acknowledgement that one owes money. The promissory note must be independent of anything else to be called this. This means that the promissory note may not contain any sort of conditions for the claim. Even if such conditions or consideration are present in the basis for enforcement, they must not be included in the promissory note. The basis for the claim will generally be an agreement between the parties, such as a loan agreement or a purchase contract. A promissory note therefore only gives details of who owes money to whom, and how much they owe. The promissory note is taken as evidence that the other party owes you money. In this way, your claim is secured. Another advantage of a promissory note is that the limitation period is longer than it is for other claims; see “Time-barring of claims” below. You can also enter into an agreement with the debtor to charge interest on the claim, so you do not lose money when the claim is not paid back all at once. If this is the case, it must be stated in the promissory note or agreement. If you want to recover the money later, you must follow the procedure under “Forced recovery”. You first have to send a demand, then notice of enforcement, before the claim can be recovered via the enforcement officer. There are various types of promissory note. The attached sample is what is known as an “enforceable promissory note” (annex 2). The advantage of an enforceable promissory note is that the enforcement officer can enforce the claim directly, without the creditor having to go to the Conciliation Board or the courts first if the debtor raises objections; see Debt Enforcement Act, Section 7-2(a). However, it is not necessary to draw up an enforceable promissory note in order to secure the claim. A written acknowledgement stating who owes money to whom and how much they owe will also secure the claim. Time-barring of claims If a claim is time-barred, it will lapse in its entirety, and the creditor will no longer be able to recover it. The Limitation Act (Foreldelsesloven) governs questions of time-barring. The normal limitation period for monetary claims is three years; see Limitation Act, Section 2. If you have secured the claim with a promissory note, the limitation period will be 10 years from the date when the promissory note was signed. Loans of money also have a limitation period of ten years; see Limitation Act, Section 5 no. 1. If the claim is not a loan and it not secured by a promissory note, the normal limitation period of three years will apply. The limitation period starts from the earliest date on which the creditor can demand payment from the debtor; see Limitation Act, Section 3. If the due date was set by the creditor at the time when the claim was established, the limitation period will start from the due date. If the due date is not specified, the limitation period will run from the date on which the claim was established, i.e. the earliest date on which the creditor can recover the money. The limitation period can be suspended by the debtor or the creditor in various ways. The consequence is that a new limitation period will start to run. The limitation period will be suspended when the debtor acknowledges his or her obligation to pay, either explicitly or by their behaviour, or by paying interest; see Limitation Act, Section 14. In such cases, the same period will start from the date of suspension (3 years or 10 years). The limitation period may also be suspended by the creditor taking the matter to the Conciliation Board or the court; see Limitation Act, Section 15, or by the creditor requesting enforcement through the enforcement officer; see Limitation Act, Section 17. In these cases, a 10-year limitation period will start, even if the original period was three years. If you are the creditor, it is important to suspend the limitation period if the end of this period is approaching. If you do not, the claim will lapse, and the creditor will no longer have any claim to repayment from the debtor. We hope you find this helpful. Place and date. Own name and address Name and address of the person who owes money. Heading: DEMAND FOR... Brief details of the matter, i.e. why you believe you have a claim. Here you can refer to documentation and attach copies (this could be an enforceable promissory note, for example). Then write how much the claim is for, what account-number it should be paid into, and whether you want interest to be charged (you can claim interest under the Interest on Overdue Payments Act (Forsinkelsesrenteloven) when the original payment period has expired). It is usual to allow two weeks for payment of the claim. Also state that this constitutes notice of enforcement, and warn that you will request enforcement if the debtor does not comply with the claim; see Enforcement Act, Section 4-18. Yours sincerely, Signature . PROMISSORY NOTE , personal ID ………………………..…….., hereby declare that I, the undersigned, , personal ID …………………………………. NOK …………………. I owe ……………………………………… kroner (in words) . The debt must be repaid no later than ….. – ….. – months from today’s date. In the event of failure to do so, the creditor reserves the right to claim interest under the Interest on Overdue Payments Act from the date of signature of this promissory note. Oslo, [date] (debtor’s signature) I, the undersigned, , hereby confirm that the above promissory note can be enforced without recourse to the courts; see Enforcement Act, Section 7-2(a). The same applies to interest and out-of-court recovery costs. Oslo, [date] (debtor’s signature) Witnesses have been called, who are both of age, and who hereby confirm that the debtor has signed this document in their presence ………………………………….. ……………………………….. Name in block letters: Name in block letters: Address: Address: Page 6 of 3