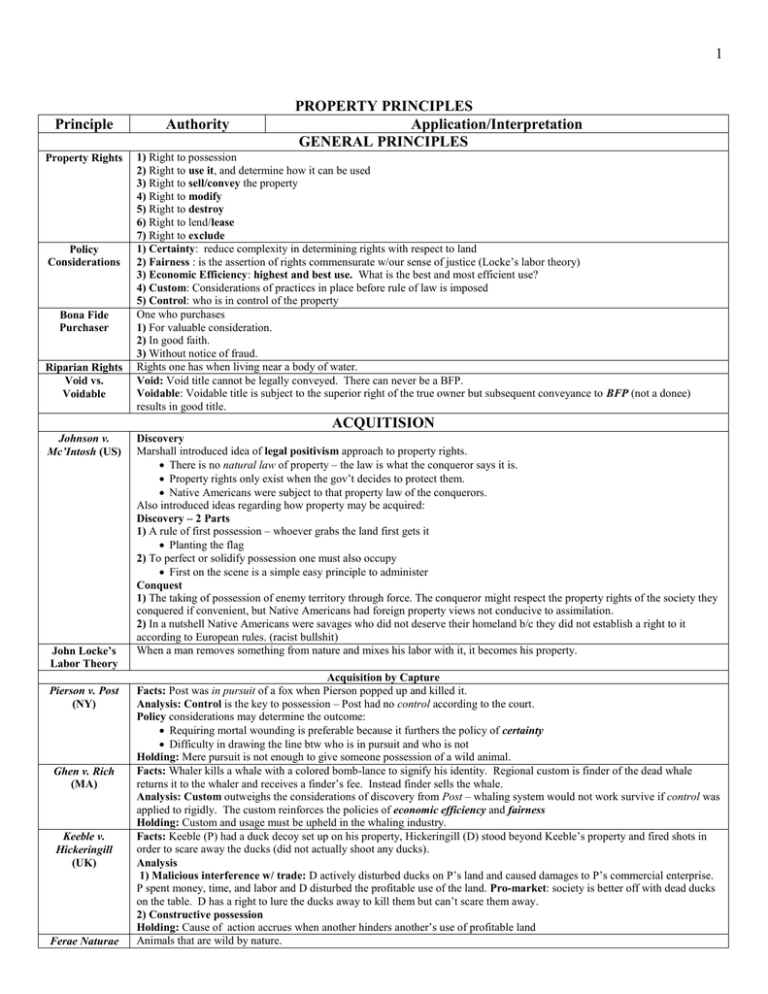

PROPERTY-PRINCIPLES - Law Office of Ciara L. Vesey, PLLC

advertisement