8

Monopoly

Outline

● Monopoly Defined

● The Monopolist’s Supply Decision

● A Comparison of Monopoly and Perfect

Competition

● Can Anything Good Be Said About

Monopoly?

● Price Discrimination Under Monopoly

Monopoly Defined

●

1.

2.

3.

Very stringent requirements for pure monopoly:

Only one firm in industry.

No close substitutes for the good firm produces.

Some reason why entry and survival of a competing

firm is unlikely.

● Pure monopolies are rare in real world because most

firms face competition from firms producing substitutes.

♦ E.g., sole provider of natural gas in a city is not a pure

monopoly, since other firms provide substitutes like heating

oil and electricity.

♦ E.g., if there is only one railroad, it still competes with bus

lines, trucking companies, and airlines.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Sources of Monopoly Power:

Barriers to Entry

1.

Legal restrictions: Monopolies are established if gov.

prevents other firms from entering the industry.

●

2.

E.g., licensing 1 cable TV supplier or right to operate a food

stand in a public stadium.

Patents: To encourage innovation, gov. gives exclusive

production rights for 17 years to product's inventors.

Monopoly is protected as long as its patent remains in

effect.

●

E.g., for many years, Xerox had a monopoly in plain paper

copying. Pfizer currently has a patent for Lipitor.

Sources of Monopoly Power:

Barriers to Entry

3.

Control of a scarce resource or input: If a good is

produced with a rare input, a Co. that gains control of

that input can establish a monopoly.

●

4.

E.g., DeBeers diamond syndicate controls S of highest

quality diamonds in the world.

Deliberately erected entry barriers: An incumbent firm

can make it difficult for potential rivals to enter.

●

E.g., Spending huge amounts on advertising forces any

potential entrant to match that expenditure to obtain

customers. Intel has used its "Intel Inside" marketing

campaign to ward off competition from AMD.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Sources of Monopoly Power:

Barriers to Entry

5.

Large sunk costs: Entry into an industry is risky if it

requires a large sunk I. Most important type of

"naturally imposed" barrier to entry.

●

E.g., Boeing was the only supplier of top-end airplanes for

many years after intro of its 747. Airbus receives gov.

subsidies so it can afford the high I costs.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Sources of Monopoly Power: Cost

Advantages

6.

Technical Superiority: A firm whose technological

expertise vastly exceeds that of any potential

competitor can maintain a monopoly for a period of

time.

●

7.

E.g., For many years, IBM had little competition in PC

business because of its superior technology.

Economies of scale: If the size of a firm gives a cost

advantage over a smaller rival, it may be impossible

for anyone to compete with largest firm in the

industry.

Natural Monopoly

● Natural monopoly is an industry where advantages of

large scale production makes it possible for a single firm

to S entire market output at a lower AC than a larger

number of firms producing smaller Q.

● Once a firm is big enough, its natural cost advantage will

drive competition out of business.

Average Cost

FIGURE 1. Natural Monopoly

B

$3.00

A

2.50

C

2.00

AC

1

2

2.5

Quantity Supplied

Natural Monopoly

● Fig. 1 considers widget companies with ↓AC.

● Initially 2 firms in industry –larger firm with Q = 2M

and AC = $2.50 and smaller firm with Q = 1M and AC =

$3.00.

● Smaller firm can match P of larger firm only by

operating at a loss.

● Larger firm can drive smaller firm out of business by

selling its Q at $3.00 > P > $2.50 and still earn a profit.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Natural Monopoly

● Once monopoly is producing 2.5M, IRTS are a barrier to

entry because no entrant can match AC = $2.00.

● If firm uses its low cost to keep P low, this benefits

society. But once rivals exit, monopolist can ↑P.

● Public utilities are regulated because technology of

producing their output enables them to achieve large

↓cost by ↑Q.

● Better to allow these firms to have entire market to

themselves and have regulatory supervision vs. breaking

them up.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

The Monopolist’s Supply

Decision

● Monopoly does not have a S curve.

♦ Unlike competitive firms, monopoly does not take market P as

given. It can select (P,Q) pair on industry D curve that max. Π.

● Monopolist’s D curve is downward sloping, not

horizontal.

● Profits are not competed away by entry of new firms.

● To max profit, monopolist compares MR and MC.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Relationship Between Price

and Marginal Revenue

● Recall D = AR = P.

● If D curve is downward sloping, then P > MR.

● Monopoly charges same P to all its customers. To ↑Qd

by 1, it must ↓P to all customers. So MR = P firm

collects from the new customer - revenue lost by ↓P to

all "previous" customers. Thus, P > MR.

● MR = P under perfect competition because firm's D

curve was horizontal. Firm could expand Q without ↓P.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

FIGURE 2. Relationship Between

Price and Marginal Revenue

P

$0.10 loss to all

"previous" customers

$2.10

A

$2.00

$2.00 P gained by

selling the 16th unit

B

D

16

P must ↓ to $2.00 to sell

16th unit (pt B).

How much revenue is

gained? TRa = $31.50

and TRb = $32.00 so

MR = $0.50.

So P = $2.00 > MR =

$0.50.

Q

15

Monopolist sells 15

units for $2.10 (pt A)

and wants ↑ sales by 1.

The Monopolist’s Supply

Decision

●

To study P and Q decision of a profit-max

monopolist (graphically):

1. Find Q where MR = MC to select the output

level.

2. Find height of the D curve at that Q to

determine P.

3. Compare P and AC to determine whether the

monopolist earns a profit.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

FIGURE 3. Profit-Maximizing

Equilibrium for a Monopolist

Π-max Q = 150

where MR = MC.

MC

Price per Unit

D

P

$10

AC

Total profit is $6 x

150 = $900 and is

represented by the

area $10 P C 4.

M

8

MC

4

AC

C

D (AR)

MR

0

P = $10 > AC = $4,

so per unit profit =

$6.

150

Quantity

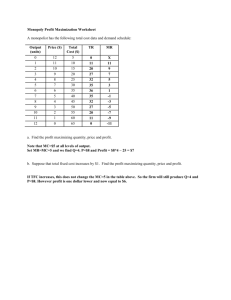

TABLE 1. A Monopolist’s PriceOutput Decision

Quantity

Price

Total

Revenue

Marginal

Revenue

Total

Cost

Marginal

Cost

Total

Profit

0

------

$0

------

$10

------

-$10

1

$140

140

$140

70

$60

70

2

107

214

74

120

50

94

3

92

276

62

166

46

110

4

80

320

44

210

44

110

5

66

330

10

253

43

77

6

50

300

-30

298

45

2

The Monopolist’s Supply

Decision

●

1.

Table 1 illustrates several important points:

↓P will raise (lower) TR when D is elastic (inelastic).

♦

2.

3.

E.g., D is elastic (inelastic) from Q = 1 to Q = 5 (from Q = 5

to Q = 6).

P > MR after 1st unit of output.

Highest profit ($110) at Q = 4 where MR = MC = $44.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

A Comparison of Monopoly

and Perfect Competition

1.

A monopolist' profits persist:

● No barriers to entry in competitive markets so

profits are competed away. In LR, firms only cover

their costs, including opportunity cost of K and L.

● But economic Π can persist under monopoly.

Monopolies are often regulated by gov. agencies

that try to limit Π they earn.

2. Monopoly restricts output to raise price: Compared

with the ideal of perfect competition, monopolist

restricts Q and charges a higher P.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

A Comparison of Monopoly

and Perfect Competition

●

●

Imagine a court order breaks up a monopoly into large

# of competitive firms.

Assume industry D and costs stay same. Somewhat

unrealistic, but it allows us to compare LR (P,Q) pair

under monopoly vs. perfect competition.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

FIGURE 4. Compare Monopoly to

Competitive Industry

Monopoly Q = 150 →

MR = MC (pt M).

MC

Price per Unit

D

AC

P

$10

M

Monopolist produces

less Q and charges a

higher P.

B

8

MC

D (= AR = P = MU)

C

AC

MR

150

Comp. Q = 300 → P

= AC (pt B).

300

Quantity

Monopoly Leads to an Inefficient

Resource Allocation

●

●

●

●

Competitive industries produce what society wants at

min possible cost.

Efficiency in resource allocation requires that MU =

MC. This occurs under competition because industry

produces where D (or MU) = MC.

Yet, monopolist produces smaller Q where MU > MC.

So consumers are willing to pay more for an add. unit

than it would cost to produce it.

Resources are allocated inefficiently under monopoly,

because too few resources are used to produce the

good.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Can Anything Good Be Said

About Monopoly?

● Monopoly may aid innovation:

♦ Monopolies are shielded from competition, so any

innovation that ↓costs → ↑profits.

♦ Monopolies may have more incentive to invest in

R&D.

♦ In SR, ↑AC with R&D spending, but in LR, ↓AC with

use of new technologies or production processes.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Can Anything Good Be Said

About Monopoly?

● Natural monopoly:

♦ ↓AC as ↑Q

♦ Costs of production would be higher if a natural

monopoly were broken up into many smaller firms.

♦ Society benefits from monopolist’s ↓AC (or IRTS).

♦ Must be regulated for consumers to receive lower P.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Price Discrimination Under

Monopoly

● Charging different customers different prices when cost

of supplying them is the same.

♦ E.g., airlines charge less to passengers willing to stay overnight

on Sat.

● Or charging different customers same P when cost of

serving them is different.

♦ E.g., U.S.P.S. charges same P for delivery of letters.

Can you think of some examples of P discrimination?

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Price Discrimination Under

Monopoly

● P discrimination occurs in many industries, but it is

easier to accomplish if firm is sole producer of a good.

● P discrimination → more profitable to sell to 1 group

than another.

● With competition, firms enter and steal profitable

customers away by charging them slightly lower P.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Price Discrimination Can

Raise Profits

● Example: Town where widgets are sold

100 rich families → willing to buy 1 if P = $30

1,000 poor families → willing to buy 1 if P = $10

● If firm cannot P discrim. → charge everyone P =$10.

♦ TR = $10 x 1,100 = $11,000

If instead, it charged P = $30 to everyone

♦ TR = $30 x 100 = $3,000

● If firm can P discrim. (and keep poor from reselling to

the rich). → TR = $13,000 = $10 x 1,000 + $30 x 100.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

FIGURE 5. Prices and Quantities

under Price Discrimination

Customer Group A

Customer Group B

Da

Db

Pa

Price

Pb

MC

0

J

Qa

K

MRa

Quantity

Da

0

Qb

MC

MRb

Quantity

Find Π-max (P,Q) for each group by: (a) optimal Q is where MR =

MC; and (b) P is determined by height of D curve at optimal Q.

Db

Price Discrimination Under

Monopoly

●

Profit max. requires MRa = MRb = MC.

♦ E.g., if MRa = $18 and MRb = $15 → switching sales from

group B to group A raises TR by $3.

● Fig. 5 assumes MC are equal across the 2 groups and that

MC is constant.

● Optimally, sell Qa to group A and Qb to group B. These

quantities ensure that MRa = MRb = MC.

● Group B (with more elastic D) is charged a lower P than

group A (with less elastic D).

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Price Discrimination Under

Monopoly

● A seller facing 2 identifiably different groups of buyers

with diff. D curves, can ↑Π by setting diff. P for 2

groups.

● Monopolist will always charge group with more elastic

D a lower P; as these customers are more sensitive to P.

♦ E.g., discount coupons for supermarkets are a means of

offering lower P to more P sensitive customers. Shoppers who

clip coupons have a lower value of time and do more

comparison-shopping. A supermarket should charge less to

customers who would otherwise shop elsewhere.

Copyright© 2006 Southwestern/Thomson Learning All rights reserved.

Is Price Discrimination Always

Undesirable?

● May not be such a bad thing.

♦ E.g., movie ticket discounts for seniors or doctors ↓fees to

needy patients.

● Sometimes it’s impossible for a firm to stay in business

without P discrim.

♦ E.g., widgets: if TC of 100 = $4,000 and TC of 1,100 =

$11,500 → firm can’t cover costs with uniform P. But can

survive with P discrim. as TR = $13,000 > TC of 1,100.

● May allow firms with IRTS to lower P (even to group

paying more). If P discrim. allows ↑Q (via attracting new

customers) → ↓AC → firm can offer lower P.