Chapter 9: The Value of Money Multiple Choice 1. is the math of

advertisement

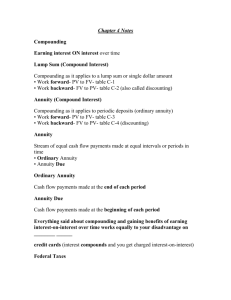

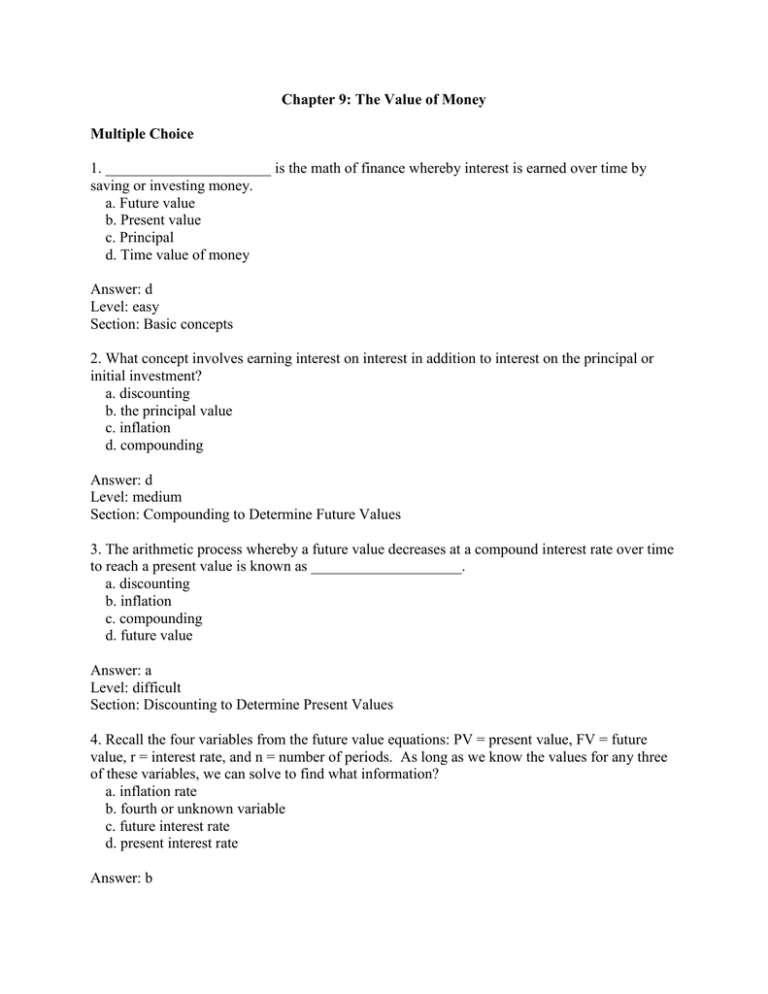

Chapter 9: The Value of Money Multiple Choice 1. ______________________ is the math of finance whereby interest is earned over time by saving or investing money. a. Future value b. Present value c. Principal d. Time value of money Answer: d Level: easy Section: Basic concepts 2. What concept involves earning interest on interest in addition to interest on the principal or initial investment? a. discounting b. the principal value c. inflation d. compounding Answer: d Level: medium Section: Compounding to Determine Future Values 3. The arithmetic process whereby a future value decreases at a compound interest rate over time to reach a present value is known as ____________________. a. discounting b. inflation c. compounding d. future value Answer: a Level: difficult Section: Discounting to Determine Present Values 4. Recall the four variables from the future value equations: PV = present value, FV = future value, r = interest rate, and n = number of periods. As long as we know the values for any three of these variables, we can solve to find what information? a. inflation rate b. fourth or unknown variable c. future interest rate d. present interest rate Answer: b Level: medium Section: Equating Present Values and Future Values 5. A shortcut method referred to as ___________________ can be used to approximate the time required for an investment to double in value. a. the future value equation b. the time value of money equation c. the Rule of 72 d. discounting Answer: c Level: medium Section: Finding Interest Rates and Time Requirements 6. What type of annuity exists when the equal payments or receipts occur at the end of each time period? a. an ordinary annuity b. a basic annuity c. an annuity due d. a compound annuity Answer: a Level: difficult Section: Future Value of an Annuity 7. Which of the following would you need to use in order to determine the present value of an annuity? a. lump sum to be received in 5 years time b. the amount of equal cash flow payment to be received each year for the next 5 years c. cash flows that increase by $1,000 each year for 5 years d. cash flows that are not known today Answer: b Level: difficult Section: Present Value of an Annuity 8. Many present value problems also involve cash flow annuities. Usually these are what type of annuity? a. a compound annuity b. an annuity due c. a basic annuity d. an ordinary annuity Answer: d Level: medium Section: Present Value of an Annuity 9. All of these are variables in interest rate or time period equations except which term? a. PV = present value b. FV = future value c. interest rate d. CV = compound value Answer: d Level: medium Section: Interest Rates and Time Requirements for Annuities 10. In many situations, compounding or discounting may ___________________. a. occur more often than annually. b. be compounded. c. be deferred. d. occur marginally. Answer: a Level: easy Section: More Frequent Compounding or Discounting Intervals 11. _________________ is repaid in equal payments over a specified time period. a. Adjustable loan mortgage loan b. An amortized loan c. An adjustable interest residential real mortgage loan d. An ARS loan Answer: b Level: difficult Section: Determining Periodic Annuity Payments 12. ________________ typically have interest rates tied to the bank prime rate or the Treasury bill rate which normally are lower than long term interest rates on fixed rate mortgage loans. It also makes it easier for borrowers with low credit scores and those that want to borrow larger amounts of money to acquire a mortgage loan. a. ARMs b. EAR c. PVR d. FVR Answer: a Level: easy Section: Determining Periodic Annuity Payments 13. ________________ is the act of lending money at an excessively high interest rate. a. Usury b. Amortization c. Shamming d. Larceny Answer: a Level: medium Section: Cost of Consumer Credit 14. What measures the true interest rate when compounding occurs more frequently than once a year? a. APR b. EAR c. PVR d. FVR Answer: b Level: easy Section: Cost of consumer credit 15. Banks, finance companies, and other lenders are required by the Truth in Lending law to do all of the following except _______________________. a. disclose their lending interest rates on credit extended to consumers. b. disclose their lending interest rates on credit extended to businesses. c. disclose their lending interest rates on credit extended to investors. d. disclose their lending interest rates to the individual credit of all bank customers to the general public. Answer: d Level: medium Section: APR versus EAR