Money, Measurement & Time Cost PPT

advertisement

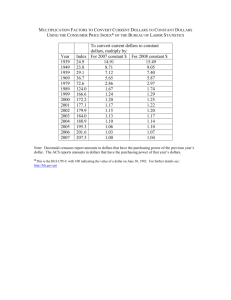

Money, Measurement, and Time Cost Roles of Money Existence of money improves standard of living, as it eliminates “double coincidence of needs” 1. Medium of Exchange – asset used to trade for goods and services 2. Store of value – Non-perishable, holds purchasing power of time 3. Unit of account – Commonly accepted measure used to set prices & make calculations What is Money? Any asset that can easily be used to purchase goods and services Three money supply measurements, each more broadly defined and less liquid than the previous one: M1 = Currency in circulation + checkable bank deposits + traveler’s checks M2 = M1 + savings deposits + money market funds + small time deposits (CDs less than $100,000) “Near-moneys” M3 = M2 + large (over $100,000) time deposits Types of Money Commodity money – A good with intrinsic value Commodity-backed money – MOE without intrinsic value but guaranteed by conversion on demand Fiat money – MOE with value derived from its official status as such Advantages – Takes up no real resources; amount in circulation is decided by needs of the economy Disadvantages – Can be counterfeited; printing too much can lead to inflation Time Value of Money In general, having a dollar today is worth more than a dollar a year from now Time value is a consideration when evaluating projects, so economists use present value to make comparison easier – using interest rate to compare the value of a dollar received today with value of a dollar received later Present Value Equation To see the relationship between dollars today (present value, or PV) and dollars one year from now (future value, or FV) a simple equation is applied: FV = PV (1 + r) Ex. Lending $100 to a friend at 10% interest for one year. FV = $100 (1.10) = $110 In other words, one year into the future, that $100 will be worth $110. PV = FV/(1+r) PV = $110/(1.10) = $100 This tells us that $110 a year from now is worth only $100 in today’s dollars. What if we were lending money for a two year period? FV= PV (1 + r)² = $100 (1.10) (1.10) = $121 Conclusions Money today is more valuable than the same amount of money in the future The present value of $1 received one year from now is $1/(1 + r) The future value of $1 invested today, for a period of one year, is $1 (1 + r) Interest paid on savings and interest charged on borrowing is designed to equate the value of dollars today with the value of future dollars