Chapter 3: Determining Gross Income

advertisement

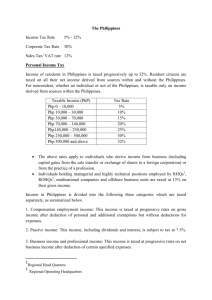

Chapter 3 Determining Gross Income 3-1 What is Gross Income? Code Section 61(a) defines gross income as “except as otherwise provided in this subtitle, gross income means all income from whatever source derived...” 3-2 What is Income? Gross income is realized income that is not excluded Realization takes place when arm’s length transaction occurs (sale of goods) Taxable income is gross income less all deductions 3-3 Tax vs. Financial Accounting Objectives are not the same Financial accounting seeks to provide information that decision makers find useful Tax reporting seeks to collect revenue equitably Differences fall into two categories Temporary (timing) differences Permanent differences 3-4 Temporary Differences Arise when income is taxed either before or after it is accrued for accounting purposes Example: prepaid rent generally is taxable when received but is only included in financial accounting income as it is earned Create a deferred tax asset or deferred tax liability on financial statements 3-5 Permanent Differences Income that is not taxed but is reported for financial accounting purposes Example: municipal bond interest generally is not taxed but is recorded as income in financial accounting records 3-6 Return of Capital Principle Basis = amount invested in an asset Basis can be recovered tax-free If the taxpayer’s return is more than basis, the taxpayer has a gain If taxpayer’s return is less than basis, the taxpayer has a loss 3-7 Investment Alternatives Investments yielding appreciation Tax deferred until gain is recognized Gain is frequently taxed at lower capital gains rates Investments yielding annual income Interest income is taxed annually at the marginal tax rate for ordinary income; dividends taxed annually but currently at lower capital gains rates 3-8 The Tax Year Calendar year Individuals S corporations and partnerships have restrictions on allowable tax years, so usually use a calendar year Fiscal year 12-month period ending on month other than December 52-to-53 week year (ends on same day) Corporations freely select tax year 3-9 Short Tax Year A short-year tax return reports less than 12 months of operating results Income must be annualized (adjusted to reflect 12 months of operations) Required by businesses that change their tax year Not required in year entity begins or ends business 3 - 10 Accounting Methods Taxpayers can use different methods for financial accounting and tax Cash method: receipt of cash or cash equivalents determine income/expense recognition (subject to constructive receipt doctrine) Accrual method: the all-events test determines income/expense recognition 3 - 11 Cash Method Income is recognized when cash or cash equivalents received Cash equivalents broadly defined to include property and services Cash equivalents included at fair market value A cash-basis taxpayer must recognize income when an amount is Credited to the taxpayer’s account Set apart for the taxpayer, or Made available in some other way to the taxpayer 3 - 12 Constructive Receipt Doctrine Constructive receipt is a modification that prevents cash basis taxpayers from “turning their backs” on income Income is not constructively received if: The taxpayer is not entitled to the income The payor has insufficient funds from which to make payment, or There are substantial limitations or restrictions placed on actual receipt 3 - 13 Limits on Cash Method Businesses that carry inventory and sell merchandise to customers generally must use the accrual method to account for sales and purchases Hybrid method – accrual for sales of inventory & cost of goods sold; cash method for other income and expenses Large corporations (gross receipts of more than $5 million) cannot use cash method 3 - 14 Accrual Method Income is recognized when “all events test” is met All events have occurred that establish the right to the income and The income amount can be determined with reasonable accuracy If liability is in dispute, the all events test is not satisfied until dispute is resolved 3 - 15 Claim of Right Doctrine Claim of right doctrine modifies the normal recognition rules for accrual basis taxpayers Requires taxpayer to recognize income when payment is received, regardless of whether money may have to be repaid later If taxpayer must return all or part of the income, deduction allowed in repayment year 3 - 16 Prepaid Income Prepaid Income is another exception to the accrual method of accounting Based on wherewithal to pay concept – taxpayer should be taxed when best able to pay the tax Income must be reported when received Examples: rent, interest, and royalty payments Refundable deposits are not prepaid income 3 - 17 Assignment of Income Doctrine A taxpayer cannot assign earned income to a third party to escape taxation Earned income must be taxed to the taxpayer rendering the services Community property states (Arizona, California, Idaho. Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin) Allocate half of income to each spouse Income from property is taxed to taxpayer who owns the property 3 - 18 Interest Income Interest income from most sources is taxable, but interest on state and local (municipal) bonds is excluded from gross income High income taxpayers may have a higher aftertax return on municipal bonds than taxable bonds offering a higher interest rate Gain on the sale of tax-exempt securities must be included in gross income Interest from private activity municipal bonds may be subject to AMT 3 - 19 Original Issue Discount Some debt instruments are issued at prices below their maturity values This original issue discount (OID) is effectively interest paid at maturity rather than periodically over the debt instrument’s life Both cash and accrual basis taxpayers recognize OID income as it accrues Exception: Series EE and Series I bonds 3 - 20 Market Discount Bonds purchased after issue in the open or secondary market at a price below their stated maturity value Excess of redemption proceeds over cost is recognized as ordinary income in year of redemption Electively, market discount can be accrued as interest income over life of bond 3 - 21 Below-Market-Rate Loans Interest-free or low interest rate loans are frequently made between related parties Interest income that is not actually received or accrued may be imputed (treated as received or accrued and taxed) at the applicable federal rate of interest 3 - 22 Gift Loan Exceptions Any gift loan of $10,000 or less is exempt from the imputed interest rules For gift loans greater than $10,000 but less than $100,000 Imputed interest cannot exceed the borrower’s net investment income for the year If borrower’s net investment income is no more than $1,000, imputed interest is zero 3 - 23 Other Loans Loan to employee – imputed exchange of cash is treated as taxable compensation (income to employee and deduction for employer) Loan to shareholder – imputed exchange of cash is treated as a dividend (taxable income to shareholder, no deduction for corporation) $10,000 exception if no tax avoidance motive 3 - 24 Dividend Income Cash and FMV of other assets distributed by a corporation from earnings and profits (E&P) are treated as dividends includable in the shareholder’s income 15% rate applies to most dividends (zero rate for individuals in 10% or 15% tax bracket in 2009) Distributions in excess of E&P are nontaxable return of capital (reducing stock basis) Distributions in excess of stock basis are taxed as capital gain (as if stock is sold) 3 - 25 Mutual Fund Dividends May distribute dividends received on stock they hold to their mutual fund shareholders May also pay dividends from gains they realize on the sale of investment assets These dividends are actually net long-term capital gains and are called capital gains distributions 3 - 26 Dividend Reinvestment Plans Treated as if the shareholder receives the cash and then purchases additional shares of stock with the dividend income (constructive receipt doctrine) Value of dividend included in income Amount included in income becomes the shareholder’s basis for these shares of stock 3 - 27 Stock Dividends Stock dividends are distributions of a corporation’s own stock to its shareholders (treated the same as a stock split) Usually stock dividends are not taxable to the shareholder Shareholder owns a greater number of shares and the basis in the original shares is divided among all shares of stock now held If shareholder has option of receiving cash or stock, then it is taxable 3 - 28 Annuity Income Usually consists of a taxable and nontaxable amount Nontaxable amount represents a return of capital Nontaxable amount of a payment is equal to the Investment in annuity / expected return from annuity x annuity payment received If the amounts invested in the annuity were all made by the employer (or by the employee using pre-tax dollars), then the employee’s investment is treated as zero 3 - 29 Prizes and Awards Prizes, awards, gambling winnings, and treasure finds are taxable The fair market value of goods or services received is included in gross income 3 - 30 Government Transfer Payments Need-based payments, such as welfare payments, school lunches & food stamps, are excluded from income Unemployment compensation is taxable because it is a substitute for wages that would be taxable Exception: the first $2,400 of unemployment benefits received in 2009 are excluded 3 - 31 Social Security Benefits Government devised a complex formula that can result in the taxation of up to 85% of social security benefits for taxpayers who have significant other income while leaving benefits completely tax free for those who have little other income MAGI = AGI before any social security benefits + exempt interest income + ½ of social security benefits 3 - 32 Social Security Benefits If MAGI is less than $25,000 for single individuals or $32,000 for married couples, then none of the social security benefits received are taxable Single taxpayers with MAGI above $34,000 and married taxpayers with income above $44,000 can be taxed on up to 85% of their benefits Taxpayers between the above thresholds can be taxed on up to 50% of their social security benefits 3 - 33 Damage Awards Damages for physical injuries are not taxed (under the return of capital doctrine) Damages for all other awards are taxed (viewed as substitute for income that would otherwise be taxable income) Punitive damages are taxable 3 - 34 Divorce-Related Payments A property settlement is simply a division of assets (no income, no deduction) Alimony is a legal shifting of income – taxable income to recipient and deductible by payor First year’s alimony should not exceed average of 2nd and 3rd year payments by more than $15,000 Child support fulfills a legal obligation to support a child (no income, no deduction) Both parties may benefit by negotiating an increase in payment if it qualifies as alimony 3 - 35 Discharge of Debt If a legal obligation is satisfied for less than the outstanding debt, the amount of debt forgiven represents an increase in the taxpayer’s wealth and is subject to taxation Exceptions are provided for debtors who are bankrupt or insolvent Exceptions for the forgiveness of some student loans when the students work in certain professions 3 - 36 Discharge of Debt Mortgage Forgiveness Debt Relief Act of 2007 provides relief for homeowners whose mortgage debt is forgiven Forgiveness on up to $2 million of qualified debt on a principal residence from 2007 through 2009, is not included in income 3 - 37 Tax Benefit Rule If a taxpayer deducted an expense or loss in one year but recovers the amount deducted in a subsequent year, all or a portion of the amount recovered may have to be included in the gross income in the year it is recovered Amount included in income is limited to the extent the taxpayer benefited from the tax deduction Example: bad debt recovery or refund of taxes previously deducted 3 - 38 Exclusions Gifts Inheritances Life Insurance Proceeds received are tax-free but any interest income on proceeds is taxable Inside buildup (increase in cash surrender value) is not taxable income unless policy is liquidated for more than premiums paid 3 - 39 Accident & Health Insurance Accident & health insurance proceeds are tax-free to extent they pay qualified medical or dental expenses; excess benefits taxable if employer provided policy Disability insurance is a substitute for lost pay is an employee cannot work If premiums for disability insurance paid by employer, then benefits received are taxable If premiums paid by employee, exception allows benefits to be received tax free 3 - 40 Scholarships Qualified scholarships are excluded from gross income “Scholarship” includes only tuition, fees, books, supplies, equipment, and related expenses required for courses Amounts designated or spent for room, board, and laundry are included in taxable income 3 - 41 Scholarships Any grant received in return for past, present, or future services must be included in gross income Funds received by students in return for teaching or research services are taxable When taxable portion cannot be determined until end of academic year, taxable income can be deferred until the taxable year in which the academic year ends 3 - 42 Other Exclusions Improvements made on leased property are excluded from landlord’s income unless improvements made in lieu of paying rent Fringe benefits (discussed in next chapter) Exclusion of gain on sale of home $250,000 if single, $500,000 if married and both spouses qualify Must have owned and lived in home as principal residence for at least 2 of previous 5 years 3 - 43 International Issues Source principal - countries tax income earned within their borders but exclude income from activities taking place (sourced) in other countries Applies to foreign persons and foreign corporations Residency principle – countries tax worldwide income Applies to resident individuals and corporations 3 - 44 International Taxation A business is usually only taxed in country of residence unless it maintains a permanent establishment (e.g. office) in another country Source country can tax income earned within its borders when a permanent establishment exists Double taxation can result when more than one jurisdiction has the right to tax the same income 3 - 45 Minimizing Double Taxation Tax treaties and tax credits minimize the impact of this double taxation A tax treaty is an agreement between two countries that explains how a taxpayer of one country is taxed when conducting business in another country Foreign tax credits can offset domestic taxes on foreign source income 3 - 46 Taxpayers Subject to U.S. Tax U.S. citizens, corporations, and resident aliens are subject to U.S. tax on their worldwide income Resident alien – individual who is not a U.S. citizen but who has established legal residence in U.S. through Green card or Substantial presence test (183 days) Individuals typically exempt from substantial presence test include diplomats, teachers, students, and certain professional athletes 3 - 47 Nonresident Aliens and Foreign Corporations Nonresident alien – individual who is not U.S. citizen and does not satisfy test to be resident alien Nonresident aliens and foreign corporations are subject to U.S. tax on Effectively connected income – U.S. business income subject to U.S. income tax U.S. investment income – taxed at flat 30% (or treaty rate if lower) 3 - 48 U.S. Corporations Doing Business in a Foreign Country A U.S. corporation can operate in a foreign country through a branch or a subsidiary A branch is viewed as an extension of the U.S. corporation Branch’s income is combined with U.S. operations and subject to U.S. tax (no income deferral) A controlled foreign corporation (CFC) is a corporation incorporated outside the U.S. that is owned more than 50% by U.S. shareholders 3 - 49 U.S. Corporations Doing Business in a Foreign Country A U.S. parent corporation is usually not taxed on the earnings of the foreign subsidiary until the earnings are repatriated to the U.S. as dividends When the U.S. parent receives a dividend, the dividend is included in its income The parent is entitled to a foreign tax credit when the dividend is received based on the income tax paid by the foreign corporation 3 - 50 U.S. Corporations Doing Business in a Foreign Country If the U.S. parent does not need cash from its overseas operations, it can direct its subsidiary to not pay dividends postponing the payment of U.S. taxes on this income As long as the parent receives no repatriated earnings, it can postpone the payment of U.S. taxes Certain foreign source income (Subpart F income) earned by a CFC is subject to U.S. tax when earned No additional U.S. tax is paid on this income when the parent receives it as a dividend 3 - 51 State and Local Taxation Most states (and some local governments) impose both corporate and individual income taxes on both residents and nonresidents Nonresidents can only be taxed on Income derived from business activity within that state and Income from property in that state 3 - 52 State Tax Issues Nexus is the type and degree of connection between a business and a state necessary for the state to have the right to impose a tax Multi-state businesses may be able to reduce their overall tax cost by shifting income from a high-tax state to a low-tax state 3 - 53 Total Effective Tax Rate For federal tax purposes, state income tax is deductible in computing taxable income Tax savings from this federal deduction reduce the cost of the state income tax When a taxpayer pays income tax at both the federal and state levels, it increases the total effective tax rate and decreases the after-tax cash flow 3 - 54 Installment Method Gain is recognized as proceeds from sale are received Use severely restricted – generally available for casual sales only (excludes sales of inventory and securities) May not want to use if Marginal tax rate is expected to increase Unused losses are expiring 3 - 55 Long-Term Contracts Completed Contract Method – no income is recognized and no deductions taken until contract completion Percentage-of-Completion Method – income is recognized as contract progresses based on an estimate of actual costs incurred to total projected costs for contract 3 - 56 The End 3 - 57