EOQ Model

EOQ (Economic Order Quantity) Model: A Brief Introduction

Let us move from Orin café in Queueing model introduction to University Book Store. The book store surveyed its student customers and came up with a few design ideas for hooded sweatshirts.

One particular design is a perennial best-seller and sells, on an average, 500 units per month =

6000 units per year (We call this demand rate D expressed in units per year). The bookstore selected a vendor to supply the shirts. In its manufacturing process, every time the vendor changes a design, it has to set up the print machine. So it charges a fixed cost per order from the book store. Thus the book store has to pay a fixed $40 (call it fixed setup cost S ) every time it places an order in addition to a per-unit purchase price of $25 per sweatshirt.

The question for book store is what should be the size of the order (batch) for that particular sweatshirt design? We use the symbol Q for this batch size decision .

The Trade-off

If the book store orders a very large quantity, it will take a long time before it sells out completely. The book store will have to carry large inventory. Working capital is used to finance this inventory. Thus a larger order will mean higher inventory carrying cost per year.

The large quantity in each order would also mean that the book store has to order fewer times a year thus saving on the fixed setup cost over a year.

The order size decision resolves this trade-off (inventory carrying cost vs fixed setup cost) optimally.

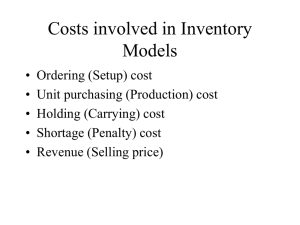

Computing Costs

For carrying inventory, we say that the book store will have to pay a carrying cost (or holding cost) H $per unit per year . If it is not given, it can be computed with the help of annual interest rate charged by the accounting department as cost of working capital. For example, if the interest rate is 20%, we can estimate holding cost H as the interest for holding one unit (worth purchase price of $25) for a year as the cost of the working capital. As a result we will estimate the holding cost H as 20% of $25=$5 per unit per year.

But how many units, on an average, are there in the book store’s inventory? That depends on the batch size decision. Suppose we order Q=100 units every time. When inventory is down to zero, we order another 100. This means that, on average, there are Q/2 = 50 units in inventory.

We can now compute the annual holding cost as H*(Q/2) or $5per unit per year * 50 units =

$250 per year.

To compute the annual cost of fixed setups, we have to know how many such setups were there in a year. If the annual demand D is 6000 units and each order size is Q=100 units, the book store must place D/Q = 6000/100 = 60 orders in a year. Note that this also means that there is a time of

Q/D = 100/6000 year between any two orders. For each of these orders, the book store pays a fixed cost of S=$40. Thus the annual setup cost is S*(D/Q) = 40*60=$2400. Annual inventory cost is the sum of annual holding cost and annual setup (ordering) costs = $250+$2400 = $2650.

Sometimes, especially when comparing alternative sources of supply with different per-unit purchase costs, it is necessary to include annual purchasing cost in our total cost computations. If annual demand is 6000 units and book store pays a per-unit price of $25 per unit, then the annual purchasing cost is per-unit purchase price*D = $25*6000 per year = $150000. Note that this annual purchasing cost is not dependent on order size Q. Therefore, to determine optimal order size, we only think about annual inventory cosy that is the sum of annual holding and setup

(ordering) costs.

Batch(Order)-Size Decision

What is the batch size Q that will minimize the sum of annual inventory costs? We can try different values of Q but a few simple steps of calculus give us the following formula the optimal

Q (Economic order quantity) that will minimize the annual inventory costs:

Economic Order Quantity EOQ

2 *

Holding Cost H

Applying it to our example gives EOQ

2 *6000* 40

5

96000

309.84

, say 310 units. (if the flow unit cannot be fractional, round it off to the closest integer)

Using this optimal batch size, the annual holding cost is H*EOQ/2 = 5*310/2 =$775, and the annual setup cost is S*(D/EOQ) = 40*(6000/310)=$774.19. This gives the sum of annual inventory cost as 775+774.19 = $1549.19. In this model, this is the minimum annual inventory cost that can be achieved by optimizing batch size Q.

Summary

Demand rate in units per year D

Fixed setup or ordering cost for each order or batch is $ S

Holding cost in $per unit per year is H

(if not given, H can be computed as annual interest rate multiplied by per-unit purchase price)

Order size or Batch size is Q

Average inventory or cycle stock is Q/2

Number of orders in a year is D/Q

Time between two orders is Q/D

Annual holding cost is H*(Q/2)

Annual setup cost is S*(D/Q)

Annual inventory cost is the sum of annual holding cost and annual setup cost

Annual purchasing cost is per-unit purchase price*D

EOQ

2 DS is the batch size that will minimize the annual inventory cost.

H

EOQ Model: Practice Problems

1 . Officer Krumpke buys doughnuts for the police department coffee-break room. The department consumes 24 doughnuts per day, 7 days per week. She buys doughnuts from the nearby Dandy doughnut shop who sells them only in boxes of one dozen doughnuts charging

$20 for each box. Officer Krumpke takes 5 minutes in placing a telephone order. The police department pays her $24 per hour. Weekly interest rate is 17.5%. Dandy offers free and immediate delivery. She wants to minimize her costs. If she called Dandy on Monday, when should she call him next ? [To keep it easy, think in units of boxes and days]

If officer Krumpke currently orders once every day, what is the % saving of using the optimal order size?

2 . (a) One of the top-selling items at a gift shop are autographed pictures of Susan Olsen (a.k.a.

Cindy Brady). Sales are 18 pictures per week, and the purchase-price from the supplier (Cindy) is $60 per picture. The cost of placing an order from Cindy is $45. Annual holding costs are $15 per picture. There are 50 weeks in a year. What size orders should the gift shop place? What will be the annual inventory cost (holding plus ordering)? How many orders will be placed per year?

How often will orders be placed?

(b) Continuing from previous part, the holding cost of $15 per picture per year was a result of applying annual interest rate of 25% to the per-unit purchase price of $60. Suppose there is an alternative source of supply that charges a fixed cost of $40 and a per-unit purchase price of $61.

Which supplier would you chose – original (in previous part) or alternative (described in this part).

EOQ Model Practice Problems Solutions

1 . Officer Krumpke buys doughnuts for the police department coffee-break room. The department consumes 24 doughnuts per day, 7 days per week. She buys doughnuts from the nearby Dandy doughnut shop who sells them only in boxes of one dozen doughnuts charging

$20 for each box. Officer Krumpke takes 5 minutes in placing a telephone order. The police department pays her $24 per hour. Weekly interest rate is 17.5%. Dandy offers free and immediate delivery. She wants to minimize her costs. If she called Dandy on Monday, when should she call him next ? [To keep it easy, think in units of boxes and days]

If officer Krumpke currently orders once every day, what is the % saving of using the optimal order size?

This one is all about using the right units. The easiest way to do it is to work with boxes as flowunits and day as time-units. Other units will work as well as long as we are consistent.

The rate at which inventory is consumed is 24 donuts per day. This is the demand rate.

Expressed in boxes per day it becomes D = 2 boxes/day.

Purchase price per box is $20. Weekly interest rate is 17.5%. Put together it tells us that the cost of holding one box for a week is 17.5% of $20 = $3.5 per box per week.. We want to match the time-unit to the one we used for D. Using 1 week = 7 days, this gives us H = $0.5 per box per day.

Fixed setup cost of placing an order is the worth of 5 minutes of officer Krumpke’s time which is equal to her pay for 5 minutes = $24/60)*5=$2. This is S.

Now, EOQ = squareroot of (2DS/H) = squareroot (2*2*2/0.5) = 4 boxes.

If 4 boxes are ordered every time and each day 2 boxes are consumed, the time between orders must be 2 days. That is, if you order on Monday, you will order on Wednesday.

If the current practice is to order once a day, the time-between-orders is 1 day. That is, 1 day =

Q/D. The order size is equal to one day’s consumption Q=2 boxes.

Holding cost is H*(Q/2) = $0.5 per box per day (2 boxes/2) = $0.5 per day

Setup cost is S*(D/Q)= $2*(2 boxes per day/2 boxes) = $2 per day

Total cost = $2.5 per day

If optimal order size is used (EOQ=4) then,

Holding cost is H*(Q/2) = $0.5 per box per day (4boxes/2) = $1 per day

Setup cost is S*(D/Q)= $2*(2 boxes per day/4 boxes) = $1 per day

Total cost = $2 per day

Saving over current cost is (2.5-2)/2.5=20%

2 . (a) One of the top-selling items at a gift shop are autographed pictures of Susan Olsen (a.k.a.

Cindy Brady). Sales are 18 pictures per week, and the purchase-price from the supplier (Cindy) is $60 per picture. The total cost of placing an order from Cindy is $45. Annual holding costs are

$15 per picture. There are 50 weeks in a year. What size orders should the gift shop place? What will be the annual inventory cost (holding plus ordering)? How many orders will be placed per year? How often will orders be placed?

Inventory is depleting at the rate of 18 pictures per week that is demand rate D is 18 per week or

18*50=900 per year.

The total cost of placing an order is $45; that is the fixed setup cost S.

Gift shop pays $60 to acquire the picture; that is the purchase price.

Holding cost is $15 per picture per year.

2 DS

What size orders should the gift shop place? The answer is EOQ = = squareroot of

H

(2*900*45/15) = 73.48

73. Note that H and D are using the same time-units. (per year)

What will be the total inventory cost (holding plus ordering)?

Annual holding cost = H*(Q/2) = 15*(73/2) = $547.5

Annual setup cost = S*(D/Q) = 45*(900/73) = $ 554.79

Annual total cost = 547.5+554.79 = $1102.29

How many orders will be placed in a year = (D/Q) = 900/73

What will be the time between two orders? If 900/73 orders are placed in a year. The time between two orders will be 73/900 year.

(b) Continuing from previous part, the holding cost of $15 per picture per year was a result of applying annual interest rate of 25% to the per-unit purchase price of $60. Suppose there is an alternative source of supply that charges a fixed cost of $40 and a per-unit purchase price of $61.

Which supplier would you chose – original (in previous part) or alternative (described in this part).

Since original and alternative supplier differ in their per-unit purchase price, we should include, annual purchase cost in our total cost computations.

Original supplier:

Annual purchase cost = demand 900/year * $60 per-unit purchase price = $54000

Annual purchase+holding+ordering cost = 54000 + 1102.29 (from part a) = 55102.29

Alternative supplier:

S=$40, per-unit purchase price =$61

New holding cost H = 25% of $61 = $15.25 per unit per year

EOQ = squarer root of (2*900*40/15.25) = 68.71

69

Annual holding+setup cost = 15.25 * 69/2 + 40* 900/69 = $1047.86

Annual purchase cost = demand 900/year * $61 per-unit purchase price = $54900

Annual purchase+holding+ordering cost = 54900 + 1047.86 = 55947.86

Select the original supplier because s/he offers lower Annual purchase+holding+ordering cost.