Holland Steinhoff Bickerton Rutgers 2014

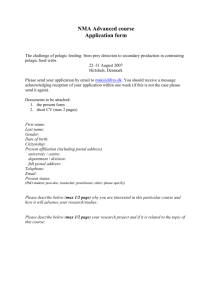

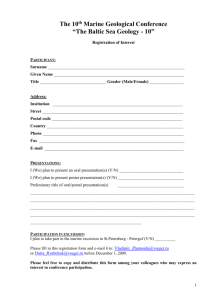

advertisement