Multiple

Accounting and Finance

Stage 3

Assessment item bank

Context: Multiple-choice

2011/25432

Accounting and Finance: Stage 3 Assessment item bank —Multiple-choice 1

Copyright

© School Curriculum and Standards Authority, 2012

This document —apart from any third party copyright material contained in it—may be freely copied, or communicated on an intranet, for non-commercial purposes by educational institutions, provided that it is not changed in any way and that the School

Curriculum and Standards Authority is acknowledged as the copyright owner.

Teachers in schools offering the Western Australian Certificate of Education (WACE) may change the document, provided that the

School Curriculum and Standards Authority’s moral rights are not infringed.

Copying or communication for any other purpose can be done only within the terms of the Copyright Act or by permission of the

School Curriculum and Standards Authority.

Copying or communication of any third party copyright material contained in this document can be done only within the terms of the

Copyright Act or by permission of the copyright owners.

Disclaimer

Any resources such as texts, websites and so on that may be referred to in this document are provided as examples of resources that teachers can use to support their learning programs. Their inclusion does not imply that they are mandatory or that they are the only resources relevant to the course.

2 Accounting and Finance: Stage 3 Assessment item bank —Multiple-choice

Multiple-choice items with answers

2

1 Which one of the following statements is incorrect ?

(a) Internal controls improve the reliability of accounting information.

(b) Internal controls prevent theft or waste of organisational resources.

(c) Internal controls ensure compliance with business policies and procedures.

(d) Internal controls provide independent verification of financial statements.

Answer: (d)

Unit 3A

Evaluating financial information for planning, coordinating, controlling and investing.

internal audit and control

purpose of internal control

review of procedures and policies

detection and correction of errors and deficiencies

relationship to the external audit process

An external auditor has completed an audit of the financial statements of Prime Resources

Ltd. and intends to provide a going concern qualification. This means, in the auditor ’s opinion, the business:

(a) will not be able to continue trading beyond the next financial year.

(b) is not complying with all relevant accounting standards.

(c) has poor internal controls which may threaten the viability of the business.

(d) has excessive levels of debt and may not be able to repay creditors.

Answer: (a)

Unit 3B

The role and influence of governments and other bodies

the role and function of external auditors

protection of external users

to perform an independent audit of the financial statements appointed by the shareholders and reappointed at the Annual General Meeting (AGM).

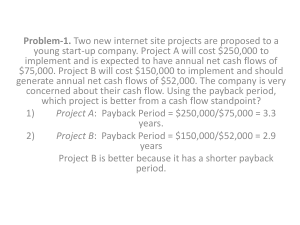

3 If net present value is zero, the project is earning a return equal to

(a) zero.

(b) the rate of inflation.

(c) the contribution margin.

(d) the cost of capital.

Answer: (d)

Unit 3A

Recording, processing and communicating financial information

capital investment/budgeting techniques for capital expenditure, limited to calculations for

discounted cash flows (net present value NPV ONLY)

payback period.

Note: Application of GST is NOT required

3 Accounting and Finance: Stage 3 Assessment item bank —Multiple-choice

4 Which one of the following statements relating to margin of safety is true?

(a) T he margin of safety refers to an organisation’s normal level of activity.

(b) A small margin of safety indicates a poor liquidity position.

(c) A large margin of safety indicates lower risk.

(d) A low margin of safety suggests operational costs are increasing.

Answer: (c)

Unit 3A

Recording, processing and communicating financial information

Cost-Volume-Profit (CVP) processing for a single and multiproduct (maximum 3 products) business

calculation of contribution margin

calculation of contribution margin per unit

calculation of weighted average contribution per unit

calculation of margin of safety

calculation of selling price, variable cost, fixed cost, profit or sales volume

calculation of break-even point

calculation of the effect on profit/loss of make or buy decisions

calculation of the effect on profit/loss of closing a department/dropping a segment product decision calculation of the gain or loss on special order decisions

6

5 Which of the following is an example of financial accounting?

(a) Producing general purpose financial reports used by external users.

(b) Producing reports and providing financial information used by internal users.

(c) Calculating the Net Present Value of a project.

(d) Calculating the payback period of a project.

Answer: (a)

Unit 3A

Financial systems and fundamental principles

distinguish between management accounting and financial accounting

Which of the following is an example of a direct cost?

(a) Salary of a factory supervisor.

(b) Glue used to make tables.

(c) Raw materials used to make shoes.

(d) Rent of a business premises.

Answer: (c)

Unit 3A

Financial systems and fundamental principles

the nature of cost concepts

materials, labour and overheads

cost behaviours: fixed, variable and mixed costs

relationships to cost objects: direct and indirect costs

treatment of costs: product and period

time orientation of costs: past and future

4 Accounting and Finance: Stage 3 Assessment item bank —Multiple-choice

7 Which one of the following is a component of business planning?

(a) setting objectives

(b) implementing internal controls

8

(c) preparing reports

(d) establishing pricing structures

Answer: (a)

Unit 3A

Evaluating financial information for planning, coordinating, controlling and investing

importance of business planning including a consideration of

goals, objectives and generic business strategies: cost leadership versus differentiation, strategic initiatives and performance management

reduce costs and risks

Which one of the following statements in relation to cost accounting is false ?

(a) Cost accounting helps to determine the value of work in process and finished goods inventory.

(b) Cost accounting helps managers determine the appropriate price to set for products.

(c) Cost accounting uses the market place to set the price of products.

(d) Cost accounting assists in determining the profitability of producing a product.

Answer: (c)

Unit 3A

Financial systems and fundamental principles

the nature of cost concepts

materials, labour and overheads

cost behaviours: fixed, variable and mixed costs

relationships to cost objects: direct and indirect costs

treatment of costs: product and period

time orientation of costs: past and future

9 Which one of the following statements in relation to the payback method is correct?

(a) The payback method is greatly influenced by an organisation’s cost of capital.

(b) Projects with a shorter payback period are considered less risky than those with longer payback periods.

(c) The payback period for a project must exceed the required rate of return to be acceptable.

(d) All estimated net cash flows are included within the calculation of the payback period.

Answer: (b)

Unit 3A

Recording, processing and communicating financial information

capital investment/budgeting techniques for capital expenditure, limited to calculations for

discounted cash flows (net present value NPV ONLY)

payback period.

Note: Application of GST is NOT required

Accounting and Finance: Stage 3 Assessment item bank —Multiple-choice 5

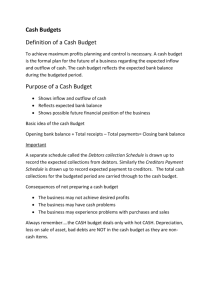

10 The purpose of cash budgets is to

(a) inform shareholders as to the movements of cash over a given period.

(b) inform stakeholders about expected movements in cash in a specified future period.

(c) assist managers to plan for the future and control expenditure.

(d) allow managers to make accurate allocation of costs to products and/or services.

Answer: (c)

Unit 3A

Recording, processing and communicating financial information

preparation of cash budgets including debtors’ and creditors’ schedules (GST NOT included)

11 On average, investors would like to see a downward trend in which one of the following ratios?

(a) debtor’s collection

(b) price/earnings

(c) dividend yield

(d) inventory turnover

Answer: (a)

Unit 3A

Recording, processing and communicating financial information

preparation of cash budgets including debtors’ and creditors’ schedules (GST NOT included)

Use the following information to answer questions 12

–15.

Lorelle Gare is the manager of ‘Hip Fashion’. She is concerned about the cash position of her business and has asked you to prepare a cash budget for the months of April and May 2010.

Information pertaining to ‘Hip Fashion’ is as follows:

March April May June

Cash sales ($)

Credit sales ($)

8,000

40,000

12,250

44,000

13,300

90,000

6,000

100,000

Credit purchases ($) 25,000 30,000 32,000 40,000

Operating expenses ($) 25,500 29,400 25,000 28,000

Additional information:

On average, 50% of credit sales are paid month after sale . in the month of sale , and 50% in the first

Equipment to the value of $8,000 will be purchased and paid for in May.

On 31 March 2010 the business has $14,100 in cash.

A motor vehicle will be sold in April. It is estimated the vehicle will be sold for $7,770 cash.

$1,200 in interest from investments is due to be received in May.

Depreciation expense in the month of April is estimated to be $3,200.

Operating expenses are paid for immediately.

Credit purchases are paid in the month following purchase.

6 Accounting and Finance: Stage 3 Assessment item bank —Multiple-choice

12 The estimated cash inflows for the month of April are

(a) $59,520.

(b) $62,020.

Answer: (b)

(c) $54,250.

(d) $76,120.

Unit 3A

Recording, processing and communicating financial information

preparation of cash budgets including debtors’ and creditors’ schedules (GST NOT included)

13 The estimated cash inflows for the month of May are

(a) $81,500.

(b) $103,300.

Answer: (a)

(c) $104,500.

(d) $80,300.

Unit 3A

Recording, processing and communicating financial information

preparation of cash budgets including debtors’ and creditors’ schedules (GST NOT included)

14 The estimated cash outflows for the month of April are

(a) $57,600

(b) $59,400.

(c) $62,400.

(d) $54,400.

Answer: (d)

Unit 3A

Recording, processing and communicating financial information

preparation of cash budgets including debtors’ and creditors’ schedules (GST NOT included)

15 The estimated cash outflows for the month of May are

(a) $63,000.

(b) $65,000.

(c) $55,000.

(d) $64,200.

Answer: (a)

Unit 3A

Recording, processing and communicating financial information

preparation of cash budgets including debtors’ and creditors’ schedules (GST NOT included)

Accounting and Finance: Stage 3 Assessment item bank —Multiple-choice 7