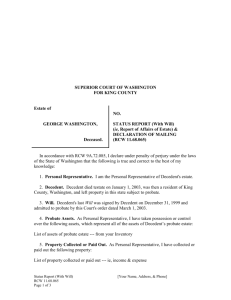

Personal Representative's Guide to Informal Probate

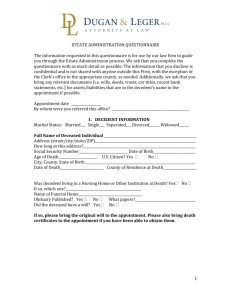

advertisement