1-2

advertisement

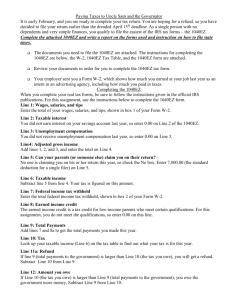

Chapter 1 Introduction to Taxation, the Income Tax Formula, and Form 1040EZ “Taxes, after all, are dues that we pay for the privileges of membership in an organized society.” -- Franklin D. Roosevelt McGraw-Hill Education Copyright © 2015 by the McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website in whole or part. Introduction • An income tax was first enacted in 1861 and repealed after the Civil War ended • An income tax law was passed in 1894 and was rejected by the Supreme Court in 1895. • Sixteenth Amendment to the Constitution was passed in 1913 – This is the basis of modern income tax law 1-2 Introduction • Almost 145 million individual income tax returns were filed in 2012 – 122 million (over 84%) were filed electronically • Individual income tax collections were about $1.2 trillion in 2012. 1-3 LO #1 Progressive, proportional, and regressive tax structures • Taxes are levied by multiplying a tax rate (the rate of tax) by a tax base (the amount taxed). – May be multiple rates on multiple bases (see Table 1-2 for married taxpayers) 1-4 LO #1 Progressive, proportional, and regressive tax structures • Progressive tax structure: – The tax rate increases as the tax base increases. – Example is the U.S. income tax system • Proportional tax structure: – The tax rate remains the same regardless of the tax base. – Example is state or local sales taxes 1-5 LO #1 Progressive, proportional, and regressive tax structures • Regressive tax structure: – The tax rate decreases as the tax base increases. – Example is social security tax system 1-6 LO #1 Progressive, proportional, and regressive tax structures – Concept Check 1-1 1. The three types of tax rate structures are ________, _________, and _________. Progressive, proportional, and regressive 2. The tax rate structure for which the tax rate remains the same for all levels of the tax base is the __________ rate structure. Proportional 3. The federal income tax system is an example of a ________ tax structure. Progressive 1-7 LO # 2 Marginal and Average Tax Rates • Average tax rate is the total tax paid on a certain amount of taxable income Total tax / taxable income = average tax rate • Marginal tax rates are the rate of tax that will be paid on the next dollar of income. – Determined with reference to tax rate schedule – For example, a married couple will pay a marginal rate of 15% on their $35,000th dollar of income. 1-8 LO # 2 The Income Tax Formula Income − Permitted Deductions from Income -------------------------------= Taxable Income × Appropriate Tax Rates -------------------------------= Tax Liability − Tax Payments and Tax Credits --------------------------------= Tax Refund or Tax Due with Return 1-9 LO # 2 The Income Tax Formula Concept Check 1-2 1. The marginal tax rate is the rate of tax imposed on the next dollar of taxable income. True 2. What is the marginal tax rate for a married couple with taxable income of $75,350? 25% 1-10 LO # 2 The Income Tax Formula Concept Check 1-2 3. Average tax rate and marginal tax rate mean the same thing. False 4. Complex tax returns do not follow the basic (or simplified) income tax formula. False 1-11 LO #3 Components of Form 1040EZ • Taxpayers annually file a tax return using – Form 1040 – Form 1040A – Form 1040EZ • All follow the basic income tax formula • Form 1040EZ is the simplest form 1-12 LO #3 Components of Form 1040EZ • To use a 1040EZ taxpayer must meet all the following: – Single or married filing jointly – Under age 65 and not blind – No dependents – Taxable income < $100,000 – Income only from wages, unemployment compensation or interest ≤ $1,500 – Claim no credits except Earned Income Credit 1-13 LO #3 Components of Form 1040EZ Concept Check 1-3 1. Almost all taxpayers can file a Form 1040EZ. False 2. Max, who is 74 years old and single, is eligible to file Form 1040EZ if his taxable income is under $100,000. False 3. Erma, a 28-year-old single taxpayer with no dependents, has wage income of $40,000. She is eligible to file a Form 1040EZ. True 1-14 LO #3 Components of Form 1040EZ • Wages include salaries, tips, commissions, bonuses, severance pay, sick pay, meals and lodging, fringe benefits, etc. – Employees receive a Form W-2 indicating total wage income in box 1 • Interest income is taxable unless specifically exempt – Interest income reported on Form 1099-INT 1-15 LO #3 Components of Form 1040EZ • Unemployment compensation is taxable – Reported on Form 1099-G • Permitted deductions are shown on line 5 – $10,150 for single, $20,300 for married • Total income minus permitted deductions equals Taxable Income (line 6) 1-16 LO #3 Components of Form 1040EZ Concept Check 1-4 1. Only certain types of income can be reported on a Form 1040EZ. They are ________. Wages, unemployment compensation, interest 2. Unemployment compensation is reported to the taxpayer on a Form ______. Form 1099-G 3. To be able to use a Form 1040EZ, a taxpayer must either be filing status _______ or filing status __________. Married filing jointly or single 1-17 LO #4 Calculation of Tax • For taxable income up to $100,000, use tax tables (printed in Appendix D and in the instructions to Form 1040, available on the IRS website) • Tax rate schedules are used for higher income (printed on inside front cover) • Tax tables calculate tax at the midpoint of the range on the table • Tax rate schedules calculate tax precisely 1-18 LO #4 Calculation of Tax Concept Check 1-5 1. Taxpayers eligible to use Form 1040EZ must calculate their tax liability using the tax tables. True 2. Refer to the tax tables. What is the tax liability of a married couple with taxable income of $89,262? $14,031 3. Using the tax rate schedule in Table 1-2, determine the tax liability (to the nearest penny) for a married couple with taxable income of $89,262. $14,028.00 1-19 LO #3 Tax Payments • Tax liability is generally paid throughout the year through withholding tax payments deducted from wages – Also reported on W-2 • Low income taxpayers may be eligible for the Earned Income Credit – Discussed in chapter 9 with other credits 1-20 LO #3 Tax Payments • A tax return is also used to “settle up” with the IRS at the end of the year. • When filing a tax return, taxpayers will either – Owe the IRS (tax liability > payments) – Receive a refund (tax liability < payments) 1-21 LO #3 Tax Payments Concept Check 1-6 1. Taxpayers pay all of their tax liability when they file their tax returns. False 2. Bret’s tax liability is $15,759. His employer withheld $16,367 from his wages. When Bret files his tax return, will he be required to pay or will he get a refund? What will be the amount of payment or refund? Refund, $608 3. An Earned Income Credit will increase the amount of tax liability. False 1-22 LO #5 Tax Authority • Tax authority is the body of law, regulation, and precedent that guide taxpayers, the IRS, and the courts in the proper application of tax law. • Three types of primary tax authority: – Statutory sources – Administrative sources – Judicial sources 1-23 LO #5 Tax Authority • Statutory sources of tax authority – 16th amendment to the U.S. Constitution – Internal Revenue Code (IRC) • Passed by Congress and signed into law by the president – Committee reports from tax law process 1-24 LO #5 Tax Authority Concept Check 1-7 1. The committee charged with considering tax legislation in the House of Representatives is called the ________________ Committee. Ways and Means 2. The most commonly relied-on statutory authority is _________________. The Internal Revenue Code 1-25 LO #5 Tax Authority Concept Check 1-7 3. All tax legislation must pass both the House of Representatives and the Senate and be signed by the president of the United States in order to become law. True 1-26 LO #5 Tax Authority • Administrative sources of tax authority, in order of strength – Treasury Regulations (IRS Regulations) – Revenue Rulings – Revenue Procedures – Private Letter Rulings – IRS Notices 1-27 LO #5 Tax Authority Concept Check 1-8 1. Administrative tax authority takes precedence over statutory tax authority. False 2. IRS Revenue Procedures are applicable only to the taxpayer to whom issued. False 3. The administrative tax authority with the most strength of authority is_______. IRS Treasury Regulations 1-28 LO #5 Tax Authority • Judicial sources of tax authority – Courts resolve disputes between taxpayers and the IRS. – Initial court of jurisdiction is either the • Tax Court • U.S. District Court • U.S. Court of Federal Claims 1-29 LO #5 Tax Authority • Tax Court and District Court rulings can be appealed to the U.S. Court of Appeals and then to the Supreme Court • U.S. Court of Federal Claims rulings can be appealed to the U.S. Court of Appeals – Federal Claims and then to the Supreme Court. 1-30 LO #5 Tax Authority Concept Check 1-9 1. The U.S. Supreme Court does not accept appeals of tax cases. False 2. A taxpayer who does not agree with an assessment of tax by the IRS has no recourse. False 3. A taxpayer who does not want to pay the tax assessed by the IRS prior to filing a legal proceeding must use the ___________ Court. Tax 1-31 LO #6 Circular 230 • Circular 230 sets forth rules which must be followed by all paid tax preparers – Includes CPA’s, attorneys, enrolled agents, and any other individual who receives compensation for preparing a tax return, providing tax advice, or practicing before the IRS • Circular 230 sets forth ethical standards and expectations. 1-32 LO #6 Circular 230 • Failure to comply with Circular 230 will subject the paid preparer to suspension or disbarment from IRS practice, public censure, fines, and civil or criminal penalty. • Rules are far reaching and complex. 1-33 LO #6 Circular 230 • Paid tax preparers must obtain a preparer tax identification number (PTIN). – Must be renewed annually. • Preparers who are not CPAs, attorneys, or enrolled agents must pass a competency exam and annually obtain continuing education. – CPAs, attorneys, and enrolled agents must also obtain continuing education. 1-34 LO #6 Circular 230 • Paid preparers must: – Sign all tax returns they prepare – Provide a copy to clients – Return records to clients – Exercise due diligence and best practices – Disclose nonfrivolous tax positions – Notify clients of errors on a client return – Provide information to the IRS – Inform a client if the client made an error 1-35 LO #6 Circular 230 • Paid preparers must NOT: – Take a position unless it has a “realistic possibility” of being sustained – Charge a contingent fee – Charge an unconscionable fee – Unreasonably delay matters with IRS – Cash an IRS check for a client – Represent a client if a conflict of interest exists – Make false or fraudulent statements 1-36