Texas Real Estate Law - PowerPoint - Ch 17

advertisement

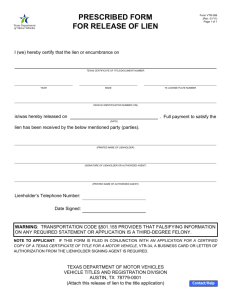

TEXAS REAL ESTATE LAW 11E Charles J. Jacobus Chapter 17 Liens 2 Liens • A lien, generally defined, is a charge on the property of a person for the payment or discharge of a debt or duty owed by that person. • It is also defined as a claim against a person’s real estate that exists as a security interest for some obligation to be discharged. • When one party is indebted to a creditor, the creditor has the right to an interest in the first party’s real estate. • The creditor may force the sale of that real estate to satisfy the debt. 3 Types of Liens General ……………..attaches to all property a debtor owns. Specific……………...attaches to only specific parcels. Equitable……………implemented upon principles of equity. Statutory……………implemented by statute. Contractual………...created by contracts. Constitutional……..implemented by the state constitution. 4 Equitable Liens • Recognized and enforced by courts under equitable principles. • An express or implied contract pertaining to some specific property and will not be applied when there is an adequate remedy at law. • The only significant requirement is that the lien holder must show an intention on his part to charge the property with a debt. • An equitable lien, since it is not usually recorded, is not good against a subsequent purchaser or creditor without notice of the lien. • Example is a a vendor’s lien which is well established as being implied every time there is a transfer of real property by a deed. • Another example is a tenant’s lien where the tenant constructs some improvement with the landlord’s knowledge and with the expectation of being paid but the landlord refuses payment. 5 Statutory Liens (1) ad valorem tax liens. (2) federal tax liens. (3) judgment liens. (4) mechanics’ and materialmen’s liens. 6 Ad Valorem Tax Liens • Both constitutional and statutory. • They are given an automatic priority and become liens on the real estate on January 1 of each year. • Title company always obtains tax certificates in order to be sure that the taxes are paid. • If any taxes are delinquent they must be paid in order for the seller to convey free and clear title. • If a foreclosure the taxes are still due at the end of each year regardless of who then holds title to the property. • All suits to collect ad valorem taxes must be filed within 20 years. 7 Federal Tax Liens • Not effective against any subsequent purchasers unless the notice of the tax lien is filed in county records. • Owner, heirs, executors, administrators, or anyone who has lien interests, can redeem the property within 180 days after sale. • If not redeemed the IRS gives a deed to person who purchased at sale. • If the purchase money lien is foreclosed and the notice of tax lien is filed less than 30 days before the sale, the foreclosure sale has priority. • If filed more than 30 days before the foreclosure sale, the lender must give the IRS at least a 25-day notice and a 120 day right of redemption. • If proper notice is not given, the lien remains on the property even after the foreclosure sale. • Suits to foreclose subject to the federal tax lien must be filed within 10 years after the lien has been filed of record. 8 Federal Judgment Liens • The Federal Debt Collection Procedure Act of 1990 (FDCPA) applies to judgment liens obtained by the United States. • Becomes a lien upon the filing the judgment or an abstract thereof in the records of the county in which the property is located. • Effective for 20 years, for all judgments entered after May 20, 1981. • The United States has a right of redemption for a period of one year from the date of foreclosure of any superior lien. 9 State Judgment Liens • Creditor must obtain a judgment of a state or federal court. • The creditor must then file an abstract of judgment. • A general lien that attaches to all real estate owned by the debtor within the county, as well as to any acquired during the life of the lien. • It must be renewed every 10 years. • Judgment liens do not attach to exempt homestead property. • Proceeds of the sale of the homestead remain exempt for six months. • If reinvested in another homestead, the new home is also protected. • Liens recorded on or after 9-1-93 may be discharged in bankruptcy. • Liens recorded before 9-1-93 will still cloud title. 10 Attachments • A writ of attachment is not a lien, but a legal seizure of property issued by judges which operates as a lien on a person’s property. • Done if a person has filed suit for damages and he feels the defendant will hide or sell his property before final judgment is rendered. • Plaintiff must first file suit and post a bond fixed by a judge. • When a final judgment has been rendered, the writ of attachment is no longer effected, and it is replaced by a judgment lien. 11 Mechanics’ and Materialmen’s Liens • Created by the legislature to protect the mechanics or materialman. • Except for homestead property, anyone who furnishes labor or materials for improvements can claim this statutory lien. • Engineers, architects, and surveyors may also have this lien. • The original contractor or a subcontractor files a lien affidavit. • The M and M lien takes inception from the time that labor or materials are furnished to the job. • The prudent lien claimant, however, should “perfect” that lien by recording it in the county courthouse in the manner prescribed by law. • The lien attaches to all of the property of the owner on which the work was performed, not just the portion on which the work was performed. 12 Special Homestead Requirements • Must contain at the top of each page in 10-point boldface type: NOTICE: THIS IS NOT A LIEN. THIS IS ONLY AN AFFIDAVIT CLAIMING A LIEN. • The notice required to be given to the owner by the subcontractor must contain a statement that the owner’s property may be subject to a lien if he fails to withhold sufficient money from the payment to the contractor, or fails to retain 10% of the contract price or 10% of the value of the work performed by the contractor. 13 Original Contractors’ Liens • Must file an affidavit with the county clerk not later than the 15th day of the fourth calendar month after the date the indebtedness accrues. • Indebtedness accrues to the original contractor on the last day of the month in which the written declaration by the original contractor or the owner is received by the other party to the original contract, stating that the original contract was terminated, completed, settled, or abandoned. • The indebtedness to a derivative claimant accrues on the last day of the last month in which labor was performed or the material furnished. • This is different from the definition given to the original contractor. • He must send two copies of the affidavit to the owner by certified mail. 14 Original Contractors’ Liens • The affidavit must be substantially in the same form as provided by statute and must contain the following: 1. A sworn statement including the amount owed. 2. The name of the owner or reputed owner, if known. 3. A general statement of the work done or materials furnished. 4. The name of the person by whom the contractor was employed. 5. The name of the original contractor. 6. A description of the property (an adequate legal description). • There is no advance notice required to be given to the owner of the property before the affidavit is filed. • The lien is considered to relate back to the date of inception, which is the day that materials were delivered or labor was first performed. 15 Subcontractors’ Liens • A subcontractor is defined by statute as a person who has furnished labor or materials to fulfill an obligation to an original contractor. • Such liens are rather technical because there is no original contract between the subcontractor and the owner of the property. • Since the subcontractor has the ability to cloud the title, he is held to a high degree of care in perfecting his claim. • In addition to the notice of lien required as to lien claimants generally, he must also give a required notice to the owner as provided by statute. • The statute provides for three types of notices from the subcontractor. 16 Notice – Retainage • If an agreement for a retainage (escrowed funds) exists the derivative claimant may give written notice to the owner of his right to a lien. • The notice must be given not later than the 15th day of the second month following delivery of materials or the performance of labor. • A copy of the notice must also be given to the original contractor. • The notices must be sent by certified or registered mail. • Notice must state the amount to be retained. • Serves as a proceeding to collect against a bond or retainage agreement, if such agreement is in full force and funds have not been disbursed out of the retainage or bond funds to another claimant. • This is not considered one of the more protective provisions of notices. 17 Notice – Withholding Funds • Owner will withhold any funds from the original contractor until he is sure that the subcontractor has been paid. • It is not uncommon for an owner to make the check payable to both the original contractor and the subcontractor. • To authorize the owner to withhold funds, the notice to the owner must state that if the bill remains unpaid, the owner may be personally liable and his property may be subjected to a lien. • Notice is an absolute requirement to authorize owner to retain funds. • If the subcontractor waits too long after the work was performed before he sends his notice, all funds could have already been distributed. 18 Notice – Fabricated Items • Used when the derivative claim is for a specially fabricated item. • The notice must also be given to the owner not later than the 15th day of the second month after the month in which the claimant receives and accepts the order for such specially fabricated material. • This notice must be sent by certified or registered mail addressed to the owner, and to the original contractor where required. • It does not provide for impoundment of funds and must be followed by a notice to perfect the lien after the material has been delivered. • Subcontractor must also file an affidavit pursuant to the same requirements that the original contractor must file. • Two copies of the affidavit are sent to the owner, and the lien must be filed in the lien records of the county courthouse. 19 Statutory Retainage • It is the duty of the owner to retain 10% of the contract price of such work for each original contract for 30 days. • It provides a fund for payment of artisans and mechanics. • The statute requires claims be filed no later than the earliest of: 1. the 15th day of the second month following date of completion. 2. the 40th day after the work under the original contract was completed. 3. the 40th day after original contract was terminated or abandoned. 4. the 30th day after the date the owner send notice to the claimant. • The claimants share ratably so there is a good chance that a claimant may only get a small proportional part of the money due him. • He will have a preference claim if he files his claim within 30 days. • The remainder of the fund, if any, goes to the other participating claimants, also ratably shared. 20 Affidavit of Completion • The owner may file an affidavit of completion. • The notice must contain the address of the owner, the name of the original contractor, a description of the property, a description of the improvements, and the date of completion in a conspicuous statement that the claimant may not have a lien on the retained funds unless the claimant files the lien affidavit not later than the 40th day after completion. • A copy of the affidavit must be sent by certified mail to the original contractor not later than the 10th day after the date the affidavit is filed and to each claimant who has sent a notice of lien to the owner not later than the 10th day after the owner receives the notice of the lien. 21 Prompt Payment to Contractors or Subcontractors • Owners are required to pay the amount stated in the written payment request , less any statutory offsets (retainage) not later than the 45th day after the owner receives the request for payment. • The contractor or subcontractor, then, is required to make payment to other subcontractors not later than the seventh day after the date the contractor or subcontractor receives payment. • The statute has two exceptions: • If a good faith dispute exists concerning the amount owed for the payment, the owner may withhold from the payment not more than 110% of the difference between the amount the contractor claims is due and the amount the owner claims is due. • The other exception relates to bank funds. Once the owner has properly requested bank funds, but the bank fails to disburse, the owner is in compliance so long as he disburses the funds not later than the fifth day after the owner receives the loan. 22 Bonds to Pay Liens or Claims • Statutory retainage may be waived if a proper bond is filed. • There are a number of requirements to perfect the bond: 1. A written contract between the owner and the original contractor. 2. The contractor must have furnished a bond in favor of the owner in a penal sum of not less than the total of the original contract amount. 3. The bond must have the written approval of the owner. 4. Bond must be filed with a contract between the owner & contractor. • After the bond has been filed, a claim against the owner can be perfected by giving notice to the corporate surety in lieu of the owner. • 60 days after the notice, a claimant may file suit against the surety. • If the foregoing bond requirements have been met no causes of action can be filed against the owner or the property. • Any subsequent purchaser can rely upon the record of such bond as proof that all claims and liens have been paid. 23 Construction Trust Funds • All monies paid to a contractor or subcontractor under a construction contract are considered to be construction trust funds for the benefit of the contractors or derivative claimants. • This effectively makes any officer of a contractor or subcontractor a trustee for all funds to be paid imposes upon them the responsibility to see that the claimants are paid. • If a contractor or subcontractor misapplies any of these funds, he may be fined and sentenced to prison for a period not exceeding 10 years. 24 Mechanics’ and Materialmen’s Lien Priorities - Severable Improvements • The lien, regardless of when filed, relates back to the date of inception. • The lien is also superior to a prior recorded deed of trust lien, where the improvements can be removed without material injury to the land and preexisting improvements (severable improvements). • One may recall that there is also a specified priority interest for fixture filings under UCC security interests (see Chapter 6). • There have been a number of concerns over the priority of the mechanics and materialmen versus that of the supplier of the fixture. 25 Statute of Limitations A contractor or subcontractor must bring a suit to foreclose his lien within two years after the date of the filed lien affidavit or within one year after completion of the work under the original contract on which the lien is claimed, whichever is later. Under the residential construction contracts, the statute of limitations has been shortened to one year. 26 Residential Construction Liens 1. Contractor must deliver to the owner a disclosure statement that informs the consumer of his rights under the M & M lien statutes. 2. Contractor must attach a written list that identifies by name, address, and telephone number each subcontractor and supplier that the contractor intends to use in the work to be performed. 3. If the owner is obtaining third-party financing for the construction, the lender is required to deliver to the owners all documentation relating to the closing not later than one business day before the date of the closing. 4. Contractor must then provide to the owner a signed periodic statement that lists the bills or expenses that the contractor represents will be paid, or have been paid, and for which the contractor is requesting payment. 5. As a condition of final payment the contractor shall deliver to the owner an affidavit stating that the contractor has paid each person in full for all labor and materials used in the construction of the improvements. 27 Residential Construction Liens • A contractor may not require an owner of real property to convey the real property to the contractor. • In a “cost plus a fee” construction contract entered into before the commencement of construction, the fee paid to the contractor is not considered trust funds. • New laws also require that a contractor on a residential homestead construction project of more than $5,000 deposit trust funds received from the owner into an escrow account at a financial institution. • Failure to establish or maintain a construction account, including the record-keeping requirements, constitutes at least a Class A misdemeanor and perhaps a third-degree felony. • If a subcontractor is not paid, he must give notice by the 15th day of the second month following each month in which all or part of the claims labor was performed or materials delivered. 28 Fraudulent Lien Claims • Texas provides civil remedies against those who have made fraudulent filings. • Criminal sanctions may be levied against those who file such fraudulent claims. • The offenses range from a Class C misdemeanor to a first-degree felony depending on the value of the property, service, or pecuniary interest. 29 The Broker’s and Appraiser’s Lien on Commercial Real Estate Act • Real estate brokers and appraisers may put liens on real estate for commissions due. • It applies to most commercial transactions, but does not apply to: 1. A transaction involving a commission of less than $2,500.00 or 2. A transaction involving a commission of $5,000.00 or less if the commercial real estate: (a) Is the principal place of business of the record title owner. (b) Is occupied by more than one and few than five tenants. (c) Is improved with 7500 square feet or less of total gross building area. • In general terms, the lien statute applies to only commercial real estate, not residential or agricultural real estate. 30 Filing the Lien • The broker has a lien on the commercial real estate interest of a seller, or lessor, if the broker has earned the commission and the notice of lien is recorded. • The lien is available only to the broker named in the commission agreement (not to an employee or independent contractor of the broker) and must be disclosed in the commission agreement. • So a commercial broker, wanting to pursue the lien claim, must make sure the lien right is clearly stated in the commission agreement. • The broker’s lien cannot be waived in a sales transaction. • It will be automatically waived if the commission is earned in a lease transaction and the commission agreement is included as a provision in the lease agreement. 31 The Lien Document • Notice of Lien must be signed by the broker and contain the following: 1. A sworn statement of the nature and amount of the claim, including: (a) The commission amount or the formula used. (b) The type of commission at issue. (c) The month and year in which the commission was earned. 2. The name of the broker and license number of the broker. 3. The names of any person broker believes is obligated to pay. 4. The name of any person the broker believes to be the owner . 5. A legal description of the property. 6. Name of any broker or principal with whom the broker intends to share the commission and the dollar or percentage amount. 7. A copy of the commission agreement in which the lien is based. • After the broker files the lien, the broker must mail a copy of the notice of lien by certified mail, return receipt requested, or registered mail, to the owner of record. 32 Lien Priority • A lien recorded before the date the broker’s lien is recorded has priority over the broker’s lien. • There are two exceptions: 1. A purchase money mortgage lien executed by the buyer of the commercial real estate. 2. A mechanic’s lien that is recorded after a broker’s lien but relates back to the date before the broker’s lien is recorded (similar to other mechanic’s liens priorities). The broker’s lien is extinguished if the property is zoned single-family use or restricted for single-family use within 360 days after the broker’s commission is payable, and those zoning ordinances or restrictive covenants are in effect until at least the second anniversary of the date the commission is payable. 33 Time for Filing the Lien • If representing the seller, the lien must be filed after the commission is earned and before the conveyance of the real estate interest. • If representing the buyer, the lien must be filed after the buyer acquires legal title to the commercial real estate interest and before the buyer conveys that commercial real estate interest. • If it is a lease transaction, the broker must record the notice of lien after the commission is earned and the earlier of: (i) the 91st day after the date the event in which the commission becomes payable. (ii) the date the person obligated to pay the commission records a subsequent conveyance of that person’s commercial real estate after executing the lease agreement. • If the notice of lien is not filed within the time required, the lien is void. 34 Suit to Foreclose the Lien • The broker can bring a suit to foreclose lien in any district court in the county in which the commercial real estate is located, which suit must be filed on or before the second anniversary of the date the notice of lien is recorded. • If it is a deferred commission, the suit must be filed before the second anniversary date on which the commission is payable or the 10th anniversary of the date the lien is recorded, or the 10th anniversary date the broker records a subsequent notice of the lien as a renewal of the broker’s right to the lien, whichever date is later. • As an alternative, the broker claiming the lien must bring suit to foreclose the lien not later than the 30th day after the date the broker receives a written demand to bring a suit to foreclose the lien. • If the suit to foreclose the lien is not brought within the abovereferenced time periods, the lien is void. 35 Other Statutory Liens • One of these is a lien for the relocation or replacement of sewer lines. It has the same priority as an assessment for paving or ad valorem taxes. • Street improvement liens have a priority that relates back to the original notice of impending sewer or paving work. • The Texas “weed-cutting” lien, is considered by statute to be privileged and subject only to the tax liens and liens for street improvements. • All three of these liens are established by the city but may not be foreclosed against a homestead. • The Texas Workforce Commission can file a Wage Lien on property which is a special labor law administrative lien. • The Superfund Amendment and Reauthorization Act of 1986 is a federal law that creates a lien upon property affected by hazardous substance removal or remedial action by the superfund statute. 36 Constitutional Liens • The Texas Constitution provides for an automatic constitutional lien as another means of protecting the mechanic, materialman, and artisan. • This type of lien is available only to an original contractor. • The lien becomes effective automatically, although it is subordinate to the homestead exemption. • Becomes effective as of the time the owner entered into the contract or at the time of first delivery of material or labor, whichever is first. • Like a vendor’s lien, if it is not recorded, it would not be good against an innocent purchaser unless the contractor filed his affidavit in accordance with the mechanics’ and materialmen’s lien statutes. 37 Contractual Liens • Can exist simply when two parties wish to establish the lien as security for some type of obligation. • An examples would be a mortgages. • Leases are also a common source of contractual liens where the tenant offers his furniture and personalty as security for payment of rent. 38 Redemption • In the event of default on any secured obligation in Texas, including liens, the only right one has is to pay the obligation (full amount of the note), or buy the property at the foreclosure sale. • Except for tax liens (Chapter 21) or installment land contracts (Chapter 9), Texas law provides for no right of redemption unless specifically provided for by agreement. 39 Questions for Discussion 1. Define the term “lien”. 2. Explain the difference between and give examples of general liens and specific liens. 3. Explain the difference between and give examples of equitable and statutory liens. 4. Explain the difference between and give examples of constitutional and contractual liens. 5. What is a writ of attachment? 40