3. The role of currency at the Greek crisis

advertisement

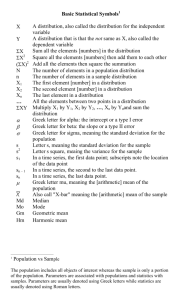

UNVERSITY OF IOANNINA DEPARTMENT OF ECONOMICS COURSE: ENGLISH FOR ECONOMIST IV INSTRUCTOR: Theodora Tseligka TOPIC : Greek/World economic crisis and Eurozone & its currency Kariofillis Ioannis A.M.: 2411 Kapartzanis Panagioths A.M.:2405 Academic Year : 2013-2014 Semester : D CONTENTS 1. Introduction 2. Economic crisis and Eurozone 2.1 The causes 2.2 The timeline of the crisis in the Eurozone 2.3 Funding from the Eurozone and the IMF The Greek crisis 3. Greek crisis 3.1 Main causes 3.2 The role of currency at the Greek crisis 4. Conclusion 1. INTRODUCTION • Since the 2008 the economies of the world started a down spiral into an unexpected crisis and the prospect of a ‘domino’=like collapse made its appearance • What was the causes of the crisis in Eurozone ? • How the crisis expended through the Europe? • How the Eurozone and the IMF fund the Greek government ? • Who are the main causes of the Greek crisis? • Who was the role of currency at the Greek crisis? 2. ECONOMIC CRISIS AND EUROZONE 2.1. THE CAUSES The main causes of the development of the crisis in the Eurozone are: i) A decade of low interest rates ii) The ‘adoption’ of the common currency and the monetary policy in different economies THE TIMELINE OF THE EUROZONE CRISIS October 18,2009 The Greek government reveals a massive black hole in the nation’s accounts April 7,2011 Portugal request a bailout loan of up to 78 billion euro October 27 ,2011 The euro-area countries agree to write down Greek debt by 50% January 6, 2012 The ECB purchase Italian and Spanish bounds June 25, 2012 Cyprus request a bailout loan of 10 billion euro 2.3. FUNDING FROM THE EUROZONE AND THE IMF • The first Memorandum of Understanding includes: • First loan of 80 billion euro form the Eurozone and 30 billion euro from the IMF • Second loan of 158 billion euro from the Eurozone, the IMF, the private sector and from re-buying Greek bonds • The second Memorandum of Understanding includes a total loan of 130 billion euro • Both Memorandum of Understanding includes a series of fiscal adjustments 3. GREEK ECONOMICAL CRISIS 3.1. THE MAIN CAUSES OF GREEK CRISIS • GDP growth rate • As we can see from the graph the negative growth of GDP rate is the real problem that Greek government has to cope with. And that is why, an economy that do not produce can not be healthy at all. So Greece has a big structural problem • Government Deficit As we can understand from the graph the country forced to take continuously loans to cover the deficit, something that make the debt even more bigger. Also, we have to observe that deficits began to grow more after the introduction of Euro in Greek economy. • Greek government Debt level • The continuously budget deficits make necessary for the country to loan. If the GDP growth rate do not turn into positive the debt won’t be sustainable. So, the increase of country’s debt in conjunction with the lack of production in the country makes the recession deeper for the Greek economy. • Statistical credibility A main cause of the Greek crisis was this one. From 2005 until 2009 in every year Eurostat noted a difference between its statistical numbers and Greece ones. They discovered it in 2009 when the Greek statistics about the GDP growth, the deficit and the public debt were worse than the reality. 3. THE ROLE OF CURRENCY AT THE GREEK CRISIS • In 2001 Greece introduced the European Monetary Union and uses Euro as currency. This fact had many positives for the country’s economy but and negatives too. Euro provided Greece with an access to competitive loan rates and also low rates in Eurobond market. That helped the country to increase the consumer spending. In the other hand we see that from the time of introduction in Euro Greek deficits are growing with bigger rate than before. 4. CONCLUSION • In conclusion we can understand better the causes of the European crisis and the deeper causes of the Greek crisis. We are able to comprehend the help that our euro-partners have give to us and why the Greece cannot sustain it self outside from the Eurozone.