History of economic thought

advertisement

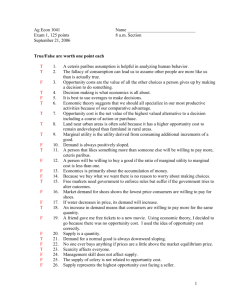

History of economic thought Presentation 9 Petr Wawrosz Establishing of modern microeconomics Basic characteristic • Concentration on behavior of individual (a consumer, a firm) • Maximalization of utility/profit • Marginal approach • General and partial equilibrium • Description of market structure – perfect and inperfect competition • Efficiency and equity Augustin Cornout (1801-1877) • French mathemathician • The first scholar to be interested in the firm as such, to study its behavior in different market situations and to pose the problem of the determination of the scale of production. • He made the first rigorous formulation of a demand function; a function which he used to determine the price and quantity produced under monopoly (and duopoly). • Cornout equilibrium: equilibrium on duopoly market - each firm makes a series of mistaken assumptions about the behavior of the other, but the size of these errors gradually diminishes in intensity until a situation is reached in which the expectations of reciprocal behavior become correct. At this point the adjustment process stops. Jules Dupuit (1804 – 1866) • He endeavored to study the social benefits derived from public goods such as canals or bridges, and, above all, to evaluate the net social gains generated by variations in tolls and rates. • He constructed a demand curve, interpreting it in terms of utility. Then he defined marginal utility and distinguished it from total utility. • Dupuit also conceptualized ‘producer surplus’, which, given an increasing cost curve, is the difference between the total revenue of the firm and the overall marginal costs. Johann Heinrich von Thünen (1783-1850) • Publication: The Isolated State in Relation to the Agricultural and National Economy (1826), written at German. • How long to usu land? Marginal productivity of land equls wage (a farmer cannot influence wage). • Which land is used: at first the nearest land to the town. But the cost of the transport increase with distance. Farmers with longest distance will specialize in production with lowest transport costs. Hermann Heinrich Gössen (1810 – 58) • Publication: The Laws of Human Relations and the Rules of Human Action Derrived Theorem, 1854). Written at Germen, forgotten, rediscovered at the end of the 1870s. • Gosen´s law. Gossen´s law • Gossen's First Law is the “law” of diminishing marginal utility: that marginal utilities are diminishing across the ranges relevant to decision-making. • Gossen's Second Law, which presumes that utility is at least weakly quantified, is that in equilibrium an agent will allocate expenditures so that the ratio of marginal utility to price (marginal cost of acquisition) is equal across all goods and services. • Gossen's Third Law is that scarcity is a precondition for economic value. Ernst Engel (1821 – 96) • German statistic. • Income elasticity. • He explored that income elasticity for the food is less 1. • Engel curve. • Necessities, luxuries, inferior good. Necessities and luxuries e>1 Percentage change in quantity demanded is higher then percentage change in income Luxories e=1 Percentage change in Goods with unit income quantity demanded equals elasticity percentage change in income e<1ae>0 Percentage change in quantity demanded is lower then percentage change in income Necessities e<1 Growht of income means decrease of quantity demanded; fall of income means increase of quantity Inferioor goods Engel‘s curve • The relationship among Income (Y, usually vertical axis) and quantity demanded (Q‘, usually horizontal axis) Engel‘s curve for inferior goods William Stanley Jevons (1835-82) • Had a formal (university) education at economist → economist became the science. • The Coal Question (1862): how to respond to the shortage of coal • The theory of Political Economy (1870) • The Principles of Science (1874) • Economics must be mathematical science: it deals wit quantities. William Stanley Jevons (1835-82) • • • • Marginal Utility Theory The Law of diminishing marginal utility Demand and Price The Sunspot theory Carl Menger (1840 – 1921) • • • • Studied law some time at Prague. Founder of Austrian School Publication: Principles of Economics (1871). The goods of first order (final goods), the goods of higher order (capital goods, goods that used for production of final goods) • Prices of factor of production (goods of highest order) is derived from the prices of the good goods of the first order they helped to produce. Carl Menger (1840 – 1921) • The Methodenstreit (the dispute about methodology): which character does have economic principles: - Menger: economics principles must be base on the general principles of human behavior - German historical school: the economic principles must be derived from the specific historical situation and facts Absolutist versus relativist approach • Absolutist approach: tends to believe that there are some objective, absolute “facts or truths” about the perceptions and patterns of economic behavior that cross cultural, temporal and social boundaries. These beliefs and patterns of behavior are perceived as universal. They are believed to apply in every society at all times in similar ways. • Relativist approach: holds that what is “true,” or useful, in one time or place may or may not be useful in some other time or place. Economic theory is a product of its environment. The relativist tends to believe that economic theory is shaped by technology, social and economic institutions. • The dispute about methodology is an example which approach are more important? Absolutist versus relativist approach • How to solve the conflict? • Perhaps a position somewhere between the extreme relativist and absolutist positions is more reasonable. There may be universal patterns of economic beliefs and behavior that span all societies. However, cultural features, technology and other factors influence our perceptions, values and behavior. • Economic theory is both a determinant and reflection of the society of which it is a part. Eugen von Böhm-Bawerk (1851-1914) • • • • A scholar of Menger Capital and Interest (1889) Why the rate of interest is positive? 1. individuals in general expect that more resources (goods) will available for consumption in the future • 2. people´s tendency to underestimate future needs • 1 + 2 → consumers must be compensated for transferring resources to the future, since they expect resources to be greater and needs to be less • 3. methods of production will be more productive when extended in time. But there must be some factor that causes producers to stop the process of time extension /to choose a period of production of finite length). Eugen von Böhm-Bawerk (1851-1914) • The theory of discount rate (1/(1 + r)) r = equilibrium price of consumption one period from now expressed in units of present consumption • A critic of the Karl Marx. Friedrich von Wieser (1851-1926) • A professor in Prague for some time • Publications: Natural Value (1889), Social economics (1914) • For the first time used term „marginal utility“ • Explanation why socialism cannot be efficient: it does not allocate resources in such way when MU1/P1 = MU2/P2 = … MUn/Pn Leon Walras (1834 – 1910) Basic facts • Professor in Lausanne university in Switzerland • Publications: Elements of Pure Economics (1874), Theory of Money (1886) • The marginalistic perspective was embedded in a economic view that was comparable to that of classics. • The price is determined both by marginal utility (demand) and cost of production (marginal costs, supply). • Supporter of using mathematics in economics. (however economic become unintelligible without knowledge of mathematics). The analysis of exchange • Initial situation: 2 persons and 2 goods, the supply of goods is fixed. • How can be characterized the equilibrium of such economy? • Walras´ model determines relative prices: the price of good 1 expressed in units of good 2. • Conclusion: one good can be taken as the unit of account. All the price can expressed in units of this good -> numeraire. • The price of numeraiere equals 1. • Consumers must compose their consumption in such way that marginal utility divided by price must be same for all goods (Gossen´s second law). General Equilibrium • Firms supply finished goods that are demanded by consumers. • In order to produce consumer goods firms demand factors of productions that are supplied by consumers. • General equilibrium exists, when: 1. the consumers 'demand is equal to firms´ supply for all consumer goods. 2. the firms 'demand is equal for all factors of productions. • Suppose economy with m goods: demand and supply of each commodity of a function of all prices. • Walras explain how equilibrium in all markets can be achieve. • Importance result: if the equilibrium is achieved on m-1 markets, the last market must be also in equilibrium. • Money is neutral in his model. • The model need not have solution (it depends on the equations and the price can be negative, what is not possible). The road to equilibrium • If there is a disequilibrium on some market, then: - if demand for the good is higher than supply, price goes up - - if demand for the good is lower than supply, price goes down • The necessary condition: free entry into and free exit out of market -> Wallras´ model is the model of perfect competition. Alfred Marshall (1842 – 1924) Principles of Economics (1890) • • • • First modern economic text-book. Supply and demand diagram. Partial equilibrium. Price is determined both by marginal cost (supply) and marginal utility - > although such results was already discovered by Walras, Marshal gave the idea clear form. • Movement along curve versus shift of the curve. • In SR inelastic (vertical) supply curve. Demand, Supply, Consumer and producer surplus • Diminishing marginal utility. If the price is higher than marginal utility, the unit is not consumed. • Income and substitution effect. • The individual consumer demand curve corresponds to decreasing part of marginal utility curve. • Consumer´s surplus. • Increasing marginal cost. If the price is lower than marginal cost, the unit is not produced. • The individual firm´s supply curve corresponds to increasing part of marginal cost curve. • Producer surplus. • The consumer and producer surplus are maximized in the equilibrium. • Social surplus: (equilibrium price is low (high), producers surplus is lower (higher) than consumer surplus. Government intervention and change of surplus. Partial versus general equilibrium • Partial equilibrium: Marshall: human intellect has limited powers so it is necessary to simplify complex problem in order to understand and be able to solve them. • The Principles emphasizes the mutual interdependencies of economic life but Marshall himself had not developed a general equilibrium mode. Partial equilibrium in perfect competition Concept of elasticity • Price elasticity = how the change of price affects quantity demanded (price elasticity of demand) or quantity supplied (price elasticity of supply). • Small change of price can have small or huge effects of quantity demanded or quantity supplied. • Huge change of price can have small or huge effects of quantity demanded or quantity supplied. Price elasticity equation • Equation: Price elasticity of demand or supply: (e)= percentage change in quantity demanded or quantity supplied -----------------------------------------------------------------------percentage change in price • Mathematically: • Percentage change in quantity demanded = (𝑄′2 − 𝑄′1 )/(1/2 * (𝑄′1 + 𝑄′2 )) • Percentage change in price = (𝑃2 − 𝑃1 )/(1/2 * (𝑃1 + 𝑃2 )) • e = (𝑄′2 − 𝑄′1 )/(1/2 * (𝑄′1 + 𝑄′2 ))/ ((𝑃2 − 𝑃1 )/(1/2 * (𝑃1 + 𝑃2 ))) = =ΔQ´/(𝑄′1 + 𝑄′2 ) * ΔP/(𝑃1 + 𝑃2 ) • Usually it is used absolute value in the case of quantity. Factors market and income distribution • Wage: • Demand: It is profitable to hire more workers as long as the value of the marginal productivity exceeds the wage rate. • The wage rate from producer point of view is given (stipulated at the market). • Supply: marginal utility analysis: wage versus dissatisfaction with work (leisure time). Factors market and income distribution • Capital: marginal productivity of capital must be higher or at least equal to the rate of interest. • Explain why productivity of labor increases over time: - higher wages - investments in human capital (Marshall does not use the term). Free market • Perfect competition maximizes producers and consumers surplus. • Such system is good for building character: it makes a person become hard-working, conscientious and prudent. • This would have a long run effect on economic growth and development. Francis Edgeworth (1845 – 1926) Importance • Marginal utility of income is decreasing. • Social welferare: the sum of individual utility. • The concept of inddifferent curve Vilfredo Pareto (1848 – 1923) Basic facts • A Course of Political economy (1896) • Manual of Political economy (1909) • Walras´s successor at University of Lausanne. • Developed the concept of indifferent curve. • Reject social welfare as the sum of individual utility. • Pareto optimality. Indifferent curve • A curve that shows the combinations of consuming bundles that give the consumer same utility. Indifferent map • Higher indifferent curve (IC) = higher utility that bundle of goods brings the consumer • Bundles of good lying on the one IC brings some utility Attributes of indifferent curves (IC) • They are diminish. • They cannot cross. • The shape of IC (usually, exceptions are substitutes and complements) reflects the law of diminishing marginal utility: for each additional unit of good that a consumer must give up (s)he needs more units of remaining (second) good so that his/her utility stays some. ICs for substitutes and complements Substitutes Complements Marginal rate of substitution (MRS) = the rate telling if a consumption of one good is decreasing for some units how much the consumer must increase the consumption of rest good to stay on the same IC (to keep his/her utility). = the rate at which a consumer would be willing to trade off one good for another. MRS • How to count MRS: • Let a consumer decreases the consumption of good Q´1 about 5 units (for instance from 12 to 7 units). If he increases the consumption of good Q´2 about 10 units (for instance from 4 to 14 units) and stay on the same indifferent curve the MRS is 10Q´2 to 5Q´1 = 5 Q´2 to 1 Q´1 . • Generally: MRS = change of units of goods whose consumption is increasing to change of units of goods whose consumption is decreasing Importance of MRS • MRS tell us the relative price (from consumers point of view): how should be price of unit of one good in the units of different good. • Example: If MRS is 5 Q´2 to 1 Q´1 then a consumer is willing to pay 5 Q´2 units of good per 1 unit of good Q´1 → the unit of the good Q´1 is for a consumer five times valuable than the unit of the good Q´2. Importance of MRS • The prices of goods are generally expressed in money. • If the ratio of monetary prices differs from MRS it is convenient for consumer to buy the cheaper good. • Example: MRS is 5 Q´2 to 1 Q´1 is five times valuable than . The good Q´1 must cost five time more than the good Q´2 so that a consumer would be indifferent (which good should buy). a) Let the price of 1 unit Q´2 is 2 CZK the price of 1 unit Q´1 is 10 CZK. At this case a consumer will be indifferent. b) Let the price of 1 unit Q´2 is 2 CZK the price of 1 unit Q´1 is 20 CZK ( is 10 times expensive than ). At this case it is more convenient for consumer to buy 5 units Q´2 than 1 unit of Q´1. c) Let the price of 1 unit Q´2 is 2 CZK the price of 1 unit Q´1 is 6 CZK ( is 6 times expensive than ). At this case it is more convenient for consumer to buy 1 units Q´1 than 5 units of Q´2. Importance of MRS • MRS can be count at each point of IC as a slope of tangent at this point. • IF IC has it standard shape the MRS is different at each points. • MRS tells a consumer´s willingness to pay (how many units of remaining good is consumer willing for the good (s)he gives up). • From MRS we can derive marginal benefit curve. Edgeworth´s box Arthur C. Pigou (1877 – 1959) Basic facts • Marshall successor at Cambridge University. • Main topic: welfare economic (publications „Economics of Welfare“ 1920, „A Study in Public Finance“, 1928). • He believed that the redistribution in favor of low income groups increase the sum of utility in society. • However admitted that such transfer could reduce the total income of society and thereby weaken the economic basis for redistribution. • Trade-off: economic efficiency versus distributive justice. Market failures • Externalities • Monopoly (the price is higher than marginal costs of production) How to designate optimal tax system? • Almost all feasible taxes involve harmful effects for the economy - have incentives on labor supply, consumption and saving: • The percentage reduction in consumption and production ought to be the same for all goods. • To achieve this: impose the highest taxes should be imposed on goods with inelastic demand or supply. Knut Wicksell (1851-1926) • Swede. • Main publication: Value, Capotal and Rent (1893)• Generalized theory of priduction and firm behavior. • Concept of production function. • Demand for factors of production: the value of marginal productivity compare to price. LRAC curve • Shape of LRAC curve • Decreasing part of the curve : increasing returns to scale • Minimum: decreasing returns to scale • Increasing of the curve: increasing returns to scale. • In perfect competition Q2 is optimal quantity produced by individual firm. • In the LR there will be constant returns to scale. The rates of interests • The natural rate of interest (rn): determined by real rate of return on capital. Independent on monetary relationships. • Market rate (rm): determined by banking system. • If rm = rn the price level wil be stable and the rate of inflation will be 0 • If rm < rn the demand for capital increases -> a positive rate of inflation. Inflation continues till: - banks increase the rm, - the natural rate falls as a result of decreasing rate return on capital. • Wicksell favors zero inflation (stable price level). Theory of taxation • Benefit principle: an indivual´s tax payment ought to reflect his/her benefits from the provision of public services. • The principle of ability to pay? The taxes should be paid by people who have money to pay them - > progressive taxation. • Wicksell favor benefit principle: projects financed by taxes should give people some benefits. • How to achieve this: The public projects must be approved by democratic institutions on the basis of unanimity. • Unanimity is not necessary in case of redistribution. Irving Fisher (1867 – 1947) • An American economist. • Founder of Econometric society. • For the first time draw a figure showing: - optimal bundle of consumed goods - optimal combination of factor of production minimizing cost of production for given level of output. Optimal bundles of goods • The bundle where the budget line touchs a indifferent curve. • Why? • A consumer - maximizes his utility. - cannot find better combination (bundle) of good Saving and Investment • Fisher Chart – how to allocate resources between present and future consumption: the consumer's marginal rate of of substitution between present and future consumption must be equal to the rate of discount (1/(1 + r)), r = interest rate. Saving and Investment • How much iti is rational to invest in real capital? • The amount maximizing present value of the investment. The point where the marginal productivity of the capital is equal to the rate of interest. The quantity theory of money • The equation: M*V = P*Y Y = real GDP (given), V = velocity of money: determined by institutional arrangements. • Results: The price level is determined by quantity of money. The amount of money determined absolute price level. The real side of economy is guided by relative process. • Fisher favors stable price level. • He defined real and nominal interest rate. Real: - backward and forward looking. • Explanation of Great depression: real interest rate continued to stay at very high level. Edward Chamberlin (1899 – 1967) • An American economist. Previous described economists looked on the market as a perfect competitive one. However reality is different. • Many firms have (for a long time) increasing returns to scale (and decreasing AC and MC curve). • Main publication: The theory of monopolistic competition – reality is between monopoly and perfect competition. • Not homogenous product – each producer is a monopolist with respect to the sale of his own good, but his monopoly position is relatively weak, since he must pay attention to the competition from those who produce goods that are closely related to his own. • The demand curve faced by the single producer is therefore not horizontal, as under perfect competition, but in comparison to the monopoly case is relatively flat: if the firms raises its price, it will lose many customers who will switch to the commodities offered by its competitors. • Chamberin expected free entry into industry. • Firms try to strengthen its position (specialization in product, advertising …) Edward Chamberlin (1899 – 1967) Short run firm´s equilibrium Long run firm´s equilibrium Joan Robinson (1903 -83) • The Economics of Imperfect Competition (1933) – published similar results as Chamberlin. • The imperfect competition on the market for factors of production. Monopsony. • The owners of the factors of production are paid less than value of their marginal product. • Price discrimination. Other economists interesting in imperfect competition • Harold Hotelling (1895 – 1973). An American. • Some firms decision in imperfect competition can be convenient for the firms but are not convenient for the consumers. • Where new firms starts to sell its product (near the shop of first producer), which product firm choose to sell (very often very similar to the first one). • Heinrich von Stackelberg (1905 – 1946): • Theory of duopolistic competition: one firm is a leader, second one is the follower. • Frederik Zeuthen (1888 – 1959). A Danish economists. • The role of bargaining in imperfect competition.