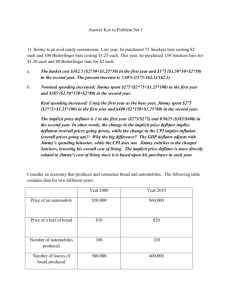

Chapter 2

Chapter 2:The Measurement and

Structure of the Canadian Economy

National Income Accounts – An accounting framework to measure current economic activity.

Three approaches to measure national economic activities

1) Product Approach – The amount of goods and services excluding intermediate goods and services produced (Value Added).

1

2) Income Approach – Income received by factors of Production

3) Expenditure Approach – Amount of spending by the ultimate purchasers/buyers

Fundamental Identity of National Accounts

Total Product = Total Income = Total

Expenditure

2

Product Approach

Gross Domestic Product (GDP) – The market value of final goods and services newly produced in a nation within a specified period of time.

Gross National Product (GNP) = GDP + Net

Factor Payment from Abroad (NFP)

NFP = Income paid to domestic factors of production by the rest of the world – Income paid to foreign factors of production in the domestic economy.

3

The Expenditure Approach

Gross Domestic Product (GDP) – Total spending on final goods and services produced within a nation during a specified period of time.

Y = GDP = Consumption (C ) + Investment

(I) + Government Purchases (G) + Net

Exports (NX)

4

1)

2)

3)

3)

4)

1)

2)

Consumption:

Consumer Durables

Semi-Durable

Non-Durable

Services

Investment: Inventory Investment + Fixed Investment

Fixed Investment:

Residential Construction

Non-Residential Construction

Machinery and Equipment Investment

5

Government Purchases – Government expenditure excluding Transfer Payments and Interest Payments on the government

Debt.

Net Exports = Exports – Imports

Income Approach

GDP – Total income received by factors of production in a nation within a specified period of time.

6

1)

2)

3)

4)

Labor Income

Corporate Profits

Interest and Investment Income

Unincorporated Investment Income

Net Domestic Product at Factor Prices = 1+2+3+4

Net Domestic Product at Market Prices = Net

Domestic Product at Factor Price + Indirect Taxes -

Subsidies

GDP = Net Domestic Product at Market Price +

Depreciation

7

Private Disposable Income = Y +

NFP + TR + INT - T

Net Government Income = T – TR

– INT

GNP = Private Disposable Income

+ Net Govt. Income = Y + NFP

8

Saving = Current Income – Current

Spending

Private Saving (S

+ INT - T- C

PVT

) = Private

Disposable Income – C = Y + NFP +TR

Government Saving (S

GOVT

) = Net

Government Income – Government

Purchases = (T – TR – INT) – G =

Budget Surplus/Deficit

9

Uses of Private Saving

S = I + (NX + NFP) = I +Current

Account Balance (CA)

S = S

PVT

+ S

GOVT

= I + CA

S

PVT

= I - S

GOVT

+ CA

10

Nominal Vrs Real Variables

Real GDP = Nominal GDP / GDP

Deflator

GDP Deflator measures the overall level of prices of goods and services included in GDP.

Consumer Price Index (CPI) – Measure of prices of consumer goods

11