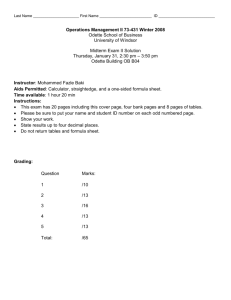

TOC LP View Practice

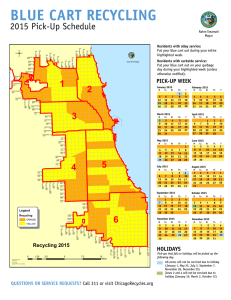

advertisement

Practice: A Production System Manufacturing Two Products, P and Q $90 / unit P: 110 units / week Q: $100 / unit 60 units / week D 5 min. D 10 min. Purchased Part $5 / unit C 10 min. C 5 min. B 25 min. A 15 min. B 10 min. A 10 min. RM1 $20 per unit RM2 $20 per unit RM3 $25 per unit Time available at each work center: 2,400 minutes per week. Operating expenses per week: $6,000. All the resources cost the same. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 1 1. Identify The Constraint(s) Product A P 15 Q 10 B 10 35 C 15 5 D Contribution Margin: P($45), Q($55) 10 Market Demand: P(110), Q(60) 5 Can we satisfy the demand? Resource requirements for 110 P’s and 60 Q’s: Resource A: 110 (15) + 60 (10) = 2250 minutes Resource B: 110(10) + 60(35) = 3200 minutes Resource C: 110(15) + 60(5) = 1950 minutes Resource D: 110(10) + 60(5) = 1400 minutes Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 2 2. Exploit the Constraint : Find the Throughput World’s Best Solution Resource B is Constrained - Bottleneck Product P Profit $ 45 Resource B needed (min) 10 Profit per min of Bottleneck 45/10 =4.5 Q 55 35 55/35 =1.6 Per unit of bottleneck Product P creates more profit than Product Q Produce as much as P, then Q Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 3 2. Exploit the Constraint : Find the World’s Best Solution to Throughput For 110 units of P, need 110 (10) = 1100 min. on B, leaving 1300 min. on B, for product Q. Each unit of Q requires 35 minutes on B. So, we can produce 1300/35 = 37.14 units of Q. We get 110(45) +37.14(55) = 6993 per week. After factoring in operating expense ($6,000), we make $993 profit. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 4 2. Exploit the Constraint : Find the World’s Best Solution to Throughput How much additional profit can we make if market for P increases from 110 to 111; by 1 unit. We need 1(10) = 10 more minutes of resource B. We need to subtract 10 min of the time allocated to Q and allocate it to P. For each unit of Q we need 35 min of resource B. Our Q production is reduced by 10/35 = 0.29 unit. One unit increase in P generates $45. But $55 is lost for each unit reduction in Q. Therefore if market for P is 111 our profit will increase by 45(1)-55(0.29) = $29. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 5 Practice: LP Formulation Decision Variables x1 : Volume of Product P x2 : Volume of Product Q Product A B C D Profit Margin Demand P Q Capacity 15 10 10 35 15 5 10 5 45 55 110 60 2400 2400 2400 2400 Resource A 15 x1 + 10 x2 2400 Market for P x1 110 Resource B 10 x1 + 35 x2 2400 Market for Q x2 60 Resource C 15 x1 + 5 x2 2400 Objective Function Maximize Z = 45 x1 +55 x2 -6000 Resource D 10 x1 + 5 x2 2400 Nonnegativity x1 0, x2 0 Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 6 Practice: Optimal Solution Product P Product Q LHS (Needed) RHS (Available) Resource A 15 10 2021.43 <= 2400 Resource B 10 35 2400.00 <= 2400 Resource C 15 5 1835.71 <= 2400 Resource D 10 5 1285.71 <= 2400 Market P 1 110.00 <= 110 Market Q 1 37.14 <= 60 Profit/Unit 45 55 993 Total Profit Product Mix 110.00 37.14 Continue solving the problem, by assuming the same assumptions of 20% discount for the Japanese market. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 7 A Practice on Sensitivity Analysis Cell Name $B$10 Product Mix Product P $C$10 Product Mix Product Q Final Reduced Objective Allowable Allowable Value Cost Coefficient Increase Decrease ?????? 0 45 1E+30 29.28571429 37.14 0 55 102.5 55 Constraints Cell $D$3 $D$4 $D$5 $D$6 $D$7 $D$8 Name Resource A LHS (Needed) Resource B LHS (Needed) Resource C LHS (Needed) Resource D LHS (Needed) Market P LHS (Needed) Market Q LHS (Needed) Final Shadow Constraint Allowable Value Price R.H. Side Increase 2021.43 0.000 2400 1E+30 2400.00 1.571 2400 800 1835.71 0.000 2400 1E+30 1285.71 0.000 2400 1E+30 110.00 29.286 110 31.17647059 37.14 0.000 60 1E+30 Allowable Decrease 378.5714286 1300 564.2857143 1114.285714 80 22.85714286 What is the value of the objective function? Z= 45(?) + 55(37.14)-6000! 2400(0)+ 2400(1.571)+2400(0) +2400(0)+110(29.286)+ 60(0) =6993 Is the objective function Z = 6993? 6993-6000 = 993 Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 8 A Practice on Sensitivity Analysis How many units of product P? What is the value of the objective function? Z= 45(???) + 55(37.14)-6000 = 993. 45X1= 4950 Final Reduced Objective X1 = 110 Cell Name Value Cost Coefficient $B$10 Product Mix Product P $C$10 Product Mix Product Q ?????? 37.14 0 0 Allowable Allowable Increase Decrease 45 1E+30 29.28571429 55 102.5 55 Constraints Cell $D$3 $D$4 $D$5 $D$6 $D$7 $D$8 Name Resource A LHS (Needed) Resource B LHS (Needed) Resource C LHS (Needed) Resource D LHS (Needed) Market P LHS (Needed) Market Q LHS (Needed) Theory of Constraints 1- Basics Final Shadow Constraint Allowable Allowable Value Price R.H. Side Increase Decrease 2021.43 0.00 2400 1E+30 378.5714286 2400.00 1.57 2400 800 1300 1835.71 0.00 2400 1E+30 564.2857143 1285.71 0.00 2400 1E+30 1114.285714 110.00 29.29 110 31.17647059 80 37.14 0.00 60 1E+30 22.85714286 Ardavan Asef-Vaziri Nov-2010 9 Step 4 : Elevate the Constraint(s). Do We Try To Sell In Japan? Processing Times A C B 15 15 10 10 5 35 Product P Q D 10 5 Product Costs and Profits Product Selling Price P (domestic) 90 Q (domestic) 100 P (Japan) 72 Q (Japan) 80 Manufg. Cost 45 45 45 45 Profit per $/Constraint unit Minute 45 4.5 55 1.57 27 2.7 35 1 Even without increasing capacity of B, we can increase our profit. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 10 2. Exploit the Constraint : Find the World’s Best Solution to Throughput For 110 units of P, need 110 (10) = 1100 min. on B, leaving 1300 min. on B, for product P in Japan. Each unit of PJ requires 10 minutes on B. So, we can produce 1300/10 = 130 units of PJ. We get 110(45) +130(27) = $8460 - $6000 = $2460 profit. Check if there is another constraint that would not allow us to collect that much profit. Let’s see. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 11 1. Identify The Constraint(s) Product A P 15 PJ 15 B 10 10 C 15 15 D Contribution Margin: P($45), PJ($27) 10 Market Demand: P(110), PJ(infinity) 10 Can we satisfy the demand? Resource requirements for 110 P’s and 130 PJ’s: Resource A: 110 (15) + 130 (15) = 3600 minutes Resource B: 110(10) + 130(10) = 2400 minutes Resource C: 110(15) + 130(15) = 3600 minutes Resource D: 110(10) + 130(10) = 2400 minutes We need to use LP to find the optimal Solution. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 12 Step 4 : Exploit the Constraint(s). Product P Resource A 15 Resource B 10 Resource C 15 Resource D 10 Market P 1 Market Q Profit/Unit 45 Product Mix 110.00 Q 10 35 5 5 PJ 15 10 15 10 QJ 10 35 5 5 1 55 28.24 27 31.18 40 0.00 2400 <= 2400 2400 <= 2400 2258.8 <= 2400 1552.9 <= 2400 110 <= 110 28.2353 <= 60 1344.71 Total Profit Not $2460 profit, but $1345. The $6000 is included. Let’s buy another machine B at investment cost of $100,000, and operating cost of $400 per week. Weekly operating expense $6400. How soon do we recover investment? Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 13 Step 4 : Elevate the Constraint(s). New Constraint Product Resource A Resource B Resource C Resource D Market P Market Q Profit/Unit Product Mix P 15 10 15 10 1 45 84.71 Q 10 35 5 5 PJ 15 10 15 10 QJ 10 35 5 5 1 55 60.00 27 0.00 40 52.94 2400 <= 2400 4800 <= 4800 1835.3 <= 2400 1411.8 <= 2400 84.7059 <= 110 60 <= 60 2829.41 Total Profit Original Profit: $993 No Machine but going to Japan: $1345 profit. Buy a machine B: $2829 profit. The $6400 is included. Going to Japan has no additional cost. Buying additional machine has initial investment and weekly operating costs. $2829-$1345 = $1484 $100,000/$1484 = 67.4 weeks Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 14 Buying a machine A at the same cost Also add one machine A. Initial investment 100,000. Operating cost $400/week. Product Resource A Resource B Resource C Resource D Market P Market Q Profit/Unit Product Mix P 15 10 15 10 1 45 110.00 Q 10 35 5 5 PJ 15 10 15 10 QJ 10 35 5 5 1 55 60.00 27 16.32 40 41.05 2905.3 <= 4800 4800 <= 4800 2400 <= 2400 1768.4 <= 2400 110 <= 110 60 <= 60 3532.63 Total Profit From $2829 to $3533 = $3533 - $2829 = $704. The $6800 included.. $100,000/$704 = 142 weeks Now B & C are a bottleneck Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 15