Ch 11 - Images

advertisement

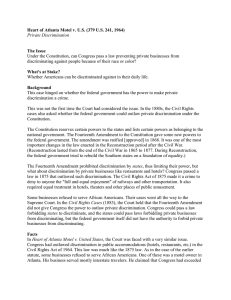

CH 11 Powers of Congress TAXES Article I section 8,Clause I Congress has the power to lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defense and general Welfare of the United States…” Tax- a charge levied by government on persons or property to meet public needs. Protective Tariff- tax for other purposes than the common good. This tax is on imports increasing their costs and protecting American manufactured goods Licensing by the federal government to certain manufacturers to produced products that are generally illegal is another form of taxation designed to protect public health and safety. This is considered a Protective Tariff LIMITS ON TAXATION Cannot Tax churches- would violate 1st Amendment free exercise of religion clause. Cannot levy a poll tax as a condition of votingwould violate the 24th amendment Cannot tax exports from any state- customs duties only on imports DIRECT AND INDIRECT TAXES Direct Tax- paid by the person on whom it is imposed. “No Capitation( head fee), or other direct tax shall be laid, unless the proportion to the Census of Enumeration herein before directed to be taken” Article I Section 9 Clause 4 A capitation tax is a head tax charged to each individual in the population of each state. This clause allows congress to levy any tax based on the state’s population as said by the Census and not on the income. However, the 16th amendment 1913 deleted the phrase the “other direct tax” making it possible to collect taxes in other forms such as and income tax system that we have today 16TH AMENDMENT “The Congress shall have power to lay and collect taxes on incomes, form whatever source derived without apportionment among the several States, and without regard to any census or enumeration.” INDIRECT TAX Tax paid initially by one person or entity but then passed on to another. It is indirectly paid by that second person and directly paid by the first. BORROWING MONEY Article I Sect 8 Clause 2 allows Congress to “borrow Money on the credit of the United States” There are no limits set in the Constitution on how much or how frequently Congress can borrow or for what purpose they are borrowing the money. Deficit Spending- Spending more money than it takes each year and then borrow to make up the difference. Deficit Spending began to finance the New Deal of FDR after the Great Depression in 1929. The economic depression lasted 10 years. Then it was used to raise money for WWII and began after that funding wars and social programs for decades Beginning in 1969 to 1998 the governments books ran in a deficit format until after 1998 when there was a short period of economic surplus when our government brought in more money that it spend/borrowed. Each year the public debt( all of the money borrowed by Congress but not paid back) would rise. Congress continues to borrow in the form of stocks and bonds(securities) issued by the federal government -In 1997 Congress passed the Balanced Budget Act and Congress and Pres. Bill Clinton agreed to abandon deficit spending and balance the budget by 2002. The goal was reached before the end of his second term as President in 2000. We had a surplus in 1998,99, 2000 and 2001. Our Federal Treasury is vague on what our nations actual debt is… Commerce Power is the power of Congress to regulate interstate and foreign trade and is vital to keeping order protocol among states and foreign countries. (Remember Articles of Confederation) “To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes” Article 1 section 8 clause 3 But… how far reaching is the Federal Governments power in the Commerce Clause??? Cannot: Tax exports, favor one port of a state over any other in regulation of trade, cannot say that vessels bound to, or from State be obliged to enter, clear or pay Duties to another and finally could not interfere with the slave trade, at least not until the year 1808 The Commerce Power had been used to settle supreme court cases such as Gibbons V Ogden over the monopoly of one Steamboat company in New York ( Robert Fulton gave Aaron Ogden the only permit for steamboat navigation between New York and New Jersey- Thomas Gibbons wanted to have equal access to the river to operate as well. New York Supreme Court said no. Federal Supreme Court said yes based on Commerce Clause) Commerce clause also struck the discrimination in access to services in hotels, motels and theatres and other accommodations on the basis of race, color, religion, or national origin in the Civil Rights act of 1964 based on the fact that these businesses served primarily interstate travelers. Gonzales v Raich FPC v. Niagara Mohawk Power Company United States v Chicago Gibson v. United States South Carolina v Georgia Cherokee Nation v Georgia United States v Lopez Kidd v Pearson Swift v. United States Carter v. Carter Coal Company National Labor Relations Board v. Jones and Laughlin Steel Corp. United States v. Darby Lumber Co. Wickard v. Filburn