Introduction to Construction Liens

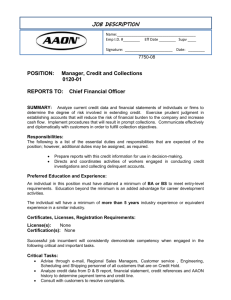

advertisement

Construction Liens April 14, 2004 Afternoon Session The more things change, the more they are the same (Plus ça change, plus c’est la même chose) Alphonse Karr, Les Guêpes, 1849 Part I – General WHY? A. G’s Committee Report: “The need […] emanates from the complicated nature of contractual relationships within the construction industry, and the credit-granting practices which are an integral part of that industry. Ordinary contractual remedies are believed to be inadequate in the face of these phenomena.” WHY? A. G’s Committee Report: “The major objective […] is to provide remedies to construction suppliers that go beyond those provided by the ordinary law of contract. The legislation creates two types of statutory rights: lien rights and trust rights.” WHY? A. G’s Committee Report: “Should the owner be unable or unwilling to pay for the work that has been done, his interest in the premises may be sold. The trust rights isolate contract monies, and require them to be used for paying suppliers who have contributed towards the making of an improvement.” Where? Construction of the White House, 1792 First Anywhere: Maryland, 1791 First in Canada: Ontario & Manitoba, 1873 First major amendment in Ontario: 1983 WHAT? KEY DEFINITIONS Privity of Contract "contract" = the contract between the owner and the contractor “Home Buyer” . . . a person who buys the interest of an owner in a premises that is a home, whether built or not at the time the agreement of purchase and sale in respect thereof is entered into, provided, (a) not more than 30 per cent of the purchase price . . . is paid prior to the conveyance, and (b) the home is not conveyed until it is ready for occupancy, . . . “Materials” . . . every kind of movable property, (a) that becomes, or is intended to become, part of the improvement, or that is used directly in the making of the improvement, or that is used to facilitate directly the making of the improvement, (b) that is equipment rented without an operator for use in the making of the improvement; “Owner” . . . any person, including the Crown, having an interest in a premises at whose request and, (a) upon whose credit, or (b) on whose behalf, or (c) with whose privity or consent, or (d) for whose direct benefit, an improvement is made to the premises but does not include a home buyer “Person Having a Lien” . . . includes both a lien claimant and a person with an unpreserved lien. “Premises” . . . includes, (a) the improvement, (b) all materials supplied to the improvement, and (c) the land occupied by the improvement, or enjoyed therewith, or the land upon or in respect of which the improvement was done or made; “Price” . . . means the price, (a) agreed upon between the parties, or (b) where no specific price has been agreed upon between them, the actual value of the services or materials that have been supplied to the improvement under the contract or subcontract “Supply of Services” . . . means any work done or service performed upon or in respect of an improvement, and includes, (a) the rental of equipment with an operator, and (b) where the making of the planned improvement is not commenced, the supply of a design, plan, drawing or specification that in itself enhances the value of the owner's interest in the land, “Written Notice of Lien” . . . includes a claim for lien and any written notice given by a person having a lien that, (a) identifies the payer and identifies the premises, and (b) states the amount that the person has not been paid and is owed to the person by the payer. Substantial Performance s. 2(1): . . . a contract is substantially performed, (a) when the improvement to be made under that contract or a substantial part thereof is ready for use or is being used for the purposes intended; and (b) when the improvement to be made under that contract is capable of completion or, where there is a known defect, correction, at a cost of not more than, (i)3 per cent of the first $500,000 of the contract price, (ii)2 per cent of the next $500,000 of the contract price, and (iii)1 per cent of the balance of the contract price. Completion s. 2(3): . . . a contract shall be deemed to be completed and services or materials shall be deemed to be last supplied to the improvement when the price of completion, correction of a known defect or last supply is not more than the lesser of, (a)1 per cent of the contract price; and (b)$1,000. KEY CONCEPTS Section 3 This statute binds the provincial Crown. Section 4 Waivers of lien are void – no matter what! Section 5 Every contract or subcontract is deemed amended to conform to the Act. AND FINALLY, COLD COMFORT Section 6 Strict compliance, except: s. 32(2)(5) and 33(1)– Certificate of Substantial Performance and its Publication S. 34(5) – Contents of Claim for Lien Section 6 … unless in the opinion of the court a person has been prejudiced by the failure to strictly comply. Part II – Trust Part II – Trust Think of each improvement as a cash silo: All cash goes in at the top (owner) All cash comes out at the bottom (least degree of priority). Part II – Trust 4 KEY CASES Minneapolis-Honeywell Regulator Co. v. Empire Brass Manufacturing Co. [1955] 3 D.L.R. 561 (S.C.C.) “. . . too often the contract price has been paid in full and the security of the land is gone. It is to meet that situation that s. 19 [contractor’s trust] has been added. The contractor and subcontractor are made trustees of the contract moneys and the trust continues while employees, material men or others remain unpaid.” “. . .payment is the correlative of receipt. The assignee acts through the right and power of the assignor; and the receipt by him is likewise that by the creditor. If this were not so, the entire purpose of the section could be nullified by an assignment contemporaneous with the contract.” Rudco Insulation Ltd. v. Toronto Sanitary Inc. (1998), 42 O.R. (3d) 292 (C.A.) . . . applying a strict interpretation to the provisions in ss. 8 and 10 of the Act and considering the purpose of the legislation, I am of the view that Part II of the Act did not confer trust benefits on the recipients of the overhead expenses and payments to them did not reduce . . . trust obligations . . . Structural Contractors Ltd. v. Westcola Holdings Inc. (2000), 48 O.R. (3d) 417 (Ont. C.A.) Westcola is essentially a landlord. Rent is not an incidental matter to it. Rent is its lifeblood, its raison d'être. To exclude rent from the trust in the case of a landlord would be to exclude Westcola from the application of s. 7. No justification has been suggested for such a step. Teepee Excavation & Grading Ltd. v. Niran Construction Ltd. (2000), 49 O.R. (3d) 612 (C.A.) “. . . but where all of the steps have been taken and a conclusion reached at a hearing, the court should not dismiss the action for lack of a lien claim and thus compel a further proceeding concerning the same issue . . . the court has available the discretion to dismiss or to permit the action to proceed without the lien claim, as the circumstances dictate.” s. 13 Part II – Trust Provisions The Hammer: s. 13(1): In addition to the persons who are otherwise liable in an action for breach of trust under this Part, (a) every director or officer of a corporation; and (b) any person, including an employee or agent of the corporation, who has effective control of a corporation or its relevant activities, who assents to, or acquiesces in, conduct that he or she knows or reasonably ought to know amounts to breach of trust by the corporation is liable for the breach of trust. Baltimore Aircoil of Canada Inc. v. ESD Industries Inc. (2002), 60 O.R. (3d) 290 (S.C.J.) Section 13 is not a restatement of the common law At common law, if a corporation breaches a trust, in order to pass that liability on to directors and officers, it is necessary to prove that they are constructive trustees Under s. 13, that level of proof is not necessary All that needs to be shown is that individuals belonged to the defined group and assented to or acquiesced in the corporation’s conduct Dominion Sheet Metal & Roofing Works v. 4701 Steeles Holdings Inc. (2002), 21 C.L.R. (3d) 250 (Ont. S.C.J.) It is not necessary for a plaintiff to prove that it suffered damages from the alleged breach of trust in order to hold a defendant liable under s. 13. Structural Contracting Ltd. v. Westcola Holdings Inc. (2000), 48 O.R. (3d) 417 (C.A.) A trial was not necessary to establish that a sole director assented to or acquiesced in conduct he knew or reasonably ought to have known amounted to breach of trust. As the sole officer, director and controlling mind of the corporation, it was beyond argument that he reasonably ought to have known that the trust was breached. Part III – The Lien Part III – The Lien All You Need to Know! s. 14(1): No lien for interest Part III – The Lien All You Need to Know s. 15: Your lien “arises” and “subsists” unless and until it “expires”. Part III – The Lien All You Need to Know s. 16: You can lien the Crown (but not its land). Part III – The Lien All You Need to Know s. 17: No set off against holdback, otherwise . . . knock yourself out. Part III – The Lien All You Need to Know s. 19: You can lien a lease! Part IV - Holdbacks Part IV – Holdbacks The Serene Centre of the Lien Act Part IV - Holdbacks s. 22: Two holdbacks: Basic and Finishing Part IV - Holdbacks s. 23: Two defaulting payers: contractors and subcontractors Part IV - Holdbacks s. 23: Two limitations on owner’s liability for holdback s. 23(2): Limitation (2) Where the defaulting payer is the contractor, the owner's personal liability to a lien claimant or to a class of lien claimants as defined by section 79 does not exceed the holdbacks the owner is required to retain. s. 23(3): Limitation (3) Where the defaulting payer is a subcontractor, the owner's personal liability to a lien claimant or to a class of lien claimants as defined by section 79 does not exceed the lesser of, (a) the holdbacks the owner is required to retain; and (b) the holdbacks required to be retained by the contractor or a subcontractor from the lien claimant's defaulting payer. s. 30: No set-off against holdback “Where the contractor or a subcontractor defaults in the performance of a contract or subcontract, a holdback shall not be applied by any payer toward obtaining services or materials in substitution for those that were to have been supplied by the person in default, nor in payment or satisfaction of any claim against the person in default, until all liens that may be claimed against that holdback have expired as provided in Part V, or have been satisfied, discharged or provided for under section 44 (payment into court).” Part V – Expiry, Preservation and Perfection s. 31(2) Expiration Part V – Expiry, Preservation and Perfection 31(2) (a) Is the contract certified? If so the liens expire at the conclusion of the forty-five-day period next following the occurrence of the earlier of, (i) the date on which the certificate is published; and (ii) the date the contract is completed or abandoned; Part V – Expiry, Preservation and Perfection 31(2) (b) If not certified, then the earlier of, (i) the date the contract is completed, and (ii) the date the contract is abandoned. s. 31(3) Expiration 31(3) For everyone else, (a) if certified, the 45 days runs from the earliest of, (i) publication (ii) last supply (iii) subcontract certified under s. 33; 31(3) For everyone else, (b) If not certified, the 45 days runs from the earliest of, (i) last supply (ii) subcontract certified complete under s. 33. Part V – Expiry, Preservation and Perfection s. 37 Expiration s. 37 37(1) A perfected lien expires immediately after the second anniversary of the commencement of the action that perfected the lien, unless one of the following occurs on or before that anniversary: 1. An order is made for the trial of an action in which the lien may be enforced. 2. An action in which the lien may be enforced is set down for trial. s. 37 Forget equities. Forget estoppel. Forget process arguments. The lien is gone. Graham Brothers Construction Ltd. v. Correct Building Corp. (1991), 46 C.L.R. 205 (Ont. Gen. Div.). Parties are in the midst of negotiations for settlement when two-year period expired Lien discharged, registration vacated Golden City Ceramic & Tile Co. v. Iona Corp. (1993), 12 C.L.R. (2d) 1 (Ont. Div. Ct.). Parties are in the midst of long examinations for discovery when two-year period expired Lien discharged, registration vacated Part VI – Right to Information Part VI – Right to Information A.G.’s Committee Report: We suggest that the Act should require disclosure of only that information which is pertinent to the decision of whether or not to preserve a lien claim or to pursue a lien action. These provisions should be reinforced with workable enforcement mechanisms. Part VI – Right to Information Result: s. 39 + $5.00 gets you a cup of coffee s. 40: gets you cross-examination Part VII – Discharge of Preserved and Perfected Liens Part VII – Discharge of Preserved and Perfected Liens How? s. 41(1): by a deed of Release Part VII – Discharge of Preserved and Perfected Liens How? s. 41(2): by withdrawal of written notice of lien Part VII – Discharge of Preserved and Perfected Liens How? s. 43: by formal Postponement of Lien Part VII – Discharge of Preserved and Perfected Liens How? s. 44: by paying into court (“Vacating”) Part VII – Discharge of Preserved and Perfected Liens How? s. 45: by court declaration Part VII – Discharge of Preserved and Perfected Liens How? s. 47: any other way you want Part VII – Discharge of Preserved and Perfected Liens How? s. 48: “A discharge of a lien under this Part is irrevocable and the discharged lien cannot be revived, but no discharge affects the right of the person whose lien was discharged to claim a lien in respect of services or materials supplied by the person subsequent to the preservation of the discharged lien.” Part VII – Discharge of Preserved and Perfected Liens s. 48 Discharge Part VII – Discharge of Preserved and Perfected Liens Southridge Construction Group Inc. v. 667293 Ontario Ltd. (1993), 12 O.R. (3d) 233 (Div. Ct.) Part VII – Discharge of Preserved and Perfected Liens Facts: Plaintiff general contractor registered against the property of the defendant a lien for $175,095.38. When the plaintiff subsequently discovered that it had mistakenly understated the amount of its lien, it registered a second lien for $279,540.43 for construction or contracting services supplied from May 13, 1991 to February 26, 1992 and discharged the first lien by registering a release of lien. Part VII – Discharge of Preserved and Perfected Liens Decision: “ The plaintiff's lien rights set forth in its second claim for lien have been eliminated and discharged by the registration of the Release, and cannot be revived, and thus, the lien must be ordered discharged, and the registration of the lien and certificate of action must be vacated and the plaintiff's action must be dismissed.” Part VII – Discharge of Preserved and Perfected Liens Decision: “ The plaintiff's lien rights set forth in its second claim for lien have been eliminated and discharged by the registration of the Release, and cannot be revived, and thus, the lien must be ordered discharged, and the registration of the lien and certificate of action must be vacated and the plaintiff's action must be dismissed.” Part VII – Discharge of Preserved and Perfected Liens Decision: “ The plaintiff's lien rights set forth in its second claim for lien have been eliminated and discharged by the registration of the Release, and cannot be revived, and thus, the lien must be ordered discharged, and the registration of the lien and certificate of action must be vacated and the plaintiff's action must be dismissed.” Part VII – Discharge of Preserved and Perfected Liens Decision: “ The plaintiff's lien rights set forth in its second claim for lien have been eliminated and discharged by the registration of the Release, and cannot be revived, and thus, the lien must be ordered discharged, and the registration of the lien and certificate of action must be vacated and the plaintiff's action must be dismissed.” Part VIII – Jurisdiction and Procedure Master Calum McLeod Part IX – Extraordinary Remedies Part IX – Extraordinary Remedies s. 68: Receiver & Manager s. 69: Labour and Material Payment Bonds Part X - Appeals Part X - Appeals s. 70: Stated Case Celebrity Flooring Systems Ltd. v. One Shaftesbury Community Association (2003), 25 C.L.R. (3d) 279 (Ont. Master) Part X - Appeals 71(3) No appeal lies from, (a) a judgment or an order on a motion to oppose confirmation of a report under this Act, where the amount claimed is $1,000 or less; or (b) an interlocutory order made by the court. Part X - Appeals s. 71: Appeal to Divisional Court Villa Verde L.M. Masonry Ltd. v. Pier One Masonry Inc. (2001), 54 O.R. (3d) 76 (C.A.): Where a judgment concerns claims only under the Construction Lien Act . . . the appeal is to the Divisional Court in all cases and not to the Court of Appeal for Ontario. Part XI - Priorities Part XI - Priorities What fresh hell is this? Part XI - Priorities Remember first principles No free rides! No unjust enrichment! Section 78 Question 1: is it a building mortgage? yes: mortgagee loses priority for deficiency in holdback, period. no: go to Question 2 Section 78 Question 2: When did the first lien arise? Answer: Before mortgage registered or fully advanced? mortgagee has priority until lien registered or written notice of lien received Answer: After mortgage registered and either fully or partially advanced? mortgagee gets lesser of - actual value when first lien arose - all advances made without notice Section 78 Question 3: Is it a homebuyer’s mortgage? Answer: If it is, the above scheme is irrelevant and the mortgagee has priority Part XII – Miscellaneous Rules s. 86 Part XII – Miscellaneous Rules 86(1) […] An order as to costs may be made against, (b) the solicitor or agent of any party to the action, application or motion, where the solicitor or agent has, (i) knowingly participated in the preservation or perfection of a lien, or represented a party at the trial of an action, where it is clear that the claim for lien is without foundation or is for a grossly excessive amount, or that the lien has expired, or (ii) prejudiced or delayed the conduct of the action Part XII – Miscellaneous Rules 86(2) Where the least expensive course is not taken by a party, the costs allowed to the party shall not exceed what would have been incurred had the least expensive course been taken. Discussion Points What can you do to make the Construction Lien Act work for you and your company? What can your lawyer do to make the Construction Lien Act work for you and your company? THE END.