Hawaii Statute References

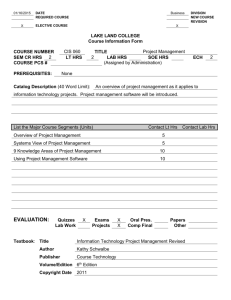

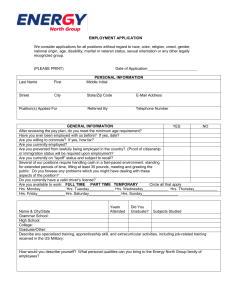

advertisement