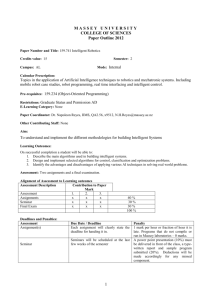

Assessments - Massey University

advertisement

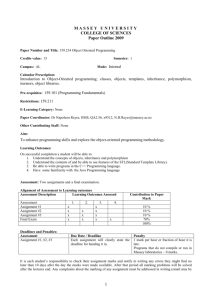

Massey University School of Economics and Finance 125.780 Advanced International Finance (30 credits) Administration Guide Viet Nam, 2012 Dr Christopher B. Malone School of Economics and Finance (PN & Wellington) Massey University 1 This material is protected by copyright and has been copied by and solely for the educational purposes of the University under licence. You may not sell, alter or further reproduce or distribute any part of this course pack/material to any other person. Where provided to you in electronic format, you may only print from it for your own private study and research. Failure to comply with the terms of this warning may expose you to legal action for copyright infringement and/or disciplinary action by the University. 2 Contents Welcome and Course Description ................................................................................. 4 Paper Coordinator.......................................................................................................... 5 Formal Description......................................................................................................... 6 Course Outline ............................................................................................................... 7 Block courses ................................................................................................................. 8 Learning Structure ....................................................................................................... 12 Readings and Resources .............................................................................................. 13 Assessment Overview .................................................................................................. 14 Assessments: ................................................................................................................ 15 Class Presentations: ..................................................................................................... 15 Assignments ................................................................. Error! Bookmark not defined. APPENDICES ................................................................................................................. 18 Appendix 1 - Plagiarism................................................................................................ 18 Appendix 2 - References .............................................................................................. 19 Appendix 3 - Presentation of written work ................................................................. 22 3 Welcome and Course Description As course coordinator for 125.780 Advanced International Finance I’d like to warmly welcome you to this inaugural class for the Viet Nam group. A general overview of the course is that it covers international financial markets and how and why corporations conduct financial transactions in these markets. The main focus is on how the processes can be managed. The first part of the course will examine issues related to the international markets, including foreign exchange markets and currency derivative markets. It will also consider corporate financial management in an international setting, including the implications of legal systems, corporate governance systems, political risk, and exchange rate mechanisms. The next part of the course will consider financial issues associated with the operation of the firm. This part will focus on the identification, measurement, and management of the impact of exchange rates on the firm; project evaluation; financial structure, and the firms' cost of capital and financing decision making in a global market. While the course discusses theoretical basis on the various issues, it also relies on both empirical evidence and discussion of firms' real world activities. The course has a combination lecture and seminar style. It evaluates students through presentations, a test and an exam. This paper is web-based so it makes use of the internet to help create an “online learning environment”. We have permission to use chapter material from Thomas O’Brien’s text International Financial Economics: Corporate Decisions In Global Markets. Please note that University expects you to put in an average of 25 hours per week into this course. Obviously you do a little more in exam week, the block week, and the assignment weeks, and so on, but you can have a few quieter weeks as well. I am sure we can successfully work together to ensure that your studies in this topic will be valuable for you. Best wishes for a successful class. Kind regards, Chris Malone 4 Paper Coordinator Here’s a little background on me. I started out as an accountant and moved into the academic side of that field. I then gravitated to the finance side and earned a masters degree and a PhD (Finance, University of Connecticut). I have taught a range of finance, accounting and economics classes in New Zealand and the United States. My research interests lie in the field of Corporate Finance, Accounting and Investments. I have both a theoretical and applied teaching approach and I enjoy seeing students rise and succeed at the challenge of learning and getting careers. I’m married, with three children. If you have any comments or questions please contact me. Refectory Building 3.15 Email: c.b.malone@massey.ac.nz : (06) 350 5799 x 2334 Postal address: Chris Malone School of Economics and Finance Massey University Private Bag 11 222 Palmerston North 5 Formal Description PRESCRIPTION This paper provides an understanding of the theory, institutions and environment of international finance, investment and management. Students will gain an insight into how exchange rates and their movements affect business organisations and can be managed. The role of conventional financial theory in an international environment will also be considered. LEARNING OUTCOMES On successful completion of this paper students should be able to: 1. Explain the roles played by the major market participants in international financial markets. 2. Analyse the types of derivative instruments traded on foreign exchange markets. 3. Derive the international parity conditions and relate these to macro-economic theories. 4. Measure and evaluate the translation, transaction, economic exposure and other international risks faced by multinationals. 5. Apply informed investment decisions in an international environment. 6 Course Outline Topic Area Week Number Week Starting Foreign Exchange Markets and Products International Corporate Governance and Political Risk International Monetary Environment and BOP Exchange Rate Determination Foreign Exchange Forecasting FX Risk Management - Transaction Exposure Block preparation FX Risk Management - Economic Exposure FX Risk Management - Translation Exposure FX Risk Management Direct Foreign Investment and CrossBorder Acquisitions Cost of Capital – Debt and Equity Multinational Capital Budgeting This course explores the environment firms face when operating in an international setting. Most of the course explores international risks confronting firms, including foreign exchange risk, international product market risk, international competition, and political risk. With risks come opportunities, so the final two sections of the course explore international opportunities available to firms, including the ability to engage in foreign direct investment as well as to raise or place capital internationally. The course is self-contained but does draw on, and extend, the material that is covered in undergraduate international finance text books, such as parity theorems, FX risk and hedging. The course material is covered using selected chapters from O’Brien, international finance journal articles and working papers, along with reading guides to the papers. There is no text book set but most international finance texts can be used to provide background material for the course. 7 Contact/Block course The Block/classroom part of the course runs over June 18 – July 1st and the format will consist of: presentations by the lecturer of course material (see the lecture overheads in Stream). presentations by students of their selected research papers. workshops and tests Presentation List Reading # 1 2 3 4 5 6 7 8 9 Title WEEK TWO - INTERNATIONAL CORPORATE GOVERNANCE Spamann, Holger (2009), The “Antidirector Rights Index” Revisited, Review of Financial Studies (2009) La Porta, R., Lopez-de-Silanes, F., Shleifer, A., Vishny, R.W. , 1998, Law and finance, Journal of Political Economy 106 (6), pp. 1113-1155. No. of peer reviewed citations: 2148. George Allayannis, Ugur Lel, and Darius P. Miller, 2009, Corporate governance and the hedging premium around the world. Electronic copy available at: http://ssrn.com/abstract=460987 WEEK THREE - THE INTERNATIONAL MONETARY ENVIRONMENT AND BALANCE OF PAYMENTS Ferguson, N., Schularick, M., 2011, The End of Chimerica, International Finance 14 (1), pp. 1-26. Dooley, M.P., Folkerts-Landau, D., Garber, P., 2004, The revived Bretton Woods system, International Journal of Finance and Economics 9 (4), pp. 307-313. Citations 39 Dooley, M.P., Folkerts-Landau, D., Garber, P., 2009, Bretton Woods II still defines the international monetary system, Pacific Economic Review 14 (3), pp. 297-311. Citations 8 WEEK FOUR - EXCHANGE RATE DETERMINATION AND FOREIGN EXCHANGE FORECASTING Mei Qiu, John F. Pinfold, Lawrence C. Rose, 2011, Predicting foreign exchange movements using historic deviations from PPP, International Review of Economics and Finance 20 (2011) 485–497. Citations: 0. Anomalies, Froot and Thaler, JEP 1990. Makridakis, S., Taleb, N., 2009, Living in a world of low levels of predictability, International Journal of Forecasting 25 (4), pp. 840-844. Citations: 1. WEEK FIVE - FX RISK OVERVIEW - MANAGING TRANSACTION EXPOSURE Presenter 8 10 11 12 13 George Allayannis, Michael J. Schill, 2010, Financial policies and hedging. M. Bartram, Gregory W. Brown, Bernadette A. Minton, 2010, Resolving the exposure puzzle: The many facets of exchange rate exposure. Journal of Financial Economics 95 (2), pp. 148-173. Citations: 7. WEEK SIX - MANAGING ECONOMIC EXPOSURE George Allayannis, Jane Ihrig, James P. Weston, 2001, Exchange-Rate Hedging: Financial versus Operational Strategies, The American Economic Review, Vol. 91, No. 2, pp. 391-395 J. Lewent and J. Kearney, “Identifying, Measuring, and Hedging Currency Risk at Merck,” Journal of Applied Corporate Finance, Winter 1990, 19-28. 9 Reading # 12 14 15 16 17 Title WEEK SIX & SEVEN - MANAGING TRANSLATION EXPOSURE George Allayannis, Jane Ihrig, James P. Weston, 2001, Exchange-Rate Hedging: Financial versus Operational Strategies, The American Economic Review, Vol. 91, No. 2, pp. 391-395 Thomas J. O’Brien, Accounting versus economic exposure to currency risk, Journal of Financial Statement Analysis, Summer 1997, 21-29 Ziebart D. A. and Kim, D.H., 1987, An analysis of the market reactions to changes from FASB 8 to FASB 52, The Accounting Review, pp. 343-357. WEEK EIGHT - MANAGING FX EXPOSURE George Allayannis and James P. Weston, 2001, The Use of Foreign Currency Derivatives and Firm Market Value, The Review of Financial Studies, Vol. 14, No. 1 (Spring, 2001), pp. 243-276. Prof. Dr. Martin Glaum (2011) Selective Hedging of Exchange Rate Exposures and the Performance of Exchange Rate Forecasts, SSRN working paper, SSRN. WEEK NINE - FOREIGN DIRECT INVESTMENT AND INTERNATIONAL ACQUISITIONS 18 19 20 21 22 23 24 25 Baker, Foley, and Wurgler, 2007, Multinationals as arbirtrageurs? The effect of stock market valuations on foreign direct investment, Review of Financial Studies. Malone, C.B., and L.C. Rose, 2006, Intangible assets and geographic diversification, (2006) International Journal of Managerial Finance, vol. 2, no. 2, pp. 136-153 WEEK TEN - COST OF CAPITAL – DEBT AND EQUITY Globalization of Capital Markets and the Cost of Capital: The Case of Nestle, R. Stulz, JACF, Fall 1995 Exchange Rates and International Differences in the Cost of Capital, McCaulley and Zimmer, FRBNY Quarterly Review, 1994 WEEK ELEVEN - MULTINATIONAL CAPITAL BUDGETING Tom Keck, Eric Levengood, Al Longfield, 1998, Using Discounted Cash Flow Analysis in an International Setting: A Survey of Issues in Modeling the Cost of Capital, Journal of Applied Corporate Finance, 11 3. Valuation in Emerging Markets, McKinsey , Fall 2000 Howell and Chaddick, 1994, Models of political risk for foreign investment and trade, Columbia Journal of World 10 26 27 Business, 70-91. Butler and Fauver, 2006, Institutional environment and sovereign credit ratings, Financial Management, 53-79. Mahajan, A. (1990) Pricing expropriation risk, Financial Management 1990, 77-86. 11 Learning Structure Each modules work is allocated a 3½ hour session of contact time and this will be broken into a session of lecture material, a workshop session, and session for case/article presentations. The articles are to be read in advance and presented and discussed in class. A major focus of the course is to learn to read important papers in international finance and present these in class. The other focus is for students to obtain a sufficient understanding of the course material to successfully undertake and pass the tests and final examination. On the stream site you will find the materials to use on the course: study guide - lecture slides journal articles chapter material from O'Brien, Thomas J. International Financial Economics : Corporate Decisions In Global Markets copies of past final examination papers discussion board notice board 12 Readings and Resources Required Text There is no set text, but we have permission to use several chapters of: O'Brien, Thomas J. (2012) International Financial Economics : Corporate Decisions In Global Markets. 3rd ed., New York : Oxford University Press, 2005 Recommended Reading You are expected to keep abreast of current issues relating to the field of international finance. Please keep an eye on e-news sites like Yahoo.Finance.com. Examples of good all-round texts to read are as follows: Eun and Resnick (2009). International Financial Management. 5th Ed, New York, USA: McGraw-Hill. Butler, Kirt (1997). Multinational Finance. Cincinati Ohio, USA: SouthWestern College Publishing. Eiteman David K, Stonehill Arthur I, and Moffett Michael H, (2006) Multinational Business Finance. Eleventh Edition, Reading, Massachusetts, USA: Addison Wesley, 2006. Levi, Maurice D. (1996). International Finance. Third edition, New York, USA: McGraw-Hill. Madura, Jeff. (1998 International Financial Management. Fifth edition, New York, USA: West. Shapiro, Alan (1999) Multinational financial management, New York, USA: John Wiley & Sons. Other references include journals, bank commentaries, company annual reports, magazines, OECD statistics, and WIKIPEDIA. 13 Assessment Overview Assessment Due Date Weighting Test 1 TBA 10% Link to Learning Outcomes 1,2,3,4,5 Test 2 TBA 10% 1,2,3,4,5 Presentations TBA 20% Varies 60% 1,2,3,4,5 Final Examination 14 Assessments: Class Presentations: Each student group will present two (depending on class numbers) of the readings on offer during the course (see the list above). Each one is worth 10 marks. Each presentation will be assigned ½ hour. A power point summary of the paper should be distributed at the time of the presentation. Please let me know by email which of the set papers you want to select, otherwise they will be assigned. Test Details These assessments will be conducted in class, 10% each. Test 1 will examine material up to and including week 3 of the course. This test will be mainly focused at the concept and problem level where students are expected to illustrate their understanding of Foreign Exchange Markets and Products, International Corporate Governance and Political Risk, and International Monetary Environment and BOP. This section will be multi-choice in nature. There will be plenty of practice quizzes that can be used to develop your skills. You will need to be familiar with the readings as well to answer some short answer questions. Test 2 will examine material from week 4 - week 7 of the course. The areas covered are Exchange Rate Determination and Forecasting, FX Risk Management Transaction Exposure and Economic Exposure. This test will also examine a range of multi-choice problems as well as test your understanding of the readings and presentation material which will be tested in short answer format. 15 Final Examination Details The final three-hour examination makes up 60% of your total mark. Purpose: to examine your written communications ability. to examine your mastery of the learning outcomes in the course. to give you a chance to apply the theories, concepts, and techniques covered in the course. The exam will include material from all parts of the course. Dishonesty in any Assessment or Examination Dishonest practice in connection with any examination or assessment is considered to be a breach of the Code of Student Conduct. A detailed account of the processes for resolution of complaints of misconduct, including the procedures for student appeals, is described in the Disciplinary Procedures for Students available from the Massey University Policy Guide at http://policyguide.massey.ac.nz (Massey University Calendar 2009). Aegrotat Consideration and Impaired Performance Aegrotat Candidates who have been prevented by illness, injury, bereavement or other critical personal circumstances from presenting themselves at any examination, compulsory component, or assessment activity may apply for AEGROTAT consideration. An AEG pass or DNC grade will be the normal outcome of an application unless a significant portion of the total formal assessment (normally 50% or more) has been completed and the paper coordinator considers the award of a letter grade appropriate. To be awarded an AEG pass, the candidate's University teachers in the paper or papers affected must be confident that the student would have passed the paper had the assessment for which the Aegrotat application was made been completed. Impaired Performance Candidates who consider that their performance in, or preparation for, any examination or assessment activity has been seriously impaired due to illness, injury, bereavement or other critical personal circumstances may apply for Impaired Performance consideration. 16 For impaired performance applications, paper coordinators will assess the typical performance of a student during the paper and, where the student's performance for the assessment item covered by the application was atypically poorer than that achieved in other assessment tasks, and in relation to the overall class performance for the assessment in question, assign a mark for the assessment item and an overall letter grade for the paper based upon this information. 17 APPENDICES Appendix 1 - Plagiarism Using someone else’s ideas/or work without citing the source is plagiarism and is not acceptable. The University Calendar states that there are strict penalties for plagiarism. Plagiarism applies to any material: written, spoken, recorded, electronic, broadcasted, visual, performance or other medium. If you use the words of another author you must enclose them in quotation marks. You must cite a page number and the full reference in the Reference List. When you have included the ideas of another author you are required to reference the source of those ideas. Contact the Student Learning Centre for information on how to avoid plagiarism. Penalties for Plagiarism The School of Finance supports and will rigorously enforce the Massey University policy on plagiarism. The School of Finance will take the following actions when plagiarism is discovered: i Where there is clear evidence that a student has copied another student’s work, neither of the students involved will receive marks for the work. ii For repeated offences or other serious transgressions, more serious penalties, such as failure in a whole paper or exclusion from the University, may be imposed. 18 Appendix 2 - References Citing References The reference system used should enable you to indicate the source of facts and opinions without interrupting the flow of your argument, and it must enable a reader to check and pursue these citations quickly and economically. These guidelines are based on the APA (American Psychological Association) referencing system. APA (2001). Publication manual (5th ed.). Washington, DC: American Psychological Association. When a reference is made in the body of the assignment it is sufficient to mention the name of the author, the year of publication, and the page number, e.g.: “..it has been urged (Kotler, 1986, p.9) that …”, or “..it has been urged by Kotler (1986, p.9) that …” Cite electronic sources as for other texts. Where page numbers are not provided, use the paragraph number, if available, preceded by the paragraph symbol or the abbreviation para. If neither paragraph nor page numbers are visible, cite the heading and the number of the paragraph following it to direct the reader to the location of the material. “.. Myers (2000, p. 5) believes..,” or “.. (Beutler, 2000, Conclusion section, para. 1)..” Reference List All references cited in the text must be reported in full standard bibliographical form under a heading “References” at the end of the assignment. The references should be arranged alphabetically by author’s surname. When listing references, all lines except the first should be indented five spaces (typically one tab stop). Note the use of italics (or underlining), capitalisation, punctuation and order of elements. For a book, italics should be used for the title. For journal articles, the title of the journal, and the volume number, should be italicised. If your word processor or printer cannot do italics, underline these elements. 19 The preferred format for different types of publications is as follows: Books Biggs, J.B., & Tang, C. (2007). Teaching for quality learning at university: What the student does. (3rd ed.). New York: Open University Press. Ramsden, P. (1997). The context of learning in academic departments. In F. Martin, D. Hounsell, & N. Entwistle (Eds.). The experience of learning (2nd ed.) (pp. 198216). Edinburgh, Great Britain: Scottish Academic Press. Sligo, F. (1991). Organisational behaviour: Case studies and commentaries. Palmerston North, New Zealand: Dunmore Press. Stephenson, J. (Ed.). (2001). Teaching and learning online: New pedagogies for new technologies. London: Kogan Page. Periodicals Becker, L.J., & Seligman, C. (1981). Welcome to the energy crisis. Journal of Science Issues, 37(2), 1-7. Emerson, A-M. (1991, December 10-17). Bald is beautiful. The Listener, p. 16. Tait, A.R. (2004). Clinical governance in primary care: A literature review. Journal of Clinical Nursing, 13, 723-730. Battling the stress monster. (1996, June/July). Safeguard, 17-22. N.B. use this style when no author is identified or use (n.a.) where author’s name would usually be, date then title. Occasional publications Irons, B. (1996, April). Quality study guides. Paper presented at the DEANZ Conference, Queenstown. Wifley, D. E. (1989). Interpersonal analysis of bulimia: Normal-weight and obese. Unpublished doctoral dissertation. University of Missouri, USA. 20 Electronic Periodicals Campbell, I. (2003). The obesity epidemic: Can we turn the tide? Heart, 89(Suppl. 2), ii22-ii24; discussion ii35-ii37. Abstract retrieved May 21, 2003, from MEDLINE database. Stiles, P. (2001). The impact of the board on strategy: An empirical examination [Electronic version]. Journal of Management Studies, 38(5), 627-650. Internet All references begin with the same information that would be provided for a printed source (or as much of that information as possible). The web information is then placed at the end of the reference. It is important to use “Retrieved from” and the “date” because documents on the web may change in content, move, or be removed from a site altogether. Zheng, L., & Smaldino, S. (2003). Key instructional design elements for distance education. The Quarterly Review of Distance Education 4(2), 153-166. Retrieved 15 May 2006, from ERIC database. Health of older people in New Zealand. (n.d.). Retrieved May 21, 2003 from http://www.moh.govt.nz/olderpeople Note: (n.d.) = no date Begin with the title when no author is identified. Court Reporter. (2002, November 21). Alcohol-fuelled driving appals judge. Manawatu Evening Standard. Retrieved May 21, 2003, from http://www.stuff.co.nz/stuff/eveningstandard/0,2106,2489959a6502,00.html Stephens, D. (2003, April 24). Why do some people have such a need for control? [Msg 430]. Message posted to http://groups.yahoo.com/group/abusesurvivors-with-ptsd/message/430 21 Appendix 3 - Presentation of written work Presentation is an important area. Assignments that are succinct, with an active writing style are preferred. University plagiarism rules must be observed. Please consider the following areas when you do your assignment: description of, and understanding of relevant issues using evidence to support any viewpoints definitions and logical development referencing Additionally, please provide your full names and student id numbers on the document. 22