Rev. Proc. 2013-14

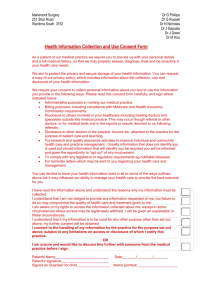

advertisement

Consents & Disclosures What You Really Need To Know! • All audio is streamed through your computer speakers. • There will be several attendance verification questions during the LIVE webinar that must be answered via the online quiz at the conclusion to qualify for CPE. • For the archived/recorded version of this webinar, there are also 3 review questions per hour and the link to the attendance verification quiz is a final exam on the topics covered during the presentation. • Please note: You will not hear any sound until the webinar begins. 1 Consents & Disclosures What You Really Need To Know! Presenter(s): Kathy Hettick, EA, ABA, ATP and Gene Bell, EA, ATA, CFP® Date: November 4, 2014 Time: 2:00-3:00 PM Eastern Learning Objectives At the end of this session you will be able to: • Understand the basic rules of §7216 and §6713 • Apply the requirements of Rev. Proc. 2013-14 • Identify potential areas of non-compliance and the penalty risks • Apply process and procedures in your office to meet the disclosure requirements 3 History of Tax Confidentiality Laws • Traced to Civil War Income Tax Act of 1862 • IRC § 6103 in the Tax Reform Act of 1976 • Gramm-Leach-Bliley Act of 1999 • IRC § 7216 & § 7431 What is IRC § 7216 • A criminal provision enacted in 1971 –Knowingly or recklessly disclosure or use • New regulations added 4 areas: –Civil Penalties –Electronic Filing –Cross Marketing –Updated Regulations What is IRC § 6713 • A civil preparer penalty –For unauthorized disclosure or use –$250/each not to exceed $10,000/year • The rules of § 7216 apply Regulations: Who do they apply to? • Paid Preparers – YOU, ME, US! • Electronic Return Originators & Transmitters • Support Contractors or Employees • Volunteer Preparers for VITA & TCE • Software Developers Rev. Proc. 2013-14 • Supersedes Rev. Proc. 2008-35 • Effective date extended to January 1, 2014 by Rev. Proc. 2013-19 Overview of Rev. Proc. 2013-14 • Applies to Form 1040 series returns • Multiple disclosures and multiple uses on one consent • Consent form format • Prescribed language • Electronic consent permitted 9 Rev Proc 2010-4; 2010-5 • 2010-4: Five acceptable scenarios –Tax law changes –Related services –Newsletters –Marketing –Economic or educational analysis • 2010-5 –Sharing with liability insurance carriers Disclosure and Use of Tax Return Information • What is “tax return information”? • What are “disclosures” of tax return information? • What are “uses” of tax return information? Two Types of Disclosures • Permissible disclosures without taxpayer consent • Disclosure requiring taxpayer consent Consent to Disclose and to Use When & How WHEN • Before Returns are Provided • Before Tax Return Information is Disclosed HOW • All tax returns • Paper Consent Form • Electronic Consent Form Consent to Disclose and to Use • 1040 Series Consents –Specify nature of the disclosure –To whom the disclosure will be made –Details on the data to be disclosed –Specific language • Refer to Reg. 301.7216-3(a)(3) Disclosing Outside the United States • Special Rules • Exceptions • See Rev. Proc. 2013-14 section 3.04 §301.7216-3(b)(4) ACA and §7216 • Will taxpayer consent be required to provide general information to clients? • Will taxpayer consent be required to solicit and facilitate enrollment if I become a health care “navigator”? 16 Practice Tip: Check Your Tax Software • May Have Fill In Forms For –Consent to Use or Disclose –Power of Attorney 2848 –Ability to E-File Forms Review Questions for Self Study CPE: Now’s the time to answer the review questions 1-3. Click here: http://www.proprofs.com/quiz-school/story.php?title=ODUzMDM3S24F *Once all questions are complete please submit and close quiz window. 18 Penalties • Civil Penalty - §6713 –$250 For each incident –Not to exceed $10,000 for a calendar year • Criminal Penalty - §7216 –Misdemeanor –One year of Imprisonment • Or BOTH of the above – YIKES! Practice Tip! When in Doubt GET CONSENT Questions? Kathy Hettick, EA, ABA, ATP Gene Bell, EA, ATP, CFP® Hettick & Bell Enterprise Awareness 1700 Iowa Street Bellingham, WA 98229-4407 http://www.hettickandbell.com/ Email: info@hettickandbell.com 21 Thank you for participating in this webinar. Below is the link to the online survey and CPE quiz: http://webinars.nsacct.org/postevent.php?id=13622 Use your password for this webinar that is in your email confirmation. You must complete this survey and the quiz or final exam (for the recorded version) to qualify to receive CPE credit. National Society of Accountants 1010 North Fairfax Street Alexandria, VA 22314-1574 Phone: (800) 966-6679 members@nsacct.org 22