UCP 600 and Its Legal Aspects

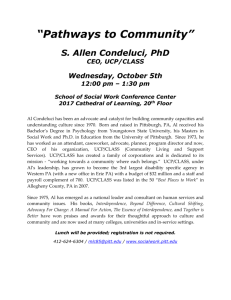

advertisement

UCP 600 and Its Legal Aspects Dr. Ramlan Ginting 2013 Letter of Credit bank obligation to pay agency contract Issuing Bank Correspondent Bank L/C contract to issue L/C L/C advice sales contract Buyer Seller shipment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 2 Status of the UCP 600 A set of contractual rules Universal acceptance by practitioners (uniformity in practice) The most successful set of private rules for trade The sixth revision UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 3 Application of UCP under UCP 600, Article 1 The Uniform Customs and Practice for Documentary Credits, 2007 Revision, ICC Publication No. 600 (“UCP”) are rules that apply to any documentary credit (“credit”) (including, to the extent to which they may be applicable, any standby letter of credit) when the text of the credit expressly indicates that it is subject to these rules. They are binding on all parties thereto unless expressly modified or excluded by the credit Credit = L/C UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 4 Meaning of Honour under UCP 600, Article 2 To pay at sight To incur a deferred payment undertaking and pay at maturity To accept a bill of exchange drawn by the beneficiary and pay at maturity Payment on deferred payment undertaking could be based on the Law on Promissory Note Payment by acceptance is in compliance with the Law on Bill of Exchange, not the UCP UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 5 Meaning of Negotiation under UCP 600, Article 2, cont… The purchase by the nominated bank of draft (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank The purchase of a draft is in compliance with the Law on Bill of Exchange, not the UCP UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 6 Independent Contracts Rule under UCP 600, Article 4 L/C is a separate transaction from the sale or other contract The undertaking of a bank to honour, to negotiate or to fulfill any other obligation under the L/C is not subject to claims or defenses by the applicant resulting from its relationships with the issuing bank or the beneficiary UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 7 Independent Contracts Rule under UCP 600, Article 4, cont… A beneficiary can in no case avail itself of the contractual relationships existing between banks or between the applicant and the issuing bank The Independent Contracts Rule is also in compliance with the Law on Letter of Credit UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 8 Document Compliance Rule under UCP 600, Article 5 Banks deal with documents and not with goods, services or performance to which the documents may relate Doctrine of Not In Contradiction (the UCP 600) Doctrine of In Compliance (the UCP 500) Doctrine of Strict Compliance (the Law on Letter of Credit) UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 9 Availability of L/C under UCP 600, Article 6 L/C must state the bank with which it is available, or L/C may be available with any bank L/C available with a nominated bank is also available with the issuing bank UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 10 Expiry Date for Presentation under UCP 600, Article 6, cont… L/C must state an expiry date for presentation An expiry date stated for honour or negotiation will be deemed to be an expiry date for presentation UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 11 Place for Presentation under UCP 600, Article 6, cont… The place of the bank with which the L/C is available is the place for presentation The place for presentation under L/C available with any bank is that of any bank The place of presentation is also the place of the issuing bank UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 12 Issuing Bank Undertaking under UCP 600, Article 7 The issuing bank must honour a complying presentation if the credit is available by sight payment, deferred payment or acceptance with the issuing bank The issuing bank must honour if the credit is available by sight payment, deferred payment, acceptance or negotiation with a nominated bank and that nominated bank does not perform its nomination UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 13 Issuing Bank Undertaking under UCP 600, Article 7, cont… Issuing bank is irrevocably bound to honour as of the time it issues the L/C Issuing bank undertakes to reimburse a nominated bank that has honoured or negotiated a complying presentation and forwarded the documents to the issuing bank UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 14 Issuing Bank Undertaking under UCP 600, Article 7, cont… Reimbursement under the L/C available by acceptance or deferred payment is due at maturity, whether or not the nominated bank prepaid or purchased before maturity Issuing bank’s undertaking to reimburse a nominated bank is independent of the issuing bank’s undertaking to the beneficiary UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 15 Confirming Bank Undertaking under UCP 600, Article 8 Confirming bank must honour a complying presentation if L/C is available by sight payment, deferred payment or acceptance with the confirming bank Confirming bank must honour a complying presentation if L/C is available by sight payment, deferred payment, acceptance or negotiation with another nominated bank and that nominated bank does not perform its nomination UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 16 Confirming Bank Undertaking under UCP 600, Article 8, cont… Confirming bank must negotiate a complying presentation, without recourse, if the L/C is available by negotiation with the confirming bank Confirming bank is irrevocably bound to honour or negotiate as of the time it adds its confirmation to the L/C Confirming bank undertakes to reimburse another nominated bank that has honoured or negotiated a complying presentation and forwarded the documents to the confirming bank UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 17 Confirming Bank Undertaking under UCP 600, Article 8, cont… Reimbursement under the L/C available by acceptance or deferred payment is due at maturity, whether or not another nominated bank prepaid or purchased before maturity Confirming bank’s undertaking to reimburse another nominated bank is independent of the confirming bank’s undertaking to the beneficiary UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 18 Advising of L/C and Amendment under UCP 600, Article 9 L/C and its amendment may be advised to a beneficiary through an advising bank Advising bank advises the L/C and its amendment without any undertaking to honour or negotiate Advising bank could be as confirming bank Advising bank signifies that it has satisfied itself as to the apparent authenticity of the L/C or amendment and that the advice accurately reflects the terms and conditions of the L/C or amendment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 19 Advising of L/C and Amendment under UCP 600, Article 9, cont… Advising bank may utilize the services of second advising bank to advise the L/C and any amendment to the beneficiary The second advising bank signifies that it has satisfied itself as to the apparent authenticity of the advice it has received and that the advice accurately reflects the terms and conditions of the L/C or amendment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 20 Advising of L/C and Amendment under UCP 600, Article 9, cont… The advising bank that cannot satisfy itself as to the apparent authenticity of the L/C, the amendment or the advice, must so inform, without delay, the bank from which the instructions appear to have been received. If the advising bank elects to advise the L/C or amendment, it must inform the beneficiary (or second advising bank) that it has not been able to satisfy itself. Amendments under UCP 600, Article 10 L/C can neither be amended nor cancelled without the agreement of the issuing bank, the confirming bank, and the beneficiary A confirming bank may extend its confirmation to an amendment The beneficiary is required to communicate its acceptance of the amendment to the bank that advised such amendment by notification of acceptance or rejection A bank that advises an amendment should inform the bank from which it received the amendment of any notification of acceptance or rejection UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 22 Teletransmitted and Pre-Advised Credits and Amendments under UCP 600, Article 11 An authenticated teletransmission of L/C or amendment will be deemed to be the operative L/C or amendment, except the teletransmission states others A pre-advice of L/C or amendment shall only be sent if the issuing bank is prepared to issue the operative L/C or amendment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 23 Nomination under UCP 600, Article 12 Nominated bank may honour or negotiate a complying presentation, but confirming bank as a nominated bank must honour or negotiate By nominating a bank to accept a draft or incur a deferred payment undertaking, an issuing bank authorizes that nominated bank to prepay or purchase a draft accepted or a deferred payment undertaking incurred by that nominated bank Banco Santander SA vs Banque Paribas is the basis of rule for discounting the deferred payment undertaking UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 24 Bank-to-Bank Reimbursement under UCP 600, Article 13 L/C may state that reimbursement is to be obtained by a nominated bank claiming on reimbursing bank. In this regard, the L/C must state if the reimbursement is subject to the ICC Rules for Bank-to-Bank Reimbursements in effect on the date of issuance of the L/C If the L/C does not state that reimbursement is subject to the ICC Rules for Bank-to-Bank Reimbursements, then Article 13b of the UCP 600 that stipulates reimbursement shall apply UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 25 Bank-to-Bank Reimbursement under UCP 600, Article 13, cont… Issuing bank is not relieved of any of its obligations to provide reimbursement if reimbursement is not made by a reimbursing bank on first demand Standard for Examination of Documents under UCP 600, Article 14 Nominated bank, confirming bank, and issuing bank must examine a presentation to determine a complying presentation under ‘on their face’ rule. Nominated bank, confirming bank, and issuing bank shall each have a maximum of five banking days following the day of presentation to determine a complying presentation. This period is not curtailed or otherwise affected by the occurrence on or after the date of presentation of any expiry date or last day for presentation. UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 27 Standard for Examination of Documents under UCP 600, Article 14, cont… Presentation must be made by or on behalf of the beneficiary not later than 21 calendar days after the date of shipment, but not later than the expiry date of the L/C UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 28 Standard for Examination of Documents under UCP 600, Article 14, cont… Data in a document, when read in context with the L/C, the document itself and international standard banking practice, need not be identical to, but must not conflict with, data in that document, any other stipulated document or the L/C In documents other than the commercial invoice, the description of the goods, services or performance may be in general terms not conflicting with their description in the L/C UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 29 Standard for Examination of Documents under UCP 600, Article 14, cont… A document may be dated prior to the issuance date of the L/C, but must not be dated later than its presentation date UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 30 Standard for Examination of Documents under UCP 600, Article 14, cont… The addresses of the beneficiary and the applicant in any document need not be the same as those in the L/C or other document, but must be within the same country as the respective addresses in the L/C The shipper or consignor of the goods need not be the beneficiary UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 31 Complying Presentation under UCP 600, Article 15 Issuing bank must honour a complying presentation Confirming bank must honour or negotiate a complying presentation and forward the documents to the issuing bank Nominated bank that honours or negotiates a complying presentation must forward the documents to the confirming bank or issuing bank UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 32 Discrepant Documents, Waiver and Notice under UCP 600, Article 16 Nominated bank, confirming bank, or issuing bank may refuse to honour or negotiate a non-complying presentation Issuing bank may, in its sole judgment, approach the applicant for a waiver of discrepancy UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 33 Discrepant Documents, Waiver and Notice under UCP 600, Article 16, cont… Nominated bank, confirming bank or issuing bank that decides to refuse to honour or negotiate a non-complying presentation must give a single notice to that effect to the presenter no later than the close of the fifth banking day following the day of presentation UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 34 Discrepant Documents, Waiver and Notice under UCP 600, Article 16, cont… Single notice, must state: a. a bank is refusing to honour or negotiate, and b. discrepancy as the basis of the refusal of the bank, and UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 35 Discrepant Documents, Waiver and Notice under UCP 600, Article 16, cont… c. a bank is holding the documents pending further instructions from the presenter; or the issuing bank is holding the documents untill receiving a waiver from the applicant and agreeing to accept it, or receiving further instructions from the presenter prior to agreeing to accept a waiver; or the bank is returning the documents; or the bank is acting in accordance with instructions previously received from the presenter UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 36 Discrepant Documents, Waiver and Notice under UCP 600, Article 16, cont… Issuing bank or confirming bank that fails to act in accordance with the provisions of Article 16 of the UCP 600, shall be precluded from claiming that the documents do not constitute a complying presentation UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 37 Discrepant Documents, Waiver and Notice under UCP 600, Article 16, cont… Issuing bank that refuses to honour or confirming bank that refuses to honour or negotiate and has given notice to that effect in accordance with the provision of Article 16 of the UCP 600, shall be entitled to claim a refund, with interest, of any reimbursement made UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 38 Original Documents and Copies under UCP 600, Article 17 At least one original of each document must be presented Requirement of the copy of documents is fulfilled by presentation of either originals or copies Requirement of multiple documents (in duplicate, in two fold, in two copies) is fulfilled by the presentation of at least one original and the remaining number in copies, except when the document itself indicates otherwise. UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 39 Commercial Invoice under UCP 600, Article 18 Commercial invoice must appear to have been issued by the beneficiary (except in case of transferable L/C), must be made out in the name of the applicant (except in case of transferable L/C), must be made out in the same currency as the L/C, and need not be signed UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 40 Commercial Invoice under UCP 600, Article 18, cont… Nominated bank, confirming bank, or issuing bank may accept a commercial invoice issued for an amount in excess of the amount permitted by the L/C, provided the bank in question has not honoured or negotiated for an amount in excess of that permitted by the L/C Description of the goods, services or performance in a commercial invoice must correspond with that appearing in the L/C UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 41 Transport Document under UCP 600, Articles 19, 20, and 21 Indication of the name of the carrier Be signed by the carrier, master, or agent Signature must be identified No name of master needed when the agent signed Sole original transport document, or full set No indication subject to a charter party Indication of transhipment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 42 Transport Document under UCP 600, Articles 22 Indication of a charter party Be signed by the master, owner, charterer, or agent Signature must be identified Indication of the name of the owner or charterer needed when the agent signed Sole original charter party bill of lading, or full set UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 43 Transport Document under UCP 600, Articles 23 Indication of the name of the carrier Be signed by the carrier or agent Signature must be identified Sole original transport document, or full set The original for consignor or shipper Indication of transhipment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 44 Transport Document under UCP 600, Articles 24 Indication of the name of the carrier Be signed by the carrier or agent Signature must be identified Sole original transport document, or full set Indication of transhipment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 45 Transport Document under UCP 600, Articles 25 Courier receipt Indication of the name of the courier service Be stamped or signed by the named courier service Post receipt or certificate of posting Be stamped or signed UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 46 “On Deck”, “Shipper’s Load and Count”, “Said by Shipper to Contain” and Charges Additional to Freight under UCP 600, Articles 26 A transport document must not indicate that the goods are or will be loaded on deck A transport document bearing a clause such as “shipper’s load and count” and “said by shipper to contain” is acceptable A transport document may bear a reference, by stamp or otherwise, to charges additional to the freight UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 47 Insurance Document and Coverage under UCP 600, Article 28 Insurance document, such as an insurance policy, an insurance certificate or a declaration under open cover, must appear to be issued and signed by an insurance company, an underwriter or their agents or their proxies When the insurance document indicates that it has been issued in more than one original, all originals must be presented UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 48 Insurance Document and Coverage under UCP 600, Article 28, cont… Cover note will not be accepted The date of the insurance document must be no later than the date of shipment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 49 Insurance Document and Coverage under UCP 600, Article 28, cont… The insurance document must indicate the amount of insurance coverage and be in the same currency as the L/C If there is no indication in the L/C of the insurance coverage, the amount of insurance coverage must be at least 110% of the CIF or CIP value of the goods UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 50 Insurance Document and Coverage under UCP 600, Article 28, cont… The insurance document must indicate that risks are covered at least between the place of taking in charge or shipment and the place of discharge or final destination as stated in the L/C Extention of Expiry Date or Last Day for Presentation under UCP 600, Article 29 The expiry date of L/C or the last day for presentation that falls on a day when the bank to which presentation is to be made is closed, the expiry date or the last day for presentation will be extended to the first following banking day. However, the latest date for shipment will not be extended UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 52 Tolerance in Credit Amount, Quantity and Unit Prices under UCP 600, Article 30 The words “about” or “approximately” used in connection with the amount or the quantity or the unit price in the L/C are to be construed as allowing a tolerance not to exceed 10% more or less to which they refer A tolerance not to exceed 5% more or less than the quantity allowed, provided the total amount of the drawings does not exceed the amount of the L/C and the L/C does not state a stipulated number of packing units or individual items UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 53 Tolerance in Credit Amount, Quantity and Unit Prices under UCP 600, Article 30, cont… Even when partial shipments are not allowed, a tolerance not to exceed 5% less than the amount of the L/C is allowed, provided the full quantity of the goods is shipped and a unit price is not reduced. However, this tolerance does not apply when the L/C stipulates a specific tolerance. UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 54 Partial Drawings or Shipments under UCP 600, Article 31 Partial drawings or shipments are allowed Partial shipments versus non-partial shipments UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 55 Instalment Drawings or Shipments under UCP 600, Article 32 If a drawing or shipment by instalments within given periods is stipulated in the L/C and any instalment is not drawn or shipped within the period allowed for that instalment, the L/C ceases to be available for that and any subsequent instalment UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 56 Hours of Presentation under UCP 600, Article 33 A bank has no obligation to accept a presentation outside of its banking hours UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 57 Disclaimer on Effectiveness of Documents Under UCP 600, Article 34 A bank assume no liability or responsibility for the form, sufficiency, accuracy, genuineness, falsification or legal effect of any document, or for the general or particular conditions stipulated in a document or superimposed thereon; UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 58 Disclaimer on Effectiveness of Documents Under UCP 600, Article 34, cont… nor does it assume any liability or responsibility for the description, quantity, weight, quality, condition, packing, delivery, value or existence of the goods, services or other performance represented by any document, or for the good faith or acts or omissions, solvency, performance or standing of the consignor, the carrier, the forwarder, the consignee or the insurer of the goods or any other person Fraud or Injunction is settled under the Law on Letter of Credit UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 59 Disclaimer on Transmission and Translation under UCP 600, Article 35 A bank assumes no liability or responsibility for the consequences arising out of delay, loss in transit, mutilation or other errors arising in the transmission of any messages or delivery of letters or documents, when such messages, letters or documents are transmitted or sent according to the requirements stated in the L/C, or when the bank may have taken the initiative in the choice of delivery service in the absence of such instructions in the L/C UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 60 Disclaimer on Transmission and Translation under UCP 600, Article 35, cont… If a nominated bank determines that a presentation is complying and forwards the documents to the issuing bank or confirming bank, the issuing bank or confirming bank must honour or negotiate, or reimburse that nominated bank, even when the documents have been lost in transit A bank assumes no liability or responsibility for errors in translation or interpretation of technical terms and may transmit L/C terms without translating them UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 61 Force Majeure under UCP 600, Article 36 A bank assumes no liability or responsibility for the consequences arising out of the interruption of its business by Acts of God, riots, civil commotions, insurrections, wars, acts of terrorism, or by any strikes or lockouts or any other causes beyond its control A bank will not, upon resumption of its business, honour or negotiate under L/C that expired during such interruption of its business UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 62 Disclaimer for Acts of an Instructed Party under UCP 600, Article 37 A bank utilizing the services of another bank for the purposes of giving effect to the instructions of the appllicant does so for the account and at the risk of the applicant An issuing bank or advising bank assumes no liability or responsibility should the instructions it transmits to another bank not be carried out, even if it has taken the initiative in the choice of that other bank UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 63 Disclaimer for Acts of an Instructed Party under UCP 600, Article 37, cont… A bank instructing another bank to perform services is liable for charges that are commissions, fees, costs or expenses incurred by that bank in connection with its instructions The applicant shall be bound by and liable to indemnify a bank against all obligations and responsibilities imposed by foreign laws and usages UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 64 Transferable L/C under UCP 600, Article 38 L/C is transferred upon approval of the transferring bank, and an issuing bank may be a transferring bank Transferable L/C means L/C that specifically states it is “transferable” Transferable L/C may be made available in whole or in part UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 65 Transferable L/C under UCP 600, Article 38, cont… Transferred L/C means L/C that has been made available by the transferring bank to a second beneficiary at the request of the first beneficiary L/C may be transferred in part to more than one second beneficiary provided partial drawings or shipments are allowed Transferred L/C cannot be transferred at the request of a second beneficiary to any subsequent beneficiary UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 66 Transferable L/C under UCP 600, Article 38, cont… The transferred L/C must accurately reflect the terms and conditions of the L/C, including confirmation, if any, with the exception of : the amount the unit price the expiry date the period for presentation, or the latest shipment date or given period for shipment, any or all of which may be reduced or curtailed UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 67 Transferable L/C under UCP 600, Article 38, cont… The percentage of insurance cover may be increased to provide the amount of cover stipulated in the L/C or UCP 600 UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 68 Transferable L/C under UCP 600, Article 38, cont… The name of the first beneficiary may be substituted for that of the applicant in the L/C If the name of the applicant is specifically required by the L/C to appear in any document other than the invoice, such requirement must be reflected in the transferred L/C UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 69 Transferable L/C under UCP 600, Article 38, cont… Presentation of documents by or on behalf of a second beneficiary must be made to the transferring bank UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 70 Assignment of Proceeds under UCP 600, Article 39 A beneficiary has a right to assign any proceeds to which it may be or may become entitled under the L/C, in accordance with the provisions of applicable law UCP 600 and Its Legal Aspects, Dr. Ramlan Ginting, 2007 71 THANK YOU