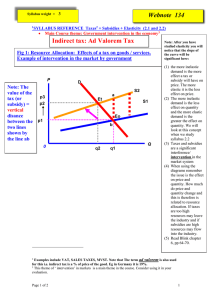

Incidence of the tax/subsidy

Topic: Taxes & Subsidies: Incidence

on Consumers or Producers

Outcome: Explain with Graphs how

elasticity of demand determines how the incidence of a tax or subsidy is split between a consumer

& a producer.

Subsidies:

• Draw up 2 S & D models. 1 with inelastic demand & 1 with elastic demand (Remember

H.E.V.I)

• Show the impact of a subsidy being granted in on both models.

Think 1 st which curve is affected –

Supply or Demand

– What is a subsidy? (Payment to producers to lower the cost of Production)

– Therefore Supply shifts outwards (cheaper to producer – increase supply)

• Remember the supply curve technically does not shift. The new curve is the original curve plus the amount of the subsidy. So it should be labelled S+Subsidy

– Effectively the producer is being guaranteed a higher price because even though the Pe (the price that consumers pay has decreased), Producers are receiving the original price they would have received for the new equilibrium quantity.

Labelling

• Show the original Pe & Qe

• Show the new Price & Quantity in the market as P1 & Q1

• Indicate by different shading, the amount of the subsidy that is received by the producer & the consumer. In each case it will be different.

For Inelastic Demand, Consumers should receive more of the subsidy than producers and vice versa for Elastic Demand.

Conclusions

What conclusions can you reach based on who gets the greater amount of the subsidy

• Why are subsidies granted?

Increase consumption of Merit Goods & or Protect local industry

...could knowing/seeing that demand is inelastic or elastic help you to identify this?.....Think about what determines relative elasticity…necessity, low proportion of income, availability of close substitutes

(like cheaper imports….)

Taxes:

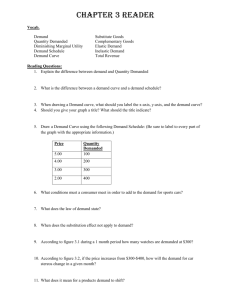

• Draw up 2 S & D models. 1 with inelastic demand & 1 with elastic demand (Remember

H.E.V.I)

• Show the impact of an indirect tax being imposed both models.

Which curve?

• With both Subsidies & Taxes it is supply.

• Producers pay an indirect tax to the government irrelevant of who actually ends up paying the tax.

• Consumers can potentially by altering their consumption habits not pay an indirect tax.

(This depends on which type of indirect tax)

The new curve is once again the original supply curve plus the amount of the tax so S+Tax

• The tax goes to the government. What you are investigating is who pays it. The actual production does not decrease but at every price less is demanded.

At the old Equilibrium. QD has decreased.

Labelling

• Show the old Pe & Qe

• Show the new Price & Quantity in the market as P1 & Q1

• Indicate by different shading, the amount of the tax that is paid by the producer & the consumer. As before In each case it will be different. For Inelastic Demand, Consumers will pay more of the subsidy than producers and vice versa for Elastic Demand.

Conclusions if any?

Think about who is penalised in each case.

• If it’s the producer who pays most of the tax then logically they should stop producing/produce less of the good as it is costing them more. Why would the government not want them to produce the good?

***Negative Spill over Effects of Production –

Externalities – Social Costs (3.3)***

If it is the consumer then it is likely that it is an addictive or demerit substance ie cigarettes, drugs etc.

By making them pay more of the tax it will hit them more in the pocket & hopefully entice them to decrease/stop consumption.

Why addictive as merit goods like power are also inelastic

Is it likely the government would want to decrease consumption or merit goods?

Who ever is creating the harm should pay…