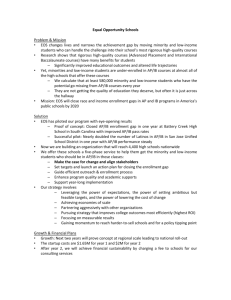

ENERGY IMPACT: Addressing Fuel Poverty

advertisement