Mayer - University of Notre Dame

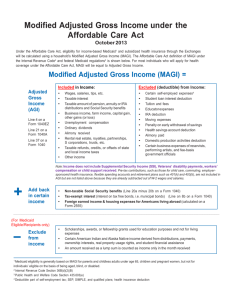

advertisement