Accounting for Income Taxes - University of Texas at El Paso

Accounting for Income Taxes

Sid Glandon, DBA, CPA

Assistant Professor of Accounting

The University of Texas at El Paso

Fundamentals

Pretax financial income

Determined in accordance with GAAP

Accrual accounting

Taxable income

Determined in accordance with IRC

Modified cash basis

Deferred Taxes

Income tax expense differs from income tax liability

Temporary differences

Tax vs. book depreciation

Reverse over time

Permanent differences

Municipal bond interest

Does not reverse over time

Deferred Tax Liability

Represents the increase in taxes payable in future years as a result of temporary taxable differences existing at the end of the current year

Deferred Tax Asset

Represents the decrease in taxes payable in future years as a result of temporary taxable differences existing at the end of the current year

Temporary Differences

Deferred Tax Assets

Revenue and gains

Recognized for income tax purposes

Deferred in financial statements

Expenses and losses

Recognized in financial statements

Deferred for income tax purposes

Deferred Tax Liabilities

Revenue and gains

Recognized in financial statements

Deferred for income tax purposes

Expenses and losses

Recognized for income tax purposes

Deferred in financial statements

Permanent Differences

Items recognized for financial accounting purposes but not tax

Interest income on tax exempt securities

Fines and expenses resulting from violations of law

Items recognized for tax purposes but not financial accounting

Dividends received deduction

Percentage depletion on natural resources

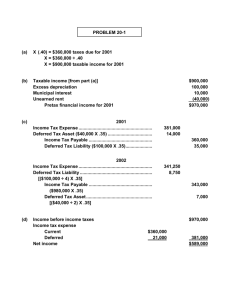

Sequence of Analysis

Schedule book to tax differences to derive taxable income

Calculate current income tax payable

Analyze temporary differences and schedule deferred tax assets and liabilities

Prepare t-account analysis

Deferred tax assets

Deferred tax liabilities

Schedule Net deferred tax expense (benefit)

Schedule income tax expense

Prepare journal entry

Deferred Tax Asset

Valuation Allowance Account

Based on all available evidence

More likely than not that some portion or all of the deferred tax asset will not be realized

A valuation allowance is established to recognize the reduction in the carrying amount of the deferred tax asset account

Valuation Allowance

Income tax expense

ACCOUNT DEBIT

Allowance Account

To reduce deferred tax asset to expected realizable value

XXX

CREDIT

XXX

The entry records a potential future tax benefit that is not expected to be realized in the future

Income Statement Presentation

Company

Income Statement

For the Period Ending December 31, XXXX

Revenues

Expenses

Income before income taxes

Income tax expense

Current

Deferred

Net income

$XXX,XXX

XXX,XXX

XXX,XXX

$ XX,XXX

X,XXX XXX,XXX

$XXX,XXX

Tax Rate Considerations

Apply the enacted tax rate for the year in question

Use the average of the enacted tax rate

Revision of future tax rates

The effect is reported as an adjustment to income tax expense in the period of change

State and foreign income taxes

Net Operating Loss

Tax terminology

Tax deductions exceed taxable income

NOL for each year is computed

Carry back 2 years (election-carry back option)

Carry forward 20 years (carry forward only)

Net Loss (Operating Loss)

Financial accounting terminology

NOL can be derived from net loss

Any tax refunds are reported in the year of the original net operating loss

NOL Carryback

Year 2002

Gross income

Business deductions

Net loss

IRS Form

1120

$200,000

Financial

Statements

$200,000

(300,000) (300,000)

(100,000) ($100,000)

Dividend received deduction

NOL (tax loss)

(70,000)

($170,000)

Transaction

2002 NOL carryback

Taxable income, 2000

Revised taxable income, 2000

NOL carryforward to 2001

Tax refund

NOL

($170,000)

Taxable

Income Income Tax

40,000

$40,000

($40,000)

$0

$12,000

$0

(130,000)

$12,000

NOL CARRYBACK RULES

2000

1st year

2001

2nd year

TAX REFUNDS

2002

NOL

Carryback

Carryback

Carryforward

Carryforward

Carryforward

Carryforward

RECORD

TAX YEARS

2003

1st year

2004

2nd year

2005

3rd year

TAX SHELTER

2022

20th year

Balance Sheet Presentation

Deferred tax classification relates to underlying asset or liability

Current

Noncurrent

Sum all current tax assets and liabilities

Sum all noncurrent tax assets and liabilities

Income Statement Presentation

Current and deferred income tax expense is allocated to:

Continuing operations

Discontinued operations

Extraordinary items

Prior period adjustments