PowerPoint Presentation - The University of Texas at Dallas

advertisement

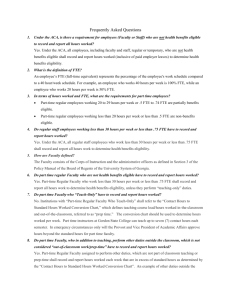

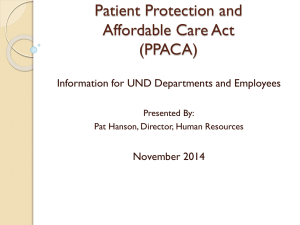

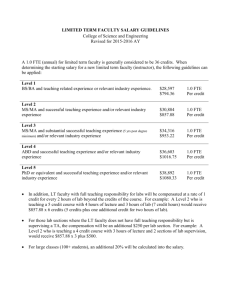

OFFICE OF HUMAN RESOURCES HR FORUM Februar y 4, 2014 Agenda • • • • Introduction Career Center and Student Employment Affordable Care Act Department Updates Office of Human Resources • HR Forum will be held on the first Wednesday of the month 10am – 11:30am. JSOM 2.115. March 4, 2015 April 1, 2015 May 6, 2015 June 3, 2015 July 1, 2015 August 5, 2015 One UTD Introducing… ONE UTD – One Network of Employees, United Through Diversity – is an effort to promote unity, collaboration, respect and partnership within the employee community. The goal of the ONE UTD initiative is to help bring awareness of the need to: 1) work together as a team to benefit UTD as a whole; 2) promote understanding and respect for diversity and inclusion of not just age, race, gender, etc., but diversity of thought, ideas, and initiatives; and 3) show our commitment and concern for diversity to external job seekers. Career Center Hiring a Student Employee The University of Texas at Dallas utdallas.edu/career Career Center Post a position in Complete these fields in CometCareers: • Number of openings • Work schedule • Hours per week • Wage/Salary • Employment Start/End Date • Supervisor • Job Description • Qualifications • Application Instructions Jobs will be reviewed and activated within 1-2 business days. The University of Texas at Dallas utdallas.edu/career Career Center Review and Interview Applicants All jobs must be posted for at least five (5) business days or until 50 applicants have applied, whichever comes first. Students can apply via CometCareers or be directed to follow an alternative process. Departments are responsible for scheduling and conducting interviews with applicants. • CometCareers can be used to schedule on-campus interviews with applicants. Contact the SEC for more information. It is recommended that each interviewee fill out a Criminal Background form (CBC) at the time of interview. The University of Texas at Dallas utdallas.edu/career Career Center Select Candidates Once the department selects their candidate, follow the steps below: • Have the student complete the top portion of the CBC form if this was not done during the interview – the bottom section will be completed by the Career Center. • Complete the Hiring Proposal Form • Both forms can be emailed to the SEC, mailed via campus mail SSB 31, or delivered in person to our office – SSB 3.300. The Hiring Proposal Form will be used as an offer letter for international students who are in need of a Social Security Card. The University of Texas at Dallas utdallas.edu/career Career Center Offer Position Once the Career Center has received the CBC and the Hiring Proposal Form, the following procedures will take place: • Career Center will submit the CBC to the Police Department. Please allow one (1) week to process CBC forms. • After receiving a cleared CBC, Career Center will extend offer via email to the student. • Students MUST come to the Career Center to complete the following forms ON or BEFORE their first day of work: • I-9/W-4/Direct Deposit • Conditions & Regulations • Selective Service Verification • Personal Data Form • Departments complete the PAF and any department specific forms. Work-study PAFs must be sent to the Career Center for approval. The University of Texas at Dallas utdallas.edu/career Career Center Stop by the Career Center! Student Services Building 3.300 972-883-2943 studentemployment@utdallas.edu The University of Texas at Dallas utdallas.edu/career Division Update BENEFITS Affordable Care Act (ACA) Update • UT Dallas is required to be in compliance with all legislative requirements under the Affordable Care Act (ACA). • One of the major compliance requirements under ACA compliance is the offering of health care coverage to all employees working an average of 30 or more hours per week or 130 hours per month. • The UT System Office of Employee Benefits mandated that this offering become effective January 1, 2015 for the UT System Health Insurance Plan. • This will allow UTD and the UT system a 9-month period of measurements without risk of penalty. This will also allow the data to be tracked to comply with the year-end reporting (similar to W-2) due in March 2016 for the reporting period of January 1, 2015 through December 31, 2015. Penalty of non-compliance will be in effect 9/1/15. Affordable Care Act (ACA) Update • Affordable Care Act (ACA) Tracking Compliance effective 1/1/15 – New FTE Calculation for Instructional Faculty (see Table 1 & Table 2) – ACA Notice to all New Hires/Rehires within 14 days of hire date – Part-time/temporary/hourly student employees will become eligible if working an average of 30 hours per week during a 12-month measurement period (see measurement periods) – Students under Work Study Program are exempt from ACA tracking – No premium sharing for ACA eligible currently - subject to legislative change as of 9/1/15 – Eligible employees must be offered coverage timely – enrollment required within 31 days of eligibility date • Timely submissions of changes (i.e. new hires/rehires & FTE changes) • 50% employees (not student positions) should receive benefits • Send all eligible employees to the Benefits Office (FTE .50% or more) Affordable Care Act (ACA) Update • UT System ACA Measurement Periods • First Measurement – 11/1/2013 – 10/31/14 eligible 1/1/15 through 12/31/15 (12 months stability) • Initial Measurement - 12 months from hire or rehire date • Standard Measurement – 6/4 – 6/3 each year; effective 9/1 • Reporting Requirements • Declaration of coverage offering to IRS • IRS required reporting begins March 2016 for 1/1/15 12/31/15 • ACA Eligibility Reporting to UT System OEB • Utilization of Equifax ACA Service Management System to track hours for ACA eligibility Penalty for Non-Compliance • ACA definition of full-time is 30 hours/week • $3,000 per each full-time employee who enrolls in coverage through the Marketplace and who receives subsidy – if they are eligible and we did not offer them coverage • $2,000 per every full-time if UTD does not offer medical coverage to 70% (2015) and 95% (2016 & beyond) of full-time employees – possible audit trigger if one enrolls & covered in Marketplace and receives subsidy • Affordability – employee coverage not to exceed 9.5% of salary- premium sharing potential Important Note: It is critical to have accurate FTE in the system and tracking of hours worked FTE Calculation Table-Fall & Spring FTE calculation tables applies to all Instructional Faculty positions, including all levels of lecturers, senior lecturers and clinical professors. Table 1 SCH UT Dallas - Approved FTE Calculation - Fall and Spring semesters TEACHING PREP/GRADING MEETING OFFICE OTHER 1 1.00 1.00 1.00 2 2.00 2.00 1.00 3 3.00 3.00 4 4.00 5 TOTAL WEEKLY HOURS 1.00 - 4.00 0.100 1.00 0.67 6.67 0.167 1.00 1.00 2.00 10.00 0.250 4.00 1.00 1.00 3.33 13.33 0.333 5.00 5.00 1.00 1.00 4.67 16.67 0.417 6 6.00 6.00 1.00 2.00 5.00 20.00 0.500 7 7.00 7.00 1.00 2.00 6.33 23.33 0.583 8 8.00 8.00 1.00 2.00 7.67 26.67 0.667 9 9.00 9.00 1.00 2.00 9.00 30.00 0.750 10 10.00 10.00 1.00 2.00 10.33 33.33 0.833 11 11.00 11.00 1.00 2.00 11.67 36.67 0.917 12 12.00 12.00 1.00 2.00 13.00 40.00 1.000 A Dean may substitute teaching hours for equivalent or additional duties outside the classroom. Example: The Dean may appropriately increase the hours of a lecturer with additional duty for course development. FTE FTE Calculation Table - Summer Table 2 SCH 1 2 UT Dallas - Approved FTE Calculation - Summer TEACHING PREP/GRADING MEETING OFFICE 1.50 1.00 1.00 1.00 - 4.50 0.113 2.00 1.00 1.00 - 7.00 0.175 3.00 OTHER TOTAL WEEKLY HOURS FTE 3 4.50 3.00 1.00 1.00 0.50 10.00 0.250 4 6.00 4.00 1.00 1.00 1.33 13.33 0.333 5 7.50 5.00 1.00 1.00 2.17 16.67 0.417 6 9.00 6.00 1.00 2.00 2.00 20.00 0.500 7 10.50 7.00 1.00 2.00 2.83 23.33 0.583 8 12.00 8.00 1.00 2.00 3.67 26.67 0.667 9 13.50 9.00 1.00 2.00 4.50 30.00 0.750 10 15.00 10.00 1.00 2.00 5.33 33.33 0.833 11 16.50 11.00 1.00 2.00 6.17 36.67 0.917 12 18.00 12.00 1.00 2.00 7.00 40.00 1.000 A Dean may substitute teaching hours for equivalent or additional duties outside the classroom. Example: The Dean may appropriately increase the hours of a lecturer with additional duty for course development. ACA Compliance FAQs • What is the impact of ACA to student employees and TA/RA employees, part-time and temporary employees? • TA/RA positions are already eligible for insurance and are not allowed under policy UTDPP1075 to work more than 20 hours per week. Here is a link to the policy http://policy.utdallas.edu/utdpp1075 • Work study student positions are not ACA eligible. • Other student positions are generally not benefits eligible. However, under ACA if the student works an average of 30 hours a week during the 12 month measurement period, they will become ACA eligible. Supervisors are advised to monitor work hours closely. • Part-time <.50% and temporary employees will become ACA eligible if they work an average of 30 hours/week ACA Compliance FAQs What should the schools/departments do to ensure ACA compliance? • Follow the FTE calculation tables to determine the appropriate FTE level. Submit, review and approve all PAFs/ePARs with the appropriate FTE to be reflected in the records. Email a list of all FTE changes (increase or decrease in percentage) effective 1/1/15 – 8/31/15 to benefits @utdallas.edu so those newly eligible for benefits can be notified and begin the enrollment process. • ACA eligible employees are not eligible for premium sharing at this time. However, the UT System Office of Employee Benefits will be proposing in the 2015 legislative session that ACA eligible employees receive 100% premium coverage (same currently full-time). Therefore, schools should anticipate and plan for this cost in their FY 16 budget in the event it is approved. • Submit ongoing employee changes (i.e. new hires and FTE changes) via PAR/ePAR in a timely manner or in advance when possible to ensure offering of benefits coverage to eligible employees within 31 days. • Notify the Benefits Office of new hire/FTE changes that are late • Notify new employees to attend orientation and/or contact the Benefits Office to enroll for benefits within 31 days of hire date or status change ACA Compliance FAQs What happens if the employee becomes ineligible or eligible for benefits as of January 2015? • Changes that drop an employee below a .50 FTE as of 9/1/15 should be submitted via the annual budget process when possible. If not, the change must be submitted via PAF/ePAR by 8/25/15. During the new FTE calculation implementation period, those who are currently benefits eligible but would become ineligible based on the new FTE table, will not lose benefits eligibility until 9/1/15. This gives the employee notice to make other arrangements and the school time to review course load for appropriate FTE level as of 9/1/15. • Changes that increase FTE to .50 or more must be submitted via PAF/ePAR to Budget. • Inform benefits eligible (.50% FTE) to contact the Benefits Office to enroll within 31 days of eligibility date • Collaborate with the Benefits Office if necessary to ensure accurate processing of benefits eligibility Benefits/ACA Eligibility Rules • Benefits Eligible Employees – eligible for premium sharing – Full-time (100% FTE) faculty and staff working at least 4 ½ months – Part-time (50% FTE or more) employees working at least 4 ½ months – RA/TA (50% FTE) working at least 4 ½ months • ACA Eligible Employees (not currently eligible for premium sharing) – Part-time/variable hours employees who worked an average of 30 hours per week (130/month) during a 12-month measurement period – Seasonal (temporary) employees who worked an average 30 hours per week for the 12-month measurement period – Student employees (not federally or state funded) who worked an average of 30 hours per week during a 12-month measurement period • Non-Benefits Eligible Employees – Part-time (less than 50% FTE) or working less than 20 hours per week or less than 30 on average for the 12-month measurement period* – Employees in a student positions and worked less than 30 hours* Note: Students under Work Study Program are not ACA eligible COBRA Notice-Offer Coverage • Coverage for faculty & RA/TA generally ends on May 31st (end of school) for those who are not appointed during the summer period and/or no Fall appointments. Staff coverage ends at end of the month of termination or retirement. • Submit termination/FTE change PAFs/ePARs timely • UTD will offer COBRA coverage if employee and dependents lose coverage • COBRA notice mailed to home - contact the Benefits Office for application forms • Conversion to individual coverage may be available for voluntary insurance, if eligible, and apply within 31 days from coverage end date 76 2015 IRS Retirement Plan Limits Mandatory Retirement for Eligible Employees (20 hours or more for 4 ½ months) Teacher Retirement System of Texas (TRS) – State Contribution: 6.8% Employee: 6.7% Compensation Limit - $265,000 (if hired on or after 9/1/96 – otherwise no limit) Optional Retirement Program (ORP) Compensation Limit - $265,000 (if hired on or after 9/1/96 – otherwise no limit) UTD Contribution: $22,525.00 (8.5% of $265,000) if hired on or after 9/1/96 Employee Contribution: $17,622.50 (6.65% of $265,000) if hired on or after 9/1/96 Total Deduction Limit is $53,000 in 2015 – combining ORP, 403(b) & Roth $6,000 age 50 catch-up – this is in addition to the $53,000 Voluntary Retirement Programs All Employees are Eligible Tax Sheltered Annuity(TSA) – 403(b) TSA limit-ORP Participants on/after 9/1/96 $18,500.00 Max + $6,000 age 50 Catch-up $12,852.50 Max + $6,000 age 50 Catch-up Roth 403(b) – After tax /earnings tax-free Shares limit with TSA noted above Deferred Compensation Plan (DCP) 457(b) $18,500 Max; $6,600 age 50 Catch-up 77 Absence Management Process FMLA & Parental Leave • FMLA – Eligibility requires 12 months of state service; 1,250 hours – Job-protected leave; employee must complete forms (online) 30 days in advance or as soon as practicable if unforeseeable for absence of more than 3 days; department should notify employee to complete required forms – Up to 12 work weeks for birth/adoption, serious health condition of employee, spouse, child and parent and military exigency – Up to 26 work weeks (combined total) to care for a covered military servicemember with a serious injury or illness (spouse, son, daughter, parent or next of kin) – Unpaid unless employee has leave balance or using disability benefits or qualified for Sick Leave Pool – Consecutive or intermittent leave – Eligible for Premium Sharing even if the leave is unpaid • Parental Leave – applies if employee is not FMLA eligible – Up to 12 weeks for birth or adoption/placement of a child – Not eligible for Premium Sharing if the leave is unpaid FML & Parental Leave FAQs • • • • Is Family Medical Leave paid or unpaid? – During the time that an employee is on leave for a FMLA reason, he/she must exhaust all APPLICABLE sick leave and vacation. Once that is exhausted, the employee will be placed on Leave Without Pay for the remainder of the 12 weeks. Employee will be responsible for paying the insurance that they normally have deducted from their paychecks (i.e., cost of coverage for dependents, longterm disability insurance, etc.). Premium sharing available. Can I choose to exhaust my own paid leave prior to beginning FMLA leave? – No, you cannot choose to exhaust your own paid leave prior to beginning FMLA leave. The UT Dallas’ Administrative Policies and Procedures (D6-155.0) require you to use your available paid leave when you are missing work due to an FMLArelated reason. Exceptions: FMLA leave due to an on-the-job injury will have option to use available paid leave or being in a leave without pay status; you are not required to FLSA comp time but have option to do so. What other payments are available during FML/Parental leave ? – Short Term Disability and/or Long Term Disability , if coverage is elected – Sick Leave Pool – must apply separately and qualify as catastrophic Link to more FAQs (https://www.utdallas.edu/hrm/benefits/lifeevents/famlvfaq.php5) Other Leave • Sick Leave Pool (cannot be retroactive) – catastrophic illness and injury – employee must be on approved leave – Must exhaust all available leave and be unpaid for one full day – 720 hours maximum • Leave without Pay – requires department approval and – coordination with the Benefits Office for benefits processing – Medical or other documentation will be required as applicable. • Extended Unpaid Military Leave – job protection under USERRA (Uniform Services and Reemployment Rights Act of 1994) – Coordination with the Benefits Office for benefits processing • Return to work release for all medical related leave – generally 5 days prior to return to work • Link to Leave Policies: https://policy.utdallas.edu/utdbp3054 Leave Online Resources Absence Management Process View Balances • Galaxy • Staff Tools • Absence Balances • “As of ” date Absence Management Process Absence Management Module • Identify • Calculate – Entitlement(s) - Accruals – Take(s) - Absences – Adjustments – Balance • Finalize • Now viewable in Galaxy Absence Management Process How does data get to payroll? Absence Management Process Absences – Event Table vs Timesheet Absence Management Process Absence Management Process Benefits Team Marita M. Yancey, Director (x2127) Insurance, Retirement, Longevity Benefits Specialists Nora Pena – x4559 Debra York – x5338 Vacant – x2131 Vacation & Sick Leave, FMLA, Sick Leave Pool Christine Moldenhauer Leave Administrator x5151 Reporting, Funding and Billing Thi Nguyen Reporting Coordinator x2605 HRIS & Technical Support Tina Sharpling HRIS Manager x4132 NEW 35 Division Update EMPLOYEE RELATIONS/ ORGANIZATIONAL DEVELOPMENT & INSTITUTIONAL EQUITY Employee Relations – Performance Appraisals Appraisal Deadlines: • April 7, 2015 – Employees who were employed during 2014. • June 30, 2015 – Employees who were hired between January 1, 2015 & April 15, 2015. (Probationary Evaluation accepted) Appraisal not required for: • Employees with an appointment of less than 4.5 months or if they are in a student position. • Employees currently out on leave – Complete when they return from leave. Employee Relations & Organizational Development & Training Training Opportunities Performance Review for Supervisors • February 5 (10:00 A.M. – 12:00 P.M.) Performance Review for Employees (“What Does it Mean for Me?) • February 10 (2:00 P.M – 4:00 P.M.) • February 19 (10:00 A.M. – 12:00 P.M.) • March 10 (2:00 P.M – 4:00 P.M.) • March 19 (10:00 A.M. – 12:00 P.M.) Catch Comet Pride • February 11 (2:00 P.M. – 4:30 P.M.) Managers/Supervisor’s Certificate Series • February 18 (2:00 P.M – 4:00 P.M.) Institutional Equity New Regulations Regarding Veterans and Persons with Disabilities Dear Faculty and Staff: The U.S. Office of Federal Contract Compliance Programs (OFCCP) has announced new regulations to strengthen federal contractors’ affirmative action and nondiscrimination responsibilities as they relate to veterans and persons with disabilities. The new regulations require federal contractors to provide an opportunity for all job applicants, new hires and employees to voluntarily self-identify in these two categories. As a UT Dallas employee, you have the opportunity to complete the following two voluntary self-identification surveys by logging in to Galaxy and navigating to “Staff Tools/Voluntary Self Identification”. For further information, please review the online PDFs of frequently asked questions regarding the disability and veteran surveys, or contact the Office Institutional Equity at institutionalequity@utdallas.edu or (972) 8832223. If you are a person with a disability who requires a workplace accommodation, you may contact the Office of Human Resources, Employee Relations at (972) 883-2221 or EmployeeRelations@utdallas.edu. Additional resources related to this new regulation include Section 503 Rehabilitation Act of 1973 and the Vietnam Era Veterans Readjustment Assistance Act (VEVRAA). Thank you, UT Dallas Office of Human Resources Division Update EMPLOYMENT SERVICES General Updates • Don’t forget...New PRR • Criminal Background Checks – International students • The will be accepted in lieu of a CBC for international students who have been in the US no longer than six (6) months after the issuance of their visa. – General • We can rely on a CBC conducted within the past 12 months, if there is no break in service of more than six (6) months. • Ask YODA is coming soon for HR! Compensation Standards • Compensation Standards and Practices were distributed to Deans/VPs in January. • Addresses key concepts and standards that will be used going forward in determining starting pay, pay increases, and job changes. • Key dates to remember: – March 1 and September 1 – All changes that impact compensation (reclassifications, promotions, equity adjustments, market reviews, etc.) Q&A