diasp_Hewlett-Jobes-MIF-IADB_Remittances Diasporas

advertisement

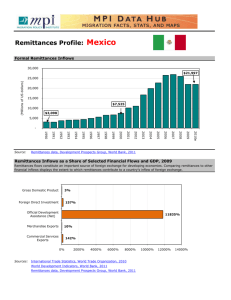

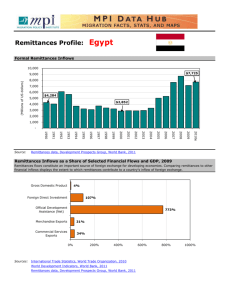

Remittances, Diasporas and Economic Development Inter-American Development Bank Multilateral Investment Fund The Multilateral Investment Fund Promotes private sector development in Latin America and the Caribbean (LAC) Funds small technical assistance and demonstration projects Tests new ways to develop micro and small enterprise, improve the business environment and engage the private sector in the process of development Is primarily a grant mechanism, but can also use a full range of instruments such as equity, quasiequity and loans Remittances and MIF Strategy Four years ago the MIF of the IDB began to commission studies, sponsor conferences, and finance projects in order to help: 1 2 3 Document the increasing importance of remittances to the Region Lower transaction costs by promoting competition, and encouraging innovative technologies; Leverage the development impact of remittances, through banking and productive investment Remittances Dramatic growth of remittances has attracted attention Now subject of public discussion and policy considerations Wide range of stakeholders – financial institutions and money transfer companies, public authorities, civil societies, international organizations But it’s about transnational families – it’s their money – a result of their hard work Fueled by Global Economy Remittances are the traditional financial support for families back in their home countries This phenomenon is generated by movement of labor across borders: people move north by the MILLIONS and money moves south by the BILLIONS. Volumes are Huge Foreign workers sent at least $174 billion to their countries of origin in 2004 $120 billion through official channels – but unofficial channels account for significant volumes. World Savings Banks Institute estimates flows are $200 billion Major implications for national economies but little really known - it has been hidden in plain view Key Findings Latin America and the Caribbean (LAC) receives the most remittances transfer costs are lowest when remittances are sent through regulated financial institutions, such as banks, credit cooperatives, and credit unions the average cost of remitting to countries outside LAC is cheaper than remitting to LAC LAC migrants North America For the last two decades the preferred destination for the over-whelming majority of Latin American and Caribbean migrants has been North America – principally the US According to the 2000 U.S. census, approx. 5% or 14.47 million people emigrated from LAC countries Remittances are Growing Latin America and the Caribbean is both the fastest growing and highest volume remittance market in the world In 2004 over $45 billion of remittances flowed into the region At current growth rates, the projected cumulative remittances to Latin America and the Caribbean for the decade (2001-2010) will approach US$ 500 billion Major Economic Impact substantially exceed of Official Development Assistance (ODA) inflows to each country account for over 10% of GDP in: Haiti, Nicaragua, El Salvador, Jamaica, the Dominican Republic, and Guyana equal more than 150% of the interest paid on the total LAC external debt during the past five years Integrating Labour Markets Central America, the Caribbean, and Andean countries all report consistent increases in remittances, which reflect the growing integration of labour markets between LAC and the rest of the world Remittances growth for 2003 over 2002 (US$ Billions) 2002 2003 US$ billion 6.50 6.35 6.00 6.07 5.80 5.50 5.00 5.42 5.41 5.37 4.50 Regions and Growth Central America Andean countries Caribbean 11.9% 18.3% 7.5% ( ES / GU / HO / NI ) ( BO / CO / EC / PE ) ( CU / DR / HT / JA ) Mexico Belize 13,266 73 Honduras Cuba 862 1,194 Dominican Republic Jamaica Guatemala Nicaragua 977 Trinidad & Tobago 788 2,106 El Salvador Costa Rica 2,316 1,425 2,217 Haiti 306 88 Panama Venezuela 220 247 Guyana 137 Colombia 3,067 Ecuador 1,656 Brazil 5,200 Peru 1,295 Bolivia Remittances by Selected LAC Countries 340 2003 (US$ millions) Uruguay Argentina 225 42 Remittance Senders A 2004 MIF study found that over 60 percent of adult, foreign-born Latino people living in the U.S. send remittances regularly and about another 10% send remittances occasionally Two-thirds of remittance senders dispatch money at least once a month, and the most recently arrived (those in the United States less than five years) are the most frequent remitters with three-quarters sending money at least once a month Most send $200 to $300 at a time Transfer Mechanisms From U.S. 70% of senders use transfer companies such as Western Union or Money Gram Transfer Mechanisms 10% By Hand 7% 2% 70% Mail Credit Union Banks 11% Wire Cost of Transfer Until recently the remittances market in LAC countries was only composed by only a small amount of major institutions and several small players Before 2000, the average cost of sending remittances to LAC was about 15% of the value of the transaction In an era of electronic transfer of resources, this suggested a lack of transparency / maturity / and competition in the remittance transfer market Cost of Transfer Cost to send rem ittances to Latin Am erica, February 2004 Ecuador 5.36% El Salvador 5.75% Peru US$200 5.56% 6.37% Colom bia Nicaragua 6.93% Guatem ala 7.26% Honduras 7.30% Mexico 7.32% Latin Am erica 7.90% Bolivia 8.17% Venezuela 8.56% Haiti 8.88% Jam aica 10.63% Dom inican Rep. 11.32% Cuba 0.00% 12.11% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% Costs are reducing In recent years, the remittance industry has become more transparent and competitive By February 2004, the average cost had nearly halved to reach 7.9 percent or $16 for sending $200 This reduced average, when compared with fees five years ago, is mostly due to the fact that charges have decreased with greater competition and use of technology. Costs Vary Remitters to Mexico, El Salvador, and Guatemala charge lower fees than companies sending money to Jamaica and the Dominican Republic where competition is less robust or ‘controlled’ For other countries, like Cuba or Haiti, where market restrictions are even tighter, charges are generally the highest Remittances and Development First - Clear up misconceptions Remittances are not: a substitute for International Development Aid a substitute for Economic Development or Social Welfare Public Policies a preferred development model for a nation Growth in Remittances is no cause for celebration Remittances are not a development model – but rather a sign of the failure of development Maximize the Positives Key Goals: Maximize the contribution of the transnational family as an agent for economic and social development in the communities of origin Maximize the economic, financial and social inclusion of the migrants and their families in their countries of origin and residence Core Principles In order to help organize and focus priorities for this collective effort, in March 2004 MIF issued a set of Core Principles promoting best practices within the LAC remittance market. Core Principles Remittances Institutions These Core Principles are aimed at: Public Authorities Civil Society Core Principles IMPROVE TRANSPARENCY PROMOTE FAIR COMPETITION AND PRICING APPLY APPROPRIATE TECHNOLOGY DO NO HARM IMPROVE DATA Core Principles SEEK PARTNERSHIPS AND ALLIANCES ENCOURAGE FINANCIAL INTERMEDIATION PROMOTE FINANCIAL LITERACY EXPAND FINANCIAL SERVICES LEVERAGE DEVELOPMENT IMPACT SUPPORT SOCIAL AND FINANCIAL INCLUSION Core Principles DO NO HARM IMPROVE DATA Governments ENCOURAGE FINANCIAL INTERMEDIATION PROMOTE FINANCIAL LITERACY Core Principles IMPROVE TRANSPARENCY PROMOTE FAIR COMPETITION AND PRICING APPLY APPROPRIATE TECHNOLOGY SEEK PARTNERSHIPS AND ALLIANCES EXPAND FINANCIAL SERVICES Remittance Institutions Core Principles Civil Society LEVERAGE DEVELOPMENT IMPACT SUPPORT SOCIAL AND FINANCIAL INCLUSION World Bank/BIS Have convened an international group of Central Banks, international and other development organizations to develop General Principles for International Remittances Will create service standards and principles for consumer protection, transparency and market behavior European Union Has developed new approach to regulating remittance transfers This creates a category of payment institutions to whom would be issued a single EU “passport” to operate in the internal market - therefore increasing competition Also regulates information to be provided with credit transfers MIF Strategy Working with a network of participating stakeholders to help reach two goals by 2010: Goals Reduce by 50% the average cost of LAC remittance market transactions by promoting increased competition Increase to 50% the number of families receiving remittances through the financial system. Key Objectives Promote financial inclusion In LAC, less than 10% of remittance recipients have bank accounts, access to loans or other financial products Develop opportunities to invest in local economic development Increase competition to lower transaction costs Improve regulatory and institutional frameworks Areas of growing focus Technology - opening new possibilities to lower costs and offer a wider range of financial services Housing - mobilize savings and turn earnings into equity Securitize remittance flows to create new source of lower cost and longer term capital Research impact of gender - women make up half of remittance senders worldwide and most heads of remittance-receiving households Looking Ahead All stakeholders can help - financial institutions and money transfer companies, public authorities, civil society and diaspora groups, international organizations However one central principle should be in mind: “It’s their money” Successful efforts will result in transnational families with more money available for their own purposes, and more options in using those resources Inter-American Development Bank 1300 New York Av. NW Washington D.C. 20577 (1) 202 942-8211 www.iadb.org/mif Inter-American Development Bank Multilateral Investment Fund