10-1

Chapter 10:

The Cost of

Capital

Copyright © 2000 by Harcourt, Inc.

All rights reserved. Requests for permission

to make copies of any part of the work should

be mailed to the following address:

Permissions Department, Harcourt, Inc., 6277

Sea Harbor Drive, Orlando, Florida 328876777.

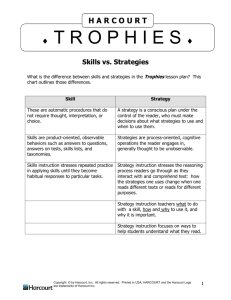

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-2

Cost of Capital

The firm’s average cost of funds, which is

the average return required by the firm’s

investors

What must be paid to attract funds

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-3

The Logic of the Weighted

Average Cost of Capital

The use of debt impacts on the ability to

use equity, and vice versa, so the

weighted average cost must be used to

evaluate projects, regardless of the

specific financing used to fund a

particular project.

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-4

Basic Definitions

Capital Component

Types of capital used by firms to raise

money

kd

= before tax interest cost

kdT

= kd(1-T) = after tax cost of debt

kps

= cost of preferred stock

ks

ke

= cost of retained earnings

= cost of external equity (new stock)

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-5

Basic Definitions

WACC = weighted average cost of capital

Capital Structure

A combination of different types of capital

used by a firm

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-6

After-Tax Cost of Debt

The relevant cost of new debt

Taking into account the tax deductibility

of interest

Used to calculate the WACC

kdT = bondholders’ required rate of return

minus tax savings

kdT = kd - (kd x T) = kd(1-T)

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-7

Cost of Preferred Stock

Rate of return investors require on the

firm’s preferred stock

The preferred dividend divided by the net

issuing price

D

D

ps

ps

k

ps NP P - Flotationcosts

0

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-8

Cost of Retained Earnings

Rate of return investors require on the

firm’s common stock

D̂

k k

RP 1 g k̂

s

RF

s

P

0

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-9

The CAPM Approach

k k

k - k

β

s

RF M

RF s

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-10

The Bond-Yield-Plus-Premium

Approach

Estimating a risk premium above the

bond interest rate

Judgmental estimate for premium

“Ballpark” figure only

k Bon dyie ld Riskpre m iu m

s

10% 4% 14%

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-11

The Discounted Cash Flow (DCF)

Approach

Price and expected rate of return on a

share of common stock depend on the

dividends expected on the stock

D̂

D̂

D̂

1

2 ...

P

0 1 k 1 1 k 2

1 k

s

s

s

D̂

t

t

1

k

t 1

s

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-12

The Discounted Cash Flow (DCF)

Approach

D̂

D̂

D̂

1

2

P

...

0 1 k 1 1 k 2

1 k

s

s

s

D̂

D̂

t

1 if g is constant

t

k

g

1

k

t 1

s

s

D̂

k k̂ 1 g

s

s P

0

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-13

Cost of Newly Issued

Common Stock

External equity, ke

based

on the cost of retained earnings

adjusted for flotation costs (the expenses

of selling new issues)

D̂

D̂

1 g

k 1 g

s NP

P 1 F

0

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-14

Target Capital Structure

Optimal Capital Structure

Percentage of debt, preferred

stock, and common equity in

the capital structure that will

maximize the price of the

firm’s stock

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-15

Weighted Average Cost of Capital,

WACC

A weighted average of the component costs

of debt, preferred stock, and common equity

Proportion After - tax Proportion Cost of Proportion Cost of

of

cost

of

of

preferred

preferred

of

common

common

debt debt stock stock equity equity

W

d

k

dT

W

ps

k

ps

W

s

k

s

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-16

Marginal Cost of Capital

MCC

The cost of obtaining another dollar

of new capital

The weighted average cost of the

last dollar of new capital raised

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-17

Marginal Cost of Capital

Marginal Cost of Capital Schedule

A graph that relates the firm’s

weighted average of each dollar of

capital to the total amount of new

capital raised

Reflects changing costs depending

on amounts of capital raised

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-18

MCC Schedule

Weighted Average Cost

of Capital (WACC) (%)

WACC3=11.5%

11.5 WACC2=11.0%

11.0 -

10.5 -

WACC1=10.5%

100

150

New Capital

Raised (millions

of dollars)

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-19

Break Point

BP

The dollar value of new capital that

can be raised before an increase in

the firm’s weighted average cost of

capital occurs

Total amount of lower cost capital of a given type

Break

Point Proportion of this type of capital in the capital structure

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-20

MCC Schedule

Weighted Average Cost

of Capital (WACC) (%)

WACC3=11.5%

11.5 WACC2=11.0%

11.0 10.5 -

WACC1=10.5%

BPRE

100

BPDebt

150

New Capital

Raised (millions of

dollars)

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-21

MCC Schedule

Schedule and break points depend

on capital structure used

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-22

MCC Schedule

Weighted Average Cost

of Capital (WACC) (%)

Smooth, or Continuous,

Marginal Cost of Capital

Schedule

WACC

0-

Dollars of New Capital Raised

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-23

Combining the MCC and

Investment Opportunity

Schedules

Use the MCC schedule to find the cost

of capital for determining projects’ net

present values

Investment Opportunity Schedule (IOS)

Graph of the firm’s investment

opportunities ranked in order of the

projects’ internal rate of return

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-24

Combining the MCC and

Investment Opportunity

Schedules

Percent

12.0 -

IRRC = 12.0%

IRRB = 11.6%

11.5 -

WACC3=11.5%

IRRD = 11.5%

IRRE = 11.3%

WACC2=11.0%

11.0 -

MCC

IRRA = 10.8%

WACC1=10.5%

10.5 -

Optimal Capital

Budget - $139

20

40

60

80

100 120 140

IOS

160

180

New Capital Raised and invested

(millions of dollars)

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.

10-25

End of Chapter 10

The Cost of Capital

Copyright (C) 2000 by Harcourt, Inc. All rights

reserved.