Private Sector Co-payment Mechanism for ACTs

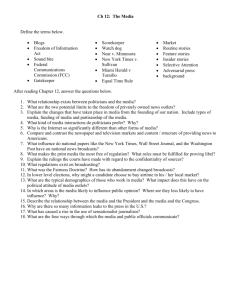

advertisement

Update on the Affordable Medicines Facility-malaria (AMFm) / Private Sector Co-payment Mechanism for ACTs Interagency Pharmaceutical Coordination Group Meeting 18-19 June 2015 Dr. Melisse Murray Specialist, Sourcing Department Key events leading to the start of Phase 1 2004 IOM releases report Saving Lives, Buying Time - Global-level subsidy for ACTs an urgent “public good” to address increasing ineffectiveness of widely available treatment, risk posed by oral AMTs and the high cost of ACTs 2006 Roll Back Malaria (RBM) Partnership fosters multi-institutional process 2007 AMFm Technical Design approved by RBM Board - Included the addition of “supporting interventions” (SIs) to promote the appropriate use of ACTs Hosting and management by the Global Fund - 2008 Global Fund Board requests the Secretariat to begin operations - 2009 select countries invited to submit applications, Technical Review Panel recommendations, Global Fund Board approvals - By mid 2010, Global Fund grant amendment processes completed for each pilot to permit initiation of country-level operations IOM = Institute of Medicine ACT: Artemisinin-based combination therapy AMT = artemisinin mono-therapy Phase 1 was a “Test of Concept” Purpose: Widely availability of quality-assured ACTs Sharply retail prices of quality-assured ACTs use of quality-assured ACTs, including by vulnerable groups Displace oral artemisinin monotherapies Displace use of ineffective medicines AMFm comprised three elements: 1) Negotiations with ACT manufacturers price of ACTs and offer public sector prices to private sector buyers 2) Buyer subsidy (co-payments) at top of global supply chain price to importers; use pre-existing supply chains 3) “Supporting interventions” to ensure effective ACT scale-up Including communications campaigns, private sector training, etc. AMFm Phase 1 Private Sector Co-payment Mechanism Mid 2010 to end 2012: AMFm Phase 1 implementation > Mid 2010 to end 2012 in nine pilots in eight countries: Cambodia, Ghana, Kenya, Madagascar, Niger, Nigeria, Tanzania, Uganda and Zanzibar > Four donors funded co-payments (US$ 333 million): ZANZIBAR Co-paid ACTs Delivered (treatment courses, in millions) > Global Fund grants funded supporting interventions (IEC/BCC, private sector training, etc.) > 290 million co-paid treatment doses delivered by end 2012, mostly A/L 120 100 80 60 40 20 0 5 4 3 2 1 0 12% ASAQ FDC 3% ASAQ Co-b 0% DHAPPQ 85% A/L November 2012 Global Fund Board Decision* > Based on evidence from AMFm Phase 1 Independent Evaluation*, following a transition period, and building on lessons learned, grantees permitted to use grant funding for co-payments and supporting interventions > Going forward: private sector only; each country to determine subsidy level and demand-shaping levers *Board Decision and full AMFm Phase 1 Independent Evaluation Report available in public domain. 3 Questions asked by IPC: • How have changes since the end of AMFm Phase 1 impacted the availability of co-paid ACTs in private sector outlets in these countries? • How have changes since the end of AMFm Phase 1 impacted the price of co-paid ACTs available in private sector outlets in these countries? 4 Summary of key changes since the end of AMFm Phase 1 Key change Participating countries AMFm Phase 1 (mid-2010 to end-2012) 2013 Transition 9 pilots in 8 countries 6 countries Source of copayment funding 2014 Transition/ Integration 5 countries (6th to resume in 2015) plus grant funds in 2 countries Co-payment financing Resources mobilized for co-payments across all pilots for the period Country-specific financial amounts for co-payments Subsidy level and demand-shaping levers Set by Secretariat and applied across all pilots simultaneously Set by each country and applied on country-specific basis, evolving over time Timing of order approvals Price negotiations with ACT suppliers On demand then monthly Aug 2011 to Dec 2012 Bi-monthly Maximum price approach Quarterly Competitive tender resulting in supplier- and product-specific prices (~ 30% reduction) 5 Annual quantities of co-paid ACTs delivered to private sector buyers in six participating countries since the end of AMFm Phase 1 (end 2012) have decreased or increased, depending on the country AMFm Phase 1 25 Peak in 2013 Peak in 2011 Peak in 2012 70 1.40 60 1.20 50 1.00 40 0.80 2011 30 0.60 2012 20 0.40 10 0.20 0 0.00 20 2010 15 10 2013 2014 5 0 Ghana Kenya Tanzania Uganda Nigeria Madagascar 6 AMFm Phase 1 Co-paid treatment doses delivered to private sector buyers, in millions Annual quantities of co-paid ACT treatment doses delivered to private sector buyers 2010 to 2014, as reported to the Global Fund by ACT suppliers Trends in Availability and Price of Co-paid ACTs • No formal post-AMFm Phase 1 evaluation has been undertaken. • Trend data is available from surveys implemented by Health Action International* - Commissioned by Global Fund during AMFm Phase 1 and beyond in select countries. - Not intended to substitute in scope or depth for the Independent Evaluation, which reported on urban and rural availability, price and market share of all categories of antimalarials, and more. - Intended to provide visibility on availability and price of co-paid ACTs to facilitate in-country discussions by implementers, technical partners and the Global Fund, with a view of informing adjustments as and when appropriate. - • Four rounds of surveys conducted between Jun and Nov 2011, four rounds between Jan and Sept 2012, two rounds in 2013, plus four rounds in DFID-supported countries in 2014, using the same methodological approach. 30 formal and 30 informal outlets were visited per country, per round. • • • Formal outlets defined as registered retail pharmacies; Informal outlets defined as unregulated, unlicensed outlets. Availability of products bearing the ACTm logo and their prices are recorded, along with some additional information (e.g., price of originator brand and lowest priced generic). * For additional detail on the use (and limitations) of WHO / HAI methodology to analyze medicines availability, see www.haiweb.org/medicineprices. Annual trends in availability of co-paid ACTs in formal outlets appear to follow trends in quantities of co-paid ACTs delivered. Average annual availability of any co-paid ACTs in formal outlets, as reported by HAI, 2011-2014, and annual quantities of co-paid ACTs delivered to private sector buyers, as reported to the Global Fund by ACT suppliers, 2010-2014 Nigeria Uganda 100% 70 100% 90% 90% 60 80% 60% 80% 50 70% 60% 40 50% 10 40% 30% 30 40% 30% 20 20% 10% 2014 0% 2013 0 2012 2014 2013 2012 2011 2010 2014 2013 2012 2011 2010 2014 2013 2012 2011 2010 2014 2013 2012 0% 2011 0 1 70% 60% 0.8 50% 0.6 40% 30% 0.4 20% 10 2011 10% 80% 50% 2010 5 90% 1.2 20% 0.2 10% 0 0% 2014 15 100% 2013 70% 1.4 2012 20 Madagascar 2011 25 2010 Co-paid treatment doses delivered to private sector buyers, in millions Tanzania 2010 Kenya Ghana 8 Annual trends in availability of co-paid ACTs in informal outlets appear to show greater variation/more sensitivity over time than measures in formal outlets in some countries. Average annual availability of any co-paid ACTs in formal and informal outlets, as reported by HAI, 2011-2014, and annual quantities of co-paid ACTs delivered to private sector buyers, as reported to the Global Fund by ACT suppliers, 2010-2014 Nigeria Uganda 100% 70 100% 90% 90% 60 80% 60% 80% 50 70% 60% 40 50% 10 40% 30% 30 40% 30% 20 20% 10% 2014 0% 2013 0 2012 2014 2013 2012 2011 2010 2014 2013 2012 2011 2010 2014 2013 2012 2011 2010 2014 2013 2012 0% 2011 0 1 70% 60% 0.8 50% 0.6 40% 30% 0.4 20% 10 2011 10% 80% 50% 2010 5 90% 1.2 20% 0.2 10% 0 0% 2014 15 100% 2013 70% 1.4 2012 20 Madagascar 2011 25 2010 Co-paid treatment doses delivered to private sector buyers, in millions Tanzania 2010 Kenya Ghana 9 Countries achieved different prices at the end of 2011 as documented in the AMFm Phase 1 Independent Evaluation, with different paces and scale of implementation of supporting interventions, particularly of IEC/BCC Median cost to patients of one AETD of QAACTs in public and private forprofit outlets (US dollar equivalent) 6.00 5.28 5.00 4.47 4.00 3.42 3.00 2.74 2.63 2.79 2.47 1.96 2.00 1.00 5.99 1.19 1.13 0.94 1.48 0.58 0 0 0.60 0.14 0 0 0 0 1.17 0.94 0 0 0 0 0 0 0 0 0.00 Ghana Kenya Madagascar Public health sector (Baseline) Private for-profit sector (Baseline) Niger Nigeria Tanzania Uganda Zanzibar mainland Public health sector (Endline) Private for-profit sector (Endline) 10 Since the end of AMFm Phase 1, retail prices of co-paid A/L 6x4 have generally increased, possibly linked to either decreases in deliveries of co-paid ACTs or a reduction in subsidy level (or both), with the exception of Madagascar. Further, it should be noted that nearly every country has scaled down communications campaigns regarding the subsidy program following a peak during AMFm Phase 1. Country Outlet Type Formal Ghana Kenya Nigeria Tanzania Madagascar Uganda Median PerRetail Price Median centNumber of of co-paid Number of Retail Price age unique price A/L 6x4 unique price of co-paid change observations AMFm observations A/L 6x4 in price Phase 1 2013-2014 period 359 $ 0.93 54 $1.20 28% Informal 103 $ 0.96 10 $1.50 Formal Informal Formal Informal Formal Informal Formal Informal Formal Informal 371 207 450 370 285 211 73 29 440 191 $ 0.52 $ 0.53 $ 1.44 $ 1.50 $ 0.63 $ 0.70 $ 0.51 $ 0.57 $ 1.24 $ 1.81 227 109 283 260 63 50 33 8 227 128 $1.17 $1.15 $2.01 $1.81 $0.92 $0.92 $0.46 $0.69 $1.81 $1.95 Key observations Peak deliveries late 2011, further decline in 2013 linked to 56% 2013 Transition envelope 125% Peak deliveries in Q3 2012; subsidy level reduced to 70% in 2013 117% 40% Peak deliveries Q3 2013; subsidy level reduced to 85% in 2013 20% 47% Peak deliveries in Q2 2012; subsidy level reduced to 80% in 2013 33% -11% Peak deliveries in 2013, when implementation was on hold. 22% 46% 8% Peak deliveries in early 2014, just as subsidy level is reduced to 50% * Data as reported by HAI, per methods described in previous slides. Key observations noted by Global Fund. 11 25 Co-paid treatment doses delivered to private sector buyers, in millions Nigeria Kenya Ghana $1.60 Introduction of subsidy reduction 25 $1.40 20 $1.60 70 $1.40 60 Introduction of subsidy reduction $3.00 $2.50 20 $1.20 $1.20 50 $2.00 $1.00 15 $1.00 15 40 $0.80 10 $0.60 $0.80 $1.50 30 10 $0.60 $1.00 $0.40 5 $0.40 20 5 $0.20 0 $- 2011 2012 2013 $0.20 0 $2011 2012 2013 2014 $0.50 10 0 $- 2011 2012 2013 2014 12 Highest, lowest and weighted average median prices of co-paid A/L 6x4 , formal outlets, reported by HAI Three examples of country-specific variation regarding changes in deliveries of co-paid ACTs, prices of co-paid A/L 6x4 and changes in subsidy levels over time HAI data from February 2015 reports prices of subsidized ACTs below those of unsubsidized originator brands and lowest priced generics. Median price trends of A/L 20/120 mg (6x4): co-paid (AMFm) versus unsubsidized originator brand and lowest price generic, February 2015 13 Key conclusions • Several changes have been implemented since the end of AMFm Phase 1 in countries that have chosen to implement the Private Sector Co-payment Mechanism. • Data available for the six AMFm Phase 1 countries implementing the Private Sector Co-payment Mechanism indicate variations across countries in the annual supply of co-paid ACTs delivered to private sector buyers each year, availability and price of co-paid A/L 6x4 in retail outlets. • These need to be interpreted in light of implementation changes that have occurred with the private sector co-payment mechanism, including reductions in subsidy levels in some countries. 14 Additional Resources on AMFm Phase 1 and the Private Sector Co-payment Mechanism From RBM: • Key Learnings from AMFm Phase 1 From the Global Fund: • AMFm Phase 1 Independent Evaluation Report • Information Note on the Private Sector Co-payment Mechanism • Operational Policy Note • HAI Price Tracking Survey Reports Thank you 16 Data for slide 12: HAI survey data 2011: 4 rounds; 2012: 4 rounds; 2013: 3 rounds; 2014: 4 rounds Ghana Formal Informal Kenya Formal Informal Tanzania Formal Informal Uganda Formal Informal Nigeria Formal Informal Madagascar Formal Informal 2011* Median N Price 168 $ 0.97 38 $ 0.99 229 $ 0.43 118 $ 0.43 153 $ 0.62 109 $ 0.75 204 $ 1.13 81 $ 1.74 213 $ 1.30 167 $ 1.40 23 $ 0.60 9 $ 0.54 2012* 2013** Median Median N Price N Price 191 $0.90 54 $ 1.20 65 $0.94 10 $ 1.50 142 $0.67 67 $ 1.17 89 $0.67 34 $ 1.17 132 $0.64 63 $ 0.92 102 $0.64 50 $ 0.92 236 $1.33 79 $ 1.95 110 $1.86 40 $ 1.95 237 $1.57 111 $ 2.04 203 $1.59 91 $ 1.73 50 $0.48 33 $ 0.46 20 $0.58 8 $ 0.69 2014* Median N Price 160 75 $1.18 $1.14 148 88 172 169 $1.73 $1.95 $2.00 $1.85 17 Trends in availability of co-paid ACTs in private sector outlets late 2011 to 2014, as reported by HAI International Availability of co-paid ACTs in informal outlets appears to be more sensitive than that in formal outlets. Availability as reported by HAI appears to track with deliveries of co-paid ACTs to each country as reported to the Global Fund by ACT suppliers. Formal Outlets 100 50 0 Ghana Kenya Madagascar Nigeria Tanzania Uganda Ghana Kenya Madagascar Nigeria Tanzania Uganda 100 Informal Outlets Percentage of facilities having any ACTm ACT available • • 50 0 Aug-11 Oct-11 Nov-11 Jan-12 Apr-12 Oct-12 Apr-13 Aug-13 Jan-14 Apr-14 Aug-14 Oct-14 18 Price trends of co-paid ACTs • • A February 2015 round of data collection by HAI International revealed a decrease and increase in formal and informal outlets in Kenya, decreases in Nigeria and Uganda. Data was not collected during 2014 in Ghana and Tanzania. It should be noted that subsidy levels decreased in several countries from AMFm Phase 1 levels of ~95% (to 70% in Kenya, 85% in Nigeria and 50%/70% in Uganda). Price trends of A/L (20/120 mg) (6x4) in private sector outlets 19