Livestock Insurance

The webinar will begin shortly.

There is no audio at this time.

This presentation is being recorded

for your viewing pleasure at a future

date.

The attendance and proctor forms are

available under ‘Materials’ in the Webinar’s

Console to the right.

The PowerPoint presentation is also

available under ‘Materials’.

You will receive the course number for

your state near the end of class.

Sponsored By:

The Hartford Financial

Use the ‘chat’ window for questions

Services

Livestock

www.InsuranceCommunityUniversity.com

1

. content.

on the

Welcome to your Insurance

Community University

Audio

All of you are currently on mute

Un-mute your own system

Telephone Option

Select Telephone on your screen

Dial in the PIN number so that your number becomes

active

Microphone and/or Speaker Option

You can use this option if you have a headset that you

use with your computer

www.InsuranceCommunityUniversity.com

.

2

Participation & Chat Window

You will receive information from the monitor via the

‘Chat’ window.

Please locate window in the control panel

Q & A is welcomed during the presentation and at the

end of the presentation

You will find the question box on your control panel

Write your question in that box

and send it to the presenter/organizer

The presenter will take those

questions in the order submitted

www.InsuranceCommunityUniversity.com

.

3

DOI Requirements

When you see a slide with the hand up symbol,

touch the “hand” icon on your control panel

Click ONCE only

If you do not raise your hand, the monitor will be

in contact with you in the chat box

If you are in a group, the designated proctor is

responsible to make certain you are all in

attendance at all times

= Hand is down

www.InsuranceCommunityUniversity.com

.

4

Polling

Throughout the class we will be

conducting periodic polls

We need 100% participation on the polls

The polls are intended to check

participation but also to create discussion

topics throughout the presentation

www.InsuranceCommunityUniversity.com

.

5

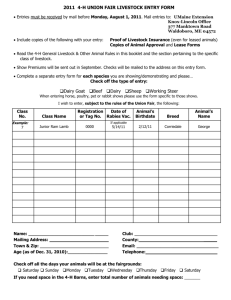

Forms To Complete for CE

After class ends

Return attendance form

Proctors – return your form to email

address

Email address is in chat window or in

email sent to you today

www.InsuranceCommunityUniversity.com

.

6

DOI Requirements

We will file your hours with the DOI after

the completion of this webinar and we

have received the attendance form.

You have 48 hours to return the form

You will be sent a Certificate of

Attendance/Completion by email. Please

retain this for your records for five years.

www.InsuranceCommunityUniversity.com

.

7

Internet Disruption

If the presenter looses internet connection

STAY ON THE LINE

The administrators will communicate with

you

www.InsuranceCommunityUniversity.com

.

Internet Failure

If the internet fails and all participants are

kicked off line by Go To Training or other

source then the seminar will be terminated

You will receive instructions by email as to

how we will proceed

This is a precautionary notice, only

www.InsuranceCommunityUniversity.com

.

9

This class is being recorded

Available in the University

This course is approved for CE in CA Only

www.InsuranceCommunityUniversity.com

.

Disclaimer

Insurance forms and endorsements vary based on

insurance company; changes in edition dates;

regulations; court decisions; and state jurisdiction. This

instructional materials provided by Insight is intended

as a general guideline and any interpretations provided

by the instructor or the creator(s) of this material do not

modify or revise insurance policy language. In

providing these materials, the authors assume neither

liability nor responsibility to any person or business

with respect to any loss that is alleged to be caused

directly or indirectly as a result of the instructional

materials provided.

Copyright 2010 – 2013 All Rights Reserved

www.insurancecommunitycenter.com

www.InsuranceCommunityUniversity.com

.

11

Your Instructor Today

Mike Sergeant , AFIS

Sales & Service Director, The Hartford

Financial Services Livestock

Sponsored By:

The Hartford Financial

www.InsuranceCommunityUniversity.com

12

.

Services

Livestock

Polling Question #1

www.InsuranceCommunityUniversity.com

.

13

Topics Covered

Background on Livestock Insurance

Specific types of Livestock Insurance

Mortality Insurance

Pasture Insurance

Feedlot Insurance

Dairy Herd Insurance

Auction Market Insurance

Transit or Cargo Insurance

Import/Export Insurance

www.InsuranceCommunityUniversity.com

.

14

Exposures to Loss

At “scheduled” locations

At “un-scheduled” locations

On pastures or grazing land

At an auction yard

While in transit

During loading or unloading

www.InsuranceCommunityUniversity.com

.

15

Background on Livestock

Insurance

www.InsuranceCommunityUniversity.com

.

16

Polling Questions #2

www.InsuranceCommunityUniversity.com

.

17

Background on Livestock

Insurance

Livestock is available under most Farm

Package Policies

Livestock may be scheduled or included

under “property” in the form

Caution:

Review values carefully

Farm Policies have limited values which

may not cover the Livestock owner’s

exposures

www.InsuranceCommunityUniversity.com

.

18

Background on Livestock

Insurance—Definition of Terms

Purebred/Registered

The animal is registered with a Breeed

Association and its bloodlines are recorded

Stocker

A non-registered animal used for breeding or

dairy purposes

Feeder

A non-registered animal being fed for eventual

slaughter intended to enter the food chain

www.InsuranceCommunityUniversity.com

.

19

Background on Livestock

Insurance—Definition of Terms

Feedlot

A lot or combination of buildings

intended for confined feeding and

raising of livestock using supplemental

feed sources

Pasture

A confinement area where grass or

crop residue is used for livestock

grazing

www.InsuranceCommunityUniversity.com

.

20

Background on Livestock

Insurance—Definition of Terms

Current Market Value

The average market value for Feeder or

Stocker livestock as determined at the

nearest applicable market or as

published by the USDA price reporting

service

www.InsuranceCommunityUniversity.com

.

21

Background on Livestock

Insurance—Definition of Terms

USDA

The United States Department of

Agriculture which is the governing

authority over all Agricultural related

affairs within the US

www.InsuranceCommunityUniversity.com

.

22

Mortality Insurance

www.InsuranceCommunityUniversity.com

.

23

Polling Question #3

Which of the following is a Covered

Cause of Loss on a Mortality Policy?

24

www.InsuranceCommunityUniversity.com

.

Mortality Insurance

This type of insurance is basically a type

of Term Live type of coverage for Horses,

Cattle and Dogs

The animal is insured against Death (or

Destruction for humane purposes) which

may occur during the policy period.

Covered causes of Death include

“accident”, “Illness” and “disease”.

www.InsuranceCommunityUniversity.com

.

25

Mortality Insurance

Additionally the policy contains the

“hazards of transportation” anywhere in

the U.S. and Canada.

Particular attention should be given to

insurance company definitions of these

coverage terms.

www.InsuranceCommunityUniversity.com

.

26

Mortality Insurance

Rates for Mortality Insurance vary

depending based on the use, age and

value of the animal being insured.

A veterinarian exam is usually required by

the insuring company prior to accepting

the risk.

www.InsuranceCommunityUniversity.com

.

27

Mortality Insurance

Most insurance carriers will accept a

“Statement of Health” which is completed

by the owner of the animal provided that

the animal has been under the owner’s

care for more than 30 days.

Livestock insured on a Mortality Policy are

usually higher value “Registered or

Purebred” animals whose loss would

cause economic hardship to their owner

www.InsuranceCommunityUniversity.com

.

28

Mortality Insurance

There are several endorsements available

on a Mortality Policy offered for an

additional premium. They may include:

Surgical Coverage;

Major Medical Coverage;

Loss of Use:

Limited Loss of Use;

Emergency Colic Surgery and Breeding

Soundness Coverage.

www.InsuranceCommunityUniversity.com

.

29

Pasture Insurance

www.InsuranceCommunityUniversity.com

.

30

Pasture Insurance

This coverage provides protection to

livestock (usually cattle) that are put on

large expanses of pasture land to graze

prior to being moved to a feedlot.

In the west, pasture land can consist of

several thousand acres and usually

involve leases of BLM (Bureau of Land

Management) land.

In other areas pastures may consist of

less than 20 acres.

www.InsuranceCommunityUniversity.com

.

31

Pasture Insurance

Coverage under this type of insurance is

available for one of three policy periods:

Annual 12 month policy,

Winter Policy ( Oct. 1 through April 30th)

Summer Policy (May 1st through Sept.

30th).

www.InsuranceCommunityUniversity.com

.

32

Pasture Insurance

Coverage is usually written as Specified

Perils wherein the policy insures the

livestock for “Death Only” when caused by

a Specific Peril.

www.InsuranceCommunityUniversity.com

.

33

Pasture Insurance

Most policies provide perils including

Fire, Lightning,

Vandalism or Malicious

Mischief,

Drowning,

Attack by Wild Dogs or Theft (Excluding

Mysterious

Animals,

Disappearance),

Electrocution by

Animal Collision

Artificial Means,

Smothering Directly

caused by a blizzard or

snowstorm.

www.InsuranceCommunityUniversity.com

.

34

Feedlot Insurance

www.InsuranceCommunityUniversity.com

.

35

Feedlot Insurance

Feedlot Insurance is similar in nature to

Pasture Insurance.

The coverage protects Livestock which is

in a confined area which are being fed

grains and supplements.

This type of operation is usually a situation

where the cattle are being fattened and

will be sent to slaughter to become steaks

and hamburger at the local supermarket.

www.InsuranceCommunityUniversity.com

.

36

Feedlot Insurance

Most policies provide perils including

Fire, Lightning,

Vandalism or Malicious

Mischief,

Drowning,

Attack by Wild Dogs or Theft (Excluding

Mysterious

Animals,

Disappearance),

Electrocution by

Animal Collision

Artificial Means,

Smothering Directly

caused by a blizzard or

snowstorm.

www.InsuranceCommunityUniversity.com

.

37

Feedlot Insurance

Typical perils NOT insured on the policy

Grazing

Lagoon, stagnant or flood water

Contamination from sources other than

feed or water

Errors in mixing of feed

www.InsuranceCommunityUniversity.com

.

38

Feedlot Insurance

Limits of insurance will usually be written

at “Current Market Value” and may have a

Maximum Limit per Occurrence.

Feedlot operations are spread throughout

the United States but the larger ones are

concentrated in the states of Texas,

Kansas, Oklahoma and Nebraska. These

are prime areas where weather conditions

can pose a serious threat to Livestock.

www.InsuranceCommunityUniversity.com

.

39

Dairy Herd Insurance

www.InsuranceCommunityUniversity.com

.

40

Dairy Herd Insurance

Dairies are similar to feedlots since they

usually consist of cattle that are in a

confined area and fed grains and

supplements.

The difference is that in some areas, Dairy

cattle are housed in enclosed structures

while in the Southwest and warmer

climates the cattle are kept in pole barns

with fans and misters to keep them cool

and comfortable

www.InsuranceCommunityUniversity.com

.

41

Dairy Herd Insurance

In this situation insurance coverage is for

ordinary Dairy cattle and can include

Milking Cows and Heifers as well as dry

cows.

www.InsuranceCommunityUniversity.com

.

42

Dairy Herd Insurance

Most policies provide perils including

Insurance protection is against Death or

Destruction for humane purposes following a

Specified Peril.

In addition coverage is provided for the Specified

Perils including: Fire, Lightning, Drowning, Attack

by Wild Dogs or Animals, Electrocution by

Artificial Means, Vandalism or Malicious Mischief,

Theft (excluding mysterious disappearance)

Animal Collision and Smothering Directly caused

by a blizzard or snowstorm.

www.InsuranceCommunityUniversity.com

.

43

Dairy Herd Insurance

Dairy cattle values tend to fluctuate with

the price of milk, however, keep in mind

that the average Dairy Cow has a life span

of 5-7 years and depending on the butter

fat content of her milk, she can be difficult

and expensive to replace should a loss

occur.

www.InsuranceCommunityUniversity.com

.

44

“Contaminated Feed & Water”

Endorsement

An endorsement for Feedlot and Dairy

Herd Insurance

What this additional coverage form offers

is protection for Death of the Livestock

when caused by a Contaminant in the

food and water supplied to the cattle.

It is a Death Only coverage and can be

purchased with a choice of Limits and

Deductibles to fit each individual situation

that Feedlot and Dairy owners may

require.

www.InsuranceCommunityUniversity.com

45

.

“Contaminated Feed &

Water” Endorsement

This endorsement has been an important

addition to coverage’s in the West and is

spreading throughout the United States.

This insurance is rapidly becoming a Bank

Loan requirement for larger facilities.

www.InsuranceCommunityUniversity.com

.

46

Auction Market Insurance

www.InsuranceCommunityUniversity.com

.

47

Polling Question #4

Have you visited a Livestock Auction,

Feedlot or Dairy in your area

recently?

www.InsuranceCommunityUniversity.com

.

48

Auction Market Insurance

Prior livestock forms death with cattle that

was being raised either on a pasture near

a farm or ranch or in a confined area such

as a feedlot or dairy

www.InsuranceCommunityUniversity.com

.

49

Auction Market Insurance

This coverage is usually written for the

owner or owners of a Livestock Auction

Facility.

In most cases these types of operations

include buildings and pens which hold the

livestock prior to and after the sale along

with a Sale Ring where the animals are

bid on by interested buyers.

www.InsuranceCommunityUniversity.com

.

50

Auction Yard Coverage

Typical “premises” forms do not

include auction yard locations

Transit forms cease when the

transportation of livestock ends

www.InsuranceCommunityUniversity.com

.

51

Auction Market Insurance

Auction Market owners are responsible for

the Care, Custody and Control of the

livestock when on their premises.

With Auction Market Insurance there is

usually no deductible and livestock are

insured for their “Current Market Value”.

www.InsuranceCommunityUniversity.com

.

52

Auction Market Insurance

There are three broad categories of

exposures/coverage

Yard Coverage

This insures the animals received on

the premises and protects against loss

to the Livestock while kept in the Yards

resulting from Specified Perils such as

Fire, Windstorm or Tornado,

Electrocution, Hail & Theft while on the

premises up to a period of 10 days.

www.InsuranceCommunityUniversity.com

.

53

Auction Market Insurance

Accidental Death & Crippling while in the

Yards

This protects the animals from the

hazards of crippling or even death while

being moved through the alleys, pens,

sheds & barns of the Auction Market

facility.

www.InsuranceCommunityUniversity.com

.

54

Auction Market Insurance

Mortgage & Theft Coverage

This is a protective measure for the Auction

Market business

It is written to protect the Auction Market itself

from being held responsible for selling cattle

that have a Mortgage on them and are sold

through the Market but the Lender never

receives payment for their monetary interest or

mortgage that they hold on the livestock.

www.InsuranceCommunityUniversity.com

.

55

Auction Market Insurance

The coverage’s are usually written as a

monthly reporting type of Policy. The

Auction market reports monthly gross

sales and pays a percentage of those

sales as premium for all three of the

protective coverage’s offered.

www.InsuranceCommunityUniversity.com

.

56

Livestock Transportation

www.InsuranceCommunityUniversity.com

.

57

Polling Question # 5

Do you work with Commercial Truckers who do

long haul or may have occasion to haul

livestock?

www.InsuranceCommunityUniversity.com

.

58

Transportation

Perhaps one of the greatest exposures

that cattle have to loss and one which

occurs on a daily basis throughout the

U.S. is exposure to Death or Injury while

being transported.

The usual mode of transportation is a

specially designed livestock trailer which

can be partitioned to separate large and

small animals.

www.InsuranceCommunityUniversity.com

.

59

Transportation

A Farm Auto Policy may be written to

include Livestock which is owned by the

insured and transported via a gooseneck

trailer or Farm truck.

Caution: be sure to read the Farm Auto

Policy to be sure that coverage under this

form is not limited to only Dead livestock

which is involved in an accident.

Check that limits per head follow the

changing livestock market values.

www.InsuranceCommunityUniversity.com

.

60

Transportation

There is Transit/Cargo Insurance

specifically written to cover livestock which

is being transported either by the Farmer

or Rancher himself or by a Commercial

Livestock Hauler who makes his living

moving cattle across the country.

www.InsuranceCommunityUniversity.com

.

61

Transportation

Two forms of stand alone Livestock Cargo

Insurance are currently on the market.

Transit Limited Coverage

this type of insurance is Limited to the

Specific Perils of Fire, Lightning,

Collapse of Bridges or Culverts and

Collision or Upset.

www.InsuranceCommunityUniversity.com

.

62

Transportation

What is unique to the coverage is that should a

loss occur due to a covered specified peril

The insurance is expanded when compared to a

Farm Auto Policy to include Dead and Crippled

Livestock.

In some cases it also will pay for Round up fees

to gather the cattle following a Specified loss and

will purchase the entire load of Livestock should

the shipper deny the balance of the load of cattle.

www.InsuranceCommunityUniversity.com

.

63

Transportation

Transit/Cargo Insurance is a Broad Form

Transit Policy.

This form is expanded to include not only

the perils of Fire, lightning, Collapse of

Bridges and Culverts and Collision or

upset but it also provides coverage for

livestock which is basically being

transported down a road and suddenly is

jostled and gets down in the trailer and is

killed or crippled.

www.InsuranceCommunityUniversity.com

.

64

Transportation

The policy states in essence that “if the

Livestock is loaded in good condition it will

be unloaded in the same, like condition”.

Premium for this type of coverage can be

expensive but it does provide the most

extensive coverage for the Livestock

hauler.

www.InsuranceCommunityUniversity.com

.

65

Import/Export Livestock

Insurance

www.InsuranceCommunityUniversity.com

.

66

Import/Export Livestock

Insurance

Import and Export Insurance for Livestock is an

ever broadening opportunity in today’s

Agricultural World.

There are some businesses dedicated to

providing services to assist in the Import or

Export of Livestock known as “Freight

Forwarders”.

There are also individual Livestock breeders

who wish to improve their current stock of

breeding animals and actually travel to

European Countries to contract for Bulls and

Cows to add to their herd.

www.InsuranceCommunityUniversity.com

.

67

Import/Export Livestock

Insurance

When writing this type of Insurance it is

recommended that as much information

as possible be gathered at least 3 to 6

months prior to shipping of the Livestock.

Information to be noted are:

Where are the Animals being shipped

from?

Where are they being Shipped to?

www.InsuranceCommunityUniversity.com

.

68

Import/Export Livestock

Insurance

How are the animals being shipped?

(the most common way is via air but

there are still shipments of livestock

that cross the oceans on a weekly

basis)

Are the animals being shipped bred ?

If they are bred how close to full term

are they?

www.InsuranceCommunityUniversity.com

.

69

Import/Export Livestock

Insurance

Is there a quarantine period required

either prior to shipping or when they arrive

at their destination?

Is transportation from the airport or dock

also needed to get the cattle safely to their

final destination?

www.InsuranceCommunityUniversity.com

.

70

Import/Export Livestock

Insurance

Types of coverage offered with Import/Export

Insurance includes:

Death and Crippling of the livestock while in

transit, be it via ship or plane.

Protection for the Livestock while in

Quarantine prior to shipment.

Protection for the Livestock while in

Quarantine after arrival at its destination

Transit/Cargo coverage for trucking to the final

destination if needed.

www.InsuranceCommunityUniversity.com

.

71

Upcoming Classes

Upcoming University/Paid CE FREE to University Members

Classes

$50.00/charge for non university members

11/14

Trucking

11/21

AgOP

12/3

Surety Bonds

Upcoming Community Classes FREE to University Members

$25.00/charge for non university members

11/19

Bullying Prevention and Intervention

Join the University TODAY. www.insurancecommunitycenter.com

Click Join University at the top of the bar

www.InsuranceCommunityUniversity.com

.

72