2004 * 05 annual report - Municipal Association of Victoria

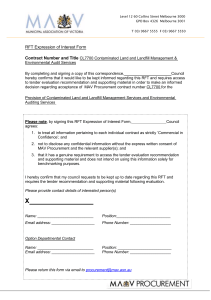

advertisement