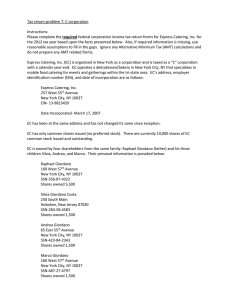

Tax return-problem 7: C corporation Instructions: Please complete

advertisement

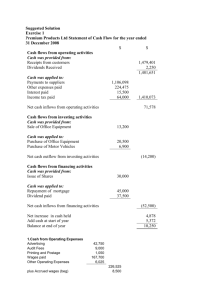

Tax return-problem 7: C corporation Instructions: Please complete the Express Catering, Inc.’s 2014 tax return based upon the information provided below. If required information is missing, use reasonable assumptions to fill in the gaps. Ignore any Alternative Minimum Tax (AMT) calculations and do not prepare any AMT related forms. Express Catering, Inc. (EC) is organized in the state of New York as a corporation and is taxed as a “C” corporation with a calendar year-end. EC operates a delicatessen/bakery in New York City, NY that specializes in mobile food catering for events and gatherings within the tri-state area. EC’s address, employer identification number (EIN), and date of incorporation are as follows: Express Catering, Inc. 257 West 55th Avenue New York City, NY 10027 EIN- 13-9823459 Date Incorporated: March 17, 2009 EC’s address has not changed since its inception. EC has only common shares issued (no preferred stock). There are currently 10,000 shares of EC common stock issued and outstanding. EC is owned by four shareholders from the same family: Raphael Giordano (father) and his three children Silvia, Andrea, and Marco. Their personal information is provided below: Raphael Giordano 160 West 57th Avenue New York City, NY 10027 SSN: 356-87-4322 Shares owned 5,500 Silvia Giordano Costa 250 South Main Hoboken, New Jersey 07030 SSN: 284-58-4583 Shares owned 1,500 Andrea Giordano 65 East 55th Avenue New York City, NY 10027 SSN: 423-84-2343 Shares owned 1,500 Marco Giordano 160 West 57th Avenue New York City, NY 10027 SSN-487-27-4797 Shares owned 1,500 EC uses the accrual method of accounting and follows GAAP. EC is not a subsidiary nor is it in an affiliated group with any other entity. EC is not audited by a CPA firm and has never had a restatement of its income statement. EC reported the following information for the year: EC did not pay dividends in excess of its current and accumulated earnings and profits. None of the stock of EC is owned by non U.S. persons. EC has never issued publicly offered debt instruments. EC is not required to file a Form UTP. EC made several payments in the current year that required the filing of federal Forms 1099. These Forms 1099 were filed timely by EC. During the year, none of the shareholders of EC changed. EC has never disposed of more than 65% (by value) of its assets in a taxable, non-taxable, or taxdeferred transaction. EC did not receive any assets in Section 351 transfers during the year. All of the questions on Schedule B, Form 1120 should be checked “no” for the year. Additional information: EC has been rapidly expanding its catering business. This expansion has required a significant amount of new equipment purchases. EC sold some of its liquid investments in order to avoid having to take on debt to fund these purchases. Further, EC invested heavily in its catering business by significantly increasing its advertising budget. EC and its officers expect that revenue increases from these expenditures will begin next year. Despite being profitable the past few years, EC does not want to carryback net operating loss (if any) generated in the current year. EC believes the next few years will be far more profitable and the losses will be of a greater tax benefit in the future. The dividends received by EC during the year were paid by Apple, Inc. EC had its sole municipal bond (New York City) redeemed (bought back) in the current year. EC originally purchased the New York City bonds on February 1, 2011 for $100,000 (no premium or discount paid). The bond was redeemed by New York City on February 1, 2014 for $100,000. EC received a Form 1099-B to reflect the transaction. Box 6b of the 1099-B was checked. EC purchased 200 shares of Apple, Inc. on October 10, 2011 for $100,000 (including commission). On July 10, of the current year, EC sold the 200 shares of Apple, Inc. for $350 a share (including commission). EC received a 1099-B reporting the sale proceeds. Box 6b was checked on the Form 1099B. During the year EC contributed $8,000 to the American Lung Association. On December 10, EC paid Madison Advertising $27,500 to design a new catering advertisement campaign for next year. This money represented half of the total $55,000 contract price. EC expects that the services will be provided and delivered to EC on about June 30, 2015. EC prepaid an insurance premium of $21,000 in September. The new policy is effective October 1, 2014 through September 30, 2015 EC’s regular tax depreciation for the year is correctly calculated as $350,000 before considering the current year fixed asset additions of $840,000 (see table below). EC wants to claim the fastest recovery method(s) possible on these asset additions without electing any §179 expensing. Total current year asset additions are as follows (all the equipment purchased was new): Description 5-year MACRS Property 7-year MACRS Property Delivery Truck (over 6,000 lbs): 5-year MACRS Property Date Purchased October 2, 2014 September 10, 2014 October 12, 2014 Amount $480,000 $320,000 $40,000 EC officer information for the year is as follows (compensation amounts included in total wages on the income statement for all employees): Name Social Security number Raphael Giordano Silvia Costa Andrea Giordano Marco Giordano 356-87-4322 284-58-4583 423-84-2343 487-27-4797 Percent of time devoted to business 100% 100% 100% 100% Percent of stock owned Amount of compensation 55% 15% 15% 15% 150,000 130,000 130,000 120,000 As reported on the balance sheet (see below), on December 31, 2013 the accrued wages were $44,500 and the accrued bonuses were $45,000. The wages and bonuses were payable to Raphael, Silvia, Andrea, and Marco. These accrued wages and bonuses were paid on January 20, of 2014. Also as reported on the balance sheet, on December 31, 2014, the accrued wages were $51,500. The wages were owed to Raphael, Silvia, Andrea, and Marco. The accrued wages were paid on January 22, 2015. All of the other employees’ wages and bonuses were paid on December 31, 2014. As of December 31, 2013 and December 31, 2014, respectively, EC had accrued vacation payable on its books of $62,500 and $73,000. All of the 2013 vacation accrual was paid during the period from April 1 through November 30, 2014. As of March 15, 2015 EC had paid none of its 2014 accrual. All of the vacation accrual amounts for both years were owed to employees other than Raphael, Silvia, Andrea, and Marco. None of the officers had accrued vacation at December 31, 2013 or 2014. On November 1, a large insurance company paid EC a $100,000 deposit to reserve catering event services on March 18, 2015 at the insurance company’s annual meeting in New York City. The money is fully refundable up until January 15, 2015. Thereafter, half of the deposit becomes non-refundable. EC maintains an inventory of several items. Inventory is valued at cost. EC has never has never changed it inventory method. EC uses specific identification for its inventory. EC has never written down any subnormal goods. The rules of Section 263A (UNICAP) do not apply to EC. EC did not pay a dividend in the current year. EC made no estimated tax payments during the current year. Financial Statements (kept on a GAAP basis): Express Catering, Inc. Balance Sheet Assets: Cash Accounts Receivable Less: Allowance for Bad Debts Inventory Publicly traded securities Tax-exempt bond U.S. Treasury Bonds Fixed Assets Less: Acc. Depreciation Prepaid Insurance Prepaid Rent Prepaid Advertising Total Assets: 1/01/2014 $ 62,500 145,000 (32,000) 59,000 100,000 100,000 125,000 2,115,000 (436,500) 0 38,500 0 $2,276,500 12/31/2014 $ 44,000 177,000 (41,000) 96,000 0 0 125,000 2,955,000 (715,000) 15,750 39,500 27,500 $2,723,750 Liabilities and Shareholders’ Equity: Accounts Payable Accrued Bonuses Accrued Vacation Accrued Wages Event Deposits Deferred Tax Liability Note Payable-First Bank of NY (Credit Line) Note Payable-EG Capital Equipment Leasing Capital Stock Additional paid-in Capital Retained Earnings-Unappropriated Total Liabilities and Shareholders’ Equity: 102,000 45,000 62,500 44,500 0 45,910 424,000 1,243,000 131,000 0 73,000 51,500 100,000 14,000 657,000 1,415,000 1,000 99,000 209,590 1,000 99,000 182,250 $2,276,500 $2,723,750 Income Statement for the period ending December 31, 2014 Item Amount Income: Gross Sales Less: Returns Net Sales Cost of Goods Sold $ 2,925,000 (8,500) 2,916,500 (1,129,850) Gross Profit 1,786,650 Dividend Income Interest Income -Bank Interest Income-U.S. Treasury Municipal Bond Interest Income Capital Loss-Apple, Inc. 2,800 150 3,000 1,400 (30,000) Total Income: 1,764,000 Expenses: Employee Salaries Repairs and Maintenance Bad Debts Rent Payroll Taxes Licensing Fees Property Taxes Interest Expense Depreciation Office Supplies Employee Training Employee Benefits Charitable Contribution Advertising Meals and Entertainment Travel Insurance Utilities Telephone Federal income tax expense/(benefit) 743,500 19,000 44,000 230,000 60,000 4,500 12,500 140,000 278,500 5,400 3,600 24,000 8,000 70,000 3,400 600 19,750 142,000 14,500 (31,910) Total Expenses: 1,791,340 Net Income (Loss): ($27,340)