Taxpayer Responses to Competitive Tax Policies and Tax Policy

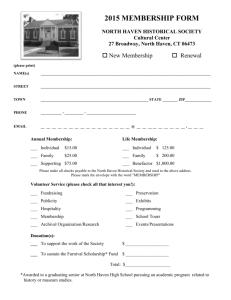

advertisement

Governments and Multinational Corporations in the Race to the Bottom Rosanne Altshuler (Rutgers University) and Harry Grubert (U.S. Treasury Department) Tax competition and the “race to the bottom” • Focus tends to be on host countries using tax policy instruments such as statutory tax rates and tax incentives to compete for mobile capital, but – neglects role of corporate tax planning by multinational corporations (MNCs) – neglects role of home governments that facilitate this planning through their tax codes • There are three parties in the “race to the bottom” – host governments, home governments, and MNCs – tax havens play a passive role only Goal of paper • Understand role of the three parties in explaining the reduction of corporate tax burdens worldwide • Use data on operations of US MNCs to illustrate role of each of the actors and how these roles may have evolved – No single data set gives complete picture • Country- and subsidiary-level data from Treasury tax files • Data on foreign direct investment and country affiliate income from Bureau of Economic Analysis (BEA) • Focus on 1992 to 2002 – Emphasis on period after 1996 – Treasury regulations issued in 1997 greatly simplified use of more aggressive tax planning strategies Plan of today’s talk • Background on new tax planning strategies • Evidence on tax planning – – – – Changes in firm level effective tax rates The growth of income shifting at the subsidiary level The location of income and real capital Revenue estimate of the tax savings to US companies due to new tax planning strategies The new tax planning strategies • What is a hybrid? – An entity that is incorporated from the host country point of view and a branch from the US point of view (or viceversa) • What is the advantage of using hybrid? – Allows US companies to avoid the current US tax under the CFC rules on inter-company payments like interest, royalties, and dividends – A hybrid entity makes this payment invisible to the US because it all occurs within one combined entity • Setting up hybrids simplified by check-the-box regulations passed in Dec. 1996 and effective Jan. 1, 1997 – All the company had to do to create a “disregarded” entity was check the box on a tax form – Once the box is checked, the entity disappears from the US view Hybrid entities • Parent injects equity into tax haven • Tax haven lends to high-tax affiliate • High-tax affiliate makes interest payments – • But, check-the-box on the high-tax affiliate – • Transaction invisible to Treasury which regards combined tax haven - high-tax operation as a consolidated corporation Result – – – – • Interest would be taxable currently under US CFC rules Interest escapes current U.S. taxation Interest deduction in high-tax country Income deferred in tax haven Interest not taxed anywhere! Parent MNC Equity Tax haven affiliate Interest Loan Data issue – In reports to the Treasury, the parent can elect to list the surviving consolidated corporation as incorporated in the high-tax location or the tax haven Hightax affiliat e More tax planning strategies with hybrids • Move income across locations without tax implications through payment of inter-company dividends – Typically pay to “holding companies” in countries with favorable regimes (exempt dividends and impose low withholding taxes) • Shift income from intellectual property like patents to tax havens – Tax haven engages in a cost-sharing agreement with parent – Haven affiliate licenses resulting technology to other affiliates in exchange for royalty payments. • These inter-company payments are invisible with check the box. • “Hybrid securities” – Considered debt by host country and equity by company receiving payments (more relevant for dividend exemption countries) Tax planning and changes in effective tax rates Average Effective Tax Rates in Manufacturing for 58 Countries Year 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 Average Effective Tax Rate (AETR) 0.33 0.34 0.34 0.32 0.31 0.26 0.25 0.22 0.23 0.24 0.21 Standard Deviation 0.85 0.98 1.03 1.05 1.09 0.89 0.86 0.72 0.79 0.77 0.67 AETR = taxes paid in host country/ E&P in host country Data from Treasury tax files. What explains the recent decreases in AETRs? • Is country behavior (tax competition) or company behavior (tax planning) responsible? – Simple regression analysis of country level data from 1992 and 1998 – Results suggestive of a tax competition story • Countries losing share of U.S. capital relative to their neighbors cut their effective tax rates the most • Countries with relatively high AETRs in 1990 and small countries cut their rates more than the average Company versus country behavior? • Add statutory tax rate to analysis – Statutory tax rate indicates incentives for company tax planning at the margin – Find that statutory tax rate plays no role in explaining decreases in AETRs over the 1992-1998 period • But, the story changes in 2000 – Change in capital share and initial effective tax rates no longer explain differences in declines in AETRs – Statutory tax rate has greater explanatory power • Company rather than country behavior seems to be explaining changes in AETRs in the most current data Tax planning and changes in firm-level ETRs • Cannot directly observe extent to which tax planning has lowered ETRS • Can look at whether factors explaining the variation in ETRs at the firm-level have changed in recent years – Hybrid entities and securities that allow income to be stripped out of high-tax countries may weaken the relationship between statutory rates and ETRs • Compare CFC level data for 1996 and 2000 – Statutory rate is smaller and much less significant determinant of ETRs in 2000 than in 1996 – Role of profitability in explaining differences in ETRs has changed • Higher profitability now associated with lower ETRs – R&D intensive CFCs in 2000 have lower ETRs • Suggests that companies are able to shift income from R&D projects in hightax countries to hybrid entities in tax havens through royalty payments Evidence on the location of income and real capital 1996 2000 $160.8 $231.1 44% 36.5 82.5 126 6.4 19.8 209 Tangible capital in all countries (net plant & equipment plus inventories) 767.5 982.4 28 Tangible capital in five major holding company low-tax countries (Bermuda, Cayman Islands, Netherlands, Luxembourg, Switzerland) 51.7 145.9 182 Earnings and profits of CFCs with parents in finance in the seven major low-tax countries 5.1 5.6 10 Total pre-tax earning and profits Earnings and profits in seven major low-tax countries (Ireland, Singapore, Bermuda, Cayman Islands, Netherlands, Luxembourg, Switzerland) Dividends received in the seven major low-tax countries Dollars in billions. Tabulations from Treasury tax files. All CFCs. Growth Evidence on income shifting • Subsidiary level data from Treasury tax files • Compare income shifting behavior in 1996 and 2000 • Results – Significant widening in the profitability disparities between high-tax and low-tax countries • Possible explanations – High-tax countries may have reacted to increasing tax sensitivity of investment by easing up on transfer pricing and thin cap rules to attract mobile corporations – Some highly profitable subsidiaries in high-tax countries may have disappeared Evidence of tax planning in the BEA data • Information from majority owned foreign affiliates (MOFAs) • US parents are instructed to include income from equity investments in foreign affiliates in their report of total income for each MOFA – Advantage: includes information from disregarded affiliates – Disadvantage: double counting of inter-company dividends • In fact, almost 100% of the growth of pre-tax income in seven major low-tax locations between 1997 and 2002 is attributable to the equity in the income of other foreign affiliates Evidence of tax planning in the BEA data All countries Income from equity investments Pre-tax income Income from equity investments Pre-tax income Growth in income from equity investments 1997 1997 2002 2002 1997-2002 Growth in pre-tax income 1997-2002 $41,781 $188,092 $120,782 $255,225 189% 36% Ireland 1,414 9,359 8,502 26,835 501 187 Luxembourg 1,935 2,352 18,995 18,405 882 683 Netherlands 9,249 17,612 15,238 20,802 65 18 Switzerland 6,326 9,709 11,515 14,105 82 45 Bermuda 1,649 5,933 22,142 25,212 1,243 325 Cayman Islands 1,046 2,678 2,268 2,809 117 5 578 5,765 2,465 7,533 326 31 22,197 53,408 81,125 115,701 265 117 Selected low-tax countries Singapore Total Dollars reported in millions. Inter-company income and worldwide tax payments • Inter-company payments may be deductible in host country and thus save host country taxes • We estimate inter-company payments deductible in the paying country but exempt from tax in the receiving country saved US MNCs $7 billion in foreign taxes in 2002 compared with 1997 – About 4% of total foreign affiliate income --- a substantial reduction in a short period Conclusions • Suggestive evidence that the roles of the three parties may have changed over the last decade • From 1998 on, tax planning by companies seems to be much more significant, facilitated by the more permissive US rules introduced in 1997 • Results illustrate importance of including both company tax planning and the cooperation of governments in any accurate depiction of race to the bottom • Results show the difficulty of using the data to understand the “real” location of profits and how it has changed over time