analytical procedures

advertisement

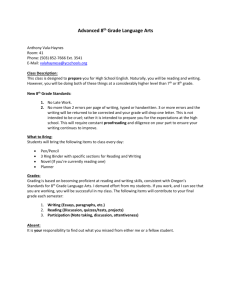

AUDITING CHAPTER 6 Evidence By David N. Ricchiute TOPICS Acquisition & evaluation of evidence Financial statement assertions, audit objectives, & audit procedures Tests of controls, substantive tests, analytical procedures & nonfinancial measures Audit documentation 2 GBW 8th ed., Ch. 6 AUDIT EVIDENCE Sufficient competent evidential matter is to be obtained through inspection, observation, inquiries, and confirmations to afford a reasonable basis for an opinion regarding financial statements under audit. SAS 31 & SAS 80, Amendment to SAS 31. 3 GBW 8th ed., Ch. 6 MEANING OF SUFFICIENT, COMPETENT EVIDENCE Sufficient: quantity of evident necessary to test management’s assertions Competent: relevant, valid, reliable Kinds of evidence necessary to test management’s assertions Link audit risk & audit evidence 4 Relevance Amount of evidence GBW 8th ed., Ch. 6 EVIDENTIAL MATTER Underlying accounting data Records of original entry (journals, ledgers, etc.) Data files Spreadsheets Corroborating information 5 Documents (checks, invoices, contracts) Written representations from 3rd parties (vendors, attorneys) Inquiries of management GBW 8th ed., Ch. 6 FINANCIAL STATEMENT ASSERTIONS Existence or Occurrence Completeness Rights & Obligations Valuation or Allocation Presentation & Disclosure 6 GBW 8th ed., Ch. 6 ACCOUNTS & JOURNAL ENTRIES Purchase & sale of inventory Inventory Accounts payable Cost of Goods Sold Inventory 7 GBW 8th ed., Ch. 6 EXISTENCE OR OCCURRENCE ASSERTION All assets, liabilities, equities exist All transactions occurred Example 8 Test whether inventory physically existed at balance sheet date GBW 8th ed., Ch. 6 COMPLETENESS ASSERTION All transactions that occurred during period are reported for the time period All accounts complete as to data Examples 9 Test whether all purchases goods, services are recorded Test whether all obligations included as liabilities GBW 8th ed., Ch. 6 RIGHTS & OBLIGATIONS ASSERTION Entity entitled to assets (rights) Entity liable for obligations Example 10 Test whether all inventory is owned, not on consignment GBW 8th ed., Ch. 6 VALUATION OR ALLOCATION ASSERTION Assets, liabilities, equities, revenues, expenses recorded at proper amounts Example Test whether inventory valued at lower cost/market Revenues, costs, expenses allocated to proper accounting periods 11 GBW 8th ed., Ch. 6 PRESENTATION & DISCLOSURE ASSERTION Financial statement components properly classified, described & disclosed Example 12 Test to assure financial statements, notes reveal substance of recorded transactions GBW 8th ed., Ch. 6 AUDIT PROCEDURES Observation Documentation Confirmation Mechanical tests Analytical procedures (Comparisons) Inquiries 13 GBW 8th ed., Ch. 6 RELATING OBJECTIVES TO OBSERVATION Direct evidence about existence 14 Example: physically observing client’s assets GBW 8th ed., Ch. 6 RELATING OBJECTIVES TO DOCUMENTATION Internal evidence in documentary form to support existence, valuation 15 Example: vouch documents supporting selected cash disbursements or liabilities GBW 8th ed., Ch. 6 RELATING OBJECTIVES TO CONFIRMATION External evidence from third parties supporting existence, valuation of account balances 16 Example: request confirmation of accounts receivable GBW 8th ed., Ch. 6 RELATING OBJECTIVES TO MECHANICAL TESTS Direct evidence to support valuation Example: recomputing (footing) cash receipts journal Direct evidence to support presentation 17 Example: trace transactions through accounting system for proper recording, classification GBW 8th ed., Ch. 6 RELATING OBJECTIVES TO COMPARISONS Analytical procedures (Comparisons) 18 Direct evidence about completeness, presentation, disclosure Example: examine trends for advertising expense to determine whether more procedures necessary Example: compare disclosures with prior periods GBW 8th ed., Ch. 6 RELATING OBJECTIVES TO INQUIRIES Direct evidence although less persuasive, may help generate leads 19 Corroborated through other procedures GBW 8th ed., Ch. 6 TESTS OF CONTROLS & SUBSTANTIVE TESTS Tests of controls Audit procedures to assess the ability of controls to prevent or detect material misstatements Provide evidence about control risk Substantive tests 20 Audit procedures that detect material misstatements Provide evidence about detection risk GBW 8th ed., Ch. 6 TESTS OF CONTROLS Procedures address questions such as 21 How are controls applied? Are controls applied consistently? By whom are controls applied? GBW 8th ed., Ch. 6 TESTS OF CONTROLS & CONTROL RISK Tests of controls are procedures to assess control risk Assessed level control risk helps determine acceptable level detection risk 22 GBW 8th ed., Ch. 6 CATEGORIES OF CONTROL ACTIVITIES Controls that create documentation, i.e., leave an audit trail Manager’s initials for credit approval Prevention control Controls that do not create documentation 23 Bank reconciliation provides no evidence of independence of preparer for cash function Detection control GBW 8th ed., Ch. 6 COMBINED SUBSTANTIVE & CONTROL TESTS Dual-purpose tests 24 Provide evidence about control risk & monetary error Example: recomputing extensions on sales invoices GBW 8th ed., Ch. 6 SUBSTANTIVE TESTS Tests of details Transactions Balances Analytical tests 25 GBW 8th ed., Ch. 6 ANALYTICAL PROCEDURES Evaluations of financial information made by a study of plausible relationships among both financial and nonfinancial data SAS No. 56 26 GBW 8th ed., Ch. 6 TESTS OF DETAILS v. ANALYTICAL TESTS Comparisons Tests of details tests all 5 assertions but analytical procedures do not support existence or rights & obligations Analytical procedures are high level tests 27 Tests of details lead to conclusions about aggregated data but analytical procedures test aggregated data GBW 8th ed., Ch. 6 USING ANALYTICAL PROCEDURES When Purpose Planning (required) Directs attention to likely misstatements Substantive tests Supports or refutes account balances Reviews reasonableness account balances Overall review (required) 28 GBW 8th ed., Ch. 6 TYPES ANALYTICAL PROCEDURES Trend analysis Ratio analysis Activity ratios Profitability ratios Liquidity ratios Solvency ratios Modeling 29 Statistical tests, i.e., regression GBW 8th ed., Ch. 6 JUDGMENT ERRORS & ANALYTICAL PROCEDURES Over reliance on unaudited numbers Disregard for unchanging account balances Overreliance on management’s explanations 30 GBW 8th ed., Ch. 6 CUSTOMER PERSPECTIVE & SKEPTICISM Issue Professional skepticism Time Declining on-time delivery rates Quality Increasing customer complaints Increasing customer complaints Performance Cost 31 Failure to be low-cost provider GBW 8th ed., Ch. 6 INTERNAL BUSINESS & SKEPTICISM Issue Professional skepticism Development Failure to be first to market Quality Increasing defect rates Productivity Unfavorable price, quantity variances Employees fail certification exams Core competencies 32 GBW 8th ed., Ch. 6 INTERNAL LEARNING & SKEPTICISM Issue Professional Skepticism Improved performance Poor performance against industry best practices Innovation Lagging product development 33 GBW 8th ed., Ch. 6 COGNITIVE BIASES IN EVALUATING EVIDENCE Heuristics: simplifying rules of thumb that may bias decision making 34 Representativeness Availability Anchoring-and-adjustment GBW 8th ed., Ch. 6 COGNITIVE BIASES: Representativeness Given an item, b, and a class of items, A, making a judgment based on how much b resembles other items from class A rather than making a judgment based on the probability that b came from class A. 35 GBW 8th ed., Ch. 6 COGNITIVE BIASES: Availability The decision maker evaluates the likelihood of a particular outcome based on infrequent but highly publicized outcomes rather than outcomes predicted by the profession’s collected experience. 36 GBW 8th ed., Ch. 6 COGNITIVE BIASES: Anchoring-and-Adjustment The decision maker assesses likelihood of an outcome with an initial, sometimes biased probability estimate (anchor) then adjusts the probability insufficiently when discovering new information. 37 GBW 8th ed., Ch. 6 AUDIT DOCUMENTATION ASB Standards Auditor’s judgment about nature, extent of documentation depends on 38 Risk of misstatement Judgment about audit work Nature of procedures Significance of evidence Nature, extent of assertions tested GBW 8th ed., Ch. 6 AUDIT DOCUMENTATION PCAOB Reviewability standard Derived from governmental standards Documents sufficient for experienced auditor to understand work performed, when, why Rebuttable presumption 39 Absent documentation of audit work, presumption that work not performed GBW 8th ed., Ch. 6 AUDIT DOCUMENTATION FILES Correspondence (administrative) file Permanent file Information of continuing interest & relevance Tax file 40 Past, present, future income & property tax obligations GBW 8th ed., Ch. 6 ROLE OF AUDIT DOCUMENTATION Work was adequately planned, supervised, and reviewed (1st standard fieldwork) Internal control considered as basis for substantive tests (2nd standard fieldwork) Sufficient competent evidential matter was obtained (3rd standard fieldwork) 41 GBW 8th ed., Ch. 6 AUTOMATED DOCUMENTATION Spreadsheet software Analytical procedures, data import/export, graphing, sorting Database management Relational structuring: combining 2 or more files for single query Text retrieval 42 Access & retrieve electronically stored text GBW 8th ed., Ch. 6