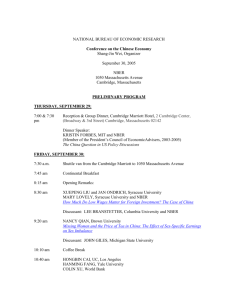

Overview of some recent activities in the NBER

advertisement

Overview of some recent activities in the NBER program in International Finance and Macroeconomics Jeffrey Frankel, IFM Director, NBER, and Professor, Harvard University NBER Board of Directors, September 28, 2015 Overview of IFM program • 76 Members (primary affiliation IFM) • Taking a spell in government service -– Kathryn Dominguez: nominated, Fed Governor – Kristin Forbes: External member, Monetary Policy Committee, Bank of England – Olivier Blanchard: Chief Economist, IMF – Maury Obstfeld: Member, Council of Economic Advisers; now succeeding O.B. at IMF – Jay Shambaugh: now succeeding M.O. at CEA – Linda Tesar: also at CEA – Raghu Rajan: RBI Governor – Shang-Jin Wei: Chief Economist, ADB. NBER Working Papers • Over 100 per year in IFM. • Some of the most active topics: – The Global Financial Crisis • Financial market imperfections • Monetary policy at the zero lower bound. – Emerging markets – Exchange rate arrangements Andy Rose • Including currency unions – Goods pricing across national borders – Fiscal policy • Counter-cyclicality • Sovereign Debt • Many of the papers from the last 6 years are surveyed in the current NBER Reporter – under the rubric of International Macro-Prudential Policy. Gita Gopinath IFM Program Meetings, 3 per year • March • October • July, 1st week of NBER Summer Institute: – Monday-Friday a.m. – IFM side-meetings: • International Trade & Macroeconomics • New IFM Data Sources project • This year: Special panel on the Greek crisis. Some IFM-related conferences • International Seminar on Macroeconomics – Meets every June in Europe – Papers now published in Journal of International Economics. – My ISoM co-director: Hélène Rey. More IFM-related conferences • 1) Project on the Global Financial Crisis – Conference held at Bretton Woods, June 2011. – Co-organizers: Charles Engel & Kristin Forbes. – Also in JIE. More IFM-related conferences, continued • 2) Sovereign Debt & Financial Crisis – October 2013 – Organizers: Sebnem Kalemli-Ozcan, Carmen Reinhart & Kenneth Rogoff. • 3) Monetary Policy & Financial Stability in Emerging Markets – June 2014, in Istanbul – Organizer: Sebnem Kalemli-Ozcan. International macro-prudential policy • Macro-prudential thinking observes that the whole of the financial system is more than the sum of the parts. – Micro-prudential regulation might, e.g., limit the loan-to-value ratio for individual mortgages or set capital minimums for individual lenders, at levels that are figured by taking the probability of housing price fluctuations as exogenous. – A macro-prudential approach recognizes that housing prices are endogenous: during a credit-fueled housing boom, the probability of a crash is greater and so regulations may need to be set more stringently. – International macro-pru policy would include also, e.g., restrictions on mortgages in foreign currency. My recent survey of recent NBER research on international macro-prudential policies includes: (1) cross-country analysis of national prudential macro-policies; (2) macro-prudential regulation that focuses on the composition of debt, treating foreign debt as carrying extra risk beyond that of domestic debt; (3) a broader precautionary approach to the national balance sheet with regard, e.g., to foreign exchange reserves. (4) Targets and instruments: Why isn’t the interest rate instrument enough? Two themes • Think about the complete cycle. – An understanding of the danger of moral hazard does not necessarily imply declarations of “no bail-out” policies during the boom phase. – If some sort of bailout is inevitable during the bust phase, then some corresponding regulation is needed during the boom phase. • Advanced countries may have something to learn from the experiences of emerging market countries. – Financial market imperfections (e.g., GFC); – Crisis management (e.g., Greek crisis); – Counter-cyclical macro-prudential tools (e.g., use of reserve requirements in Asian countries). Theory • What is the source of the market failure? – The need for collateral to assure creditworthiness. – Can explain pro-cyclical capital flows. • Over-borrowing – “Pecuniary externalities” – “Fire sales” • Theory papers – Javier Bianchi & Enrique Mendoza – Emmanuel Farhi & Ivan Werning – Anton Korinek & Olivier Jeanne Specific examples of macro-prudential policies • Banks: reserve requirements – E.g., higher on fx liabilities than domestic. • Stock market: Margin requirements • Housing market: • Maximum Loan/value ratio • Maximum Debt service/income ratio • Prohibition on foreign-currency mortgages. • A surprising proposition – Emerging Market countries perhaps successfully apply these tools in a counter-cyclical manner more than do the US and other advanced countries. Even more surprising: China’s stock market regulator raised margin requirements during the recent bubble, in January & April and on June 12. Federico, Végh & Vuletin (2014) find that developing countries use reserve requirements countercyclically far more than advanced countries do. Pablo Federico, Carlos Végh, and Guillermo Vuletin, "Reserve Requirement Policy over the Business Cycle," NBER Working Paper No. 20612, October 2014, and "Effects and Role of Macroprudential Policy: Evidence from Reserve Requirements Based on a Narrative Approach," presented at 2014 Central Bank of the Republic of Turkey-NBER Conference on Monetary Policy and Financial Stability in Emerging Economies Mortgage lending has over time increasingly come to dominate other bank lending. “Betting the House,” Òscar Jordà, Moritz Schularick & Alan Taylor, ISoM, JIE, 2015 “Loose monetary conditions lead to booms in real estate lending and house prices bubbles; these, in turn, materially heighten the risk of financial crises. Both effects have become stronger in the postwar era.” Credit-fed housing bubbles lead to worse recessions than do other bubbles. Òscar Jordà, Moritz Schularick, & Alan Taylor, 2015, “Leveraged Bubbles,” NBER WP No. 21486, August, a study of housing and equity markets in 17 countries over the past 140 years. Credit-fed equity bubbles lead to worse recessions too, than other bubbles. Jordà, Schularick, Taylor, 2015, “Leveraged Bubbles,” NBER WP No. 21486, August, a study of housing and equity markets in 17 countries over the past 140 years. "Definition [of bubble:] real asset prices diverge significantly from their trend, becoming elevated by more than one standard deviation from a country-specific Hodrick-Prescott filtered trend …But, secondly, we also require for our definition that at some point during an episode of elevation thus defined, a large price correction occurs (“the bubble bursts”), with real asset prices falling by more than 15% over a 3-year window.” Policy responses: Use of macroprudential policies -- Kuttner & Shim (2015) Kenneth Kuttner & Ilhyock Shim, “Can non-interest rate policies stabilize housing markets? Evidence from a panel of 57 economies,” NBER WP 19723, 2013. Asian & other EM countries take macro-prudential actions more often than advanced countries do -- Kuttner & Shim (2015) Kenneth Kuttner & Ilhyock Shim, “Can non-interest rate policies stabilize housing markets? Evidence from a panel of 57 economies,” NBER WP 19723, 2013. Kenneth Kuttner & Ilhyock Shim, “Can non-interest rate policies stabilize housing markets? Evidence from a panel of 57 economies,” NBER WP 19723. Revised 2015. Interest rate and credit policies in Korea Interest'rate Reserve'Req Interest rate and credit policies in China Interest'rate 5 LTV 20 <1 10 interest'rate,'% 1 15 DSTI 3 15 5 6 95 4 2 5 0 0 1986 1989 1992 1995 1998 2001 2004 2007 2010 2002 2004 2006 2008 2010 Kuttner & Shim (2015): Ceilings on ratio of Debt Service to Income significantly affect housing credit. cumula/ ve'/ ghtening 25 LTV cumula/ ve'/ ghtening interest'rate,'% DSTI 25 Reserve'Req Targets and instruments • Countries may need macro-prudential policy as an additional instrument – because monetary policy is constrained. • In large advanced countries: by the zero lower bound. • In small countries: by international constraints. • Does a floating exchange rate give monetary independence from international constraints? – Hélène Rey (2014, 2015): No. Regardless of floating, EMs are hit by external financial shocks (e.g., Fed tightening or “risk-off”). – Michael Klein & Jay Shambaugh (2013): Yes. Even if passive EMs are hit by external shocks, floating gives them the option to adjust their monetary policies in response. Rey challenges the traditional “impossible trinity,” which claims that exchange rate flexibility is sufficient to allow an independent monetary policy. “Dilemma, not Trilemma” -- She says only capital controls can give independence. One can also define macro-prudential more broadly • to include, e.g., EM accumulation of foreign exchange reserves during the boom phase – as insurance against the bust phase of the cycle. • Some studies find that countries with higher fx reserves have done better in recent crises: – Aizenman et al (2011, 2012, 2014), – Frankel & Saravelos (2012), – Dominguez, Hashimoto & Ito (2012). Kathryn Dominguez, et al (2012): Countries able to draw on foreign exchange reserves did better in the Global Financial Crisis of 2008-09. Program in International Finance and Macroeconomics