A. Planning the Sample

Part Six

Audit Sampling

Structure of Seminar

• 1. Basic Concepts

• 2. Sampling Risk

• 3. Types of Audit Sampling

• 4. Audit Testing with Samples

• 5. Statistical Sampling Techniques

• 6. Conclusions

1. Basic Concepts

• ASA 530 Audit Sampling

– “a process which includes the application of audit procedures to less than 100% of items within a class of transactions or account balance, such that all sampling units have an equal chance of selection”

• Used in both tests of controls & substantive tests

• Why is sampling used?

– Cost/benefit analysis

Basic Concepts

—Increase efficiency without compromising effectiveness

2. Sampling Risk

• Requirement for reasonable basis in arriving at opinion allows for degree of uncertainty

• Uncertainty involves judgment as to consequences of erroneous opinion (audit risk) versus cost & time of extra audit effort

• When sampling is used to obtain audit evidence, uncertainties may result from

– The use of sampling (sampling risk)

– Factors unrelated to sampling (non-sampling risk)

Sampling Risk

• conclusion, based on a sample, may be different from the conclusion reached if the entire population were subjected to the same audit procedureSampling risk the risk arising from the possibility that the auditor’s

• i.e. sample is not representative

• In the case of tests of controls

– Risk of over-reliance

– Risk of under-reliance

• In the case of substantive tests

Sampling Risk

– Risk of incorrect acceptance

– Risk of incorrect rejection

• Impacts on audit efficiency & effectiveness

Sampling risks for tests of controls and substantive tests of details

Sampling risks for tests of controls and substantive tests of details (cont’d)

Sampling Risk

• How sampling risk be controlled?

– By increasing the sample size

• How can sampling risk be eliminated?

– By testing the whole population!

• Even if sampling risk is zero, non-sampling risk cannot be eliminated!

• Non-sampling risk is risk of reaching wrong conclusion for reasons other than sample size

Sampling Risk

– Human error, relying on wrong info, etc

– Unlike sampling risk, cannot be quantified

– Can be controlled by taking “due care”

3. Types of Audit Sampling

• Sampling can be statistical or non-statistical

• Statistical sampling – random selection, use of probability theory to evaluate results, including quantification of sampling risk

• Non-statistical sampling – other than the above!

• “Haphazard” selection

• Common practice in audit firms

• Emphasis on “auditor judgment ”

Types of Audit Sampling

• Other types of testing

– Selecting all items

– Selecting specific items

• High value or key items

• All items over a certain amount

• Items to obtain information

• Items to test control activities

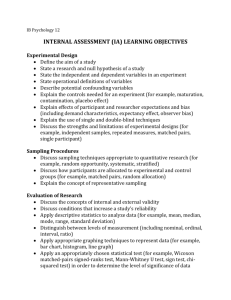

4. Audit Testing with Samples

A. Planning the sample

B. Selecting the sample

C. Performing the audit test

D. Evaluating the results

Audit Testing with Samples

• A. Planning the Sample

1.

Determine the objectives of the test

2.

Define what errors are being sought

3.

Identify the population

4.

Consider the use of stratification

5.

Define the sampling unit

6.

Specify the tolerable error

7.

Specify the expected error

8.

Specify required confidence level

9.

Determine the sample size

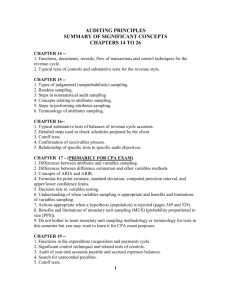

Factors that influence sample size for tests of controls

Factors that influence sample size for substantive procedures

Audit Testing with Samples

• B. Selecting the Sample

10. Select the sample

• Methods

– Random (statistical sampling)

– Systematic

• divide units by sample size to give sampling interval

– Haphazard

Audit Testing with Samples

• C. Testing the sample

11. Perform the audit procedures and note errors discovered

– Auditor tests in item in accordance with required audit objective

– Errors or deviations discovered need to be evaluated

Audit Testing with Samples

• D. Evaluating the Results

12. Consider qualitative aspects of errors

13. Project the error to the population and conclude on audit test

– Tests of control – if projected deviation rate exceeds tolerable deviation rate, then preliminary control risk assessment not confirmed – increase substantive tests

– Substantive tests – if projected error exceeds tolerable error, more evidence may be necessary – management to adjust account

5. Statistical Sampling

Techniques

• Attribute sampling plans (tests of control)

– Attribute sampling

– Sequential sampling

– Discovery sampling

• Variable sampling plans

• PPS - Probability-proportionate-to-size sampling

6. Conclusions

• Sampling is an efficient means of gathering audit evidence

• Sample must be representative of population

• Sample size is a function of

– Risk the auditor is willing to accept

– Magnitude of errors/deviations considered material

– Expected errors/deviations