Domino's Pizza

advertisement

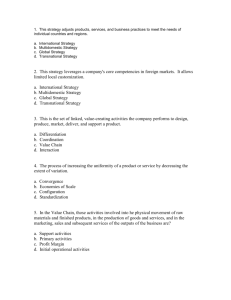

Agenda for November 2 • Review of Chapter 8 – International Strategy • Video & discussion International Strategy: Opportunities and Outcomes REASONS for international expansion STRATEGIES for international expansion Increased Market Size International Business-Level Strategy Return on Investment Economies of Scale and Learning Location Advantage International Corporate-Level Strategy * multidomestic * global * transnational MODES of ENTRY OUTCOMES of international expansion Exporting Higher Performance Returns Exporting Strategic Alliances Acquisition Innovation Establishment of New Subsidiary Management Problems and Risk REASONS for International Expansion Increase Market Size or Global Market Share Japanese electronics or automobile manufacturers Return on Investment Large investment projects may require global markets to justify the capital outlays Aircraft manufacturers Boeing or McDonnell Douglas REASONS for International Expansion Economies of Scale or Learning Expanding size or scope of markets helps to achieve economies of scale in manufacturing as well as marketing, R & D or distribution Location Advantages Low cost markets may aid in developing competitive advantage May achieve better access to: - Raw materials - Key customers - Lower cost labor - Energy - Key suppliers - Natural resources International Strategy: Opportunities and Outcomes REASONS for international expansion STRATEGIES for international expansion Increased Market Size International Business-Level Strategy Return on Investment Economies of Scale and Learning Location Advantage International Corporate-Level Strategy * multidomestic * global * transnational MODES of ENTRY OUTCOMES of international expansion Exporting Higher Performance Returns Exporting Strategic Alliances Acquisition Innovation Establishment of New Subsidiary Management Problems and Risk International Business-Level Strategies International Low Cost Usually involves locating in home country and exporting internationally International Differentiation Common among firms in countries with advanced factor conditions International Focus International Integrated Low Cost / Differentiation Can be most effective in dealing with diverse markets International Corporate Strategy International Corporate-Level Strategies Type of Corporate Strategy selected will have an impact on the selection and implementation of the business-level strategies Three Corporate Strategies Multi-Domestic Strategy Global Strategy Transnational Strategy International Corporate Strategy International Corporate-Level Strategies Multi-Domestic Strategy Strategy & operating decisions are decentralized to independent strategic business units in each country Products and services are tailored to local markets Prominent strategy among European firms due to variety of cultures & markets in Europe International Corporate Strategy International Corporate-Level Strategies Global Strategy Decisions regarding business-level strategies are centralized in the home office; SBU’s are interdependent Products are standardized across national markets Requires resource sharing and coordination across borders International Corporate Strategy International Corporate-Level Strategies Transnational Strategy Seeks to achieve both global efficiency and local responsiveness Organizational learning & knowledge transfer is critical International Corporate Strategy International Corporate-Level Strategies When is each strategy appropriate? High GLOBAL TRANSNATIONAL Need for Global Integration MULTIDOMESTIC Low Low High Need for Local Market Responsiveness International Strategy: Opportunities and Outcomes REASONS for international expansion STRATEGIES for international expansion Increased Market Size International Business-Level Strategy Return on Investment Economies of Scale and Learning Location Advantage International Corporate-Level Strategy * multidomestic * global * transnational MODES of ENTRY OUTCOMES of international expansion Exporting Higher Performance Returns Exporting Strategic Alliances Acquisition Innovation Establishment of New Subsidiary Management Problems and Risk International CorporateEntry StrategyMode Choice of International Exporting No need to establish operations in other countries Establish distribution channels through contractual relationships Common way to enter new international markets May have high transportation costs International CorporateEntry StrategyMode Choice of International Exporting RISKS May have high transportation costs May encounter high import tariffs May have less control on marketing and distribution Difficult to customize products International CorporateEntry StrategyMode Choice of International Licensing Firm authorizes another firm to manufacture and sell its products Licensor is paid a royalty on each unit produced and sold Least risky way to enter a foreign market: Licensee takes risks in mfg investments International CorporateEntry StrategyMode Choice of International Licensing RISKS Licensor loses control over product quality and distribution Relatively low profit potential Licensee may learn technology and compete on its own when license expires International CorporateEntry StrategyMode Choice of International Strategic Alliances Enable firms to shares risks and resources. Commonly called joint ventures. Most international joint ventures involve: * foreign company with a new product or technology * host company with access to distribution or knowledge of local customs, norms or politics International CorporateEntry StrategyMode Choice of International Strategic Alliances RISKS May experience difficulties in merging disparate cultures Partners may not understand each other’s strategic intent or may experience divergent goals International CorporateEntry StrategyMode Choice of International Acquisitions Largest & most rapid form of international expansion Can be cheap if exchange rates are favorable International CorporateEntry StrategyMode Choice of International Acquisitions RISKS May be costly due to size Legal and regulatory requirements may present barriers to foreign ownership Usually require complex and costly negotiations Potentially disparate corporate cultures International CorporateEntry StrategyMode Choice of International New Wholly-Owned Subsidiary Achieves greatest degree of control e.g., over technology, marketing & distribution Potentially most profitable, if successful International CorporateEntry StrategyMode Choice of International New Wholly-Owned Subsidiary RISKS Most costly and complex of entry alternatives May need to acquire expertise and knowledge that is relevant to host country Could require hiring host country nationals or consultants at high cost International Strategy: Opportunities and Outcomes REASONS for international expansion STRATEGIES for international expansion Increased Market Size International Business-Level Strategy Return on Investment Economies of Scale and Learning Location Advantage International Corporate-Level Strategy * multidomestic * global * transnational MODES of ENTRY OUTCOMES of international expansion Exporting Higher Performance Returns Exporting Strategic Alliances Acquisition Innovation Establishment of New Subsidiary Management Problems and Risk International Corporate Strategy Strategic Competitiveness OUTCOMES May fulfill the reasons for expansion * increased market size * provides sufficient ROI to support extensive R&D * facilitates economies of scale & organizational learning Leads to greater returns when implemented and managed effectively International Strategy: Opportunities and Outcomes REASONS for international expansion STRATEGIES for international expansion Increased Market Size International Business-Level Strategy Return on Investment Economies of Scale and Learning Location Advantage International Corporate-Level Strategy * multidomestic * global * transnational MODES of ENTRY OUTCOMES of international expansion Exporting Higher Performance Returns Exporting Strategic Alliances Acquisition Innovation Establishment of New Subsidiary Management Problems and Risk Major RISKS of International Diversification Political Risk Major RISKS of International Diversification Political Risk Economic Risk